By Sharon C. Tayfield, MCIPP

Thailand covers an area of nearly 514,000 sq. km (200,000 sq. miles) and is almost equal in size to Spain. Myanmar (Burma), Cambodia, the Lao People's Democratic Republic (Laos), and Malaysia share borders with Thailand. The ecosystems within Thailand range from densely forested areas to rugged coastlines. Thailand is home to an estimated population of 70 million people.

Thailand covers an area of nearly 514,000 sq. km (200,000 sq. miles) and is almost equal in size to Spain. Myanmar (Burma), Cambodia, the Lao People's Democratic Republic (Laos), and Malaysia share borders with Thailand. The ecosystems within Thailand range from densely forested areas to rugged coastlines. Thailand is home to an estimated population of 70 million people.

Thailand, which is considered a monarchy, is also a popular tourist destination that hosts more than six million visitors annually with its many beaches, temples, and delicious food being the main attractions. With more than 1,400 Thai islands to choose from, it is no surprise that island hopping is among the features that rank high on the “things to do” list for Thailand.

The HSBC Guide to Doing Business in Thailand refers to Thailand as the “land of smiles.” It is a desirable location due to the low cost of living, government incentives, and the skilled workforce.

Legal System for Operating a Business

Thailand’s laws are based on civil law, which follow the civil laws found in Europe. Common law has played a significant role in the legal landscape. Thailand’s laws have two main sources—the legislative and executive branches of both central and local governments.

Labour Code Hiring, Termination

In Thailand, an employer is required to pay any basic, overtime, holiday, holiday overtime, and other pay elements as per the employment contract to the employee at least once a month. The exception to this rule is if there is a specific agreement with the employee, and then this must be of benefit to the employee. The payment must be made at the workplace or, if it is made at any other place or in any other way, it must be with the consent of the employee.

When employment is terminated or an employee resigns before the date of the payment, the employer must make such payment to the employee within three days from the date of termination or resignation.

Employment Contracts in Thailand

Written employment contracts are standard practice in Thailand, but verbal contracts are also allowed. Employment contracts can be fixed-term or for an indefinite period. Fixed-term contracts can extend to a maximum of two years.

Minimum Wage

Minimum wages vary region by region in Thailand and range between THB 313 ($9.73 USD) and THB 336 ($10.06 USD) per day for an eight-hour day. Although it’s not required by law, the payment of a 13th month or annual bonus is a common practice.

Working Hours

Work hours cannot exceed eight hours a day or 48 hours per week. There are also limitations of work that could be harmful to the employee’s health and safety. Work falling into that category cannot exceed seven hours a day and 42 hours a week.

Employees are entitled to a one-hour break for every five consecutive hours worked. Employees receive one day off per week, and this is required to be no more than six days apart. If the weekly rest day needs to be postponed or accumulated, both the employee and employer must agree in advance to this arrangement.

Overtime

Employers must have consent from the employee for any overtime required to be worked. The exceptions are where the nature of the work necessitates continuous performance or where damage may be caused by a stoppage, or it is an urgent matter.

Overtime is limited to 36 hours a week and the rates of payment are:

• 150% of the basic wages for overtime on weekdays

• 300% for overtime on weekends or any overtime on holidays

According to Thai legislation, there are two types of wage payments for determining the overtime rate. These may be due to an employee who is required to work on a day when they would have been on vacation or on a national holiday. For monthly wage earners who are entitled to wages on these dates, they will receive 100% of their normal hourly rate. For an employee who is not entitled to receive payment on holiday leave or annual vacation day (daily wage earners), should be remunerated 200% of the normal hourly rate.

2022 National Holidays

Thailand officially observes 13 public holidays each year. The approved holidays should be published by the employer by 1 December for the following year commencing 1 January. The complete list of public holidays is provided at Table 1. If a holiday falls on a weekend or an employee’s weekly rest day, the employee generally receives the following weekday off. An employer may provide additional public holidays to employees. This would be communicated in advance to the employees in writing.

Income Tax in Thailand

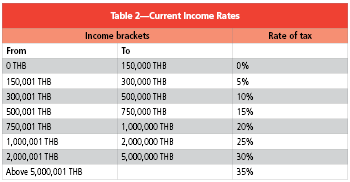

As is the case with many countries around the world, the obligation rests with the employer to withhold income tax from employees’ salaries and remit this back to the state. In Thailand, any balance due is paid at the time the individual files their personal annual return. A progressive rate of tax is applied on income derived from employment within Thailand on both residents and nonresidents. Income earned outside of Thailand is also included in the taxable earnings of residents if this is remitted to Thailand in the year received. The income tax rates are as shown in Table 2.

Employers must report taxes withheld via the payroll to Thailand’s national tax authority, the Revenue Department, using Form P.N.D.1, and pay the taxes in accordance with the following deadlines:

Employers must report taxes withheld via the payroll to Thailand’s national tax authority, the Revenue Department, using Form P.N.D.1, and pay the taxes in accordance with the following deadlines:

• If filing is performed by mail—by the 7th day of the following month

• If filing is processed online—by the 15th day of the following month

Social Security

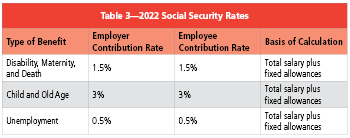

The social security system in operation in Thailand covers disability, maternity, death, child, old-age, and unemployment benefits. Funding required to provide the services is generated by general taxation. Social security benefits are managed by the Social Security Office. Voluntary contributions can be made by employees to a provident fund for their retirement. Employers are required to match employees’ contributions. This is not operated by the Thai government.

Employers and employees each contribute up to 5% of the employee’s salary, but reduced rates may apply; therefore, it is important that payroll professionals regularly check the government websites. The Thai government temporarily reduced social security contribution rates for certain months in 2021 in response to the economic challenges caused by COVID-19.

The rates for 2022 are currently as reflected in Table 3.

In 2022, the minimum base to which both employer and employee rates apply is THB 1,650 ($49.69 USD) per month. The maximum base is THB 15,000 ($448.79 USD) per month. No contributions are made on salary below the floor or above the ceiling. The floor and ceiling are updated from time to time through ministerial regulations and again an annual review should be undertaken to ensure that the correct rates are being processed.

In 2022, the minimum base to which both employer and employee rates apply is THB 1,650 ($49.69 USD) per month. The maximum base is THB 15,000 ($448.79 USD) per month. No contributions are made on salary below the floor or above the ceiling. The floor and ceiling are updated from time to time through ministerial regulations and again an annual review should be undertaken to ensure that the correct rates are being processed.

The retirement age in Thailand is 55 years old, although there are discussions on increasing this to age 60, provided that the employee has made at least 180 months of social security contributions and has stopped all work.

Retirees will receive a monthly payment until death. Individuals aged 55, who have not made 180 months of contributions will receive a lump sum payment.

Employers must withhold employees’ social security contributions via the payroll and pay these amounts, together with the employer’s contributions for social security, to the Social Security Office using Form NSO 1-10 and the department’s online portal. Reports and payments are due monthly, by the 15th of the following month.

Annual Vacation

In addition to national holidays (public holidays), employees are entitled to a minimum of six days of paid annual leave after a year of service. Employees with less than a year of service will receive an entitlement on a pro-rata basis. There is nothing prohibiting an employer from offering more beneficial leave arrangements as part of the employment contract.

Annual leave is not cumulative and must be taken within the year unless there is an agreement in advance between the employee and the employer. Where there has been an agreement to delay the use of annual vacation, the leave must be taken within two years.

For religious leave, Buddhist men are entitled to 120 days of Monkhood leave and Muslim employees receive 120 days for Hajj leave.

Maternity Leave

Female employees receive up to 98 days of fully paid maternity leave including weekends. The employer pays 45 days and 45 days are paid by the social security fund. Maternity leave is provided in addition to sick leave days.

Paternity Leave

There is no paternity leave.

Sick Leave

Employees generally receive up to 30 days of paid sick leave a year. Employees are required to provide a medical certificate after missing work for three days. If they are unable to produce the certificate, they must be able to explain why they are absent.

Military Leave

When the government requires an employee to present themselves for personnel inspection, military training, or “combat readiness” testing, the employee should be paid the basic pay equivalent to a normal working day to a maximum period of 60 days. This does not include conscription.

Other Leave

Employees are entitled to paid leave for a variety of life events, including five days for compassionate leave and three days for personal business leave.

An employee can take training leave up to three times a year to maintain the competencies required for their role as imposed by legislation, or as agreed will be beneficial to their development. The amount of training leave entitlement will be specified in the employment contract.

An employee also has the right to sterilization leave where they provide the employer with a medical certificate from a first-class medical practitioner. They will be compensated at normal pay for the duration of the leave.

Health Care

Provision is made by the state for universal healthcare through the civil welfare system for civil servants, social security for private employees (expatriates and nationals), and a universal health scheme for all other citizens.

Healthcare is non-contributory and the service is funded by various governmental taxes on individuals. Employers often elect to provide supplementary healthcare.

Termination and Severance

Where a fixed-term contract is in place, the employment contract may be terminated at the end of the contract period by either the employer or the employee.

An employer may dismiss an employee for cause or misconduct for specific actions. In these circumstances, there is no requirement to provide notice or make a severance payment. Some of the acts are covered by the law and include fraud or dishonesty, intentional destruction of employer property, gross negligence, missing work for three days without justification, and imprisonment.

An employer must provide notice to the employee before termination and is also required to make a severance payment to the employee. The notice period required is one full pay cycle, up to a maximum of three months.

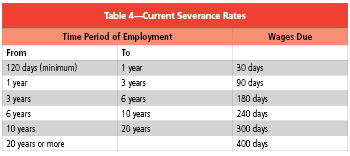

Severance pay is calculated based on time in employment. Table 4 sets out the wages that are required to be paid.

Although there is no specific time limit on probationary periods, employers are still required to maintain the notice period and make severance payments for probation periods.

Although there is no specific time limit on probationary periods, employers are still required to maintain the notice period and make severance payments for probation periods.

If an employer is planning on relocating the business to a location that essentially geographically terminates an employee, the employer must give notice of that relocation at least 30 days in advance. Employers can provide payment in lieu of notice.

Regardless of the type of termination that occurred, an employer will be responsible for the payout of any due salary, overtime pay, unused annual vacation time, and severance pay within three days of the date of termination. Employees are entitled to end employment by retiring at age 60 unless the employer provides for earlier retirement age. Employees receive severance upon retiring. Employees who are 60 years old or older have the right to choose to retire with full severance pay.

Conclusion

With the many benefits of doing business in “the land of smiles,” it is not surprising that multi-national organizations are expanding into the country. As global payroll professionals are aware, having an overview of the legislation in a country is an excellent stating point to ensure compliance with local legislation and reduce the level of risk associated with managing payroll in another country.