The Republic of Cyprus is an island country in the Eastern Mediterranean and is the third largest and third most populated island in the sea.

Settled by Mycenaean Greeks as early as 2000 BC, their descendants—the Greek Cypriots— make up the majority population of the country and share cultural and religious aspects.

The country has two official languages—Greek and Turkish—in recognition of its major demographics of Greek Cypriots and Turkish Cypriots. However, English is a commonly spoken unofficial language and is widely featured on road signs, public notices, and advertisements due to influence from its time under British colonial rule.

Cyprus is a member of the Commonwealth of Nations and the European Union (EU). The country joined the Eurozone and adopted the euro in 2008.

Applicable Laws

Several laws applicable in Cyprus cover many aspects of employment and insurance. The most commonly used ones include social insurance, annual paid leave, and termination of employment legislation as well as social pension legislation.

Social Insurance Foundation

The Social Insurance Contribution is compulsory in Cyprus and covers everyone employed in the Republic.

The Social Insurance Contribution is compulsory in Cyprus and covers everyone employed in the Republic.

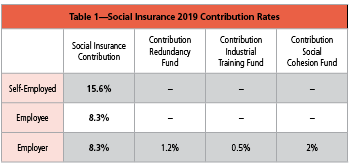

As of 1 January 2019, an additional rate of contribution to the Social Insurance Funds will increase by 0.5 percentage points for the employer and the employee, effectively raising the rate from 7.8% to 8.3%. Further increases as detailed below and in Table 1 will be applied in future years:

Contribution Rates:

- 21.5% from 1 January 2019 (8.3% deducted from employer, 8.3% from employee, and 4.9% by the State)

- 22.8% from 1 January 2024 (8.8% deducted from employer, 8.8% from employee, and 5.2% by the State)

- 24.1% from 1 January 2029 (9.3% deducted from employer, 9.3% from employee, and 5.5% by the State)

- 25.4% from 1 January 2034 (9.8% deducted from employer, 9.8% from employee, and 5.8% by the State)

- 26.7% from 1 January 2039 (10.3% deducted from employer, 10.3% from employee, and 6.1% by the State)

Social Cohesion Fund

Since 1 January 2003, every employer is liable to pay a 2% contribution to a special fund called the “cohesion fund” on salaries of all employees, both locals and expatriates.

However, an exemption from the contribution to the Social Cohesion Fund is granted in cases of foreign employees employed by an international business company, a foreign government, a ship management company, or a company owning a Cyprus ship.

Introduction of National Health Insurance System

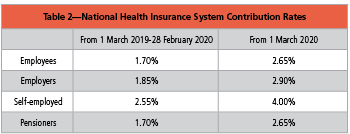

The implementation of the national health insurance system (NHIS) started on 1 March 2019, initially covering only outpatient care, with full implementation expected to be finalized by 1 June 2020.

The implementation of the national health insurance system (NHIS) started on 1 March 2019, initially covering only outpatient care, with full implementation expected to be finalized by 1 June 2020.

The contribution rates for NHIS will be as follows in Table 2.

Maximum Insurable Earnings

As of 1 January 2019, social insurance maximum insurable earnings have increased from EUR 54,396 to EUR 54,648 per year and from EUR 4,533 to EUR 4,554 per month.

Employer’s Statement TD7 (IR7)

For 2018, the employer’s statement TD7 (IR7) was submitted in July. As of 2019, the TD7 (IR7) employer’s statement for year 2019 will be submitted either monthly, at the end of the following month for the previous month, or yearly.

Payroll Calculation Procedure

The payment of an employee’s salary usually is made at the end of each month. The amount to be paid is calculated according to the employment agreement. If the employee has been absent on a non-paid leave, the employer has the right to deduct from the employee’s salary an amount proportional to the absence.

Employment Procedure

The employer must be legally registered with the Social Insurance Services and have a registration number in order to employ another person. Furthermore, a hiring document/contract is completed by the employer containing full personal details of the employee. The document must be signed by both employer and employee. The agreement must also state the nature of the employee’s work, the working hours, and the way that payments will be made.

Protection of Employment

Holidays: Employees who work five days per week have the right to 20 days of annual leave. Employees who work six days per week are entitled to 24 days per year. The paid leave can be reduced if the employee has worked less than 48 weeks during the year.

Holidays: Employees who work five days per week have the right to 20 days of annual leave. Employees who work six days per week are entitled to 24 days per year. The paid leave can be reduced if the employee has worked less than 48 weeks during the year.

Public holidays (see Table 5), maternity leave, leave due to accidents, or inability to work are not calculated as annual leave.

Every employer is liable to pay a contribution of 6% to 9% of the employee’s salary, depending on the type of work, to the Annual Leave Fund from which the employees are paid for their annual leave, unless the employer pays the employees directly for their leave.

Sick Leave: In case of illness, the employee is obligated to visit a doctor, who will decide how many days of sick leave the employee will require. The salary and insurance for this leave are covered exclusively by the Social Insurance Fund. The first three days of sick leave are unpaid. In order to receive this salary, the employee must complete a request form and submit it to the Social Insurance authorities. The form must be submitted within 21 days from the date the benefit is claimed.

Maternity Leave: The maternity allowance is 18 consecutive weeks (can start two to six weeks prior to the estimated birth date). The salary and insurance contributions of the new mother are usually paid by the Social Insurance Fund and equal 72% of the salary. If the mother is the head of the family, the allowance is 80%, or 90% if the mother has more than one dependent.

The employer is not allowed to dismiss the new mother for at least one year after she has given birth.

Furthermore, after the mother goes back to work, she is entitled to a shift reduction of one hour per day for the first nine months after the date of birth.

With the delivery of a second child, the duration of maternity leave extends for four more weeks. In the case of delivery of more than two children, it is extended for another four weeks.

Paternity Leave: The Paternity Leave Act was passed by the Plenary Assembly under the Protection of Paternity Law in 2017 (No. 117(I)/2017) and allows for a total of 16 weeks of leave.

This decision of the Parliament establishes granting a paternity leave for two consecutive weeks (during a period that expires after 16 weeks) to a father whose wife gave birth or acquired a child through a surrogacy arrangement or in cases where he and his wife have adopted a child up to 12 years of age.

It is prohibited for an employer to terminate the employment of a father or to give any termination notice during the period commencing from the date of the written decision by the father of his intention to exercise his right of paternity leave.

Recently, the Cyprus House of Representatives introduced an amending law that entitles all fathers (regardless of marital status) to paid paternity leave.

Termination of Employment

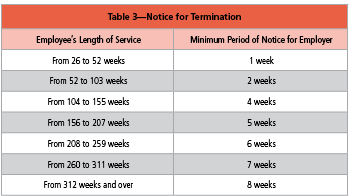

If the employer decides to terminate an employee, the employer is obligated to give a minimum period of notice depending on the length of service. The minimum notice is as follows in Table 3:

If the employer decides to terminate an employee, the employer is obligated to give a minimum period of notice depending on the length of service. The minimum notice is as follows in Table 3:

Both parties sign a termination of employment document. If the service is terminated by the employer after the closing of the two years of service, the employee may be entitled to the payment of two monthly salaries.

The employer is obliged to pay the employee for the period in service, as well as to provide the employee with the benefits he/she is entitled to for the period worked (such as 13th salary) and all days of leave due to the employee.

If the duration of the agreement is a defined one and it comes to an end, the employee is obliged to leave without any additional compensation after getting paid for the period in service. If there is intention from both parties to continue the cooperation, the agreement may automatically continue for an indefinite time of employment.

For an employee who is absent from work due to sickness, the 12 months is the period of prohibition provision warning to termination of employment to an employee. In addition, the law protects the employee from dismissal after the return to work for a period equal to one-fourth of the total period of absence.

Incorporated into the law is the right of the employer to replace the temporary employee who is absent due to illness based on the Law on Employees with fixed-term work.

Personal Income Tax

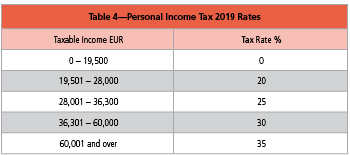

Resident individuals are subject to tax on their worldwide income. In order to be classified as a resident individual, one must reside in the Republic of Cyprus for a period exceeding 183 days in a calendar year. Tax is charged on income from any trade, business, profession, or vocation or from any office or employment, including pensions, dividends, interest, rents, annuities, royalties, and salaries. Salaried individuals’ income also includes benefits in kind (BIKs).

Resident individuals are subject to tax on their worldwide income. In order to be classified as a resident individual, one must reside in the Republic of Cyprus for a period exceeding 183 days in a calendar year. Tax is charged on income from any trade, business, profession, or vocation or from any office or employment, including pensions, dividends, interest, rents, annuities, royalties, and salaries. Salaried individuals’ income also includes benefits in kind (BIKs).

The personal income tax rates applicable are as follows in Table 4.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Eurofast is a regional business advisory organization employing local advisors in more than 22 cities in South East Europe & Middle East (SEEME). The organization is uniquely positioned as a “one stop shop” for investors and companies looking for professional services in SEEME. The organization has more than 40 years of history, working with many global brands and leading Institutions, operating in the manufacturing, retail, airlines, and professional services sector.