Spain, commonly called the Kingdom of Spain, is a Southwestern European nation. It operates as a secular parliamentary democracy under a constitutional monarchy, with King Felipe VI serving as the reigning monarch and head of state. Economically, Spain stands out as a leading advanced capitalist nation, ranking 15th globally in terms of both nominal GDP and Purchasing Power Parity (PPP). Notably, within the European Union, it holds the fourth position by nominal GDP.

Spain, commonly called the Kingdom of Spain, is a Southwestern European nation. It operates as a secular parliamentary democracy under a constitutional monarchy, with King Felipe VI serving as the reigning monarch and head of state. Economically, Spain stands out as a leading advanced capitalist nation, ranking 15th globally in terms of both nominal GDP and Purchasing Power Parity (PPP). Notably, within the European Union, it holds the fourth position by nominal GDP.

Internationally, Spain is an active member of numerous organisations, including the United Nations, the European Union, the eurozone, and the North Atlantic Treaty Organization (NATO). It holds a permanent guest status in the G20. Also, it collaborates with entities like the Council of Europe (CoE), the Organization of Ibero-American States (OEI), the Union for the Mediterranean, the Organisation for Economic Co-operation and Development (OECD), the Organization for Security and Co-operation in Europe (OSCE), and the World Trade Organization (WTO).

Labor Code

Spanish labour regulations are comprehensive and prioritise the welfare of employees. These rules supervise both individual and collective interactions between employers and their staff. They also include social security, health, safety, and employment.

A pivotal part of Spanish employment law is the Workers’ Statute, often called the Estatuto de los Trabajadores. This statute dictates various aspects of individual and group employment engagements. Moreover, it oversees collective bargaining agreements (CBAs) determining the minimum wages and associated rights for specific professions.

Examples of items covered by employment law include the following:

- Employee protection

- Employment contracts

- Training

- Leave rights

- Data protection and employee privacy

- Work from home

- Workplace harassment and discrimination

- Joining unions

- Health and safety

- Retirement

- Employment termination

Minimum Wage

Minimum wage standards are determined by CBAs specific to each industry sector. Nonetheless, the commonly recognised minimum wage across the country is 1,080 EUR, distributed over 14 payments. For temporary staff and seasonal workers employed by a company for under 120 days, the daily wage is set at a minimum of 51.15 EUR.

Working Hours

The standard workweek is capped at 40 hours. A conventional workday usually starts between 8:30 a.m. to 9:00 a.m. and goes on until about 2:00 p.m. After this, there's a break for the siesta, and work resumes from around 4:00 p.m. to 5:00 p.m., continuing until roughly 8:00 p.m.

Per the Spanish Worker’s Statute Royal Decree-Law 8/2019, all workers must log their daily work hours. This involves "clocking" in and out during breaks and after their workday.

Overtime Pay

When an employee exceeds the 40-hour weekly work limit, overtime compensation becomes mandatory. An individual employee can only work up to 80 extra hours annually. The regulations governing overtime hours and their respective payments are stringently outlined in collective agreements.

13th or 14th Month Wages

In Spain, employers are required to make 13th and 14th-month salary payments. The yearly salary is typically divided into 14 parts to accommodate these extra payments, usually disbursed in July and December. This arrangement is outlined in both the employee's contract and collective agreements.

Severance Pay

If an employer ends an employment contract without prior notice, severance pay becomes due. This compensation would equal the amount the employee earned during the notice period.

Employers have the option to either conclude an employment contract by providing a notice period or by immediately ending the contract and offering a payment in place of notice. A mixed approach is also feasible, where a part of the notice period is served, followed by compensation for the remaining period.

The compensation replacing the notice is determined based on the employee's yearly salary at the point of termination, incorporating both statutory and agreed-upon fringe benefits. When an employer decides to end a contract, the following specific legal criteria must be met:

- The employer is required to give the employee a written notice detailing the reasons for the termination.

- A compensation equivalent to 20 days of the salary for each year of service must be provided at the time of delivering the written notice, capped at a year's salary.

- The employee should be informed of the contract's termination 30 days in advance, starting from the official notification's date.

- If the termination is deemed unjust, the employer is obligated to pay an amount equal to 45 days of salary for each year of service (for those employed before 12 February 2012 and 33 days of salary for each year of service after this date), with a maximum limit set at 42 months of salary.

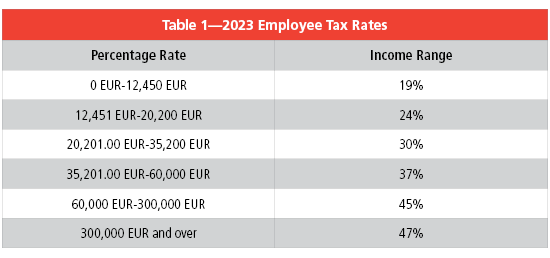

Taxes

Table 1 shows the tax rates for employees.

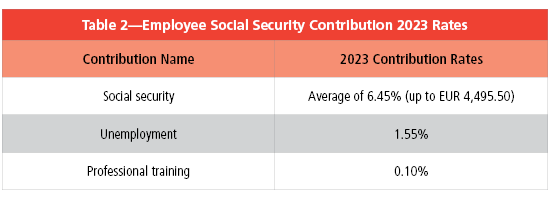

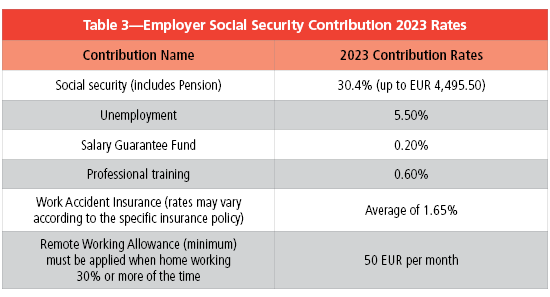

Social Security Contributions

Table 2 shows social security contributions for the employee, and Table 3 shows contributions by the employer.

Time Off

Annual Leave

Employees have the right to 30 calendar days (equivalent to 22 working days) of paid vacation each year. However, certain collective agreements might offer different or additional benefits.

Maternity Leave

Employees expecting a child in Spain are eligible for 16 weeks of unpaid maternity leave. This duration can be extended to 18 weeks in cases of complex deliveries or multiple births.

The 16-week maternity leave is divided into the following:

- A mandatory six-week leave immediately following the birth

- An optional leave of either 10 full weeks or 20 half-day absences, which can be availed anytime within the subsequent year, given a 15-day notice

Maternity benefits are facilitated and disbursed by the Social Security System Health Insurance Fund. Those on maternity leave receive a monthly benefit from social security, amounting to 100% of the mother's base rate, determined by the previous month's contributions before the start of the leave.

Furthermore, all expectant mothers have access to healthcare services before, during, and post-delivery. To use these services, they should visit a healthcare centre with their Sistema Nacional de Salud (National Health Service) user card.

Paternity Leave

Fathers are granted 16 days of paid paternity leave, which can be extended to 18 days in the case of multiple births. For same-sex couples, both partners are eligible for paid leave. One parent should apply for paternity leave and its associated benefits, while the other should apply for maternity leave and benefits. To be eligible for these paid benefits, it is crucial for each parent to have the appropriate legal relationship with the child.

The Spanish Government will cover 100% of the paternity pay, provided the father has consistently contributed to social security for at least 180 working days within the previous seven years or a total of 360 days throughout his career. Nonetheless, the employer remains responsible for certain taxes related to these salary payments.

Sick Leave

If an employee in Spain falls ill or is injured in an accident, they are eligible for a temporary disability benefit. This means they'll receive a minimum of 60% of their usual salary as sick pay.

For general illnesses or injuries unrelated to work, the compensation structure in Spain is as follows:

- For the first three days, no payment is mandated unless the employer voluntarily agrees or if it is specified in the CBA

- From day 4 to day 15, employees receive 60% of their contribution base, covered by the employer

- From day 16 to day 20, 60% is paid by social security, even if the employer handles the transaction

- From day 21 onwards, 75% is paid by social security, even if the employer makes the payment on behalf of social security.

It is essential to note that these guidelines are the standard unless there's an alternative provision in a specific CBA or a different company policy.

Additional Time Off

Based on the CBA in effect, employees might be eligible for various additional leave types, subject to mutual agreement between the employer and the employee. These include the following:

- Up to two years of unpaid employee leave to support a gravely ill family or household member

- A two-day leave (or four days if travel is involved) for those tending to a family member with a severe illness or injury

- If an employee's child, adopted child, or foster child has a disability, they may receive an extra two weeks of maternity leave

- Employees can use two days of paid leave (or four days if travelling) in the event of a family member's death

- For relocating to a new residence, employees are entitled to a day off

- Marriage grants employees up to 15 days of leave

- For fulfilling public or personal duties, such as court appearances, employees can take paid leave, provided they give written notice

- Employees involved in trade union tasks or serving as workers' representatives may receive additional leaves per legal provisions or the CBA

Holidays

There are 10 public/national holidays (see Table 4). Other holidays vary between regions (see different regions here).

Additional Common Benefits

It is always essential to check CBAs for additional common benefits that might be obligatory to provide to employees. Below are a few examples of other common benefits.

- Supplemental health, dental, and vision insurance

- Private pension plans

- Life insurance

- Food allowance/vouchers

- Health insurance allowance

- Childcare vouchers

- Company cars, car insurance, petrol allowances, or public transportation allowances

Locale

Spain uniquely extends its reach to the Atlantic Ocean, the Mediterranean Sea, and even Africa. The vastness of Spain covers most of the Iberian Peninsula. It includes territories like the Canary Islands in the Atlantic, the Balearic Islands in the Mediterranean, and the independent cities of Ceuta and Melilla in Africa. The nation shares its northern boundaries with France, Andorra, and the Bay of Biscay. The Mediterranean Sea lies to its east, while the south touches Morocco in Ceuta and Melilla and even the United Kingdom in Gibraltar. Its western neighbours are Portugal and the vast Atlantic Ocean.

Madrid stands as Spain's bustling capital and its most populous city. Other significant cities encompass Barcelona, Valencia, Zaragoza, Seville, Málaga, Murcia, Palma de Mallorca, Las Palmas de Gran Canaria, and Bilbao.

As the most expansive country in Southern Europe, Spain is also the fourth largest by population within the European Union.