Poland is a widely diversified economy with robust investment opportunities. Poland has emerged as one of the strongest economies in the European Union (EU). Since 2017, it has occupied the sixth largest position in terms of GDP growth. According to Brookings, it was the only European economy to avoid recession during the 2008 recession.

Poland is a widely diversified economy with robust investment opportunities. Poland has emerged as one of the strongest economies in the European Union (EU). Since 2017, it has occupied the sixth largest position in terms of GDP growth. According to Brookings, it was the only European economy to avoid recession during the 2008 recession.

However, the emergence of the COVID-19 pandemic in 2020 created a serious economic crisis around the world, which included Poland. Some key factors that slowed down Poland’s economy during COVID-19 were the onset of the global financial crisis, an increase in unemployment, and reduced exports. The Polish government and the EU have extended their hands to rescue the collapsed economy by aiding non-business individuals, micro and medium enterprises, large corporations, and self- employed individuals.

While Poland was re-emerging from the COVID-19 crisis, war broke out between neighboring Ukraine and Russia. This had a negative impact on trade and other collaborations between Poland, Russia, and Ukraine. A massive migration of Ukraine refugees flooded Poland, which in turn resulted in inflation. In November 2021, Polish President Andrzej Duda approved an amendment to the country’s Personal Income Tax Act, Corporate Income Tax Act, and other acts in an effort to curb the effects of COVID-19 and other economic issues. The scheme approved is commonly known as the Polish Deal.

This new deal was a major change and one of the most significant in the last 30 years. As a result, opinions were welcomed from experts and the public in an open forum. Additional amendments were then introduced into the Polish Deal during this time, primarily because of the war in Ukraine. The earlier scheme proposed in November 2021 was renamed Polish Deal 1.0, followed by Polish Deal 2.0, which became effective on 1 July 2022.

Modification to Existing Provision

Significant changes were enacted by Polish Deal 1.0 and Polish Deal 2.0 in support of individuals to withstand the current economic crisis, both as a modification to existing provisions and as an introduction of new provisions. What follows is a summary of some of those changes.

Change in Income Tax Threshold

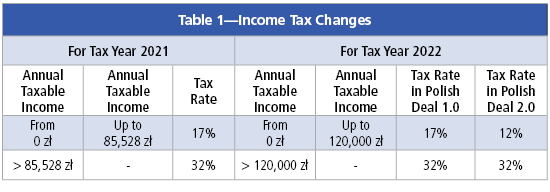

Polish Deal 1.0 initially raised the income tax bracket so it can be subject to a lower tax rate of 17% for tax year 2022. However, based on deliberations, a further benefit has been passed on to lower income earners through the reduction of the first tax bracket from 17% to 12% in Polish Deal 2.0 (see Table 1).

Table 1—Income Tax Changes

This increase in the income tax threshold, along with the reduction of tax rates, has not only reduced the tax burden, but has also led to an increase in the tax reducing amount.

Increase in Tax-Free, Tax Reducing Amounts

Prior to Polish Deal 1.0, for individuals with income subject to progressive taxation, the tax-free income threshold was 8,000 zł. This threshold progressively decreases depending upon income earned and does not apply to individuals with an income above 127,000 zł.

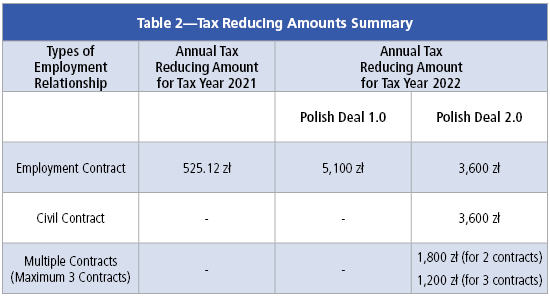

After the enactment of Polish Deal 1.0, the tax-free threshold increased to 30,000 zł per annum. The annual tax reducing amount thus is 5,100 zł (30,000 zł x 17%), instead of 525.12 zł as in 2021. In Polish Deal 2.0, owing to the reduction in the progressive tax slab rate, the annual tax reducing amount was adjusted accordingly from 17% to 12%. Accordingly, the tax reducing amount which can be claimed is 3,600 zł (30,000 zł x 12%).

Furthermore, the tax reducing amount has been extended to employees under civil contracts as well apart from earlier applicability of employment contracts. If an employee is engaged in more than one contract at the same time, there is an option now to distribute and deduct the tax reducing amount maximum under three contract types. For example, if there is only one contract, 1/12th of 3,600 zł = 300 zł per month is applicable. Similarly, for two contracts, it would be 1/24th of 3,600 zł = 150 zł per month, and for three contracts, 1/36th of 3,600 zł = 100 zł per month. Table 2 shows the summary of the applicable tax reducing amounts.

Table 2—Tax Reducing Amounts Summary

Change in Tax Threshold for Civil Contractors

The Polish Deal 2.0 had a flat tax rate of 17% that was applicable for nonresident civil contractors for annual taxable income up to 200 zł, which has been reduced to 12% for the purpose of encouraging foreign workers to work even during this difficult economic situation.

Health Insurance Contributions Becomes Non-Deductible

For income earned under employment contracts, the health insurance contribution of 7.75% could be claimed as a reduction from income tax payable (it was tax deductible). After the enactment of Polish Deal 1.0, this benefit can’t be claimed, thus increasing the tax burden. This remains unchanged under Polish Deal 2.0.

Preferential Tax Treatment for Single Parents

Polish Deal 1.0 introduced a fixed relief of 1,500 zł per annum for single parents instead of a tax-free allowance of 30,000 zł that can be claimed twice by filing a joint tax return with their children. This amendment deprived the tax benefit that the single parents were eligible for earlier, so considering the demands raised by the affected group, the relief has been restored to its original position in Polish Deal 2.0.

Introduction of New Tax Reliefs

Polish Deal 1.0 brought in numerous tax advantages in the form of relief for individuals overcoming the difficult economic situation and further improvements were considered in Polish Deal 2.0 as stated below:

Middle Class Relief

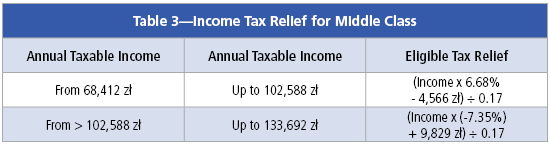

To compensate for the removal of the health insurance contribution deduction that benefited many employees earlier, the Polish government introduced middle class tax relief in Polish Deal 1.0. If the annual salary income of an individual from an employment contract falls between 68,412 zł and 133,692 zł, then they are eligible for relief as per Table 3.

Table 3—Income Tax Relief for Middle Class

After considering the complexity involved in the calculation of this relief, Polish Deal 2.0 eliminated the middle-class relief allowance.

Return Relief

This relief has been introduced mainly to attract skilled employees from other countries to work in Poland and to bring back those Poles who moved out of Poland. Under this relief, income up to 85,528 zł is exempt if an individual earning income from employment, personal service contract, or non-agricultural business activity shifts the place of residence to Poland after 31 December 2021, and becomes a Polish tax resident, subject to certain conditions. The exemption applies for four consecutive tax years starting from the year of transfer of place of residence to the territory of Poland or from the beginning of the following year.

Relief for Families With Four or More Children

If an individual earning income from employment, personal service contract, or non-agricultural business activity takes care of four or more children during the tax year, then income up to 85,528 zł is exempt for each parent per year—subject to certain other conditions. This relief has been brought in to encourage people to have more children and support families for managing their increased living expenses.

Relief for Older Workers

If an individual earning income from employment, personal service contract, or non-agricultural business activity is 65 years or older for men, or 60 years or older for women, then income up to 85,528 zł is exempt. This relief is provided to retain competent older workers in the labor force.

The above three exemptions can be availed either in the annual tax return or during calculation of monthly advances. A written declaration must be submitted by the taxpayer during the tax advance calculation to the employer that he/she satisfies the required conditions. However, there is no template available yet.

Other Changes

To further support the taxpayers for seamlessly fulfilling other obligations such as filing, remittance, etc., the following instructions should also be considered:

- Extending time limits for collection and payment of tax advances—For employees with gross revenue up to 12,800 zł, tax advances are to be calculated in accordance with those rules in force on 31 December 2021, and as per Polish Deal 1.0. If an additional tax advance is payable under the Polish Deal, the excess tax portion does not need to be collected from the taxpayer's income and it can be deferred and paid later when the tax advance calculated as per the Polish Deal is less. This option to calculate tax advances under old provisions was provided basically as a temporary solution to adapt to the enormous tax changes that were quickly introduced. When conditions stabilized, the tax advantage in the form of deferral of Personal Income Tax (PIT) advances was eliminated in Polish Deal 2.0.

- No requirement for calculation of tax advances—At the taxpayer's written request, the remitter may refrain from collecting tax advances on certain types of income from personally performed activities. Such a request can be submitted by taxpayers with annual income not exceeding 30,000 zł. As per the Polish Deal 2.0, this request can be submitted by any other taxpayer, even if the annual income exceeds 30,000 zł.

- Change in tax forms—Amendments brought by Polish Deal 1.0 and 2.0 have resulted in changes in the PIT forms as well. Most of the changes concern information in PIT-11 as new tax reliefs have been introduced. The latest forms can be accessed here.

- Valuation of benefit in kind in form of company car used for private purposes—The monetary value of a company car given to the employee for private use has been changed as under in Polish Deal 1.0.

- Tax year 2021

- For cars with engine capacity up to 1,600 cm3: 250 zł per month

- For cars with engine capacity above 1,600 cm3: 400 zł per month

- Tax year 2022—250 zł per month for the following:

- For motor cars with an engine power of up to 60 kW

- For electric vehicle

- For hydrogen-powered vehicle

400 zł per month for any other car not mentioned above. There is no change to the above in Polish Deal 2.0.

Increase in Salary Capping Limit for Retirement, Disability Pension Contributions

The base for retirement and disability pension contributions are capped on the income level. Therefore, if an employee’s income exceeds the capped amount, the employer is not obliged to withhold retirement and disability contributions on an employee’s income exceeding the capping limit. The cap for 2022 increased from 157,770 zł to 177,660 zł.

Increase in Minimum Remuneration

The monthly minimum remuneration has been revised for the tax year 2022 as 3,010 zł from PLN 2,800 zł and the minimum hourly rate would be 19.70 zł instead of 18.30 zł. This increase is to encourage individuals to buy and consume more and help reduce the effects of inflation.

This historic tax reform was brought in by the Polish government with the primary intent to revive the Polish economy, but on its implementation, it resulted in numerous issues due to lack of appropriate guidelines and application complexities. Though many advantages were passed on for the benefit of individuals, it is not considerable enough to provide a complete solution to the current economic situation. Since 2022 was the first year for the implementation of these tax changes, further clarity is expected once compliance finishes for that year.