For years, payroll has been treated as a cost centre instead of the vital internal support process that is critical for keeping employees loyal and engaged. As a result, investment in digital payroll processes has fallen behind that of customer facing functions.

For years, payroll has been treated as a cost centre instead of the vital internal support process that is critical for keeping employees loyal and engaged. As a result, investment in digital payroll processes has fallen behind that of customer facing functions.

This need for investment was highlighted during the first pandemic lockdown in 2020 when the lack of remote access to payroll processes put the process at risk. The legal, moral, and employee obligations were hard, and in some cases, impossible to maintain, especially if piecemeal solutions had to be put in place to keep essential workers working.

Many of these fixes have since been converted into payroll modernization projects. As it stands, 61% of respondents to the Alight 2021 Global Payroll Complexity Index, published in October 2021, have outsourced some or all their payroll operations. Key drivers for this were regulatory complexity (42%), corporate strategy for outsourcing (30%), cost reduction (27%), and to support mergers and acquisition (M&A) activities (15%).

In the past two years, technology investment and adoption has increased, and is now recognized as essential to meet the demands put upon all business functions to boost efficiencies, lower risks, and create an employee user experience that enables optimum productivity. For the first time ever, the use of agile cloud payroll technologies exceeds that of on-premise (62%)—a rise from 34.8% in 2019.

Drivers for Change

There are many factors involved that are driving the need for change in payroll processes. As a result, it’s important that multiple departments come together to make these decisions as all areas of the business are affected. Figure 1 outlines those factors to help you prioritize and determine which areas need the most attention. While we all know this is challenge, it is important to remember that the benefits your organization will realize could likely change your business forever.

Figure 1—Factors Driving Payroll Process Changes

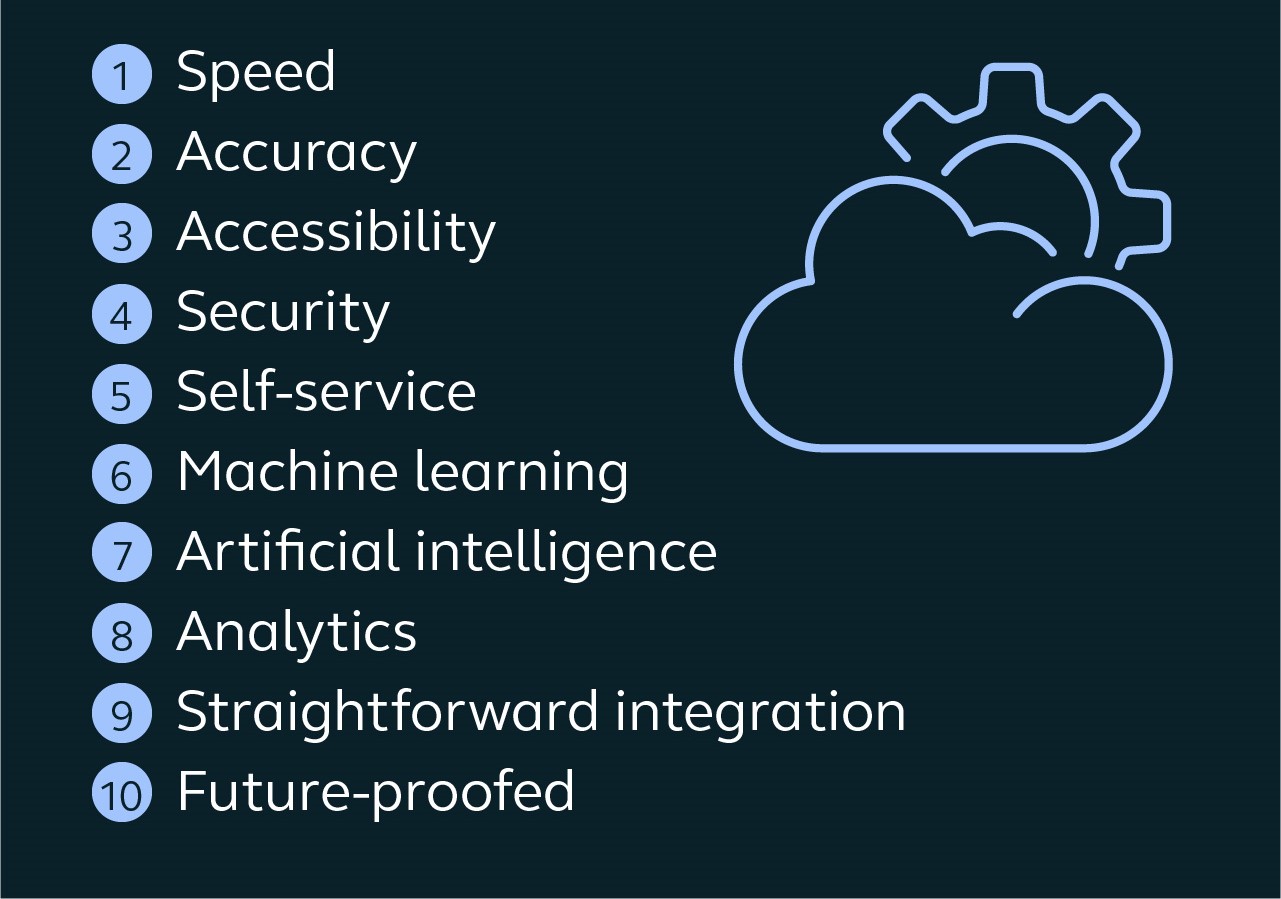

Payroll automation takes everyday payroll processes and makes them faster, more accurate, and predictable. Calculations are completed, anomalies identified, and issues proactively addressed. As a result, time and cost savings are realized immediately.

Automation moves each stage of the payroll process from spreadsheet or paper form to digital, and when stored in the cloud, payroll data is available around the clock with controls in place on who can access or make changes. Further, automation keeps employee data secure and protects the organization from losing data (see Figure 2).

Figure 2—10 Benefits of Payroll Automation

Self-service is a huge advantage of cloud payroll. It puts employees in control with instant access to information about their pay and benefits and lets them see how working hours are related to their pay. Queries can also be raised directly.

The use of

artificial intelligence (AI) and machine learning in payroll is also rising steadily. Largely, it’s used for anomaly checking, time tracking, and workflows that can be automated for smoother performance. It removes process redundancy, minimizes human error, and improves outcomes.

However, even among firms that have embraced automation, the picture is mixed (see Figure 3). Forty percent of companies still use spreadsheets, and 18% continue to use incredibly high-risk and largely noncompliant manual and paper-based activities as part of their payroll processing. It’s almost impossible to produce reliable, consolidated payroll reporting using decentralized and poorly integrated systems.

Figure 3—5 Key Reasons Payroll Transformation Projects Get Side-lined

Disparate and outdated, this lack of universal data and reporting capabilities puts firms in a precarious position. Stiff fines for noncompliance, rising complexity in tax and social security deductions, plus greater legal protection and rights for employees only add to the issues.

Employees Are Driving Need for Payroll Process Agility

Business strategies remain focused on attracting, training, reskilling, and retaining employees, but if you don’t pay them on time, accurately, and within the mandates of local, regional, and national regulations and taxes, the result is the same: People will leave.

Further complexities are on the horizon for payroll. New working models are being tested to potentially change how, what, and when employees are compensated. The increasing number of gig workers and the rise in elastic hiring continues, as do those advocating on-demand pay. Traditional payroll systems are not set up to manage instances such as these.

“The payroll function is becoming increasingly complex as companies struggle to keep pace with shifting workforce demographics brought on by the pandemic,” said Luca Saracino, Senior Vice President of International Sales and Strategy at Alight. “It was a major achievement for companies to keep payroll running at times when business continuity was challenged, but it was far from ideal. HR and payroll leaders are eager to realize the benefits of digital payroll.”

There is a definite trend as more businesses invest in

HR transformation initiatives, so payroll modernization is starting to be pulled along. The thinking behind this is the need to streamline and simplify manual processes across the entire workforce management; to use technology to cut costs, increase efficiencies, and improve the user experience. To this end,

40% of companies say they will modernize payroll systems by 2023.

Payroll Transformation for Business Sakes

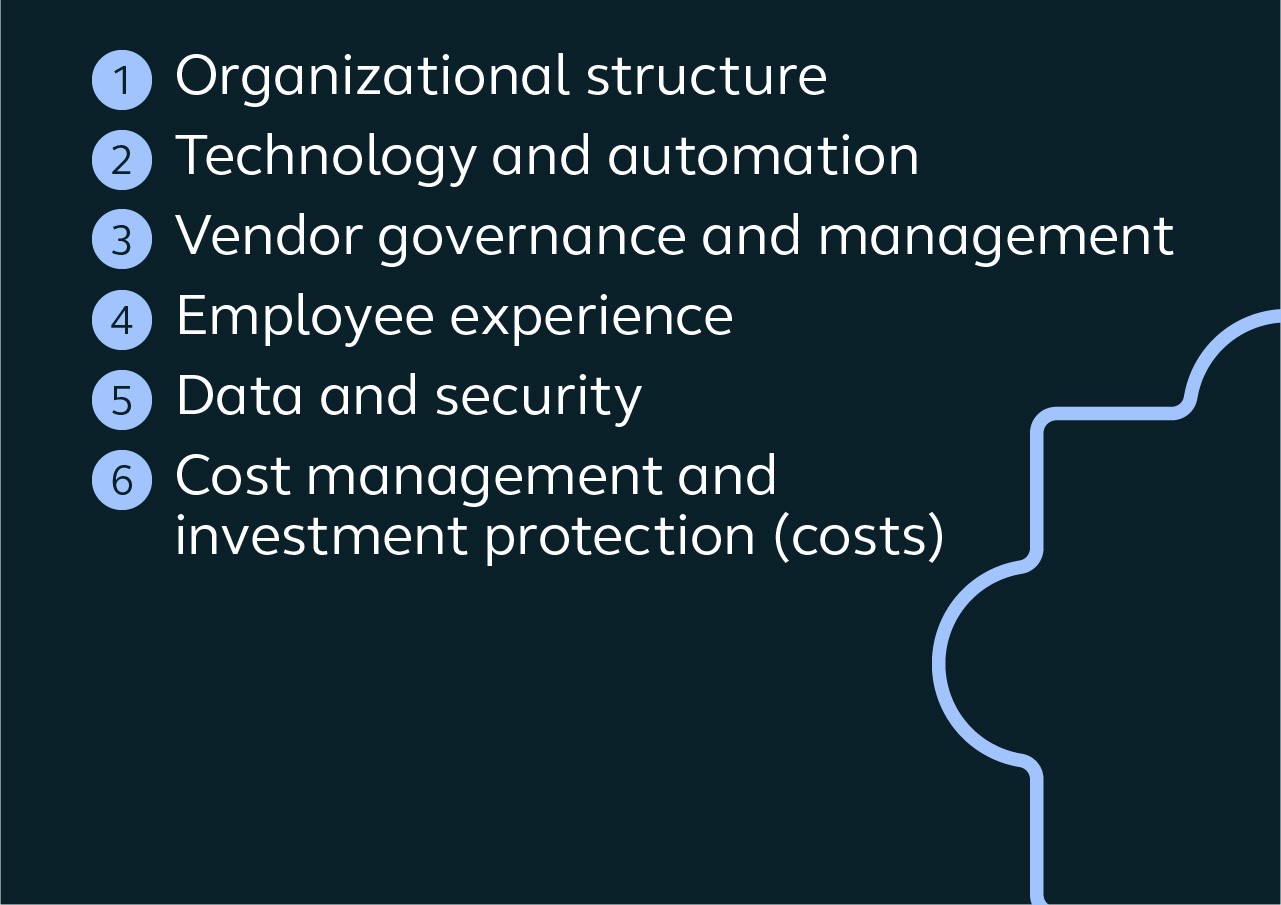

As is usually the case with any business transformation project, there is no one-size-fits-all model when it comes to digitizing payroll. Before all else, it is important to understand the stakeholders’ needs for payroll investment. This will enable you to do what is outlined in Figure 4.

Figure 4—Understanding a Stakeholder’s Needs

It’s not a straightforward re-evaluation. There are multiple stakeholders invested in the payroll processes. These range from those being paid, to people who manage the processes, and to those who require it to be efficient low-risk and low-cost invisible processes. In addition, authorities expect it to be fully compliant and reported. All must be equally satisfied (see Figure 5).

Figure 5—There Are 6 Key Aspects to Consider

The big question to ask here is, “Can you manage or have the skills in-house to do this without

specialist support?”

Investment Protection

Payroll modernization projects must flex to the needs of the business. Therefore, the technology chosen must be agile. The two obvious options are to outsource or invest in a scalable cloud HCM and payroll system that can be added to and integrated with other process systems. This approach is also future-proofed due to the nature of the purchasing model.

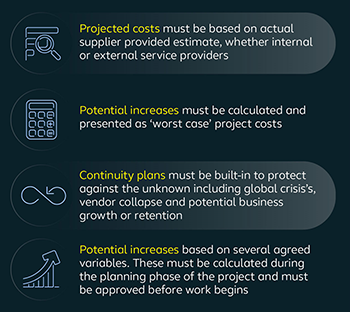

For the fledgling project to stand a chance of success, the needs and the expectations of all stakeholders must be established, discussed, and agreed upon. A value management project as part of the planning stage is essential and should include at least what is shown in Figure 6.

Figure 6—Expectations During Planning Stage

Boost Effectiveness of Payroll Operations

Payroll automation technologies will transform your payroll function and eliminate many of the risks and challenges associated with manual processes. The right technology choices and integration partners can connect your payroll with HR and workforce management software.

Other functions including finance and procurement can also be integrated to provide a powerful platform for managing the careers, development, cost, and efficiency of your total workforce. This clean source of standardized data can then provide the business intelligence on which strategic business intelligence is based.

For more information on the business case for payroll process transformation, the following resources are useful:

• Payroll solutions and technologies

• Payroll value assessment

• 2021 Global Payroll Complexity Index

Or contact Alight to discuss your organization’s specific payroll modernization needs.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Luca Saracino is Growth Leader, International at Alight.