Peru, officially known as the Republic of Peru, is in the western part of South America. It shares its northern borders with Ecuador and Colombia, eastern borders with Brazil, southeastern borders with Bolivia, and southern borders with Chile. The Pacific Ocean lines its south and western borders. Renowned for its vast biodiversity, Peru's landscapes vary from the dry coastal plains along the Pacific to the towering Andes mountains stretching from north to southeast and further to the lush Amazon rainforest in the east, home to the mighty Amazon River.

Peru is a unitary semi-presidential republic with a multi-party system following its 1993 Constitution. This constitution introduced a more liberal democratic system, replacing a previous constitution that gave the presidency more federative powers and substantial authority. Peru's government structure borrows from the United States (with a written constitution, an independent Supreme Court, and a presidential system) and the People's Republic of China (featuring a unicameral congress and a premier-ministry system).

Labour Law

The Political Constitution of Peru, effective since 1993, includes several articles outlining principles and rules related to labour rights:

- Article 1 emphasises the defence of human dignity

- Article 2, Clause 14 upholds the right to enter into contracts for lawful purposes within the bounds of law and public order

- Article 22 recognises work as a duty and a right integral to social welfare and personal fulfilment

- Article 23 prioritises work as a critical focus of the State, emphasising labour education and employment promotion

- Article 24 guarantees fair and adequate remuneration for workers and their families

- Article 25 sets the standard workday at eight hours or 48 hours per week, with provisions for overtime compensation

- Article 26 enforces three labour principles: equality of opportunity without discrimination, the inalienable nature of constitutional and legal rights, and worker-favourable interpretation of ambiguous rules

- Article 28 protects collective labour rights, such as unionisation, collective bargaining, and the right to strike, to be exercised within democratic and legal frameworks

- Article 29 entitles workers to a share in the company’s profits

Peru’s labour laws are diverse and include the Single Ordered Text of Legislative Decree No. 728 the Labour Productivity and Competitiveness Law. However, the law—published in 1997—doesn't cover all types of activities in the labour system. Special labour regimes with unique rules are acknowledged, as stated in Article 45 of the Law.

Law No. 29783, the "Law on Safety and Health at Work," was enacted in 2011 and promotes occupational risk prevention. It outlines employer responsibilities, state inspection roles, and worker and union participation in enforcing safety regulations.

As of 27 April 2023, Peruvian employers must adhere to Law No. 31572, the Law of Teleworking, and Supreme Decree No. 002-2023-TR. This law acknowledges teleworking as a valid form of employment, with teleworkers entitled to the same rights as onsite workers. Employment contracts must specify teleworking arrangements, including total or partial teleworking, notice periods, work schedules, communication methods, and prohibitions on third-party service provision.

Employers are responsible for providing necessary work tools and covering internet and electricity costs unless otherwise agreed with the worker. The teleworker can request changes in work modality, but the employer retains the right to accept or deny these requests.

The law also mandates employers ensure workplace safety and health for teleworkers, who must allow employers access to their remote workplaces. Teleworkers are required to adhere to work schedules, recognise digital disconnection rights, and maintain availability during work hours.

Working Hours

The standard work week is 48 hours. The typical work week is from Monday to Saturday. Employees are entitled to a day of rest after six consecutive days of work.

Work performed between 10:00 p.m. and 6:00 a.m. is classified as night work and is compensated at a rate 35% higher than the standard wage.

Employees working on a holiday or designated rest day receive compensation at a rate of 100% above their regular salary.

Minimum Wage

As of 26 January 2023, the national minimum wage in Peru is 1,025 PEN ($267 USD) per month. This wage applies to all workers, regardless of their age, occupation, or industry.

Overtime Pay

The employment contract or collective bargaining agreement (CBA) defines the specific overtime compensation rate. The minimum compensation rate for the initial two hours of overtime must be at least 25% above the employee's regular pay.

For each hour of overtime beyond the first two hours, the additional pay must be no less than 35% per hour. Certain exemptions to these overtime rules may apply to specific roles, such as managers, supervisors, on-call workers, and employees who work without direct supervision.

The workday is when an employee is available to the employer for work-related duties.

13th Month or Christmas Bonus Wage

The 13th month salary, known as "Gratificacion de Fiestas Patrias," is paid in the first half of July in celebration of Independence Day. The 14th month salary, referred to as "Navidad," is paid in December. Both these additional monthly payments are equivalent to one month's regular salary.

Profit Sharing

Employers with more than 20 employees must distribute a portion of their annual pre-tax profits among their employees. The percentage shared varies by industry: mining, wholesale, retail, and restaurant businesses allocate 8% of their profits, while manufacturing, fisheries, and telecommunication businesses distribute 10% of their earnings. All other companies are obligated to share 5% of their earnings with their employees.

Severance Pay

While there is no mandatory severance payment, employees are entitled to compensation in cases of unjust dismissal, where the employer lacks a legally valid reason for termination.

For unfair dismissals, the compensation is as follows:

- Employees on an indefinite employment contract receive 1.5 times their monthly salary for each year of service

- For periods of service less than one year, this compensation is prorated

- In the case of a fixed-term contract, employees are compensated 1.5 times their monthly salary for each month remaining in the contract

However, in both scenarios, the total compensation is capped at a maximum of 12 months' salary.

Taxes

The National Superintendency of Customs and Tax Administration (SUNAT) administers all taxes (income tax, value-added tax, etc.). Companies based in Peru must be registered with the tax administration (Taxpayer’s Registry). Peru levies personal income tax on resident and nonresident individuals through the Peruvian tax authorities. Residents are taxed on their worldwide income, while nonresidents are taxed only on their income sourced from Peru. The personal income tax in Peru is known as "impuesto a la renta - personas."

An individual is considered a tax resident of Peru if they spend more than 183 days within the country over 12 months. The determination of residency status is made as of 30 June each year. For instance, if someone permanently relocates to Peru on 1 March, they will not qualify as a tax resident in that year as they would not have been in Peru for more than 183 days by 30 June. However, they would become a tax resident in the subsequent year. Nonresident wages are withheld at a 30% tax rate. When a payment subject to withholding tax is made to a country’s resident with a double tax treaty with Peru, the applicable withholding tax rate may be lower than the standard rates prescribed for nonresidents.

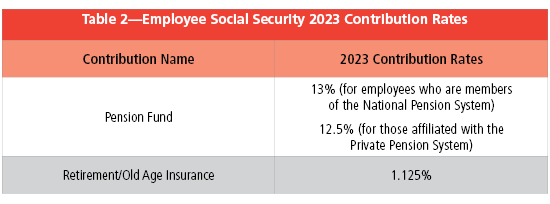

Resident individuals in Peru are subject to income tax at progressive rates. The annual income brackets for taxation are measured in tax value units, known as "Unidad Impositiva Tributaria" (UIT). For 2023, the value of one "Unidad Impositiva Tributaria" (UIT) in Peru is set at 4,950 Peruvian soles (PEN) ($105.47 USD). See Table 1.

Employers are responsible for deducting income taxes from their employees' salaries and paying these taxes every month. Additionally, employers must withhold and submit both the employees' and their own social security contributions to SUNAT each month. These transactions are reported using a PLAME return.

For remittance, employers are required to use the SUNAT Operaciones en Línea (SOL) platform, accessible via SUNAT’s website. The specific deadline for these submissions is determined by the last digit of the employer’s tax identification number, with the earliest possible monthly deadline being the 12th of the month following the month in which the wages were paid.

The tax year for individuals aligns with the calendar year, running from 1 January to 31 December.

Table 1—Peruvian 2023 Income Tax Rates

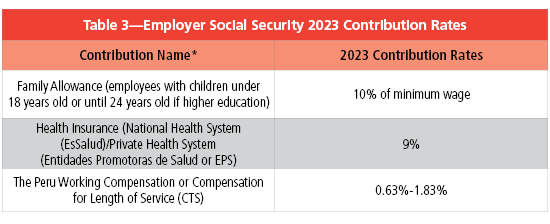

Social Security

Peru’s social security system encompasses a range of services, including pensions, health insurance, and work injury insurance. Oversight of this system is provided by the Comptroller General of the Republic (La Contraloría General de la República del Perú). Social security programs are managed by the Office of Social Security Normalization (Oficina de Normalización Previsional, ONP).

The public healthcare system, known as Social Security Health Insurance (El Seguro Social de Salud, EsSalud), is administered separately. SUNAT collects social security contributions.

The pension system in Peru offers two options:

- A social pension fund

- An individual account system

Employees can contribute either to the social pension fund or to an individual account (see Table 2 for employee rates and Table 3 for employer contribution rates).

Peru’s healthcare system includes:

- Public healthcare is provided through EsSalud

- Private healthcare offered by Health Promoting Entities (Entidades Promotoras de Salud, EPS)

Employees can select their healthcare from either EsSalud or an EPS provider.

Table 2—Employee Social Security 2023 Contribution Rates

Table 3—Employer Social Security 2023 Contribution Rates

Time Off

Annual Leave

Employees are entitled to 30 days of paid annual vacation. The initial 15 days can be split into two segments, one at least seven days and the other at least eight days. The remaining days should be used in at least one-day increments. Vacation leave cannot coincide with periods of maternity leave or disability leave. If an employee is unable to take their vacation within the year, the employer is obligated to pay one month's salary for the unused vacation time, plus an additional month's salary as indemnity.

For domestic workers, the entitlement is 15 days of annual leave.

Sick Leave

Employees are entitled to a year of paid sick leave. The employer covers the first 20 days, and any additional sick leave, up to a total of 11 months and 10 days, is paid by the social security system (EsSalud). If, after one year, the employee is still unable to work, they may apply for a disability pension. To be eligible for this benefit, the employee must have made contributions to social security for either three consecutive or four non-consecutive months within the six months before the start of their temporary incapacity.

Maternity Leave

Female employees in Peru are entitled to 98 days of paid maternity leave, divided into 49 days before and after childbirth. During the 49 days preceding the delivery, the employee has the option to either not work or work reduced hours. If she opts for reduced hours, she can add the hours worked during this period to her post-birth leave. For example, if an employee works only two days a week for seven weeks before giving birth, she would be eligible for an additional 14 days of leave after the birth.

However, the employee must inform the employer about her intended leave at least two months in advance. In cases of multiple births or pregnancy-related complications, the maternity leave can be extended by an additional 30 days.

The Social Security System (EsSalud) funds maternity leave, paying 100% of the leave based on the employee's average salary over the last 12 months.

Additionally, female employees are provided one hour daily for breastfeeding until the child reaches one year old. This hour can be split into two equal periods within the workday but cannot exceed one hour.

To use maternity leave before childbirth, the pregnant employee must present a Certificate of Temporary Incapacity for Work (CITT) for maternity issued by EsSalud or, in its absence, a Medical Certificate from her own doctor, certified by EsSalud. After maternity leave, female employees are guaranteed the right to return to the same position.

Eligibility for maternity benefits requires the employee to have worked for three consecutive or four non-consecutive months within the six months before the leave.

Paternity Leave

Male employees are eligible for 10 days of paternity leave. This leave is extended to 20 consecutive days in cases of multiple births or premature delivery.

Adoption Leave

Employees are entitled to 30 days of paid leave for adoption if they are adopting a child under 12 years old. This leave is available only to the adoptive mother, and the adoptive parents must be married to qualify for this benefit.

Caretaker Leave

Employees have the right to the following leaves for family care:

- Seven days per year to take care of immediate family members

- Fifty-six hours per year, either consecutive or intermittent, to assist disabled children

- One day per year for caring for a family member with Alzheimer’s or a similar condition

Bereavement leave

Public employees are entitled to five days of paid bereavement leave upon the death of an immediate family member. In cases of all leaves, be sure to check any CBAs in place.

Other Leaves

Employees in Peru are entitled to various paid special leaves for specific circumstances:

- Leave to attend a military, judicial, or police summons, provided there is a certificate of attendance

- Paid leave for preventive cancer examinations, up to two days per year, which can be taken either consecutively or separately

- Union leave of up to 30 days for specified positions within the union

- Leave for being a member of the Occupational Health and Safety Committee, with a maximum of 30 days per year

- Leave for blood or organ donation for the necessary time, as health institutions may not offer donation hours outside of working hours

Holidays

Whether in the public or private sector, employees are entitled to 15 national holidays (see Table 4).

Employees who work on a holiday will receive payment for the day worked with an additional 100% surcharge.

Table 4—2024[ National Peruvian Holidays

Additional Benefits

Some employers provide additional benefits to maintain competitiveness in recruitment and employee retention. It's crucial to review any trade union agreements or CBAs for further common benefits that may be mandatory to offer to employees. Additionally, consulting with a tax advisor is advisable to ensure no extra tax implications are associated with providing these benefits.

Some additional benefits might include the following:

- Private (EPS) medical insurance

- Employee assistance programs

- Life insurance

- Food allowance

- House and car allowance

- Education allowance

Culture

Peru is a diverse country, home to indigenous communities and immigrants from Europe (predominantly Spain and Italy), Asia (notably China and Japan), and Africa. While those of Spanish-European descent have primarily influenced the country's modern history, Peru has the second-largest indigenous population in Latin America. Culturally, the indigenous groups in Peru have traditionally emphasised a collective approach, in contrast to the more individualistic perspectives of the Spanish and other Europeans.

Greetings

When meeting a group, it's customary to shake hands with everyone upon arrival and departure. Maintaining direct eye contact and smiling during greetings are seen as indicators of confidence and honesty. However, be mindful that direct eye contact between members of the opposite sex might sometimes be misinterpreted. It's essential to start interactions formally, addressing colleagues by their professional title and Señor, Señora, or Señorita.

Business Cards

Ensure you have ample business cards when meeting new contacts, as exchanging them is common. Bilingual business cards, featuring Spanish on one side, are particularly valued.

Your business card should accurately represent your position within your company. When receiving a business card from someone else, take a moment to read it carefully and offer a complimentary remark about their company or their professional title.

Business Hours

Companies typically operate from 8:00 a.m. or 9:00 a.m. until 5:00 p.m. or 6:00 p.m., Monday through Friday.

Banks and government offices generally close earlier than regular businesses.

The lunch hour is commonly observed between 1:00 p.m. and 3:00 p.m.

Business Presentations

When conducting a presentation, use an engaging style. Peruvian audiences often appreciate a presentation that appeals to emotions, provides ample background information, and gradually builds up to the main point.

A formal appearance is vital in presentations, especially to external parties. Dressing formally and behaving professionally leave a positive impression.

If you are hosting the presentation, arrange for refreshments and allocate time for socialising at the start, as attendees may arrive gradually.

Peruvians may be reserved in formal settings, so fostering a relaxed and friendly atmosphere can encourage them to share their opinions more freely. Aim to be amiable and avoid situations where someone might be embarrassed or could lose respect.

It's advisable to ascertain beforehand whether your audience prefers a direct and straightforward presentation or a more socially engaging and eloquent approach.

Influencing Decisions

When conducting business in Peru, keep in mind the following:

- Focus on Relationships: Establishing and nurturing relationships is crucial in Peru. The stronger your relationship with your counterparts, the more open they will be to your business proposals.

- Emotional Engagement: Connect with your audience emotionally. Use stories and anecdotes to engage their emotions and intuition.

- Clarity and Benefits: Clearly outline the reasons and benefits of your proposal. Providing detailed information can help alleviate uncertainties and aid decision-making.

- Centralized and Hierarchical Approach: The traditional decision-making style in Peru tends to be centralised and hierarchical, with decisions often made by those at higher levels of the organisation.

Obtaining Information

Keep in mind the following when obtaining information in Peru:

- Restricted Information Flow: In Peru, information is often considered a source of power, leading to its careful control and limited distribution.

- Use of Informal Networks: Exercise caution with sensitive information. Due to the prevalence of extended networks in Peruvian business culture, confidential details may inadvertently spread through informal communication channels.

- Risk of Information Exchange Through Bribery: Be aware that offering payment for favours is common, and sensitive information is acquired unethically through bribery.

- Clarity and Incentives in Requests: When requesting information, provide as much detail as possible to minimise any uncertainty the other party may have. Highlighting any incentives they will gain from providing the requested information can be an effective strategy.

Virtual Communication

When communicating in Peru, follow the below preferences:

- In-Person Meetings: Whenever feasible, opt for face-to-face meetings, as they are highly preferred in Peruvian culture.

- Cell Phone Communication: Mobile phones are a common and effective way to contact colleagues in Peru.

- Alternative Contact Strategies: If you cannot reach someone, consider calling again later or sending a text message, as voicemail is not commonly used. If you must leave a voice message, keep it brief, clear, and concise.

- Email Usage: Emails are typically used to summarise previously discussed topics rather than for initiating new conversations or detailed discussions.

Gestures, Body Language

When conducting business in Peru, be mindful of the following mannerisms:

- Physical Proximity and Contact: Maintaining close personal space and engaging in physical contact during conversations is viewed positively, as it conveys warmth and approachability.

- Eye Contact: Direct eye contact is generally preferred in Peru, but men should keep it brief when interacting with women as it may not be considered a professional gesture.

- Expressive Gestures: Peruvians often use expressive and active gestures while speaking.

- Nodding Interpretation: In Peru, nodding doesn’t necessarily imply agreement; it often indicates that the person is listening.

- Specific Gestures: Be cautious with hand gestures; for example, forming a circle with the thumb and index finger can be considered impolite.

Leadership

In Peru, management styles can vary significantly based on factors such as the type of company, industry, educational level, and the generation of the workforce. Foreign leaders should be adaptable and choose the management approach that best aligns with their goals and the context of their organisation. The following are some leadership styles:

- Traditional Style: Leaders expect a certain level of distance and formality in more traditional Peruvian settings. Decision-making is often centralised, with clear directives provided to employees. The hierarchical structure is evident in many organisations, where leaders are respected and maintain a formal demeanour. All levels of employees may attend social events, but senior management often interacts within their own group.

- Alternate Styles: In some modern companies, especially multinational corporations, management styles are more participatory and less hierarchical. These environments may be more welcoming to employees who have been educated abroad or are from newer generations, focusing on empowerment, constructive feedback, and delegation.

- Direction Without Micromanagement: Peruvian employees respect authority and expect clear guidance, but they generally prefer not to be micromanaged. Excessive oversight or public correction can be seen as insulting.

- Preferred Qualities: Effective managers in Peru are typically people-oriented, valuing and acknowledging employees' competencies and showing genuine concern for their development. Solid yet open communication, realistic objectives, and respect and approachability are key.

- Participatory Management: Implementing a more participatory management style requires building trust and confidence before delegating responsibilities. However, being too lenient can lead to being taken advantage of, so it’s essential to be involved while setting clear boundaries.

- Private Constructive Feedback: Refrain from public criticism of employees. Instead, offer constructive feedback during private conversations.

- Public Recognition: When acknowledging good performance, do so with positive feedback or praise in a public setting.

- Focus on Development: Show a genuine interest in employees' personal and professional development. Emphasise that constructive feedback is meant for improvement, not as a critique.

- Documentation for Evaluations: Before giving performance feedback, prepare written documentation that is factual and specific to support your evaluation.

- Company as Family: Encouraging Peruvians to see themselves as part of a “company family” can effectively foster teamwork.

- Navigating Hierarchy: Peru's prevalent preference for hierarchical structures might challenge creating a collaborative work environment.

- Social Events for Relationship Building: Utilize social events to strengthen relationships among team members, as Peruvians are generally relationship oriented.

- Time Management Agreement: Considering the flexible approach to time in Peru, establish precise schedules and conduct regular follow-ups to ensure timely completion of tasks.

- Idea Generation: Engage team members in brainstorming and problem-solving to enhance teamwork and collective participation.

- Punctuality: When interacting with Peruvian counterparts, it's essential to be understanding about punctuality. Showing anger or impatience over lateness can be counterproductive. Instead, setting a positive example and explaining your expectations while remaining flexible is advisable.

Peru is home to more than 32 million people, with its capital and most populous city being Lima. Covering an area of 1,285,216 square kilometres (496,225 square miles), Peru ranks as the 19th largest country globally and the third largest in South America.

Peru’s economy is ranked 48th globally in Purchasing Power Parity, and the World Bank classifies its income level as upper middle. As of 2011, Peru was among the fastest-growing economies globally, mainly due to an economic surge in the 2000s. The nation’s Human Development Index, above average at 0.77, has consistently improved over the past 25 years. Historically, Peru's economic progress has been heavily linked to its export sector, which is crucial for generating foreign currency needed for imports and paying off external debts. Despite substantial export revenue, achieving self-sustained growth and equitable income distribution remains challenging. As of 2015, 19.3% of the population lived in poverty, including 9% in extreme poverty. In 2012, Peru had the lowest inflation rate in Latin America at 1.8%, although it rose in 2013 due to increasing oil and commodity prices, reaching 2.5% in 2014 and 8.6% in 2023. The unemployment rate, declining recently, was at 6.56% as of October 2023.