Zimbabwe is a landlocked country in Southern Africa. It is bordered by Zambia, Mozambique, Botswana, and South Africa. It was once the bread basket of the region. However, severe droughts and the negative effects of the land reform programmes introduced by the previous President, Robert Mugabe, have meant that in recent years the country has not been able to feed its population. Many Zimbabweans have travelled south to South Africa in search of food and a better lifestyle.

In January 2018, the Wall Street Journal ran an article on Zimbabwe in which it described the country “as having once been the jewel of Africa” and alluded that the country could be regaining some of its brilliance and lustre. The 2018 National Budget statement gave an indication that revival within the land has taken centre stage, with plans announced to streamline government departments, cut taxes and fees, and, most importantly for global businesses, move toward a freer economy.

Employment Legislation

The Labour Act (Chapter 28:01) is the main piece of legislation covering employment in Zimbabwe. There are, however, additional sources of legislation that need to be consulted to ensure that employers remain in compliance in Zimbabwe. The major ones are:

- Accident Prevention and Workers’ Compensation Scheme Notice, 1990 (S.I. 68 of 1990)

- The National Social Security Authority Act—Acts 12/1989, 29/1991, 15/1994, 12/1997 (s. 13), 22/2001, 8/2002

- The National Social Security Fund Rules S - I 222—1

The Labour Act outlines the fundamental rights of employees and provides a legal framework to promote fair labour standards. The Act regulates the conditions of employment and covers the formation, registration, and function of trade unions as well as the enforcement of collective bargaining agreements (CBAs). The establishment and functions of the Labour Court are also addressed in the Act.

The Constitution regulates that every employee is entitled to satisfactory and equitable conditions of work. The Labour Act also ensures that employers cannot force any employee to work under conditions which are below those prescribed by law. It is the duty of an employer to ensure the health and safety of its employees. Employees are also required to comply with occupational safety and health-related regulations and to take reasonable steps to protect their own safety and health.

Employers are required to provide written instructions to employees on safety measures. The instructions need to be in a language that is understood by the majority of the workers. Workers need to be released to attend training during working hours and at the employer’s expense. Under the Factories and Works (General) Regulations and the Statutory Instruments 68 of 1990, employers have to supply free of charge, and maintain in good condition, adequate protective clothing and appliances (such as eye protection) to each employee.

Employment Contract

The contract of employment may be an oral contract or a written contract (per Labour Act, Chapter 28:01, Section 12(1)).

Minimum Wage

While Zimbabwe does not have a single official minimum wage, there are 22 industrial sectors, each of which has a specific minimum wage, as well as a minimum wage for agricultural, domestic, and government employees.

Working Hours and Overtime

The Minister of Labour can issue regulations regarding overtime, shift, and night work. Overtime may be regulated under CBAs. Normal working hours for adult employees are not clearly defined in the Labour Act, but the common standard is 8.5 hours a day with a 44-hour workweek. The minimum overtime rate is 150% of the normal salary/wage rate when employees are required to work beyond the normal working hours. When an employee works on a public holiday, then a premium of 200% of the normal salary/wage is normally paid.

Leave Entitlements

Maternity leave—Female employees are protected under law and are entitled to 98 working days’ leave on full earnings. (There is a compulsory entitlement of 21 days before confinement included in the 98 days.)

Annual leave—Employees are entitled to a rate of 30 days or one-month leave after a continuous employment period of one year. Weekends and public holidays are counted as part of the vacation leave days.

Sick leave—An employee is allowed 90 days of sick leave of full pay upon request, supported by a certificate signed by a registered medical practitioner. If the employee has exhausted the 90 days of sick leave in any one-year period of service, they may request a further 90 days of sick leave at half pay. Again the request needs to be accompanied by a signed certificate from a registered medical practitioner. During any one-year period of service, if the sick leave exceeds 90 days of full pay and 180 days of full and half pay, the employer may terminate the employment of the employee concerned.

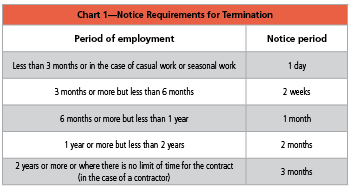

Notice requirements for termination of employment—A contract of employment can be terminated if both employer and employee mutually agree to this in writing. Where the employment contract has not stipulated a longer notice period, the Zimbabwean Labour Law will govern the notice period required to be given.

Notice requirements for termination of employment—A contract of employment can be terminated if both employer and employee mutually agree to this in writing. Where the employment contract has not stipulated a longer notice period, the Zimbabwean Labour Law will govern the notice period required to be given.

The Labour Law provides time periods as indicated in Chart 1.

Retrenchments—The law dictates that employers are required to notify the employee committee or trade union of the intention to retrench or lay off any employees. The notice needs to include concrete reasons for this decision and the names of all employees affected. A copy of the notice has to be submitted to the Retrenchment Board as well as to the Labour Investigation Officer. The Labour Investigation Officer has a duty to ensure that the retrenchment has been correctly handled procedurally according to the Labour Law. Where there are any doubts, the retrenchments cannot be granted.

Income Tax

Registrations and Filings

Zimbabwean tax residents are subject to income tax on their earnings. The Income Tax Act (Chapter 23:06) provides the framework for determining taxable earnings and the rate of tax that is applicable to the earnings. It also provides details of income that is exempt from tax and deductions that are permitted in determining taxable earnings.

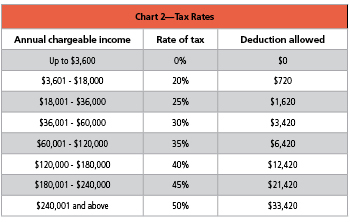

Employees are taxed on a monthly basis in terms of the pay-as-you-earn (PAYE) system. Tax is withheld at the source by an employer on taxable amounts paid to an employee. The tax tables operate on an escalating scale basis until a certain threshold is reached, after which a flat rate of tax applies. (The flat rate threshold is referred to as the Marginal Tax Rate (MTR).)

Employees are taxed on a monthly basis in terms of the pay-as-you-earn (PAYE) system. Tax is withheld at the source by an employer on taxable amounts paid to an employee. The tax tables operate on an escalating scale basis until a certain threshold is reached, after which a flat rate of tax applies. (The flat rate threshold is referred to as the Marginal Tax Rate (MTR).)

The annual rates of tax payable are listed in Chart 2.

As an example, if an employee receives annual taxable earnings of US$ 150,000, the PAYE to be withheld would be calculated as shown below:

US$ 150,000 x 40% - US$ 12,420 = US$ 47,580 (per annum)

The employer has a responsibility to withhold the correct PAYE and make payment to the Zimbabwe Revenue Authority (ZIMRA) by the 10th of the following month after the end of the month in which PAYE was deducted. The employer is also required to submit a return by the same date. The return can be submitted using the e-filing system (electronic submission for PAYE).

Employees are required to contribute toward a fund for AIDS. The AIDS Levy is calculated as a percentage of the individual’s taxable income. The current rate is 3%. Thus, an employee with a tax charge of US$ 5,074.15 would be charged US$ 152.22 for the AIDS Levy. The employer is tasked with the calculation and deduction of the AIDS Levy. The AIDS Levy is paid to ZIMRA along with the PAYE withheld.

National Social Security Authority Obligations and Filings

Employers are obliged to contribute on a monthly basis to the National Social Security Authority (NSSA, the National Pension Scheme) at a rate of 3.5% of an employee’s monthly earnings, with 3.5% being deducted from the employee’s earnings as his or her share of the contribution. There is an earnings ceiling limit in place that currently is set at US $700 per month (the limit is subject to change, and payroll professionals are encouraged to check amendments in legislation regularly to ensure that payroll calculations remain compliant). Contributions are made for all employees between the ages of 16 and 65.

Employers are required monthly to complete a Form P4A, which is a remittance form and ensures that contributions made for the period are correctly credited, and a Form P4, which provides a breakdown of employer and employee contributions.

When there is a new hire, employers will need to complete a Form P3 in the month in which the employee is paid their first earnings. For terminations of employment, a Form P4C is required to be completed. Contributions will be made in the normal manner up to the last day of employment.

Employers are required to ensure that records are maintained for each employee and are available on demand for inspection by an NSSA inspector. The information that needs to be provided during an inspection includes: the National Social Security number, the national identity number and full name of an employee, the employee’s date of birth, the date of commencement of employment, the date of termination of employment, the date and amount of total earnings (monthly/weekly/any other time period), the amount of the deduction from basic earnings in each contribution month, the employer’s contribution in respect of each month, and a summary record of the number of workers in employment per month with the associated total wage bill.

Accident Prevention and Workers Compensation (APWC)

Businesses in Zimbabwe are classified according to the industry in which they operate and each is allocated an industry code (IC). (The Sixth Schedule to Statutory Instrument 68 of 1990 contains the code listings.) Each industry is allocated an insurance premium rate that is determined as a result of annual risk analysis reviews. The rates are gazetted into law each year. Payroll professionals should review the NSSA website or Government printers’ websites to ensure that the correct rates are being used.

Employers are required to complete an annual wage declaration form (WC 50), which is used to assess the employer’s risk and will determine the rate the employer will pay the following year. The form is prepared by NSSA, and the employer is required to insert missing data.

Brief Review of the Journey Zimbabwe Has Undertaken

Zimbabwe was, in its infancy, noted for gold mining and construction. The ruins of Great Zimbabwe, which according to ancient legend was the capital of the Queen of Sheba between the 11th and 15th centuries, covers nearly 80 hectares. The site is now a World Heritage site.

In 1889, Cecil John Rhodes colonized part of the area for Britain, and in 1965 the then Prime Minister, Ian Smith, declared independence from Britain under a white minority rule. This led to international isolation but also to a very lengthy internal guerrilla war. Two rival nationalist parties emerged to challenge the government, ZAPU and ZANU.

The ZANU party won the national elections in 1980, and Robert Mugabe was appointed Prime Minister. Shortly thereafter, military forces carried out a series of massacres of Ndebele civilians. The Ndebele civilians were great supporters of the ZAPU party, and this was seen as a deliberate strategy to ensure continued dominance of the ZANU party. These incidents became known as the Gukurahundi campaign. It is estimated that some 20,000 people were killed during the campaign.

The start of 2000 saw land distributions occurring with many white farmers being forced off the land they have farmed for generations. The land distribution also resulted in increases in attacks and violent acts being committed against the farming community and led to increased criticism from world leaders. In 2002, there was a disputed presidential election, and this event finally resulted in Zimbabwe being suspended from the Commonwealth.

According to the “Social Protection in Zimbabwe” paper presented by Prosper Chitambara, “Over the period 1997 to 2008 the Zimbabwean economy was mired in a severe vicious cycle of economic regression and paralysis. From a peak of 9.7% in 1996, economic growth slumped to a record -14.8% in 2008.”

In 2008, the opposition leader Morgan Tsvangirai succeeded in beating Robert Mugabe in the presidential election, but he was forced to withdraw from a runoff election after his supporters came under continued attack. In 2009, Mugabe’s ZANU-PF party lost the parliamentary majority, and this forced a period of power-sharing with Tsvangirai’s party which continued until 2013.

In November 2017, Mugabe finally resigned after 37 years in power. Emmerson Mnangagwa was appointed President of Zimbabwe.

Conclusion

For a country that has been through many years of internal warfare and seen great economic impoverishments, the country now seems to be emerging from this period. Global companies are once again considering opening operations in the region. This overview will hopefully ensure that payroll professionals will be able to add to discussions around the cost of doing business in the country from a payroll perspective.

Sharon C. Tayfield is a Senior Account Manager for a business advisory firm in the U.S. She graduated with a Bachelor of Commerce majoring in Accounting, Taxation and Managerial Accounts and Finance. She followed this with a Higher Diploma in Education (Post Graduate). She went on to obtain a Diploma in Advanced Property Practice with Distinction in 1993 and then in 2001, successfully completed a Higher Diploma in Financial Markets & Instruments (Post Graduate) (Cum Laude). In 2014 she completed the CIPP Payroll Technician Certificate. She is a registered tax practitioner in South Africa and a member of CIPP (Certified Institute of Payroll Professionals) (UK) and GPA (Global Payroll Association).