Poland is the largest country to enter the European Union this century.

Poland is the largest country to enter the European Union this century.

Many of us have had direct experience with the Polish work ethic, either through direct contact with a Polish colleague or by using the services of a tradesman who completed work on time and on budget. With 40 million people, and strategically placed at the heart of Europe, Poland is an economic force to be reckoned with.

Since the collapse of Communism, by a combination of radical economic reform and sheer hard work, Poland has become one of the most dynamic economies in the old Eastern bloc with an average household income of about US$18,000. Include the affluence of newly returned émigrés, and you have an attractive market for any company. If your business decides to launch an operation in Poland, what do you need to know regarding payroll legislation and practice?

Payroll as a Subset of Accounting

The payroll function in Poland is usually viewed as a subset of the accounting profession, and payroll therefore is usually located within finance. All employers, regardless of size, that have a physical presence in Poland are required to withhold and account for a number of different taxes and levies based on an employee’s salary. Both the Tax and Social Security offices will provide basic training to companies at no cost, although this is usually available only in Polish.

Personal income tax (PIT) must be deducted at the source from employees’ salaries by employers, and is administered by the Urzad Skarbowy (Tax Office). The Polish fiscal year runs from 1 January to 31 December. Poland uses a simple tax system, applying just two rates of tax: 18% and, for incomes over Polish zloty (PLN) 85,528 (about $23,305), 32%. The higher rate threshold has remained frozen for some years.

Pay is calculated using a simple cumulative system, which frontloads the 18% tax rate into the first months of the tax year rather than evenly spreading it over the whole tax year. This means that net pay for high earners will be higher in the earlier months of the fiscal year when they pay the lower 18% rate.

Benefits in kind are also included in the tax calculation by use of estimated cash values. Popular benefits routinely provided include private medical insurance and company cars, with the taxation of cars being limited to a cash value assessed on the private use of the vehicle. Social security insurance and a proportion of the separate health care contribution are deductible from taxable income. In addition, all employees are entitled to a small deduction in lieu of the travel costs associated with getting to work. Finally, a flat rate personal tax relief of PLN 46.33 (about $13) per month is deducted before tax is calculated. This allowance is not available to those with incomes exceeding PLN 127,000 but should this be over-awarded through the payroll calculation, the onus is on the employee to correct it on their annual tax return.

End Year Filings

An annual year end consisting of two forms must be filed at the end of each tax year. Form PIT-4R shows the total amount of PIT paid to the Tax Office during the year and must be filed by 31 January. In addition both the Tax Office and the employee must receive Form PIT-11 detailing individual pay, social security contributions, and taxes by 28 February. While both declarations are sent to the tax office electronically, the employee must still be given a paper copy of Form PIT-11. The forms must be individually signed (rather than having a signature printed onto them), which can be a major logistical challenge if you have hundreds of certificates to complete. All employees are required by law to file an annual tax return by 30 April. This return can be submitted electronically. Employers must remit the tax deducted from salaries to the Tax Office by the 20th of each month.

Social Security

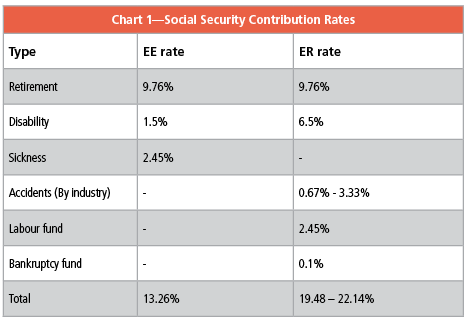

Social security is administered by the Zaklad Ubezpieczen Spolecznych (ZUS) office. Contributions are compulsory for all employees regardless of age, and continue to be due at the full rate past state retirement age. The system includes a maximum annual earnings threshold that applies to both employee and employer contributions. This is set at 30 times the national average wage, which for 2018 is PLN 133,290 (about $39,790). Each employee is given a unique identifying number for life by ZUS, known as a PESEL, which the employer should obtain on recruitment. The contribution is assessed for a number of different categories of insurance, as detailed in Chart 1.

Each contribution type must be calculated, accounted for, and displayed on payslips separately. In addition, the employee must pay an additional healthcare contribution calculated as 9% of gross pay less ZUS contributions. Paying the contribution entitles the employee and their family to free treatment under the Polish state healthcare system, and insurance contributions are reported to the medical profession via the eWUS system to confirm entitlement to publically funded treatment.

Platnik—Reporting Earnings and Contributions

A full return of earnings and contributions deducted must be made by the employer each month. This is done electronically using a government-issued software programme called Platnik. In addition, the software is also used to report starters, leavers, and ad-hoc changes such as employee address. The return should be made by the 15th of each month, which is also the deadline for making payment of the contributions to ZUS. The remittance must be split and paid to three separate ZUS accounts, according to contribution type.

Employers face a third levy calculated by reference to gross payroll, known as PFRON. The Polish government uses the levy to provide support services to the disabled. It is payable by all employers once their workforce reaches 25 employees, but the liability can be limited or even eliminated if the company either directly employs registered disabled people or buys goods and services from organisations created to provide employment for the disabled. To eliminate the liability, a company would have to have 6% of its workforce as registered disabled. This practical measure actively encourages the recruitment of disabled workers and is very successful in achieving its aim of increased employment and reduced social exclusion of the disabled. A monthly return detailing payroll calculations must be submitted. You can view more details here.

Polish Labour Laws

Poland has a complex series of labour laws designed to side with the employee, particularly regarding termination of employment. Another rule requires employers to pay salary for hours worked either in the month they were worked, or by the 10th of the following month. While this is easy to achieve for those paying a fixed monthly salary, it is extremely challenging for those employers that operate payment by the hour and are used to mid-month payroll cutoff points. One large U.K. retailer that recently arrived in Poland has had to move payday from the end of the month to the 10th of the month to comply with this rule. Foreign businesses planning to open in Poland should pay careful attention to local advice regarding the impact of labour laws on the payment of salary, as they may have a major impact on the company’s usual method of operating.

All of these rules apply equally to foreign businesses expanding to Poland, whether the intention is to run a local payroll, send expatriate employees to Poland, or a combination of these factors. If only expats are sent, then it is likely that withholding obligations will centre around tax, as the assignee will probably be covered by Form A1 (within the European Economic Area) or Certificate of Coverage (countries with a bilateral agreement on social security with Poland) and remain insured for social insurance in their home country. If the employer has no permanent place of business in Poland, then there is no entity for the Tax Office to enforce withholding on. Instead, employee tax obligations must be met through payment of tax via a self-assessment system. Providing local professional assistance to help expat employees through this process is likely to be a must for any benefit package.

All of these rules apply equally to foreign businesses expanding to Poland, whether the intention is to run a local payroll, send expatriate employees to Poland, or a combination of these factors. If only expats are sent, then it is likely that withholding obligations will centre around tax, as the assignee will probably be covered by Form A1 (within the European Economic Area) or Certificate of Coverage (countries with a bilateral agreement on social security with Poland) and remain insured for social insurance in their home country. If the employer has no permanent place of business in Poland, then there is no entity for the Tax Office to enforce withholding on. Instead, employee tax obligations must be met through payment of tax via a self-assessment system. Providing local professional assistance to help expat employees through this process is likely to be a must for any benefit package.

In summary, if your business is planning to consider opening in Poland, make sure the payroll department is part of the project team. The requirements can be complex, and are actively policed by both ZUS and the Labour Inspection Office. The salary payment rule might have a significant impact on internal procedures spreading wider than payroll; for example, it could require redesigns to your standard time and attendance system. If all this sounds like a minefield, then don’t despair. Fortunately, Poland already has an established market of local payroll providers.

Tim Kelsey has worked in the payroll industry for 28 years, working as a Payroll Manager for large UK public sector bodies paying up to 18,000 employees. His particular specialism is international payroll, and he has run payrolls from Kingston, Jamaica to Entebbe, Uganda, and most places in between. In 2007, he formed his own company and now spends much of his time writing and lecturing on all aspects of payroll.