The island nation of Singapore is an economic giant for its size that has transitioned from an industrialized, labor-intensive society to an economy based on high technology and value-added products.

Dezan Shira & Associates Regional Manager David Lee and Assistant Manager Richelle Tay led a two-day Global Payroll Management Institute (GPMI) webinar on “Payroll in Singapore: Challenges of a Global Workforce.” To accommodate their worldwide audience, Lee and Tay began each session at midnight Singapore time. They discussed Singapore’s compliance requirements, payroll calculations, and human resources administration principles. The four-hour, two-part webinar is available on demand.

Lee explained that Singapore ranks as one of the world’s most pro-business climates, with low tax rates and the third highest per-capita GDP in the world in terms of purchasing power parity. He attributed the ranking to an attractive investment climate and stable political environment that allows for foreign direct investments from global investors and institutions.

“In Singapore, our personal tax rate is one of the lowest in the world,” Tay said. “Singapore follows a territorial basis of taxation, which means that companies and individuals mainly are taxed only on Singapore-sourced income. I believe this is a bit different from the U.S., where you are taxed on worldwide income.”

Tay added that in Singapore, foreign-sourced income such as branch profits, dividends, and service income is only taxed if it is remitted or deemed remitted into Singapore, unless the income was already subject to taxes in a foreign jurisdiction with a headline tax rate of at least 15%. She said that “fortunately and unfortunately,” the country of about 5.6 million people has no prescribed minimum wage.

Lee and Tay detailed the Singapore Employment Act, the country’s primary labor law. It provides workers’ basic terms and working conditions, with exceptions including managers and executives.

The Act also outlines rest days, hours of work, annual leave, and other conditions of service that do not apply to the workman who draws a monthly basic salary of more than Singapore $4,500 and an employee who is not a workman but who is covered by the Employment Act and draws a monthly basic salary of more than S$2,500.

“A workman generally refers to blue collar workers doing manual labor, and a non-workman refers to white collar workers doing job duties in an office setting,” Tay said.

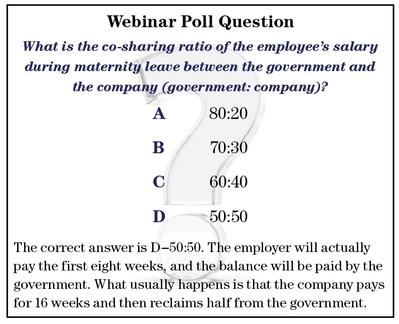

One interesting aspect of Singapore employment is maternity leave in the country, which is covered under Government-Paid Maternity Leave (GPML) or the Employment Act.

To be eligible for 12-16 weeks of maternity leave, the following requirements must be met:

- The child is a Singapore citizen*

- Mother must be lawfully married* to the child’s father

- For employees, must have served the employer for a continuous period of at least three months immediately before the birth of the child

- For self-employed, must have been engaged in work for at least three continuous months and have lost income during the maternity leave period

*If either condition is not fulfilled, then only 12 weeks of maternity leave will be granted.

“This has caused a bit of controversy in Singapore,” Tay said. “From the government’s perspective, they want to encourage more people to get married. The percentage of people getting married is getting lower and lower, and people are getting married later. The government is using these schemes to encourage people to settle down early and to have a child.”

Register for the webinar, now available on demand, to learn more on payroll in Singapore or to see other education brought to you by GPMI.