Multinational organizations are facing critical challenges in managing rapid payroll legislative changes as well as increased expansion into new geographies. This storm of operational disruption and new regulations creates an ever-evolving wave of new requirements and process adjustments. Simultaneously, the pressure to maintain accurate payroll processing, tax withholding, and statutory reporting requirements in countries throughout the world is growing.

Recall when Brazil announced its move to eSocial, or when France transitioned to Déclaration Sociale Nominative; were you ready? Organizations whose payroll functions do not remain compliant could be at risk of incorrect payrolls and dissatisfied employees. In the May Global Payroll issue, part I of this article discussed a typical real-life scenario and some of the most complex global payroll practices were discussed.

In Part II of this article, we will finish the remaining noncompliant global payroll consequences to security and morale as well as look at the five important keys to maintaining a compliant global payroll.

Security Risks

We’ve highlighted some new systems in place mandated by the government. And with those new systems, the governments have devoted millions to counteract potential security breaches. Payroll is just one of many departments that hackers try to infiltrate. Phishing schemes might ask employees to fill out their Forms W-2 online, stolen computers can be hacked, and systemwide malware can completely disrupt payroll functions. Organizations should confirm their systems have correct procedures in place before, during, and after a breach. Payroll professionals need only look at consumer credit reporting agency Equifax’s data breach as an example to understand how real the threat is for their own companies.

Every part of a business is responsible for the actions of the entire business. Communicating security measures does not just apply to payroll. It applies to HR, benefits, compensation, legal, public affairs, finance, treasury, systems operations, and IT. To protect your payroll department, you’ll need to consider the following stages if your company system is breached:

- Impact analysis

- Risk assessment

- Recovery strategy

- Mitigation plan implementation

In your analysis, do not forget about the company’s vendor security protocol, which would involve platforms such as Workday, Oracle, SAP, Ultimate, ADP, Ceridian, and others.

Decreased Employee Satisfaction

If compliant international payroll proves difficult for an organization to manage, there is risk of delayed or incorrect pay calculations for international employees. If these delays and miscalculations persist, employee morale will tumble. If there are issues with some countries and not others, it can also send the wrong message to employees about which markets the organization prioritizes. Low employee morale leaves an organization at risk of high staff turnover and low retention rates.

Maintaining a Compliant Global Payroll: 5 Important Keys

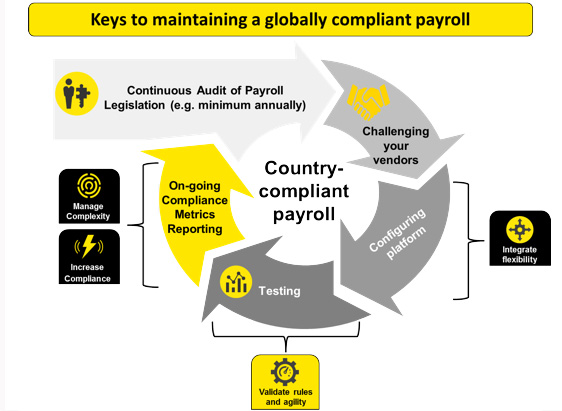

The varying complexity of payroll around the world and consequences associated with noncompliance could be a risk for any organization. Five keys to consider are shown in the diagram below to ensure your payroll operations meet the compliance requirements in all countries where you do business:

- Control audits of payroll legislation—Advocate and put into practice monthly audits of tax updates to incorporate rigorous standards and leading practices.

- Challenging your vendors—Request that vendors subscribe to governmental notices and provide updates on tax requirements. Regular review and having knowledge within your organization on tax regulations are crucial in optimizing your payroll compliance. Vendor contracts should also be reviewed and updated relative to service level agreements and metric reporting, governance, liability, and compliance. A helpful alternative is to outsource your payroll tax compliance, tracking, and filing to take advantage of leading trends and best practices in the market to further solidify your control around payroll tax compliance.

- Platform configuration—Execute tax configuration analysis, so that tax tables, rates, and overall platform configuration are accurate and correct. As payroll leaders, we do this when we receive a patch or update from our vendor, but how many of us do not think about it once the update is completed?

- Testing—Perform periodic testing and controls of the payroll results through your reconciliation efforts and reasonability testing. Do you conduct regression testing after major regulatory updates are applied? This process of testing ensures that previous configurations that were not altered remained unchanged and are not broken due to the new changes added to your platform elsewhere.

- Ongoing compliance metrics reporting and reviews—In operations, data that gets measured gets the proper attention from executives and helps them prepare for, identify, and resolve issues before they become major compliance problems. As a payroll leader, report not only your operational successes but also your challenges. The idea here is to optimize your compliance and manage the complexities that seem to come your way when you least expect them. By developing metrics for accuracy and timeliness around your payroll compliance and delivery, you can work with the numbers that point objectively toward your efficiencies and deficiencies and then weigh the best options to address your specific situation. Additionally, you want to periodically perform a service delivery model assessment, including processes and documentation evaluations.

Additional Strategies: Education, Standardization, and Network of Global Payroll Professionals

Most payroll practitioners find that it takes years of education and experience to master payroll rules and laws. And even the most experienced payroll practitioner must stay up to date with the ever-changing regulatory environment. Self-education is an important facet to remain compliant in global payroll.

Global payroll success also comes easier with a standardized payroll operations model. Organizations that are juggling five different payroll systems to process payroll in several countries will face increased risk of having a noncompliant global payroll. Standardizing systems and aligning business processes can result in organizational synchronicity and effectiveness. Until recently, many payroll departments did not have access to new technology to allow for multiple country payroll management. Services firms (vendors and technology companies) are now helping their clients respond to global payroll complexity through the development of enhanced tools and systems, in an effort to combat the implications of global payroll on an organization.

One of the leading trends is to build or become part of a network of global payroll professionals who interpret and decode the nuances of payroll tax rules in one or many countries. This will help an organization manage these global payroll complexities. The network can be a local group of payroll professionals, a consulting firm, or a well-positioned firm that has practitioners in all the countries where the organization does business. The advisement you receive from your network will lead to a clearer understanding and interpretation of how payroll compliance, rules, and taxes should be handled by each country.

Conclusion

We know that some truths are inevitable—politicians will create new laws with their constituents, and unbridled innovation will continue to disrupt our current operations and technology—but methods and procedures are in place to help you remain compliant. Following the important keys to maintaining a compliant payroll—continuous audit of payroll legislation, challenging your vendors, configuring payroll platforms, testing, and reporting of ongoing compliance metrics—is a great first step organizations can take to meet payroll needs in new countries. Additional strategies including education, standardization, and joining a network of global payroll professionals will help reduce the risk of noncompliance.

Matthew Busanic is an experienced Senior Manager within the People Advisory Practice at Ernst & Young with a concentration in global payroll, human resources, intelligent process Automation, Technology, equity processing, project management, and continuous process improvement. Busanic has more than 30 years of experience in the payroll industry. He specializes in global payroll implementations and operational efficiencies with various platforms. Busanic has led and successfully managed several multinational payroll and human capital transformation deployments, with a focus on payroll compliance, operations, and intelligent process automation. His engagements includes successful projects for Fortune 100 and Fortune 500 clients in the chemical, consumer products, entertainment, financial services, hospitality, information technology, manufacturing, pharmaceutical, and retail industries.

Matthew Busanic is an experienced Senior Manager within the People Advisory Practice at Ernst & Young with a concentration in global payroll, human resources, intelligent process Automation, Technology, equity processing, project management, and continuous process improvement. Busanic has more than 30 years of experience in the payroll industry. He specializes in global payroll implementations and operational efficiencies with various platforms. Busanic has led and successfully managed several multinational payroll and human capital transformation deployments, with a focus on payroll compliance, operations, and intelligent process automation. His engagements includes successful projects for Fortune 100 and Fortune 500 clients in the chemical, consumer products, entertainment, financial services, hospitality, information technology, manufacturing, pharmaceutical, and retail industries.