Germany, officially known as the Federal Republic of Germany (Bundesrepublik Deutschland), is a nation located in the western part of Central Europe. It is Europe's second most populous country, with only Russia surpassing it, and it stands as the most densely populated member state of the European Union (EU).

Germany is strategically positioned between the Baltic and North Seas to its north, while the imposing Alps dominate its southern landscape. The country is composed of 16 constituent states (Landers), each sharing borders with neighbouring countries. To the north, Germany shares its border with Denmark, to the east with Poland and the Czech Republic, to the south with Austria and Switzerland, and to the west with France, Luxembourg, Belgium, and the Netherlands. Berlin is the capital city and the most populous urban centre, while Frankfurt is its primary financial hub. The Ruhr region boasts the largest concentration of urban development within the country.

Thanks to its robust economy, Germany is often characterised as a major global player. It has the largest economy in Europe, ranking as the fourth largest in the world by nominal gross domestic product (GDP) and the fifth largest by purchasing price parity (PPP). The nation exerts substantial influence across industrial, scientific, and technological domains on the international stage, and is the world's third-largest exporter and importer.

Furthermore, Germany is recognised as a developed country that places a premium on social welfare. It provides its citizens with comprehensive social security, a universally accessible healthcare system, and tuition-free university education.

On the global diplomatic front, Germany is an active member of several influential organisations, including the United Nations, the EU, NATO, the Council of Europe, the G7, the G20, and the Organisation for Economic Co-operation and Development (OECD).

Ranked 17th in the World Bank's “Ease of Doing Business” survey, Germany presents a compelling landscape for investment due to its thriving economy.

Germany boasts a highly skilled and innovative workforce, with 81% of its population possessing university or vocational qualifications. The nation also allocates substantial federal funding, amounting to billions of euros annually, for research and development initiatives.

Labour Code

German employment law is not consolidated into a single labour code. There are several different statutes covering most of the relevant employment law topics.

The following are some of the statutes:

- German Civil Code (Bürgerliches Gesetzbuch)

- German Health and Safety Law (Arbeitsschutzgesetz)

- Occupational Health Insurance (Gesetzliche Unfallversicherung)

- Federal Data Protection Act (Bundesdatenschutzgesetz)

- Equal Opportunities Act (Gleichbehandlungsgesetz)

- Hours of Work Act (Arbeitszeitgesetz)

Minimum Wage

The national minimum wage is €12.00 per hour. Effective 1 January 2024, the minimum wage will be €12.41 per hour with a scheduled increase to €12.82 per hour, effective 1 January 2025.

This wage floor extends to all employees, including those with mini jobs. It also encompasses internships for individuals who have concluded vocational training or university education.

It's essential to remember that specific industries may have higher minimum pay rates as dictated by collective bargaining agreements.

Working Hours

The typical workweek in Germany is contingent upon the specific industry in which a job is situated. A five-day workweek, constituting 40 hours, is the norm for full-time employees. While most employees typically work from Monday to Friday, it is common for some to work on Saturdays. Essential personnel, such as police officers, firefighters, hospital staff, public transportation operators, and others, often have schedules that require them to work on any day of the week, frequently involving shift work.

Germany's Arbeitszeitgesetz (ArbZG), also known as the Hours of Work Act, ensures that employees across all industries are entitled to at least one day off from work each week. Additionally, it imposes a strict limit of 48 hours as the maximum allowable weekly working hours by law. On average, German employees work approximately 34.7 hours per week, with full-time workers averaging around 40.5 hours and part-time employees working approximately 20.8 hours per week.

Overtime Pay

Germany does not have specific statutory provisions regarding overtime; however, how overtime pay is handled varies depending on the region and the collective bargaining agreement established between the employee and the regional trade union.

In Germany, overtime is categorised into two types:

- Mehrarbeit: This encompasses any additional working hours that surpass the 48-hour workweek limit stipulated by the Hours of Work Act. Employers can extend the daily work hours to up to 10 for employees who usually work eight hours a day over six months.

- Überstunden: This term refers to any extra hours an employee works as mutually agreed upon in the employment contract. Employees are entitled to fair compensation for the additional hours worked.

Compensation for overtime hours worked by an employee can take one of two forms:

- Additional days off

- Financial compensation

The employee must agree upon the choice between these options.

In cases where additional days off are chosen, the employee should receive time off commensurate with the number of overtime hours worked in each week.

Overtime pay in Germany is typically included in an employee's regular salary, with an additional 10% to 20% supplement based on the terms outlined in the collective bargaining agreement.

13th Month Wages

There are no provisions in the labour code for 13th month payments. However, a 13th month payment is customary at the end of each year, depending on the employee’s contract. Certain collective agreements allow German employees who have worked all 12 months of the year to receive full payment of a month's wages as a year-end bonus.

Taxes

Employers in Germany have withholding obligations for their employees. Those withholding obligations include income tax and social security contributions covering pensions, unemployment, and medical care.

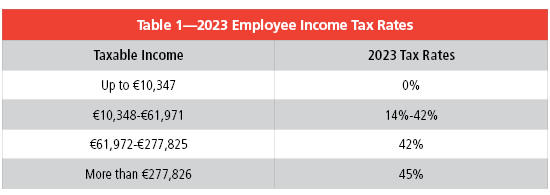

Tax Rates

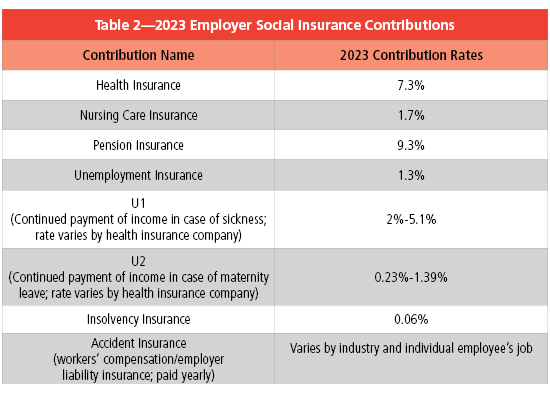

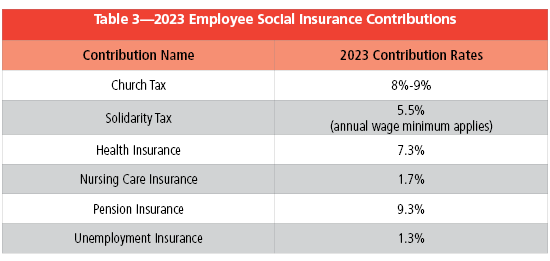

Social Insurance Contributions

Benefits

Healthcare

Health insurance is obligatory in Germany, ensuring nearly universal coverage. The statutory health insurance (SHI) system comprises 110 sickness funds, acting as intermediaries, and covers approximately 88% of the population. Self-employed individuals and employees who surpass a specific income threshold can either remain within the SHI or select private health insurance (PHI) provided by 41 insurance companies. PHI extends coverage to roughly 10% of the population, including civil servants, while special schemes cater to the remaining segments, like the military. A minor portion, estimated at 0.1% of the population, remains uninsured due to administrative challenges or difficulties in meeting premium payments.

Pensions

Pensions in Germany are structured around a "three-tiered system":

- The first tier encompasses mandatory state pension insurance (gesetzliche Rentenversicherung) and is a fundamental social security system component. Both employees and employers contribute a portion of their salaries to this system.

- The second tier comprises voluntary occupational pension insurance.

- The third tier involves private insurance schemes.

The system operates under the pay-as-you-go model, where funds contributed by participants (both employees and employers) are not set aside or invested but instead used to cover current pension obligations.

In Germany, civil servants do not personally contribute to the pension scheme; however, their salaries are adjusted accordingly and tend to be lower than those in the private sector.

From 2012 to 2023, the retirement age incrementally increased to age 66. Starting in 2023, the retirement age is undergoing a gradual two-month increment each year until it reaches age 67 in 2031—any year missed results in a 3.6% reduction in pension entitlement.

Payouts to retirees are determined based on average earnings. The German pension insurance agency releases the value of each year's contribution, known as a "remuneration point." This figure is then multiplied by the number of years contributed and the percentage of the average income earned over a person's lifetime.

Time Off

Annual Leave

In Germany, employees are entitled to 20 days of paid leave, based on a five-day workweek.

Holiday Entitlement (Urlaubsanspruch)

As stipulated by the Federal Holiday Act (Bundesurlaubsgesetz), the statutory minimum requirement for paid holidays is 20 working days per year, assuming a five-day workweek. For employees working six days a week (excluding Sundays), the entitlement increases to 24 paid days. Public holidays are granted on top of this entitlement. This applies to all full-time employees.

Holiday leave is also commonly referred to as vacation or annual leave (Urlaub).

In practice, most German employers go beyond the minimum requirements, often offering 25 to 30 days of leave, even for a five-day workweek (in addition to public holidays). This practice is largely attributed to the Collective Agreements Act (Tarifvertragsgesetz). The specific number of days (Urlaubstage) may vary by industry, but the average is typically 28 days.

Employees desiring more vacation days than stipulated in their employment contract can negotiate additional days off, usually resulting in a salary deduction. This arrangement is not legally mandated and can only be executed with the employer's consent.

Employers might grant extra leave to specific groups, including individuals under age 18, employees with disabilities, and those consistently engaged in physically demanding or hazardous occupations. Employees with severe disabilities are entitled to an additional five days of paid leave.

Holiday entitlement becomes effective after an employee has completed six months of service, typically during the probationary period.

Employees who are terminated during this initial six-month period will receive half of their entitled holiday days for each month worked. However, if an employee is terminated after successfully completing six months of employment with the organisation, they might be entitled to their full holiday allocation.

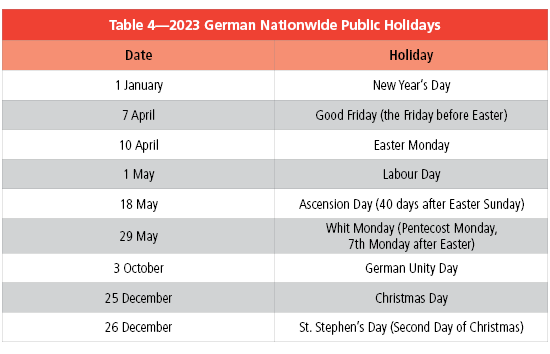

Germany observes nine nationwide public holidays that are universally recognised across all states (see Table 4).

Beyond these national holidays, public holidays in Germany are contingent upon the specific state. Each of the 16 German states maintains its own distinct number of holidays, ranging from 10-14 days.

Parental Leave

Parents in Germany can take up to three years of unpaid leave, which may be supplemented by parental allowance.

Both mothers and fathers can take advantage of parental leave (Elternzeit).

Biological and adoptive parents are entitled to a maximum of three years of unpaid leave from birth until the child reaches age three.

With their employer's consent, parents can opt to save up to 24 months of parental leave, which can be utilised between the child's third and eighth birthdays.

Employees have a legal right to work part-time, with hours ranging from 15 to 30 per week, during their parental leave unless compelling business reasons prevent such part-time arrangements.

Upon the conclusion of their parental leave, employees have the right to return to their previous position.

Employers are not obligated to provide paid leave during parental leave; however, parents can apply for parental allowance (Elterngeld).

Maternity Leave

Expectant mothers in Germany are entitled to a comprehensive maternity leave package that spans 14 weeks, with compensation provided.

Pregnant employees are entitled to a 14-week paid maternity leave (Mutterschutz). This leave encompasses six weeks before the anticipated due date for prenatal care and extends to eight weeks after the child's birth for postnatal care. In cases involving complications, premature births, or multiple births, the postnatal leave can be extended to 12 weeks.

During maternity leave, employees receive maternity pay, which is calculated based on their average gross salary over the three months leading up to the commencement of maternity leave. The maternity pay is distributed between the Health Insurance Company and the employer.

To safeguard the well-being of pregnant or nursing employees, Germany has enacted regulations that restrict their ability to work additional hours, engage in night shifts, or work on Sundays and public holidays. Employers are obliged to adapt the workplace and job tasks to support pregnant and nursing employees, beginning as soon as they are informed of the pregnancy. Additionally, heavy physical labour, piecework, and work with hazardous materials are prohibited.

Job protection measures are also in place to ensure job security for expectant and new mothers.

These provisions are governed by the Maternity Protection Act (Mutterschutzgesetz).

Paternity Leave

Currently, there is no specific paternity leave in place. Fathers can only make use of parental leave.

However, starting in 2024, German fathers will be entitled to two weeks of paid paternity leave, which will be automatically provided to them following the birth of their child.

Sick Leave

Employees in Germany are entitled to up to six weeks of paid sick leave.

To qualify for paid sick leave, employees must have completed more than four weeks of employment before commencing their leave.

Eligible employees in Germany can avail themselves of paid sick leave for a maximum of six weeks, with their employer covering their salary at 100%, as guaranteed by the Continued Remuneration Act (Entgeltfortzahlungsgesetz).

Employees who remain unwell after these six weeks are entitled to sickness benefits from their health insurance (Krankengeld) for up to 72 weeks. Employees receive compensation at 70% of their regular earnings during this period, provided this amount does not exceed 90% of their net salary.

In cases where an employee experiences a recurrence of the same illness and requires further sick leave, they must wait for six months from the conclusion of their last sick leave, or one year from the commencement of the previous sick leave for the six weeks to reset. However, if the employee falls ill due to a different ailment, the six-week period will automatically restart.

Employees who cannot perform their job due to physical or mental illness are permitted to request leave from work, provided they promptly inform their employer. If the absence exceeds three consecutive days, the employee must furnish their employer with a medical certificate.

In certain companies, if an employee falls ill while on vacation, they may have the option to classify this period as sick leave rather than depleting their vacation days.

During the first six weeks of sick leave, employers cover 100% of the salary. However, if the employer has fewer than 30 employees, the national health insurance in Germany reimburses them for 80% of the sick pay.

Carer's Leave

Employees can take up to 10 days of unpaid leave or, in some cases, up to six unpaid months.

Family Care Leave

Workers have the right to take time off to care for a family member requiring assistance. This leave can extend for up to 10 days and is unpaid (as per the Pflegezeitgesetz).

Nursing Care Leave

Like family care, nursing care leave is unpaid but can last for up to six months, either on a full-time or part-time basis, to provide care for a close relative.

Bereavement Leave

A customary practice in Germany is to grant employees two days of bereavement leave.

When an employee experiences the loss of a close family member, it is generally accepted for them to take a two-day absence from work (Sonderurlaub or special leave). This leave is usually paid, but if an employee takes anything over two days, the leave is unpaid, or the employee can take accrued time off.

Severance Pay

A severance payment is not obligatory when a valid reason for termination is provided with appropriate notice. However, a severance payment should be provided if operational changes lead to termination and the employer has included such provisions in a social plan with the works council. There are no fixed regulations regarding the exact amount of a severance payment. Typically, it equates to half a month's regular wages for each year of service with the company. However, it can range up to two months' salary for each year of employment.

While severance payments are not mandatory, it is customary for employers and employees to agree on this matter.

The law offers executive employees the option of termination by court order, which mandates a severance payment determined by the court. In such cases, the payment is capped at 12 months' salary, increasing to 15 months for employees aged 50 or older with 15 years of continuous service and 18 months' salary for employees aged 55 with 20 years of unbroken service to the company.