The Dominican Republic (DR) is the eastern part of the island of Hispaniola, which sits in the Caribbean within the North American continent. It is a country with a stable democracy and constant economic growth. Its economy is diverse, and its primary industries include tourism, agro-industry, free trade zones, and mining.

The Dominican Republic has experienced a remarkable period of strong economic growth over the past 25 years. On average, the economy grew 5.3% between 2000 and 2019. This was mainly driven by rapid capital accumulation and productivity improvements. The consolidation of the tourism sector, the increase in remittances, the vital role of foreign direct investment, and free trade zones to promote exports have—over the last decade—helped turn the DR into the second fastest-growing economy in Latin America and the Caribbean. This remarkable development contributes to its goal of achieving high-income country status by 2030.

Labor Code

In the Dominican Republic, Law 16-92, dated 29 May 1992, better known as the Labor Code, is the law that regulates all matters related to working in the Dominican Republic, including the following:

- Definition of the employment contract

- Contract modalities

- Official and private regulations of the different types of employment contracts

- Application procedures of the law by the administrative authorities and courts

- Regulations for the application of the code

Likewise, there are a series of resolutions issued by the Ministry of Labor whose objective is the best application of laws and regulations.

In addition, the National Congress has ratified approximately 30 agreements from the International Labor Organization (ILO).

Minimum Wage

The monthly minimum wage in the Dominican Republic varies based on the size of the company:

- 21,000 DOP in large companies

- 19,250 DOP in medium-sized companies

- 12,900 DOP in small companies

- 11,900 DOP in micro-enterprises

Salary payment is made directly to the employee unless otherwise agreed.

Additional mandated benefits include social security, Christmas salary, profit sharing, and vacation compensation. Other benefits represent between 34.9% to 45% of the annual salary.

Working Hours/Conditions

The standard workweek in the Dominican Republic is 44 hours per week, not to exceed eight hours per day on weekdays and four hours on Saturdays before noon.

The working day established in the Labor Code, Article 149, is as follows:

- Day shift: 7:00 a.m. to 9:00 p.m.

- Night shift: 9:00 p.m. to 7:00 a.m.

- The weekly shift must be at most 44 hours and eight hours daily. In practice, employees work Monday to Friday and until noon on Saturday.

- Part-time employees must not work over 29 hours in a single week.

Overtime Pay

Work over the standard weekly working hours is considered overtime and is regulated by the employment contract or collective bargaining agreements (CBAs).

All overtime hours above 44 hours per week are paid at 135% of regular wages. Any overtime above 68 hours per week is paid at 170% of normal wages.

Overtime hours performed on a weekend or public holiday are paid at 200% of the employee’s regular pay rate, and overtime hours working during the night are paid at the rate of 115%.

Christmas Bonus

All employees are entitled to receive a Christmas bonus by 20 December of each year that is the result of the sum of all wages received in a year divided by 12.

Profit Sharing

All companies must grant participation in the profits of the company equivalent to 10% of the annual net profits or benefits to all its workers for an indefinite period as follows:

- From 0-1 year: Monthly salary x number of months/12 x 1.5

- From 1-3 years: Equivalent to 45 days of ordinary salary

- More than 3 years: Equivalent to 60 days of ordinary salary

Article 224 adds, “The payment of the participation to the workers will be carried out by the companies no later than 90 to 120 days after the end of each financial year.”

Composition of the Workforce

At least 80% of any company’s workforce must be of Dominican nationality. This includes administrators, managers, directors, and other people who exercise administrative functions. If a Dominican replaces a foreigner in one of these positions, they must enjoy the same salary, rights, and working conditions as the foreign worker.

Taxes

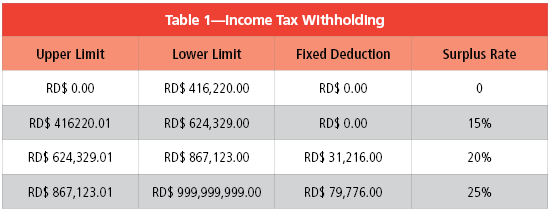

According to Table 1, employees' annual salaries are subject to income tax withholding, updated annually by the General Directorate of Internal Taxes through the National Congress.

The declaration and payment of income taxes are made every month. The company is considered the withholding agent and must pay the withheld taxes to the General Directorate of Internal Taxes.

Table 1—Income Tax Withholding

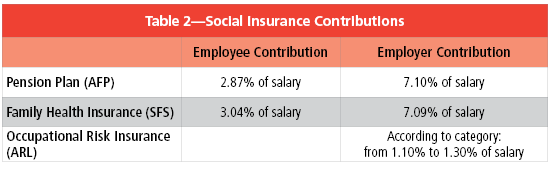

Social Insurance Contributions

Law 87-01, that creates the Dominican Social Security System enacted on 14 May 2001, makes mandatory universal membership without discrimination of salary level as provided by law to employees in a dependency relationship under the contributory regime. Both the employer and employee contribute jointly to the payment of social security contributions according to the percentages established by the same law, both for health insurance and for old-age, disability, and survival insurance (pension funds) (see Table 2). The contributions to the Risk Insurance Labor (professional diseases and accidents at work) correspond exclusively to the employer.

It should be noted that Article 39 of the Law 87-01 indicates among the obligated persons to join the system: “Foreign citizens with legal and permanent residence in the Dominican Republic."

Consequently, it is mandatory for all employers and employees to join the system.

Table 2—Social Insurance Contributions

Vocational Technical Training Institute

All companies that operate in the Dominican Republic are subject to paying a monthly fee to INFOTEP (Institute Professional of Technical Training). This contribution is equivalent to 1% of wages and 0.50% of the annual bonuses paid to employees.

The Ministry of Labor and the Social Security Treasury require companies to send digital information monthly that includes employee payroll, new hires or terminated employees, income tax returns, and social security, among other elements.

Paid Time Off

- Employees are entitled to take the following leave with salary:

- Five days of leave to get married

- Three days of leave for the death of an immediate family member or spouse, or partner

- Two days for paternity leave

- Six weeks preceding the birth of a child and six weeks following. This is called prenatal and postnatal care granted to women. When the worker does not use all the prenatal rest, unused time accumulates during the postnatal rest period.

- Documented sick leave

After completing one year of continuous work, employees acquire the right to a vacation period according to the following scale:

- 14 days of ordinary salary for continuous employment from 1-5 years

- 18 days of ordinary salary for continuous employment exceeding five years

If employment ends before completing the year of service, employees must be compensated according to the following scale:

- Five months=six days

- Six months=seven days

- Seven months=eight days

- Eight months=nine days

- Nine months=10 days

- 10 months=11 days

- 11 months=12 days

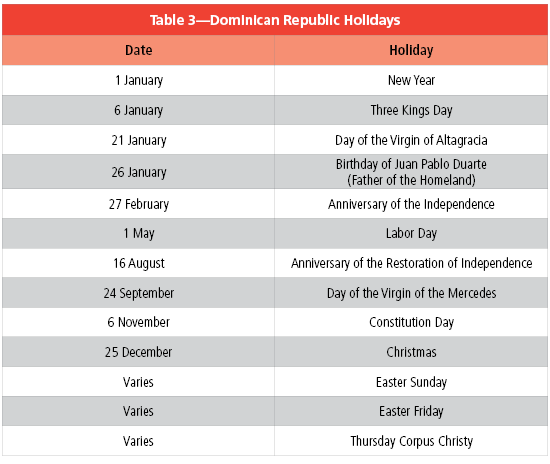

There are 13 holidays per year in the Dominican Republic (see Table 3).

Table 3—Dominican Republic Holidays

Foreign Hires

Foreign nationals require a business visa to conduct business activities in the Dominican Republic. Business visas are either issued for 60 days for a single entry or multiple entries and are valid for one year. The authorized period of stay is granted at the discretion of the admitting officer and corresponds to the duration of the activity, but typically does not exceed 30 consecutive days. Business visa holders may apply for an extension usually granted for a maximum of 30 additional days.

Foreign nationals who intend to work in the Dominican Republic require either a business visa for employment purposes for assignments of one year or less (issued by consular post with authorization from the Ministry of Foreign Affairs) or a Temporary Residence Permit for assignments exceeding one year.