The United Mexican States is a federation of 31 states. Each state has its own constitution, Congress, and judiciary, with an elected governor serving a six-year term. The Federal District (Mexico City) is a special political division and not a separate state.

Mexico is the third largest country with which the United States does business.

COVID-19 Response

According to Auxadi’s guide “COVID-19: A Global Crisis,” Mexico is one of the countries in Latin America that is reacting more slowly than its neighbors to the pandemic. However, the cases of those affected by the coronavirus continue to grow, which is forcing the government to take measures and updates on various fronts.

In late March, the federal government headed by President Andrés Manuel López Obrador presented a plan to reduce the impact that the COVID-19 emergency will have on the country's economy and public finances.

All workers received their full salaries in April because an "emergency" has been declared due to "force majeure" and not as a “health contingency" that would allow employers to pay only the minimum wage.

The President had presented a speech in which he promised two million jobs, greater public investment, and the expansion of social welfare programs in a brief plan for economic recovery to alleviate the coronavirus crisis, which the business community received with doubts. In fiscal terms, he only mentioned that "taxes will not increase, nor will new ones be created. VAT will be promptly returned to taxpayers."

Readers can sign up for “COVID-19: A Global Crisis,” which Auxadi updates weekly.

Registering as a Business in Mexico

A company must first be registered in order to process its payroll in Mexico. The following registrations are required:

- Registration of the public deed containing the establishment of the legal vehicle at the Public Registry of Property and Commerce

- Registration of the legal vehicle with the National Foreign Investment Bureau

- Application for the Tax ID (Registro Federal de Contribuyentes)

- Obtaining the Advanced Electronic Signature (Firma Electronica Avanzada) to file tax returns

- Employer registration before the Mexican Social Security Institute

- Registration for the local payroll tax (if applicable)

Registrations can take up to 90 days, and a company must ensure that these are obtained prior to paying employees in Mexico. When a company begins its global journey to Mexico, it will need to ensure that it takes this timeline into consideration.

Paying Employees in Mexico

A company must make all salary and statutory payments from an in-country bank account, which can create extra timelines that should be considered when setting up payroll in that country.

In Mexico, payments created using a Mexico debit account will need the receiver of the payment to be a registered beneficiary. This is a regulatory requirement indicated in the General Decree applicable to Credit Institutions as stated by Comisión Nacional Bancaria y de Valores.

The payments that require beneficiary registration include the following:

- Priority Payments (International)

- Priority Payment SPEI (Domestic)

- Mexico ACH Credits—General Template, Payroll, and Online Payroll

Labor-Related Issues

An employee who works for at least a month for a Mexican employer is presumed to be a permanent employee. For the first month of employment, if a contract is prepared describing the temporary nature of an employee’s work, the employer may terminate the contract within the month without cause. After that month, an employee may only be separated for cause without the employer owing severance.

Work Week, Overtime

The Federal Labour Law (FLL) establishes maximum regular hours of work daily. The normal workweek ranges from 40 to 48 hours. Employees work a maximum of six days a week and are paid for the seventh day.

Employers may not allow employees to work for more than eight hours in the daytime, seven hours for night work, and seven-and-a-half hours for a shift that is both day and night. Employees are provided at least one rest day, which employers are urged to provide on Sundays. Employees who work on Sundays are provided a bonus equal to 25% of their regular daily pay. Even if the employee does not work on Sundays, however, he or she is paid regular pay for Sundays. Therefore, even though employees in Mexico are not required to work more than a 48-hour week, they are paid for seven days, or 56 hours.

Employees are required to work up to, but not more than, three hours a day and nine hours a week of overtime, with overtime being paid at a rate of double salary. Because employees can choose whether to work overtime beyond nine hours, they could have a cause of action, including the penalty for employers to pay triple time for the hours beyond nine hours.

Leave in Mexico

Vacation. Employees who work for an employer are entitled to the following paid vacation, in addition to a 25% vacation premium:

- Six days of paid vacation after one year of work

- An additional two days annually every added year of service until the end of the employee’s fourth year with the employer

- Two days of paid vacation every additional five years of work

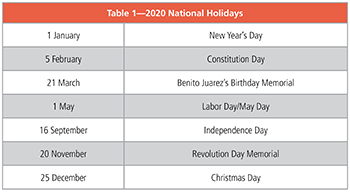

Holidays. There are at least seven required paid holidays annually (1 January, 5 February, 21 March, 1 May, 16 September, 20 November, and 25 December). See Table 1 for the 2020 holidays.

Additional Pay Considerations in Mexico

There are several other pay considerations, including the following:

- Christmas bonus. Employers must pay employees at least 15 days of salary before 20 December of each year, based on the number of days worked that year by the employee. For example, an employee who has worked eight months is entitled to 10 days of Christmas bonus.

- Special bonuses. Employees who work in areas that have high employment rates will be entitled to bonuses based on factors such as work habits (punctuality) and company productivity.

Employees’ salaries are to be revised every year; collective bargaining agreements are required to be changed every two years.

After their first year of operations, Mexican employers are required to pay approximately 10% of their net annual income among all employees.

Taxes in Mexico

The tax year runs from 1 January to 31 December. The Mexican tax authorities include the following agencies:

Residents working in Mexico must obtain a tax ID number (RFC) and a CURP (Uniform Population Control). Mexican employers are obligated to register all employees with the Mexican tax authorities.

There are 10 types of taxable income:

- Salaries and remunerations

- Professionals fees and income from business activities

- Incorporation regime

- Rental income

- Income from sale of assets

- Income from the acquisition of assets

- Interest

- Prizes

- Dividends

- Other miscellaneous income

A Mexican employer is obligated to register all its employees with the Mexican Social Security Institute. Once registered, the employee will receive confirmation of registration. Employee contributions to the Mexican Social Security Institute are withheld on salary payments. The employer also makes contributions. Both contributions are calculated at varying rates and subject to various limits based on multiples of the minimum wage.

Employees must pay social security and retirement contributions on their salaries at a rate of approximately 5% up to the max.

Employers contribute to social security, housing fund, and retirement fund. However, this is taken from the salaries of employees (based on the minimum wage) and add up to roughly 25% of the salaries.

Social security contributions are capped to an integrated daily salary for calculation purposes.

The penalty for late payment of social security taxes is up to 40% of the amount due.

Both the employer and employee contribute to the state pension in Mexico. The following contributions are made:

- The employer pays 2% of the employees’ base salary as pension contributions for retirement.

- The employer pays 3.15% of employees’ base salary as pension contributions for unemployment and old age insurance.

- Employees pay 1.125% of their base salary as pension contributions for unemployment and old age insurance.

Contributions to the Mexican Social Security Institute are not subject to income tax. A proportion of the pension is exempt from tax and the excess will be taxed at the applicable rate.

Most Mexican states levy a relatively low rate of tax on salaries (but not on income in general), which is payable by the employer. Mexico City imposes a 3% payroll tax. It is payable by the employer and constitutes a tax-deductible expense.

Social security contributions are filed and paid the following two ways:

- Tax Returns

- Social security (monthly)

- Housing (bimonthly)

- Retirement (bimonthly)

- Local payroll tax (monthly)

- Employee withholding income tax (monthly)

- Informational Returns

- Annualized individual’s income tax calculation prior to the year-end (annually in December)

- Social security’s professional risk coverage percentage calculation (annually in February)

- Information return on payments and withholdings to employees (annually in February)

- Proof of income tax withholdings and annual income earned issuance for all the employees (in February)

- The submission is via the internet

- The payroll provider needs to be granted a power of attorney for legal representation for tax filings

Joiners/New Hires

The employer and employees should register with the Instituto Mexicano del Seguro Social (IMSS).

New starters should register with the IMSS within their first five days of commencing employment.

In order to set up a new starter the following information is required:

- Employment contract

- Employee compensation package and benefits

- Employee personal information

- Employee bank details

- Copy of identification, tax ID (RFC), general population registry (CURP), social security number

- Proof of address

Leavers/Terminations

For leavers, the payroll company will require an email confirming the leaving date and whether it is a resignation or the employee requires severance pay.

Employees are entitled to receive severance based on three months of salary in addition to 20 days of salary for each year of service, with a lesser amount paid for the proportion of the year worked by the employee, as well as a proportional Christmas bonus and vacation. Employees are also entitled to a “seniority premium” of 12 days for every year of service up to a maximum of twice the amount of the minimum salary in Mexico.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Dee Byrd, CPP, PHR, SHRM-CP, is a Project Manager for PayTech, Inc., who has more than 25 years of global payroll management experience and has represented the payroll profession by speaking to the U.S. Congress in matters regarding multistate payroll taxation issues. She is an American Payroll Association (APA) Vice President, a member and past chair of the APA’s Electronic Payments Committee, part of the APA’s Payroll Cards Subcommittee of the Government Relations Task Force (GRTF), a member of the APA’s Global Issues Subcommittee of the Strategic Payroll Leadership Task Force (SPLTF), and a member of the APA’s Board of Contributing Writers. She was also the APA’s 2011 Payroll Woman of the Year.