This article presents some of the relevant issues non-Danish companies have to consider when hiring people in Denmark. The article does not cover posted employees in Denmark (see “Posted Workers” at the end of the article). What will become evident is the complexity of Danish payroll as well as the statutory filing requirements. As a direct consequence, many multinational companies outsource these functions to dedicated specialized payroll companies, one of them being Poul Hansen & Co.

people in Denmark. The article does not cover posted employees in Denmark (see “Posted Workers” at the end of the article). What will become evident is the complexity of Danish payroll as well as the statutory filing requirements. As a direct consequence, many multinational companies outsource these functions to dedicated specialized payroll companies, one of them being Poul Hansen & Co.

Denmark is in Northern Europe, a member of the European Union that borders Germany and is the southernmost of the Nordic countries. Denmark, Norway, and Sweden are also known as the Scandinavian countries. Denmark has an area of 43,094 square kilometers (16,639 square miles) and a population of 5.7 million. GDP (PPP-estimate for 2015) is $257 billion, equaling $45,500 per capita.

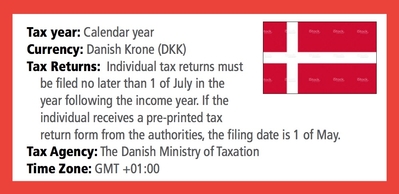

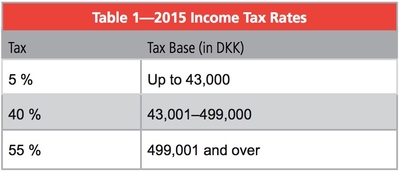

Denmark is known for its free medical treatment, education, child care (small payment applies), elder care, unemployment payments, maternity pay, sickness pay, state pension to all, subsidized low public transportation fares, free libraries, etc. Because of this, Denmark has one of the world’s highest taxations of personal income (see Table 1). Its average marginal tax in 2016 amounts to around 56.4%, unchanged from 2015. Marginal tax applies to income exceeding USD 74,000 / DKK (Danish krone) 508,000 a year (gross personal income before deduction of 8% AM tax) (2015–DKK 499,000).

Consequently, Denmark has very complex and detailed laws/regulations regarding taxation/registration in order to ensure that any payment received in money or goods is taxed correctly. The complexity of reporting and withholding of personal income taxes is a direct result of the political system.

Another consequence is that in order for the authorities to handle this efficiently, a high degree of digitalization is necessary and has been implemented. Today, most communication with any authority is only possible via digital signatures and digital mailboxes. This adds to the complexity for foreign companies with employees in Denmark.

Despite this, Danes are ranked as one of the happiest people in the world—welcome to Denmark!

Employer Registration

Danish and foreign companies employing people in Denmark are obliged to register as an employer with the Danish authorities.

the Danish authorities.

You need to determine whether your business in Denmark will be a “permanent establishment” or a “non- permanent establishment” (i.e., only a representation office). There are specific things a company must do depending on which of the two types it is:

- Permanent Establishment—If the business is a permanent establishment, the company must:

- Pay company tax in Denmark on profits made in Denmark—and file a company tax return

- Withhold payroll taxes on the salary paid to employees in Denmark

A “permanent establishment” applies if the employees (EEs) do buying and selling (invoicing) from a fixed place of business where work is performed, or from where the business is managed in Denmark.

The permanent establishment could be registered as a limited liability entity (Aktieselskab (A/S)—public limited company or Anpartsselskab (ApS)—private limited company, etc.) a branch, an organization, etc.

- Non-Permanent Establishment—A business does not have a permanent establishment if the purpose is only to represent the foreign entity via its EEs.

Let’s learn some more about these two types of business establishments.

Permanent vs. Non-Permanent Establishment

The type of registration to choose depends on the kind of business in Denmark, company tax issues, VAT, liability issues, etc. A representation office is not company tax-liable and needs only to do the required payroll filing.

Determining if the establishment is permanent requires in-depth knowledge of the activity/business. This will normally be a decision made by senior management with a Danish legal advisor.

Not only the type of entity but also the homeland of the “mother company” (i.e., EU or non-EU) could have an influence on the registration, such as whether a local-liable (regarding payroll taxes) representative is mandatory.

If the entity is a non-permanent establishment (and therefore not liable to pay company tax on profits made in Denmark), it is optional to pay out salaries as “A” or “B” income. The difference between A and B income is that the company has to withhold A and AM tax from the salary if A income and pay this monthly to the tax authorities as well as monthly filing all payroll data to the authorities. If B income no withholding of payroll taxes and no filing—the EEs file and pay taxes themselves.

If payments are made through a Danish agent (e.g., payroll provider), it will be A income. Payroll taxes need to be withheld and payroll filed monthly to the tax authorities by the agent. The agent will be responsible for the payment of payroll taxes. This issue must be addressed in the agreement between the employer (ER) and the payroll provider.

If payments are made directly from the ER, it will be B income, no payroll to be filed nor payroll taxes to be paid by the employer except for The Labour Market Supplementary Pension Scheme (ATP) tax and the related “samlet betaling” (i.e., small ER/EE taxes). If B income, the employee needs to file the payroll on his own to the tax authorities and pay tax.

When registered, the entity gets a CVR number (company registration number), which is referenced in all filings.

Digital Signature and Bank Account

After registration with a CVR number, all entities need to acquire a digital signature in order to communicate with the Danish authorities and in order to activate and access the mandatory digital mailbox. The digital mailbox is the only option for receiving communication from public authorities.

In order to get a digital signature, the entity needs to appoint a digital signature administrator. To do this, a form needs to be prepared over the Internet, printed, and signed by persons with powers of attorney (POA), then sent to the digital signature authorities (NETS) by postal mail. The person will receive an email and by postal mail (to the registered company address) a letter with a code to be used to activate the digital signature.

The digital signature is needed for all types of communication/filings with the authorities. This includes the monthly filing of payroll, filing of applications for refund in connection with sickness and maternity, also for other ad hoc filings such as paternity, statistics (if applicable), communication, with vacation pay fund, etc.

the monthly filing of payroll, filing of applications for refund in connection with sickness and maternity, also for other ad hoc filings such as paternity, statistics (if applicable), communication, with vacation pay fund, etc.

The digital signature administrator is able to appoint other persons with a digital signature and decide what these persons are entitled to do with their signature, i.e., assign rights. Generally, the payroll provider needs to be assigned a digital signature with the minimum right to do the payroll filings.

All entities need to appoint a bank account as their “NEM account” (it could be a foreign bank account). The NEM account is mandatory and will be used by the authorities if any funds are to be transferred from the authorities to the company. All payments from authorities to the company are automatically paid to the registered NEM account.

Legislation About Employees, Payroll, and Employer Costs

When hiring a person to work in Denmark, companies must ensure that the employment contract is in line with and does not violate several laws. Some of the most important laws are:

- Funktionærloven (“Salaried Employees Act”) protects the EE and gives rules for notice, layoff, etc.

- Ansættelsesbevisloven (“Employment Contracts Act”) makes it mandatory for the ER to specify all relevant details in the employment contract in connection with the employment, and states 10 issues that at least need to be included in the employment contract. Failure to comply could result in the employer becoming liable to pay compensation to the employee in question.

- Ferieloven (“Holiday Act”) applies to all employees in Denmark except executive officers and states that you earn the right to paid vacation during the calendar year to be taken in the vacation year that runs from the following May 1 through April 30. In addition to paid vacation (if earned), 1% of the vacation pay entitled salary is to be paid in May the year after (alternatively paid when the EE is having vacation).

- Barselloven (“Act on Entitlement to Leave and Benefits in the Event of Childbirth”).

- Sygedagpengeloven (“Act on sickness benefits”) entitles the employee to receive sickness benefits from the employer and subsequently from the municipality.

- Arbejdsmiljøloven (“Working Environment Act”) lays down the general objectives and requirements in relation to the working environment and aims at preventing accidents and diseases in the workplace, and protecting children and young persons in the labour market through special rules.

- Ligebehandlingsloven (“Act on the Prohibition of Differential Treatment on the Labour Market”).

- Ligelønsloven (“Act on Equal Pay to Men and Women”).

- Forskelsbehandlingsloven (“Act on Prohibition against Discrimination on the Labour Market”) prohibits direct and indirect discrimination in the labour market on grounds of: race, colour, or ethnic origin, religion or belief, sexual orientation, national or social origin, political opinions, age, or disability.

- Arbejdsskadeloven (“Workers’ Compensation Act”). The employer is liable to pay compensation/damages to an employee for any personal injury or occupational disease caused by the nature of the work performed in the service of the employer. It is mandatory to take out insurance (in Danish “Aarbejdsskadeforsikring”) to cover for this potential liability.

In addition to these laws (and more), collective bargaining agreements could be applicable if the ER is a member of an ER organization or has agreed to accede to a collective agreement. Due to the very specific and detailed laws and regulations, companies need to ensure that employment contracts remain in line with Danish legislation.

Let’s look at each of these important Danish laws in more detail.

Funktionærloven (“Salaried Employees Act”)

The act gives salaried employees (only applies to white-collar workers) certain rights with regard to termination, vacation, illness, non-solicitation and non-competition clauses, etc. The Act aims at a general protection of white-collar workers (but does not apply to directors).

Ansættelsesbevisloven (“Employment Contracts Act”)

Employees working at least eight hours a week on average and whose periods of employment are intended to last at least one month must be notified in writing of all material employment terms. This notification must be given to them within one month after the date on which their employment begins. At a minimum, the notification must include details regarding:

- Names and addresses of the employer and the employee

- Place of work

- Job title or position, or a description of work duties

- Date of commencement of employment

- Expected length of employment (in the case of temporary employment)

- Entitlement to paid holiday

- Notice periods

- Remuneration, including benefits-in-kind and pension contributions, and the intervals at which remuneration is paid

- Standard daily or weekly hours of work

- Collective Bargaining Agreements governing the employment

Ferieloven (“Holiday Act”): Vacation and Vacation Pay Accrual

Employees in Denmark typically receive two types of vacation:

- Mandatory vacation, per the Holiday Act, is 25 days (right to paid vacation is earned during the calendar year and to be held during the corresponding vacation year—see more details below).

- Contractual (between ER and EE) additional vacation. Number of days vary from company to company.

The vacation pay accrual based on the Holiday Act (25 days yearly vacation) is a material financial liability. The accrual is calculated based on the vacation pay entitled salary in the relevant calendar years times 12.5% reduced with vacation days taken in the corresponding vacation year (i.e., May 1 the year after to April 30 two years after). The consequence is that a company could have accruals relating to three calendar years and three vacation years. The above calculation is based on what is to be paid to the public vacation pay fund (Feriekonto) if an EE leaves the company. Feriekonto then pays the funds to the EE.

The consequence is also that the EE is to receive a reduced salary if taking vacation not earned. As per vacation pay law, this is to be calculated at 4.8% of the monthly salary per day of vacation taken not earned.

In addition, to be accrued is the 1% special vacation pay (based on the calendar years vacation pay entitled salary) normally paid directly to the EE’s with May payroll the following year. If the employee leaves the company before May, they do not receive the 1%. The 1% is not vacation pay entitled when calculating the ordinary vacation pay accrual.

The EE is allowed to transfer the fifth vacation week to next year if a written agreement is made between the EE and ER, or to get the fifth vacation week paid, also if a written agreement has been signed. If not, untaken vacation is to be paid to AFF (www.aff.dk) and is lost for both EE and ER.

Many companies provide additional contractual vacation days to the mandatory ones. Accruals also need to be calculated for these based on the contractual details between ER and EE.

In connection with decisions made (i.e., calculation of vacation pay accrual for financial reporting purposes), one needs to follow company policy/general accepted accounting practices (i.e., how to accrue). The above method is based on what to pay if the EE leaves. Alternatively, and in accordance with general accepted accounting practice, it should be calculated as the expected salary to be paid when the EE is expected to take his holiday. Both calculations are relevant.

Barselloven (“Act on Entitlement to Leave and Benefits in the Event of Childbirth”)

Parents have the right to a total of 52 weeks leave with maternity subsistence allowance. The mother is entitled to four weeks’ maternity leave prior to giving birth and 14 weeks after. The father is entitled to two weeks’ leave after the birth, and the remaining time can be divided according to individual wishes.

Private sector employees are entitled to a minimum level of maternity benefit, which is subject to negotiation with the employer. Parents who are not entitled to paid maternity leave from their workplace can receive maternity maintenance from their municipal office in their place of residence.

The Equal Treatment Act prohibits unfair differential treatment and states that employers are not allowed to dismiss an employee who has exercised his or her right to absence or who has been absent in accordance with the Act on Benefits in the Event of Illness and Childbirth or due to pregnancy, maternity/paternity leave, or adoption.

Companies are entitled to refund from the relevant authorities in connection with leave due to childbirth:

- Mother: (4 weeks before expected date of birth and 14 weeks after actual date of birth)

- Father: (2 weeks within 14 weeks after actual date of birth)

- Mother and father: (32 weeks in total to be used by mother or father or a combination)

- Deadline for filing the leave is eight weeks after the end of every leave period. After filing the leave, one needs to file for every refund request.

Filing Process:

- We advise that the ER make a written agreement (i.e., period start, absence, salary, and vacation) with the EE in order for HR and payroll to be able to take the necessary action.

- File with the authorities (www.virk.dk / nemrefusion) in connection with first day of leave.

- Filing of refund request to “authorities (Kommune) and if applicable due to union agreement second application”. It’s optional how often to apply for refund.

- Assistance with identification and reconciliation of received funds.

- Communication and follow up with EE.

- All filings need to be done digitally with a digital company EE signature. Every company needs to have digital company EE administrator assigned. This person is able to give others (ICP) a digital signature and assign the relevant authorizations.

Sygedagpengeloven (“Act on sickness benefits”) Refund in Connection With Sickness

The Sickness Benefit Act entitles the employee to receive benefits in the case of sickness. During the first 30 days of sickness, the employer pays the benefits. There is a minimum size of the benefits.

Companies are entitled to a refund after 30 days of continued sickness. An application needs to be filed no later than 35 days after the first day of sickness. Thereafter, one needs to file for every refund request.

Setting Up Employees

In order to set up an EE the following information is needed by the payroll provider/administrator:

- EE’s CPR number (all Danes have and foreigners need to get a CPR number)

- Address and telephone

- Start date

- Bank account details (i.e., name, four-digit registration number, and 10-digit account number)

- Method for forwarding the pay slip—in practice, the EE’s mandatory digital mailbox is used—alternatively by email or postal mail (not used in practice due to handling costs)

- Copy of EE contract (not mandatory but used to assist if issues arises)

- If EEs are taken over from another payroll provider, all relevant information (i.e., vacation accurals and vacation days need to be provided)

- If entitled to pension, the provider needs account details

- Basis for the pension calculation to be defined

- Finally, the provider needs all relevant remuneration details for the first pay run including regarding pension, benefits, tax-free travel allowances, free telephone/IT, free car, tax-free mileage, bonuses, stock options, etc.

Filing of Payroll Data With Tax Authorities and Year-End Corrections

In Denmark it is mandatory to file all payroll data every month to the tax authorities. The benefit is that no special year-end filing is needed. December filing is a filing as all other filings.

The only issue relates to any subsequent corrections needed to the filings. This could relate to tax-free mileage and travel allowances, etc. (i.e., not included in the input received for December). This data needs to be filed manually after year-end when the information has been received and before the deadline for filing (i.e., around mid-January).

All EEs are able to log on to the tax authorities via their digital signature to see what the ER/ER’s have filed.

EEs are also able at any time to change online their tax card based on changing their forecasted income for the year. The changed tax card is automatically updated in the common used payroll applications on a daily basis. The tax card determines the A tax percentage and the monthly deduction for the A tax calculation. AM tax is always 8% of the A tax income and deductible before calculation of the A tax. The consequence is that if it happens that a tax card is changed between the date for the approved payroll and the final payroll, thus resulting in a change between the net pay to pay and the A tax to pay, there is no change to P/L.

For EEs who have more than one source of income (i.e., EEs who work for two (or more) ERs or Students who obtain income from authorities and have a job), the Main-tax card (Hoved-kort) shall be used by only one of these. For second, and all other income sources, the tax-withhold/payment shall be made using the Secondary tax card (Bi-kort).

2016 ER Taxes/Cost

Compared to other countries, ER taxes are very small (this must be seen in connection with the high personal taxation).

There are five mandatory ER taxes to be paid to the public and on top a mandatory work injury insurance to be paid to an insurance company.

ATP (Public Pension Scheme) is billed separately and payable around the seventh day in the second month after the quarter ends. The other four, called “samlet betaling,” are billed together and payable around the 14th in the fifth month, after the quarter ends based on ATP paid (i.e., the same quarter).

The 2016 quarterly fees are as follows:

- ATP (public pension scheme) as from Jan. 1, 2016, the quarterly ER fee is 568,05 and the EE part 283,95 or a total of 852 (the EE part is withheld monthly by ER with 94,65 via the pay slip) (2015 fees: 540 on top EE pays 50% or 270).

- AES (sickness insurance). Price depends on type of work and sickness risk. For office work (business code/branchekode 821100) fee is around 56 in 2016 (83 in 2015). Business code/branchekode is shown on the CVR registration (see www.cvr.dk) and based on registration by the companies themselves.

- AUB (education fee) around 694 in 2016 (710 in 2015) Please note that if only one EE no AUB is to be paid, this also applies to every 50 EE.

- FIB (finance tax) around 154 in 2016 (161 in 2015).

- Barsel.dk (Pregnancy/Maternity tax) around 188 in 2016 (unchanged from 2015). Yearly ER fee per EE amount in 2016 to around (568+56+694+154+188)*4=6.640 based on the aforementioned assumptions.

The cost of the mandatory injury insurance is to be based on negotiation with/offer from an insurance company.

Taxation of EE Benefits

As a general rule, all benefits paid to EEs are taxed as salary and included in the vacation pay entitled salary, and need to be filed to the tax authorities together with the monthly filing of payroll. Below are the most common benefits and how they are taxed:

- Paid company car. EE is to be taxed monthly based on the purchase value of the car. 25% of the first 300.000 and 20% of value above per year. In addition, one needs to add the environmental tax. This tax is based on the specific car and published by the tax authorities. The taxable value of the company car is included in the vacation pay entitled remuneration. Any payment by the EE reduces the taxation with the paid amount. Company to obtain documentation for the cost paid and to book it in its books as a cost and an income (tax rule).

- Paid telephone is taxed with 2.700 per year in 2016 (2.600 in 2015) or with 225 per month this includes Internet and PC if also used for business purposes. The amount is treated as vacation pay entitled salary.

- Lunch paid by ER is to be taxed unless the EE pays for this. Tax authorities accept a payment of 20 per meal including something to drink (15 if nothing to drink).

- If EEs drive their own cars for business purposes they can receive tax free mileage in 2016 at 3,63 per km up to 20.000 km and 1,99 thereafter (2015 rates 3,70 and 2,05).

- If traveling for business purposes EEs are entitled to receive instead of paid expenses for food and other small sundry expenses a tax-free per diem allowance for every 24 hours travel (need to include sleep outside home) 477 in 2016?additional hours at 477/24 (2015 rate 471). If all costs paid by ER, EEs are allowed to receive 477/4 in 2016 as tax free per diem allowance to cover small travel expenses without vouchers (471/4 in 2015).

- If company pays for medical insurance (quite common) the EE is to be taxed on the cost.

- Free glasses to be used only at work in connection with work with computers are not taxed (the EE is not allowed to bring them home).

- Gifts up to 1.100 in 2016 (2015 unchanged) are not to be filed to the tax authorities. But the EE has to declare if he has received gifts with a value of more than 1.100 for the calendar year. If this is the case the total amount is taxed. Christmas gift up to 800 is not taxed unchanged from 2015. Small gifts in connection with birthday and other relevant personal mark days are also tax free if reasonable cost. These are not included in the mentioned 1.100 gift limit. Due to the responsibility for the EE to declare gifts over 1.100 it is necessary for the company to register this in order to assist the EEs if asked or if the tax authorities ask for specifications. All gifts in cash or cash equivalent are taxed as salary.

- A paid leave compensation on top of contractual obligations is tax-free (no A and AM tax) as for the first 8.000. This applies also for gifts in connection with the company’s 25-year anniversary and thereafter every 25 years, and when the EE has been employed 25, 35, and thereafter every five years. Max 8.000 per year unchanged in 2016 from 2015.

- The company can pay for business-related expenses that are also used privately up to a maximum of DKK 5.800 in 2016 (5.700 in 2015). This is, for instance, paid newspapers delivered to private address, food in connection with overtime, flu vaccination, expense to open and yearly fees credit card, company clothes, etc.

Preventing International Crime and Money Laundering (Based on ‘Know Your Customer’)

Payroll providers, auditors, banks, etc., in Denmark are obliged to comply with Danish legislation and rules on preventing international crime and money laundering. These rules require receipt of documentation for the kind of operation the company is involved with, company structure, and details (i.e., any person owning (or controlling) more than 25% of the company (beneficial owner).

In order to comply, the payroll provider needs to have updated information about:

- Company operations

- Company organizational chart

- Name, address, and copy of passport (i.e., any person (Beneficial owner) who owns or controls more than 25% of the company)

Data Processing

Payroll providers in Denmark must comply with the Danish “Act on Processing of Personal Data.”

When a company uses a payroll provider to process personal data, the company shall make sure that the processor is in a position to comply with security measures according to the legislation. The carrying out of processing by the payroll provider must be governed by a written contract between the parties. This contract must stipulate that the payroll provider shall act only on instructions from the company and that the required security measures shall apply to processing by way of the payroll provider.

Posted Workers

The article does not cover posting of employees of a non-Danish company to Denmark. Many issues presented in this article are relevant in the case of posted workers due to the Danish “Act on posting.” The act states that employees posted to Denmark by a foreign company are covered by main parts of Danish legislation aimed at protecting employees. In addition, tax issues are to a large extent relevant for posted employees.

To determine if an employee is “posted” or “employed” in Denmark, one must consider the following:

- Only if the employee is habitually performing his work in another country than Denmark and is temporarily performing work in Denmark can he be regarded as posted to Denmark.

- Companies posting employees to Denmark must register with the Danish authorities in the Register of Foreign Service Providers (Danish “Registret for Udenlandske Tjenesteydere = RUT”).