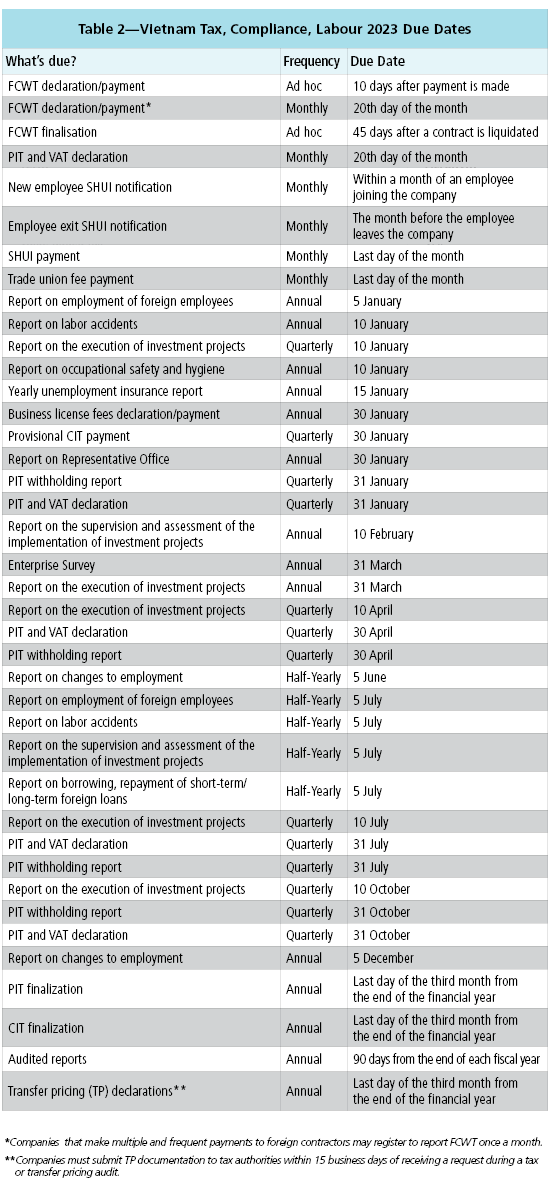

There are many due dates for compliance, labour, and tax in Vietnam, and it can be difficult to keep track of them all. This list shows all the key dates a business may need to know. It covers what is due, when it is due, how often it is due, and which department or ministry it needs to be submitted to.

Vietnam’s Financial Year

Vietnam’s financial year is from 1 January to 31 December. In the first year, if a business is in operation for less than 183 days, then the calendar year is 12 months from when the business starts operating. Every subsequent year will then need to align with the calendar year.

Alternatively, a business may choose a 12-month period beginning the first day of any standard quarter, but this must be registered with the tax department.

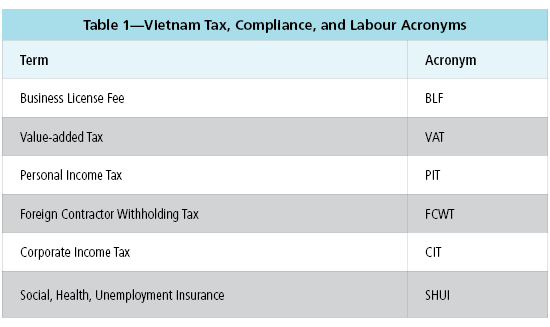

Table 1 shows a list of common acronyms associated with Vietnam tax, compliance, and labour.

Vietnam Tax, Labour, Compliance Due Dates

If a deadline falls on a weekend or public holiday, payment is due on the next working day. Table 2 shows many of the tax, labour, and compliance due dates.

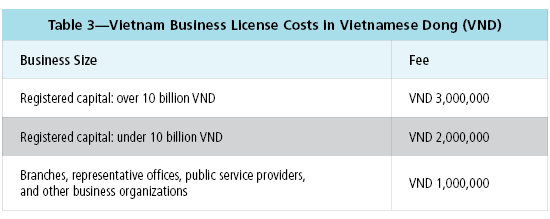

Business License Fees

What’s due? Declaration and payment

When is it due? 30 January

FCWT Declarations (Ad hoc)

Deadline: The 10th day from the day on which payment is made and finalized within 45 days from date of contract liquidation. When a foreign contract is generated, the tax number for FCWT use must be registered within 10 workdays. The obligation is incurred once the payment is made.

FCWT Declarations (Monthly)

Companies that make multiple and frequent payments to foreign contractors may register to report FCWT once a month.

What’s due? Declaration and payment

When is it due? 20th of each month*

PIT, VAT Declaration (Monthly)

What’s due? Declaration and payment

When is it due? 20th of each month*

PIT, VAT Declaration (Quarterly)

What’s due? Declaration and payment

When is it due? The last day of the first month of the next quarter

- Companies that earn total revenue of VND 50 billion or less from the sale of goods and/or services in the preceding year may be eligible to declare VAT quarterly

- If a company is in its first year of trading, it can declare its VAT quarterly. In the next calendar year, VAT declarations will be declared either monthly or quarterly depending on the revenue from the preceding calendar year.

- PIT is generally paid monthly; however, if a company is approved to pay PIT quarterly, the due date is the same day as the VAT

PIT Withholding Report (Quarterly)

When is it due? The last day of the first month of the next quarter*

Details: No payment is required. Simply submit the PIT withholding report to the tax department.

PIT Finalization

What’s due? Declaration and payment

Due:

- The last day of the third month from the end of the financial year

- PIT self-finalization—The end of the fourth month, following the end of the financial year

- Departing expatriate employees—Within 45 days upon departure

Corporate Income Tax—Provisional CIT Payment

Frequency: Annual

Due: 30 January

- While the total CIT due will be based on an annual figure, companies can make payments in quarterly installments

- Total provisional CIT paid in four quarters must not be less than 80% of the CIT liabilities payable at the time of CIT finalization

- The standard CIT rate applicable to businesses in Vietnam is 20% in assessable income

CIT Calculation

- Assessable income = Total revenue – Deductible expenses + Other income – Carried forward losses – Tax-exempted income

- CIT payable = [Assessable income – Deductions for establishing a science and technology fund] x CIT Rate

Arrears

- If the provisional corporate income tax of four quarters is unpaid or is not paid in full, late payment interest will be charged on the arrears

- This will be calculated from the first day after the due date to the day before the arrears is cleared

- The late payment fine of tax payable is 0.03% per day on the overdue amount from the overdue date. This does not apply if the fault is on the part of the tax authorities.

CIT Finalization

Due: The last day of the third month from the end of the financial year

Audited Reports

Due: 90 days from the end of each fiscal year

Audit reports must be submitted to the following local agencies:

- Tax department (online submission)

- General Statistics Office

- Finance department

- Department of Planning and Investment

Transfer Pricing Declarations

Due:

- Before annual CIT returns (the last day of the third month from the end of the financial year)

- Companies must submit TP documentation to tax authorities within 15 business days of receiving a request during a tax or transfer pricing audit

New Employee SHUI Notification

Due: Within a month of an employee joining the company

Employee Exit SHUI Notification

Due: The month before the employee leaves the company

- When there is a reduction in employment, the company must notify the SHUI Department the month before. If the company fails to notify the department, it must pay 4.5% in health insurance for that month.

- For example, if an employee leaves the company in January, the company must submit a decrease declaration for that employee in December. If the company submits the declaration in January, it must pay 4.5% for health insurance.

SHUI Payment

Due: Last day of the month

Report on Employment of Foreign Employees

Due:

- Half-yearly report: 5 July

- Annual report: 5 January

Submit to: The Provincial Department of Labour, Invalids, and Social Affairs where the company’s head office is located.

Report on Changes to Employment

Due:

- Half-yearly report: 5 June

- Annual report: 5 December

Submit to: The Provincial Department of Labour, Invalids, and Social Affairs where the company’s head office is located.

Report on Labor Accidents

Due:

- Half-yearly report: 5 July

- Annual report: 10 January

Submit to: The Provincial Department of Labour, Invalids, and Social Affairs where the company’s head office is located. This can be submitted online via the National Public Service Portal.

Report on Occupational Safety and Hygiene

Due: 10 January of the following year

Submit to: The Provincial Department of Labour, Invalids, and Social Affairs where the company’s head office is located.

Yearly Unemployment Insurance Report

Due: 15 January

Submit to: The SHUI Department where the company’s head office is located.

Report on the Execution of Investment Projects

Due:

- Quarterly: By the 10th day of the month following the reporting quarter

- Annually: By 31 March of the following reporting year

Submit to: The Department of Planning and Investment where the company’s head office is located.

Report on the Supervision and Assessment of the Implementation of Investment Projects

Due:

- Half-yearly report: 5 July

- Annual report: 10 February

Submit to: The Department of Planning and Investment where the company’s head office is located.

Enterprise Survey

Due: 31 March

Frequency: Annual

Submit to: General Statistics Office where the company’s head office is located. This is covered in Form 04/VĐTDN-Q.

Report on Borrowing, Repayment of Short-term/Long-term Foreign Loans

Due: Quarterly on the 5th day of the first month of the following quarter

Submit to: State Bank of Vietnam branch where the company’s head office is located.

Report on Representative Office

Due: 30 January for the year before

Submit to: Department of Industry and Trade where the company’s head office is located.

*Companies that make multiple and frequent payments to foreign contractors may register to report FCWT once a month.

**Companies must submit TP documentation to tax authorities within 15 business days of receiving a request during a tax or transfer pricing audit.