In February, Singapore unveiled its S$109 billion (US$80 billion) 2022 budget which provides a slew of tax hikes for higher-income groups and an expected increase in the goods and services tax in 2023.

The moves come as Singapore emerges from an economic slump amid the government’s commitment of more than S$100 billion (US$74 billion) over the last two years to cushion the economy from the impact of the pandemic.

Singapore’s Finance Minister Lawrence Wong announced that this year’s budget will run up an expected deficit of S$3 billion (US$2.2 billion) or 0.5% of GDP, which is down from the S$5 billion (US$3.7 billion) deficit in 2021 and lower than earlier estimates of S$11 billion (US$8.1 billion). Further, the government will draw S$6 billion (US$4.4 billion) from Singapore’s vast reserve to fund the COVID-19 public health measures.

The economy grew 7.4% in 2021, rebounding from a pandemic-induced 5.4% contraction in 2020. The current economic trend is expected to continue, with a projected growth of 3%-5% this year. Still, recovery is expected to remain uneven, especially for the aviation and tourism industries, which will take longer as concerns over the virus, as new variants remain.

What Are New Tax Measures in Singapore’s 2022 Budget?

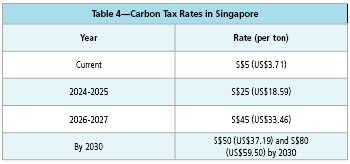

The top marginal personal income tax (PIT) will be increased for the 2024 year of assessment (YA). See Table 1.

Increase in Goods, Services Tax in Singapore

The goods and services tax (GST) rate, also known as the value-added tax (VAT), will be increased in two steps:

- From 7% to 8%, from 1 January 2023

- From 8% to 9%, from 1 January 2024

GST Treatment for Travel Arranging Services

With the growth of the online travel booking industry, the government aims to ensure the GST system remains resilient in supporting the industry.

The basis as to whether zero-rating of GST applies to a supply of travel arranging services will be updated and will be based on the place where the customer and direct beneficiary of the service belong.

This means the following:

- If the customer of the travel arranging service belongs in Singapore, the service will be the standard rate; or

- If the customer belongs outside Singapore and the direct beneficiary either belongs in Singapore or is GST-registered in Singapore, the travel arranging service will be zero-rated.

This change will take effect on 1 January 2023.

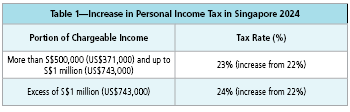

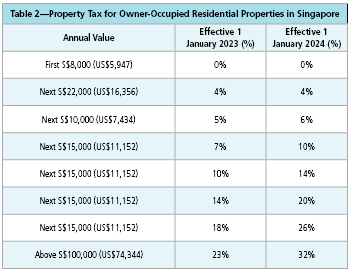

Increase in Property Tax in Singapore

From 2023 to 2024, the government will increase the marginal tax rates for non-owner-occupied residential properties and for owner-occupied residential properties. The rates are illustrated in Tables 2 and 3.

The Minimum Effective Tax Rate Regime

In response to the proposal by the Organization for Economic Co-operation and Development (OECD) for a global minimum effective tax rate, Singapore’s Ministry of Finance (MoF) is exploring a top-up tax called the minimum effective tax rate (METR).

The METR will impose a tax rate of 15% on multinational enterprise groups with annual revenues of at least €750 million (US$849 million). The MoF will continue to consult with industry stakeholders on the design of the METR.

Extension of Approved Royalties Incentive Scheme

Although the approved royalties incentive (ARI) scheme lapses on 31 December 2023, the government has decided to extend the scheme until 31 December 2028.

Under the ARI, a reduced or nil withholding tax (WHT) rate is available on royalty payments to access advanced technology and know-how to capture new growth opportunities.

Shipping, Container Leasing

The WHT exemption for container lease payments made to non-tax resident lessors under operating lease agreements has been extended until 31 December 2027.

Further, the WHT exemption on ship and container lease payments made to non-tax resident lessors under finance lease (FL) for Maritime Sector Incentive (MSI) recipients has also been extended until 31 December 2028.

The pandemic caused a global shortage in containers with the knock-on effect on the production for new containers causing prices to rise sharply. The WHT exemption for container lease payments can help businesses alleviate these rising costs.

International Mediation, Arbitration

The income derived by non-tax resident mediators and arbitrators from work undertaken in Singapore is exempt from tax until 31 March 2023.

From 1 April 2023, the gross income of non-tax resident mediators and arbitrators for work carried out in Singapore will be subject to a 10% WHT rate. Alternatively, nonresident mediators can choose to be taxed at 24% of their net income instead of the 10% on gross income.

Extension of Aircraft Leasing Scheme

The aircraft leasing scheme offers a concessionary tax rate of 8% on income derived from the leasing of aircraft engines or aircraft and other qualifying ancillary activities. The incentive had been due to end 31 December 2022 but was extended until 31 December 2027.

Extension of Approved Foreign Loan Scheme

The approved foreign loan (AFL) scheme, which was due to lapse on 31 December 2023, has been extended until 31 December 2028.

This scheme provides a reduced or nil WHT tax rate on interest payments on loans used for the purchase of productive equipment.

Extension, Rationalization of Withholding Tax Exemption for Financial Sector

The WHT exemption for the following payments is scheduled to end after 31 December 2022.

The WHT exemption for payments a) to d) will be extended till 31 December 2026. The WHT exemption for payment e), will be allowed to lapse on 31 December 2022.

- Payments made under a currency swap transaction by Singapore swap counterparties to issuers of Singapore dollar debt securities

- Interest payments on margin deposits under derivative contracts by approved clearinghouses, approved exchanges, members of approved clearinghouses, and members of approved exchanges

- Payments made under currency swap transactions or interest rate by the Monetary Authority of Singapore (MAS)

- Specific payments made under repurchase agreements or securities lending; and

- Payments made under currency swap transactions or interest rates by financial institutions

Extension of Tax Incentives for Project, Infrastructure Financing

The following incentives under Singapore’s project and infrastructure financing scheme will be extended until 31 December 2025:

- Exemption of qualifying income from qualifying project debt securities

- Exemption of qualifying foreign-sourced income from qualifying offshore infrastructure projects/assets received by approved entities listed on the Singapore Exchange

The concessionary tax rate on qualifying income derived by an approved Infrastructure Trustee-Manager/Fund Management Company (ITMFM) will be allowed to lapse after 31 December 2022. MAS will provide greater detail by 31 May 2022.

The government hopes these measures will continue to strengthen Singapore’s position as the region’s infrastructure financing hub.

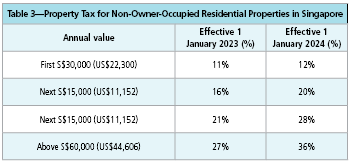

Carbon Tax

Singapore’s carbon tax will be progressively increased from the current rate of S$5 (US$3.71) per ton to between S$50 (US$37.19) and S$80 (US$59.50) by 2030. See Table 4.

This is higher than the previous target of S$10 and S$15 set in the 2018 national budget. The revised carbon trajectory comes as Singapore aims to bring forward its net-zero target by the mid-century.