Georgia lies in the Caucasus region of Eurasia, bordered by Russia to the north, Azerbaijan to the east, and Armenia and Turkey to the south. The capital and largest city, Tbilisi, is home to 1.5 million out of a total population of 3.7 million.

Georgia lies in the Caucasus region of Eurasia, bordered by Russia to the north, Azerbaijan to the east, and Armenia and Turkey to the south. The capital and largest city, Tbilisi, is home to 1.5 million out of a total population of 3.7 million.

Georgia is a unitary parliamentary republic and is currently a member of the United Nations, the Council of Europe, and the GUAM Organization for Democracy and Economic Development. The country also contains two de facto independent regions, Abkhazia and South Ossetia, which most of the world’s countries recognize as Georgian territories under Russian occupation.

Applicable Laws

The applicable laws related to payroll in Georgia are the Tax Code of Georgia, Order Number 996 on Tax Administration issued by the Minister of Finance, the Labor Code of Georgia, and the Law of Georgia on Public Service.

The Tax Code regulates general principles of the formation and functioning of the tax system of Georgia, legal relations related to meeting tax liabilities, legal status of taxpayers and tax agencies, responsibility for the violation of tax legislation, and the procedures and conditions for appealing illegal actions (inaction) of tax agencies and officials thereof. Order Number 996 on Tax Administration is an implementing regulation of the Tax Code.

The Labor Code regulates employment and employment-associated relations.

The Law on Public Service regulates employment issues specifically related to public servants.

Social Insurance

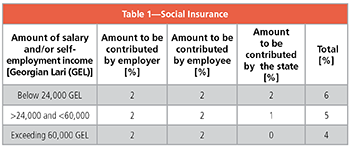

The Government of Georgia initiated pension reform and it took effect on 1 January 2019. This scheme consists of the activation of a “funded pension” to which everyone will make a minor contribution—the employee, the employer, and the state treasury.

Participation in the contributions is mandatory and is imposed on employers, resident persons, citizens of Georgia, foreign citizens, and stateless persons permanently living in Georgia.

The total percentage of the installment varies from 4% to 6%, depending on the annual taxable salaries and/or self-employed income (see Table 1).

Personal Income Tax

Georgia’s 2020 personal income tax rate is 20%. To arrive at a tax base, taxpayers can deduct all expenses contributing to the generation of taxable income except for non-deductible or partially-deductible expenses. Expenses incurred for the receipt of employment income cannot be deducted from an individual’s taxable income.

Employment Procedure

The employment agreement is executed in writing or verbally and is for a definite period, indefinite period, or for a specific duration employment.

An employment agreement must be made in writing if labor relations continue for more than three months. A written employment agreement is executed in a language understandable to the employee and employer, though it may be executed in several languages. If a written employment agreement is executed in several languages, it should contain the acknowledgement of the prevailing language in case of divergence between the provisions of the agreement. A person’s application and the document issued by the employer on its basis, which certifies the intention of the employer to hire a person, has the same power as execution of the employment agreement.

The employer issues a certificate of employment upon request of the employee that includes data on performed labor, labor compensation, and duration of the employment agreement. The employment agreement states that the operations manual represents part of the agreement. In such case, the employer must introduce the operations manual to the employee if such exists prior to execution of the employment agreement, and any further amendments thereon. If several employment agreements are concluded with the employee, which merely complement and do not fully substitute each other, all such agreements remain in force and are construed as a singular employment agreement. The prior employment agreement remains in force to the extent that its provisions are not amended by the subsequent agreement. In cases of the existence of several employment agreements with the employee under the same terms, the latest agreement prevails.

An employment agreement for the probation period is concluded with the job candidate only once and for no longer than six months. An employment agreement for the probation period is made only in writing; in other cases such agreement will be deemed as the employment agreement. With the exception of a few compulsory elements, the Labor Code empowers employees and employers to regulate issues upon mutual agreement. Employment issues of public servants are regulated in a stricter manner by the Law on Public Service.

Protection of Employment

Business trip: Sending an employee on a business trip by the employer is not considered a change of the employment conditions if the business trip period does not exceed 45 calendar days per year. In cases when this duration is exceeded, it is deemed as a modification of the employment agreement terms. The employer must fully compensate the expenses of the employee associated with the business trip.

Paid leave: An employee is entitled to a paid leave of not less than 24 working days and 15 calendar days as nonpaid leave per year. An employee has the right to be fully paid during official holidays that are set by law.

Leave for pregnancy, childbirth, and childcare: An employee is entitled to request leave for pregnancy, childbirth, and childcare of up to 730 calendar days—183 calendar days are payable, and in the case of a complicated childbirth or multiple births—200 calendar days.

Leave for adoption of a newborn: An employee adopting a newborn younger than 12 months, upon his/her request, is entitled to take a leave of 550 calendar days after the birth. Out of this leave, 90 calendar days are paid.

Compensation of the leave: Leaves taken for pregnancy, childbirth, childcare, and the adoption of the newborn are compensated from the state budget up to the amount of 1,000 GEL. The employer and employee may agree on additional compensation.

Additional leave for childcare: An employee, upon his/her request, is entitled to take not less than two successive weeks in a year (or in portions) of unpaid leave for childcare for a period of 12 months before the child turns age five. Additional leave for childcare may be given to any person who actually takes care of a child.

Unused leave: If the employment agreement is terminated for the reasons set forth in the Labor Code, the employer must pay the employee any unused leave calculated in proportion to the duration of employment.

Payroll Calculation Procedure

Remuneration will be paid once a month. Remuneration and benefits paid by a Georgian employer or nonresident employer with a permanent establishment in Georgia are generally taxed through periodic (monthly) payroll withholding taxation simultaneously with the payment of such amounts.

Termination of Employment

Options for the termination of a labor agreement are available for both employee and employer. If the initiator of the termination is the employee, then he or she must notify the employer about the termination not fewer than 30 calendar days prior in written form.

If the initiator of the termination is the employer, it must give the employee at least 30 calendar days’ prior written notice. In addition, the employee will be granted a remuneration pay of at least one month’s salary within 30 calendar days after the termination of the labor agreement.

If employment is terminated, the employer must make final payment to the employee no later than seven calendar days, unless otherwise directed by the labor agreement or law.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Irina Lopatina is Country Executive for Eurofast based in Tbilisi, Georgia. She obtained her Association of Chartered Certified Accountants (ACCA) in London in 2011, specializing in tax and audit, International Financial Reporting Standards (IFRS), and management accounting and also holds a bachelor’s degree in languages and translation from Tbilisi State University in Georgia from 1998. Lopatina joined Eurofast in 2016, supporting and representing its operations in Georgia. Her previous experience covers financial analysis, management accounting, and financial controls in both U.K. and Georgian-based companies. She coordinates two big payroll projects, supervises legal and tax requests, is trained in global control standards, transactional process improvements, global bribery, and anti-corruption acts. She is fluent in English, Russian, and Georgian.