Located between Honduras and Costa Rica, the Republic of Nicaragua is in the heart of Central America. The country is known for its unique terrain of lakes, volcanoes, and beaches; boasting the only place on the planet to find freshwater sharks in its largest lake, Lake Nicaragua. Due to its unique location, it was once slated to be the location of a second canal connecting the Atlantic and Pacific oceans.

Located between Honduras and Costa Rica, the Republic of Nicaragua is in the heart of Central America. The country is known for its unique terrain of lakes, volcanoes, and beaches; boasting the only place on the planet to find freshwater sharks in its largest lake, Lake Nicaragua. Due to its unique location, it was once slated to be the location of a second canal connecting the Atlantic and Pacific oceans.

Spanish is the official language and Catholicism is the predominant religion. The three largest cities in the country are Managua (the Capital), Leon, and Granada. Trade, textiles, and agriculture combined account for nearly 50% of their exports; beef, coffee, and gold are their best three commodities.

Getting Started

The most common type of business in Nicaragua is called the Nicaragua Corporation, although many multinational companies open a branch of their existing company instead. A business needs to have at least one director, two shareholders, and an auditor to register as a corporation; or one director and one shareholder if registered as a branch. Companies will also need a tax identification code. All businesses are regulated by the Ministry of Development, Industry, and Trade; with all transactions traditionally done in person.

Commercial bank accounts are required for all new businesses operating in Nicaragua and can typically take 4-6 weeks to establish. Additional time should be planned to account for any delays in processing the necessary paperwork. The speed and ease of opening a business account are heavily dependent on the company’s understanding of the system and language. Companies that don’t have an ally in country, or a deep understanding of the country’s customs and language, may risk missing an important step or making an error in the paperwork.

Labor Code

Employment contracts in Nicaragua can either be written or verbal. Two copies of the written employment contracts are sent to the Ministry of Labor to be authorized and certified. A copy is returned to the employer later.

Verbal employment contracts are allowed for fieldwork, domestic service, and temporary or seasonal employment that do not extend beyond 10 days. Employers must provide employees with a certificate outlining the start date, type of work to be performed, and wages within three days of starting work.

Employment contracts may be fixed term or indefinite.

The standard work week is 48 hours constituted by eight-hour workdays typically performed between the hours of 6 a.m. and 8 p.m. Work performed at night (between 8 p.m. and 6 a.m.) cannot exceed 42 hours a week; mixed day and night work cannot exceed 45 hours per week. Work that is classified as dangerous or unhealthy by the Ministry of Labor cannot exceed six hours a day.

Compensation and Leave

Minimum wage is set by industry sector and ranges from C$4,723.95 ($132 USD) for agricultural sectors to C$10,571.78 ($295 USD) for construction, financial institutions, and insurance per month. Hours worked beyond the standard working hours are paid as overtime and regulated by the employment contracts or collective agreements.

Overtime on holidays is limited to nine hours a week. All overtime exceeding 48 hours a week is paid at an overtime rate of 200% of the employee’s regular salary. However, employees may opt for a 24-hour rest period in lieu of receiving overtime pay for work performed on a weekend or holiday.

Like many Latin American countries, Nicaragua has a mandatory 13th month payment, and the employer must pay an additional month’s salary within the first 10 days of December.

Payroll Cycle

Payroll frequency is mandated in the employment contract. In general, manual workers are typically paid weekly, and monthly paid employees are paid on the 15th day of the cycle.

Paid Time Off

Employees are entitled to 15 days of paid leave following six months of consecutive employment. This increases to 30 days of vacation leave after one year of work. This equates to receiving 15 days of vacation per six months of service.

Sick Days

Employees can take up to 26 weeks of sick leave, paid at 60% of their regular wages by the Social Security Institute starting on the fourth day. The first three days of sick leave are unpaid unless the company has an established practice of paying for those days and it is stipulated in the employment contract. However, if the employee is hospitalized, or it is a work-related illness or injury, the three-day waiting period is waived.

Maternity/Paternity Leave

Maternity leave in Nicaragua is 12-weeks of paid leave; the employee must take four weeks of leave before the birth and eight weeks after birth. In the case of multiple births (twins, etc.), the employee is entitled to 14 weeks of leave; four weeks prior to birth and 10 weeks after delivering.

Social security provides 60% of the employee’s regular salary and the employer is responsible for 40%, resulting in 100% paid maternity leave. To earn the full benefit, employees need to have contributed to social security for a minimum of 16 weeks prior to childbirth. If the employee has not contributed to social security, the compensation falls to the employer.

The father/partner is entitled to five business days of paid paternity leave after the child’s birth.

Currently, there is no provision for parental leave.

Termination

There is a process in place that needs to be followed when terminating an employee and it varies according to the employment contract and/or collective agreement that is currently in place. Regardless of the provision in place under the agreements, an employer must also request permission from the labor inspection department. An employee who is terminated is entitled to receive any remaining vacation pay and their annual bonus.

Employers must provide 15 days’ notice to the employee being terminated.

All terminated employees are entitled to at least one month’s wages in severance and can go up to, but not exceed, fives month’s total wages.

All employees are also subject to a 30-day probation period where either party may terminate the employment for any reason.

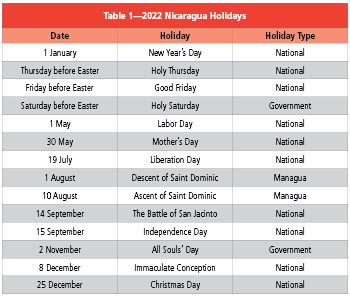

Holidays

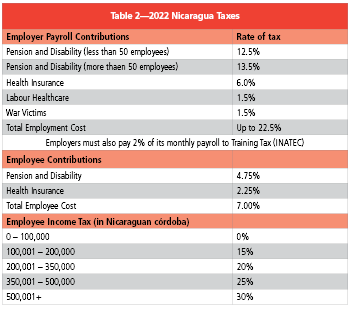

Taxes

VAT

The standard rate of value-added tax (VAT) in Nicaragua is 15%.