The Republic of Serbia is a sovereign state located in Southeastern Europe between Macedonia and Hungary. Its capital, Belgrade, is among the oldest and largest cities, with its history dating back to 7,000 BC. It has a population of more than seven million people, 83% of whom are ethnically Serbian with minorities of Hungarian, Romani, and Bosnian people. While a secular country, more than 84% of the country are practicing Orthodox. An emerging market economy in the upper-middle income range, it is the world’s largest producer of plums and the second largest producer of raspberries.

Serbia is a member of the United Nations, the Council of Europe (CoE), and is seeking to join the European Union by 2025.

Applicable Laws

The following are the applicable laws in Serbia:

- Labour Law

- Pension and Disability Insurance Law

- Health Insurance Law

- Law on Employment and Insurance in a case of unemployment

- Personal Income Tax Law

- Law on the Employment of Foreigners

- Law on Tax Procedure and Tax Administration

The salary is to be agreed upon between the employer and the employee and stated in the employment contract in the gross amount. The gross salary includes net earnings, income tax, and contributions paid on behalf of the employee.

By law, wages must not be lower than the minimum wage, which is decided annually by the Social and Economic Council of Republic of Serbia (SEC). The latest decision of SEC states that the minimum salary for 2018 amounts to net 143.00 RSD/hour which translates to monthly 25,168.00 RSD (approximately EUR 210) and equals the gross amount of RSD 33,763.00 (approximately EUR 282).

The law prescribes other salary elements (for work during holidays, overtime, etc.) and reimbursement of expenses, such as fees for meal allowances, subsidies for annual holidays, bonuses, and seniority pay.

Employees are guaranteed equal earnings for the same work or work of equal value performed for an employer. The “work of equal value” is work requiring the same professional qualification level, abilities, responsibility, and physical and intellectual work and experience.

Social Insurance and Contributions

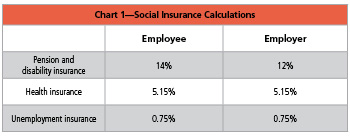

The employee is entitled to social insurance, including pension and disability insurance, health insurance, and insurance in case of unemployment. Social insurance contributions are calculated at the expense of both employee and employer at the rates shown in Chart 1.

The employee is entitled to social insurance, including pension and disability insurance, health insurance, and insurance in case of unemployment. Social insurance contributions are calculated at the expense of both employee and employer at the rates shown in Chart 1.

The employer has the obligation for calculation and payment of contributions. Taxes and contributions have to be paid before the payment of the employee’s net earnings. All withholding tax and contribution returns can be submitted exclusively electronically, via the web portal of the Tax Administration.

Personal Income Tax

Personal income tax on salaries is 10%. The gross amount is used as a basis to calculate contributions. The taxable amount is equal to the gross salary reduced by the non-taxable part (RSD 15,000.00), which is fixed and changeable once per year (prescribed by law and valid from February 1 of the current year until January 31 of the following year).

Tax Incentives and Subsidies for Employment

With the latest changes in legislation, most tax incentives have been abolished, including those for employment of trainees under the age of 30 and all other age-conditioned incentives. All the benefits earned before the amendment of the law can be used until the expiration of the period for which they were claimed.

The incentives and subsidies for employment of people with disabilities and incentives conditioned by number of newly hired employees (under some additional conditions) still remain in force.

Employment Procedures

Contract—The employment relationship is established on the basis of an employment contract signed by the employee and the employer who is represented by the Director (member of the Board of Directors) or an employee authorized by Power of Attorney issued by the Director. Contracts must have all the general data for both employer and employee, with signature, date, and commencement day included. A contract also must define:

- The type of job and main responsibilities for both employer and employee

- Gross salary

- Working hours

- Violation of employment discipline

- Cancellation of contract notice (minimum 15-30 days)

- Other details that are not defined by law or internal act, such as amounts for meal allowance and subsidy for annual holiday, work in shifts, terrain work, conditions for additional days for annual leave, etc.

Limitations—An employment relationship can be established with a person who is at least 15 years old, but people age 15 to 17 can be employed only with written consent by a legal guardian as well as with medical certificate of work capability.

The employer is forbidden from requesting from the employee certain data/information regarding family status, marital status, family planning, or to request the employee to submit to a pregnancy test.

Registration Procedure—Registration of employment is done by the employer as a “single-desk procedure” by submitting a single social insurance application. By law, this step should be performed before the starting date of the new employee.

It is up to the employer to choose whether they will submit the application form to the Pension and Disability Fund or to the National Health Insurance Fund. For several years now, there is a possibility of submitting the registration online via the Central Registry of Compulsory Social Insurance.

For the sake of full e-administration, the old paper health booklets have been replaced with new e-medical cards with chips, with the aim of simplifying the issuance of cards and data changes, and above all, simplification of the process of health card verification renewal.

Employment of Foreigners—In general, foreigners who want to work in Serbia are obliged to possess a work permit. Certain exceptions apply, such as if their stay in Serbia is less than 90 days during a six-month period, if they are company owners, representatives, or members of corporate bodies, there for training purposes, seconded employees, etc.

Work permits may be:

- Personal work permits—For foreigners with permanent residence in Serbia, refugees, etc.

- Work permits—Include employment permit, work permits for special cases (seconded employees, transfers within a same company, independent professionals) and self-employment work permits (entrepreneurs or self-employed people with contract-based activities/work in Serbia).

Residence permits are issued by The Ministry of Internal Affairs and work permits by the National Employment Service. The validity period should correspond to the residency permit. An employment contract cannot be signed for a period longer then the validity of the working permit.

Foreigners are considered taxpayers for the earnings realized in Serbia.

Variety of Employment

Probation Work—Probation work and its duration may be stipulated in the employment contract but cannot last longer than six months. During the probation work, both employee and employer can cancel the employment contract with a notice period of not less than five working days.

Definite Duration Contract—Employment can be contracted for a definite term, but no longer than 24 months, and in the following cases: seasonal jobs, increased volume of work, replacement of a temporarily absent employee, work on timed projects, with foreign citizens until the expiry of the work permit. For definite duration work in a company registered for less than one year, this period is extended to 36 months.

Part-Time Work—An employee can be hired for part-time work for indefinite or definite periods. For the remaining hours up to a total full-time workload, he/she can be engaged by another employer.

Work Outside the Employer’s Premises—A labor contract can be concluded for performing work outside the employer’s premises, including teleworking or working from home. This contract should contain: working conditions and way of supervising employee’s operations; use of employee’s means of work, and compensation for it and for other work-related costs. These employees have equal rights to employees who work at the employer’s premises.

Employment of People With Disabilities

All employers with 20 or more employees have the legal obligation to employ people with disabilities. In addition to the actual employment of the required number of people with disabilities, the obligation can be fulfilled by participating in financing salaries of people with disabilities or by fulfilling other financial or material obligations from the contracted cooperation with the company for vocational rehabilitation. Otherwise, the employer will be obliged to pay penalties to the Budget Fund for Vocational Rehabilitation and Employment of Persons with Disabilities.

Protection of Employees

Working Hours

The full working hours amount to 40 hours per week. A general employer’s act may stipulate that full working hours are less than 40 hours per week, but in any case they cannot be less than 36 hours per week.

Overtime work

The employee has the obligation to work overtime per a reasonable employer’s request. Overtime work of an employee cannot exceed eight hours per week and four hours per day.

The employee shall be entitled to an increase in the salary for overtime work. The increment cannot be less than 26% of the basic salary.

Holidays

The annual leave given to an employee amounts to a minimum of 20 working days.

The minimum of 20 working days can be increased on the basis of:

- Work contribution

- Work conditions

- Working experience

- Level of education

- Other criteria determined by a general act or employment contract

The employee will be entitled to annual leave in a calendar year after a month of continuous work from the date of employment with the employer. Such an employee is entitled to 1/12 of the annual leave (proportional part) for each month of work in a calendar year.

Paid and Unpaid Absence

The right to paid absence for a maximum of five work days in total during a calendar year is granted to an employee in the case of marriage, birth, serious illness of a member of the close family, and in other cases determined in a general act or the employment contract. An employee is entitled to additional days of paid leave as follows:

- Five days in the case of the death of a close family member

- Two days in the case of voluntary blood donation

Sick Leave

An employee is entitled to compensation of salary during absence from work due to temporary inability to work for up to 30 days (65% of the average salary in the 12 months preceding if illness or injury was not inflicted at work or 100% if inability is caused by an occupational illness or injury inflicted at work). An employee is obliged to submit to the employer—no later than three days from the occurrence of his/her temporary impediment from work—a certificate issued by a physician. Such a certificate has to be issued in accordance with the health insurance regulations. For sick leave longer than 30 days, the National Health Insurance Fund will be charged (the employer has the right to request a refund of paid salaries).

Pregnancy and Maternity Leave

An employee who is on pregnancy leave is entitled to a reimbursement of salary in the amount of the average salary for the last three months, and during maternity leave in the amount of the average salary in the last 12 months. The employee is entitled to maternity leave as well as to nursing leave in the combined duration of 365 days for the first and the second child, and two years for a third and a fourth child.

Unpaid leave could be granted to an employee. In the case of unpaid leave, the employee’s rights and duties stagnate (are frozen).

Payroll Calculation Procedure

The gross salary (net salary + social insurance contribution and taxes) includes:

- Salary for performed work and time spent at work;

- Bonuses, premiums, and other incomes derived from the employee’s contribution to employer’s business success;

- Other incomes in accordance with laws, bylaws, and internal acts.

The salary shall be paid in the way determined by the general act and/or employment contract at least once a month. The employer is obliged to pay the salary for the previous month until the end of the current month at the latest.

Termination of Employment

An employee’s employment will be terminated in one of the following ways:

- After the expiration period stated in the employment agreement

- If the employee is 65 years old and completes 15 years of social insurance contributions and employer and employee have not agreed otherwise

- By mutual agreement between employer and employee

- By termination of the contract by employer or employee

- At the request of the parents or guardian of an employee younger than age 15

- Other ways stipulated by law, general act, or employment agreement

Termination of employment by an employee

Written notice of termination of employment has to be given to the employer, and the notice period cannot be fewer than 15 days prior to the day of termination or longer than 30 days.

An employer is obligated to issue a warning letter to an employee prior to termination. The grounds and reasons for the termination of employment have to be explained in a letter and facts and evidences, which indicate existence of termination reasons, must be presented. An employee has the right to answer to a warning letter for a period of at least eight days.

The employee has 60 days from the date of delivery to initiate a case in court against such ruling.

Prohibited termination

The employer is prohibited from terminating the employment contract of an employee who is pregnant, on maternity leave or nursing leave, or on leave for special care for a child.

Martina Lalic leads Eurofast’s payroll team in Serbia managing its payroll operations, including employee compensation packages and benefits. She supervises Eurofast’s payroll projects and process improvements with the business IT team and works closely with clients to optimise their bottom line. Lalic specialises in delivering client-focused consulting solutions for compensation, employment, and payroll solutions for local and international clients. She is responsible for planning, managing, and executing all aspects of a client’s payroll and ensures accurate and timely processing in accordance with internal policies and legislative compliance requirements including tax and labour. She holds a master’s degree in business economics with a specialisation in Accounting & Audit.