Germany has Europe’s largest and strongest economy, based on research, innovation, exports, and its ability to attract foreign direct investment (FDI). It is widely regarded as one of the world’s most welcoming environments for overseas businesses, offering access to a large and well-educated population.

Germany has Europe’s largest and strongest economy, based on research, innovation, exports, and its ability to attract foreign direct investment (FDI). It is widely regarded as one of the world’s most welcoming environments for overseas businesses, offering access to a large and well-educated population.

Officially known as The Federal Republic of Germany (Deutschland, abbreviated to DE or DEU), Germany is made up of 16 States (Bundesländer).

Germany has one of the most modern transportation systems in the world. Credit cards are not as widely accepted as in other countries, cash is the most common form of payment in stores, shops, bars, and restaurants. Sundays are traditionally considered a day of rest with shops, supermarkets, and pharmacies closed. You can, however, still visit a museum, bar, or café.

Labor Code

The basic labor law guarantees freedom of association, free choice of occupation, and prohibition of forced labor. It also establishes the principle of equal treatment and requires the state to support the effective realisation of gender equality. The major sources of labor law are federal legislation, collective agreements, work agreements, and case law. There is not one consolidated labor code. Minimum labor standards are laid down in separate acts on various labor-related issues, which are supplemented by the government's ordinances. More details can be found on the International Labour Organisation website.

Employment

Employers should be aware of the regulations regarding payment of salaries and wages, which are governed by Germany’s Civil Code, its Industrial Code, and various collective agreements.

Payments to employees and third parties are usually made by electronic bank transfers under the country’s standard File Transfer and Access Management (FTAM) protocol.

Germany has a wide variety of bonus, profit-sharing, and incentive schemes that can be awarded to employees. These include the “13th month” salary payment which certain collective agreements allow German employees who have worked all 12 months of the year to receive full payment of a month’s wages as a year-end bonus—or a pro-rated amount for less than a year’s work. Supplemental pay can also be granted for various reasons.

National Minimum Wage

From 1 January 2022, the national minimum wage (NMW) rate increased to €9.82, and then goes to €10.45 on 1 July 2022.

There are plans to raise the minimum wage to €12.00 gross per hour, but no timetable for this is available yet.

There are exceptions to the NMW rate based on employees’ age, status, or any applicable collective bargaining agreements (CBAs). Trainees, those in entry-level qualifications, or those working as part of an apprenticeship or university course may also be exempt on a case-by-case basis.

There are also industry-specific minimum wages that often are higher than the national standard minimum wage. Employers that do not comply with the NMW may be subject to a claim for the difference, and a fine of up to €500,000. Subcontractors are also covered under the NMW and can claim against their direct employer and the contracting company.

Hours of Work

Working hours are limited to 48 per week by statute. Usually, they do not exceed 40 hours. Employees must have at least 11 hours of uninterrupted rest between shifts. If this is interrupted, it must be granted in full after the interruption.

Employees must not work more than six consecutive hours without a break. When working 6-9 hours, a 30-minute break is provided. However, for those employees working in excess of nine hours, a 45-minute break is required. Breaks can be split into periods of at least 15 minutes through the period.

Reduced working hours allowance: Employers may apply to the Federal Employment Agency (Bundesagentur für Arbeit) for compensation to employees, known as the reduced working hours allowance (Kurzarbeitergeld, abbreviated as Kug), for working hours lost because of temporary, unavoidable events or economic conditions. Employers must notify the agency of a loss of working hours.

Overtime Pay

Employees can be required to perform overtime work only if there is a provision in the employment agreement or in a collective bargaining agreement giving the employer that right. Workers can only work a total of 12 hours more than the normal 48-hour maximum in overtime.

Overtime pay is not required or regulated by statutory law, and in principle, it is possible to have overtime work included in monthly wages. Overtime needs only to be compensated if it occurs regularly and is necessary to fulfill the workload of the employee or if the employer requires overtime. Employers are not legally required to pay employees surcharges for work on Sundays, holidays, and at night. If employers pay these surcharges, they are tax-free up to a limit determined as a percentage of the employee's basic wage (Grundlohn).

Overtime limits are as follows:

- 25% of basic wage for night work. If the night work begins before midnight, the tax-free surcharge limit is 40% for the period between midnight and 4 a.m.

- 50% of basic wage for Sunday work

- 125% of basic wage for work on holidays, and on 31 December after 2 p.m.

- 150% of basic wage for work on 24 December after 2 p.m., on 25 and 26 December, and on 1 May

Termination Pay

Employment may be cancelled at any time by a mutually agreed upon contract between the employer and the employee with or without severance pay through a contract of cancellation. The employer generally offers a severance payment to entice the employee to accept the offered contract of cancellation.

If the dismissal is for business-related reasons, the Act on Protection Against Unfair Dismissal (Kündigungsschutzgesetz, abbreviated as KSchG) gives the employee the right to compensation if the employee does not bring an action in court that the dismissal is unjustified or otherwise invalid. In this case, the employee is entitled to severance pay equal to half the employee's monthly salary for each year of service. The maximum severance payment is 12 times the employee's monthly salary; 15 times if the employee is at least 50 years of age and has at least 15 years of service; or 18 times if the employee is at least 55 years of age, has not reached the pensionable age, and has at least 20 years of service.

Wage Payment

German payroll is complex and consistently found in the top sector of the Global Pay Complexity Index. The date of wage payment depends primarily on employment agreements. If there is no agreement and if a payment schedule is not established by the circumstances, remuneration must be paid after the employee has performed work. If the wage is calculated on a time basis—weekly or monthly, for instance—it must be paid after the expiration of the period. In general, the wage payment interval may not exceed one month.

Income Taxes

It is the employer’s responsibility to calculate the income tax amount for each employee based on their specific tax class and pay the withheld amount to the appropriate tax office by the 10th of the following month. The penalty for late submission is a maximum of 10% of the assessed tax, and interest due for late payment is 6% per annum.

Germany has tax treaties with approximately 90 countries to prevent employees from being taxed on the same income by two different countries.

Germany has a progressive tax rate system. For 2022, the tax rates range from 14% up to 45%. The final tax rate is applied only when the annual income tax return is completed (and all amounts are available, all costs are declared, etc).

The information required by the employees to complete their annual income tax return is provided via wage tax certificates or if a client does not have a German office and there is no wage tax deduction wage journals/wage accounts are supplied.

Tax Rates

The following tax rates apply in Germany for 2022:

|

Taxable Income

|

Tax Rate

|

|

Up to €9,984

|

0%

|

|

€9,985 - €14,926

|

14%

|

|

€14,927 - €58,596

|

24%

|

|

€58,597 - €277,825

|

42%

|

|

€277,826+

|

45%

|

Social Insurance Programs

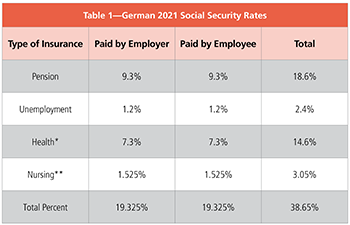

Employers must also comply with Germany’s social security system and its mandatory insurance principle. This requires that membership in and contributions to Germany’s statutory social insurance schemes are required by law. Employers and employees must contribute to different schemes. Companies in Germany must withhold a percentage of employees’ total monthly earnings across four insurance categories--health, nursing, pension, and unemployment. The amounts are paid to the authorities by the third-to-last working day of each month (see Table 1).

- Health Insurance (Krankenversicherung)—The basic contribution rate is 14.6% of the employee’s gross income, split equally between employer and employee. Employees earning a gross wage up to a set limit each year are compulsorily insured by one of the public health insurance providers; those above that threshold can choose from public or private insurers.

- Nursing Care (Pflegeversicherung)—Contributions for nursing care insurance is 2.55% of the gross wage. Employers and employees each pay half of the contribution rate. Childless employees pay an extra 0.25% on top of their contribution.

- Pension Insurance (Rentenversicherung)—Compulsory for employees. The premium is based on the gross wage and is divided equally between employee and employer. Pensions are paid from age 65 (this is being increased to age 67) and the maximum payout is 67% of average net income during the employee’s working life.

- Unemployment Insurance (Arbeitslosenversicherung)—Mandatory unemployment insurance is 2.5% of the gross wage. It is split equally between the employer and employee.

Insolvency (Insolvenzgeld) Benefit Funding

Employers are assessed an insolvency benefit contribution to fund wage-replacement benefits to individuals who lost work because their employer became insolvent. The insolvency benefit contribution rate for employers is 0.06% of payroll.

Types of Leave

The Federal Leave Act (Bundesurlaubsgesetz, abbreviated as BUrlG), mandates time off, such as vacation, maternity, parental, and sick leave.

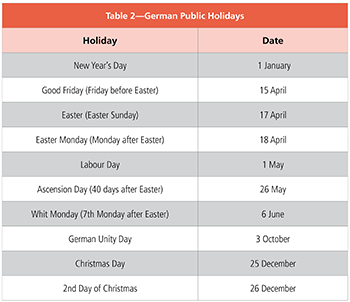

Some States have additional holidays, mainly religious.

Sick Leave—Employers are required to give employees up to six weeks of sick leave at full remuneration.

Under certain circumstances, the six weeks can be triggered more than once a year and will start again if six months have passed since the end of the last sick leave (for the same illness), or if one year has passed since the beginning of the first sick leave. If the reason for the illness is different the six-week period automatically starts again.

After six weeks, employees are entitled to receive a sickness allowance paid by their statutory health insurance plan for 70% of their normal pay. The maximum period for this allowance payment is 78 weeks.

Paternity Leave—Germany doesn’t have any statutory paternity leave entitlement, but fathers can choose to take the same parental leave as the mother, along with the allowance up to the maximum period.

Maternity Leave—Employers are required to give pregnant employees (including consultants and self-employed workers who are economically dependent on them), six weeks leave before and eight weeks after the birth of the child. If there are premature or multiple births or child disabilities that occur within eight weeks of delivery, this increases to 12 weeks after birth.

During the maternity leave period, employees receive full pay from health insurance.

The Maternity Protection Act (Mutterschutzgesetz), abbreviated as MuSchG) ensures that female employees suffer no financial disadvantages due to maternity.

Annual Leave (Vacation)—All employees are entitled to 24 working days of paid leave in addition to official holidays, after completing six months of work. Leave is paid based on the average salary during the previous 13 weeks of employment. The law expressly forbids substituting money for the vacation. This is only permitted if the employment has ended.

Parental Leave—Employers are required to give parents up to three years of unpaid parental leave. The first two years must be taken immediately after the child's birth and the third year can be taken at any time up to the child's eighth birthday. Both parents can claim parental benefits if they are on leave during the first 12 months after the child's birthday. The benefit is calculated at 65% of the parent's previous monthly salary.

Bonuses, Special Benefits

Much of the administration of labor-related requirements and benefits are the responsibility of the German Trade Union confederation and collective bargaining agreements. The labor law does not require the payment of bonuses in addition to wages. In most cases, various sorts of bonuses are commonly provided by German employers. These bonuses include the following:

- Gratuities: Special bonuses paid in addition to regular wages on special occasions (e.g., Christmas, anniversaries, annual reports). The most common gratuities are the Christmas bonus and the vacation allowance. A legal claim for the gratuity can arise from a collective bargaining agreement, a works agreement, or an employment agreement.

- Profit-sharing bonuses: These are mostly granted at or above the executive officer level in addition to fixed remuneration. Employment contracts or work agreements form a contractual basis.

- Company car: May be provided as an additional bonus.

Language

German is the official language, both spoken and written. It is useful to know a few basic words/phrases such as the following:

- Hallo!, Hallo?, Guten Tag!, Servus!—Hello

- Auf Wiedersehen!, Tschüss—Goodbye

- Bitte—Please

- Danke—Thank you

- Ja/nein—Yes/no

- Was kostet das?—How much is that?

- Ich spreche kein Deutsch—I don’t speak German

- Sprichst du Englisch/Französisch?—Do you speak English/French?

- Ich bin verloren—I’m lost

Culture

German business culture is generally organised, planned, and aims for perfectionism and the decision-making process takes place at the top of the company.

Did You Know?

- University education in Germany is free, even for international students.

- Berlin has more bridges than Venice with 960 and is nine times bigger than Paris.

- The following cities have all at one time or another been capitals of Germany: Aachen, Regensburg, Frankfurt-am-Main, Nuremberg, Berlin, Weimar, and Bonn.

- Munich’s Oktoberfest is the world’s biggest folk festival, which actually starts in the last week of September and dates back to 1810 when Crown Prince Ludwig threw a party to celebrate his wedding to Princess Terese on 12 October.

- Berlin has the largest train station in Europe.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Danita Lewis is Global Account Director with iiPay.