The changes COVID-19 is engendering are wide-ranging. We no longer notice that everyone’s mouths and noses are covered in public and working from the office is the exception rather than the rule. There has also been a technological shift. Meetings are all held virtually, and we’ve seen a significant rise in the number of organizations moving their platforms and services to the cloud.

Given recent criticism of the software program Microsoft Excel, I wonder if it also spells the demise of spreadsheets as the tool of choice for making lists and keeping track of data. For example, toward the end of 2020, it came to light that the figures for the number of COVID-19 cases in the U.K. were inaccurate. Part of the reason for this was attributed to the use of Excel.

As Paul Clough from the University of Sheffield said, “Public Health England (PHE) used Microsoft Excel as an intermediary to manage a large volume of sensitive data. And herein lies the problem. Although Excel is popular and commonly used for analysis, it has several limitations that make it unsuitable for large amounts of data and more sophisticated analyses.”

Because Excel has a cut-off point of 1,048,576 rows and 16,384 columns per file, any excess records were not included in the official database. In this particular case, The Guardian reports that a lab sent in daily testing results in a CSV file—essentially a list of comma-separated values in a text file. According to Popular Mechanics, Excel cut off the 15,841 new records at the bottom, leading PHE to release incorrect figures for positive COVID-19 cases.

The first quarter of a new year always seems the ideal time to consider change, a chance to adopt new processes, or switch project management tools. It also helps that because technology is always evolving, we are continually given new and more efficient ways to complete tasks. Here are eight reasons for looking at alternatives to spreadsheets.

- Ability to Manage Multiple Sources of Data—When working with multiple international payrolls, the reality is you are likely to receive data in a plethora of formats. Rarely is it all in one neat bundle ready to be uploaded automatically. Time taken to collate and standardize multiple documents is time taken from performing more strategic and high-value tasks. Working with a global payroll platform with the functionality to gather multiple files and formats and automatically transform them into cohesive and consolidated data and reports for your payroll team to review and analyse … well, the benefits are significant.

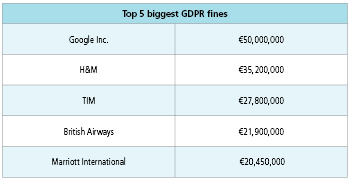

- Support GDPR Compliance—Payroll files contain some of the organization’s most sensitive information—employee bank details, home address, and much more. Sending these via email, even with password protection, is not safe. You are leaving your company vulnerable to a data breach. This harms your brand, puts your employees at risk, and can involve fines and even jail time. Companies are paying heavily for such breaches under the EU’s General Data Protection Regulation (GDPR).

The H&M case is of particular interest to payroll professionals because it came due to a technical error that made the company’s network drive accessible to all employees. Apart from the data breach, it also revealed that the company had collected large volumes of sensitive employee personal data through whispering campaigns and other courses and had used this information in the employment process.

The H&M case is of particular interest to payroll professionals because it came due to a technical error that made the company’s network drive accessible to all employees. Apart from the data breach, it also revealed that the company had collected large volumes of sensitive employee personal data through whispering campaigns and other courses and had used this information in the employment process.

- Reduce Likelihood of Error—In a piece of illuminating research, Ventana Research was able to map the time it took to process payroll using Excel.

“Our research correlates the degree to which companies use spreadsheets in the close with how long it takes a company to complete the process. Those that are substantial users on average take 7.7 days, more than one day longer than those that limit their use (6.5 days) and more than two days longer than those that rarely use them (5.5 days). One reason for this disparity is that spreadsheets are inherently error-prone, and thus the work product from spreadsheets must be checked and validated, which is a time-consuming process.”

As well as being error-prone, the use of spreadsheets is highly dependent on people following standard operating procedures rather than having built scalable, repeatable, and automated processes.

Excel should not be used for recurring corporate processes—like payroll. Collating multiple information from emails, other Excel spreadsheets, phone calls, and more into one version of the truth is difficult and risky.

- Leverage Automation—Manually collating and processing payroll is slow and time intensive. However, it doesn’t need to be quite so slow or laborious. Technology is facilitating the automation of many payroll operations, bringing it many benefits. HR Technologist explores these advantages, including the streamlining of your data collection, accelerating access to data, ensuring its accuracy, and reducing duplication of tasks. We all know that accuracy of payments is critical and working with a payroll solution that checks for mistakes and issues alerts when data is missing can contribute hugely to eliminating the potential for errors.

On a side note, one of the concerns I hear about automation is that often payroll and finance employees are not trained for automation. In a recent poll of CFOs by Censuswide, 98% of CFO respondents had some concerns among their finance team about the automation of their finance operations, with the majority (77%) of respondents saying their teams are concerned about not having the right skills to manage increased automation, and more than half (57%) are worried that automated solutions could replace their jobs. Therefore, companies must offer the necessary training to their current payroll team to ensure they can reap the benefits.

- Increase Time Allocated to Higher Value Work—By removing the manual work, CFOs and CHROs are assured that their payroll and finance teams are doing higher value, strategic work. Again, from research, we know that 62% of CFOs plan to switch the focus of their employees who currently handle manual finance tasks to higher-value work. Developing a workforce strategy takes on a more critical role when companies are looking to expand into new markets, so it is imperative that payroll has the time to build and execute such plans. An objective that is harder to meet if they are spending time inputting employee data and manually changing files.

- Address Lack of Scalability—Spreadsheets are not scalable. As companies grow into new markets, acquire companies, and hire more people, global payroll via spreadsheets becomes a less than desirable option. And despite the worldwide pandemic and political turmoil of recent months, growth is on the cards for many companies in 2021. Nasdaq believes that a combination of advantageous interest rates and greater availability of capital will results in an increase in mergers and acquisitions activity in 2021 despite travel restrictions and remote working.

- Enhance Employee Experience—It’s a universal truth—people expect that their employer will pay them the correct amount. That they will conduct due diligence and be sure to make the appropriate deductions, pay tax, and comply with all local and country legislation regardless of where their employer is physically located. If they do not, then employees lose trust in their employers. Research shows that 49% will start a new job search after experiencing just two problems with their paycheck.

Employers cannot afford to make payroll mistakes. Apart from the fines and penalties, there is also reputational damage. If you are using spreadsheets, what measures are you taking to ensure accuracy and compliance?

- Generate Better Data Insight, Analytics—CFOs, in fact, all business leaders, want data. Data’s worth is today invaluable and having the ability to mine the incredible store of data that inherently sits with payroll is essential. Global payroll solutions like the Immedis Platform offer organizations international oversight, variance analysis, customizable reports, country-level drill-down, and powerful visualization tools. Many of these reports are no longer optional. Organizations with a headcount of 250 or more must follow U.K. regulations on gender pay gap reporting. While spreadsheets can check some of the reporting analytics, the bottom line is they are no longer the most efficient or productive tool to use.

As we all look to the year ahead, uncertainties abound. Will there be a return to “normal”? Will people stay working from home? Will there be political stability? However, there is one certainty: technology is reimagining the way we live and the way we work. Is it time, therefore, for it to transform the way we record and track data?

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Richard Limpkin, Chief Product Officer at Immedis, is responsible for the Immedis technical and product roadmap, including platform and service components, driving integration across global human capital management systems, and promoting finance technology partnerships. He leads a team of innovative HR and payroll technology and operational experts to produce world-class SaaS payroll solutions and services for Immedis clients. Limpkin chose an eclectic path, starting with an M.Sc. in Physics from Durham University, through management consulting and chartered accountancy, to leading professional services, solutions, and innovation organizations.