Norway’s flag, folk costumes, and landscape are major symbols of national unity in the Northern European country that lies to the west of Sweden and borders the North Sea and North Atlantic Ocean.

Festive days in this home-centered society often feature a public celebration followed by gatherings of families and relatives in people’s homes. Entertaining is done at home, not at restaurants or bars.

The national culture tends to be extremely child-centered.

Its 5.2 million residents tend to be egalitarian, private, and noncompetitive. Individuals generally do not call attention to themselves through loud speech or flamboyant behavior. Personal space is respected, so individuals stand well apart from each other when conversing. Punctuality is expected both in business and in social life.

People may be reserved among strangers but are warm and friendly once a relationship has been established. One should not inquire about personal issues unless one is well acquainted with a person. Respect for each individual’s dignity is expected.

Confirmation as a member of the church is an important rite of passage.

Vocational training or higher education is emphasized for the majority of citizens.

Norwegian employment law is codified by the Norwegian Employment Protection Act of 2005.

The Working Environment Act applies to all employees, with the exception of those working in seafaring and at fisheries, which have their own regulations. The Act contains provisions about employers’ and employees’ obligations with respect to ensuring an acceptable working environment. Enterprises are required to have safety delegates and working environment committees, and some enterprises are required to have a corporate health service where necessary.

Minimum Wage—Norway does not have a minimum wage, but many times wages are specified in collective bargaining agreements.

Hours—Normally nine hours per day/40 hours per week An employee must have at least one break if the daily working hours exceed five hours and 30 minutes.

Overtime Pay—Use of overtime as a permanent arrangement is not permitted. Overtime is only permitted when there is an exceptional and time-limited need for it. Overtime is limited to 10 hours during a seven-day period, 25 hours during a four-week period, and 200 hours during a 52-week period. Total working hours must not exceed 13 hours during a 24-hour period, or 48 hours during a seven-day period.

If the company has a collective bargaining agreement, the employer and employee representatives can agree in writing to more extensive overtime work. The Norwegian Labour Inspection Authority can grant permission for more extensive overtime work in special cases.

The Working Environment Act provides for a minimum overtime supplement of 40% in addition to ordinary pay for work in excess of the Act’s definition of normal working hours. Many agreements, for example collective bargaining agreements, have better terms. The employment contract must include information about overtime pay.

Employment Contracts—All employees are entitled to a valid employment contract, whether they are in full-time or part-time employment. The contract should specify the rights and responsibilities of both the employee and employer.

Work contracts should include the following information:

- The duration of employment

- Wage (including how often wages are paid and how payment is made)

- The probationary period—normally six months

- Terms for giving notice (during and after any probationary period)

- Working hours

- The job description (including duties, job title, and other information)

- Holiday leave

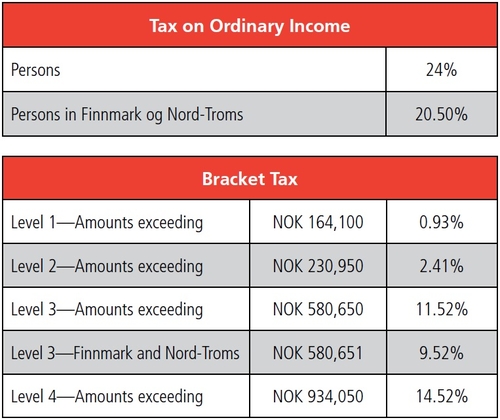

Income Tax Filing

The tax year is from January 1 to December 31. Returns are due by 30 April each year.

Everyone who has income and/or assets liable to taxation in Norway must submit a tax return to the Norwegian tax authorities.

In late March/early April in the year after the end of the income year, each taxpayer will receive a tax return from the tax authorities. The tax return is pre- completed with information received by the Norwegian Tax Administration from employers, banks, insurance companies, day care centers, etc.

A taxpayer must review the pre-completed return and indicate that the information is correct. If the information is correct, nothing else is required. If the information is incorrect, the taxpayer must make the corrections and submit by the filing deadline.

If a pre-completed tax return is not received, the taxpayer must contact the Norwegian Tax Administration and complete a return.

Tax Payment Due Dates—Tax withholding is due monthly by the fifth of the month following payroll, filed electronically.

Social Insurance Programs—Social security rates are 8.2% for employee social security contributions and up to 14.1% for employer social security contributions.

Time Off

Annual Leave (Vacation)—Employees are entitled to a minimum annual holiday of 25 “workdays,” which is covered under the Holidays Act. Saturdays are considered workdays. Holiday pay must be at 10.2% of the annual remuneration if the employee is entitled to 25 workdays’ annual holiday.

Although the Holidays Act specifies 25 days, many Norwegian companies provide five weeks of vacation either based on collective bargaining agreements, individual employment contracts, or an employer policy. The holiday pay should be 12% of the annual remuneration.

The holiday pay system in Norway is complex. Under the Holidays Act, salary is deducted when the employees are absent due to a holiday. As a substitute, employees are entitled to holiday pay. Under the Holidays Act, holiday pay must be paid out immediately before the holiday, but the parties can agree otherwise. To simplify the holiday pay procedure, most companies instead deduct the monthly payment in June (plus 4/26 of the July remuneration if the employee is entitled to 30 workdays of holiday) and replace the June remuneration with last year’s holiday pay irrespective of when the employee in fact is absent due to a holiday.

Maternity and Paternity Leave—Maternity leave, including compensation, lasts for a maximum of 54 weeks. In addition, parents have the right to take a leave of absence for an additional year without compensation. The compensation is either 80% of the salary for 54 weeks or 100% for 44 weeks, which is covered by the National Insurance Act of 1997.

The period of parental leave may be shared by the parents, but three weeks before the birth and the first six weeks after the birth are reserved for the mother as a compulsory main rule. Ten weeks are reserved for the father. If the father does not use the 10 weeks, the benefit period will be shortened. The time allotted to the father cannot be transferred to the mother.

Child Care—Kindergarten is available for children between the ages of 1 and 5. The Norwegian government strictly regulates kindergartens. Parents pay a monthly fee for each child, which is based on income. Regulations are outlined in the Kindergarten Act—Act No. 64 of June 2005.

Sick Leave—Sick pay benefits are available if the employee becomes ill. The employee must have been employed for at least four weeks before sick leave begins and can collect benefits for a maximum of 52 weeks. The illness must be documented by a self-declaration or a medical certificate. The sick pay benefit starts on the employee’s first day of absence. The employer pays the sick pay benefit for the first 16 days, after which the Norwegian National Insurance scheme takes over.

Personal ID Number

When moving to Norway permanently or for at least six months, an employee must be registered as a resident in the Norwegian Population Register. To register, the employee must visit a Norwegian tax office in person and will be required to present proper identification.

Everyone who is registered as a resident in the population register is assigned a Norwegian personal identification number. The personal ID number consists of 11 digits and includes the person’s date of birth in the first six digits. People will retain this number for their entire lives much like a U.S. social security number.

Web Resources

For more information, visit the following web resources:

http://www.everyculture.com/No-Sa/Norway.html#ixzz4cBbslSM6

https://www.skatteetaten.no/en/International-pages/

https://www.cia.gov/library/publications/the-world-factbook/geos/no.html

https://www.regjeringen.no/en/topics/labour/the-working-environment-and-safety/innsikt/the-working-environment-act/id447107/

https://iclg.com/practice-areas/employment-and-labour-law/employment-and-labour-law-2016/norway

http://www.officeholidays.com/countries/norway/

https://www.altinn.no/en/Start-and-Run-a-Business/Operation/Working-conditions/Employment/What-working-hours-can-beagreed/Overtime-rules/

www.nordisketax.net/main.asp?url=files/nor/eng/i07.asp

https://www.justlanded.com/english/Norway/Norway-guide/Jobs/Employment-contracts

https://www.altinn.no/en/Start-and-Run-a-Business/Operation/Working-conditions/Employment/What-working-hours-can-be-agreed/

http://us.practicallaw.com/3-507-2636

https://www.skatteetaten.no/en/International-pages/Felles-innhold-benyttes-i-flere-malgrupper/Articles/Norwegian-national-ID-numbers/

https://www.nordisketax.net/main.asp?url=files/nor/eng/i05.asp

https://www.activpayroll.com/global-insights/norway

https://www.nordisketax.net/main.asp?url=files/nor/eng/i05.asp

https://iclg.com/practice-areas/employment-and-labour-law/employment-and-labour-law-2016/norway

http://www.childresearch.net/projects/ecec/2013_01.htm

https://www.regjeringen.no/en/dokumenter/kindergarten-act/id115281

http://us.practicallaw.com/3-507-2636

http://www.nyinorge.no/en/Ny-i-Norge-velg-sprak/New-in-Norway/Work/Employment/Sickness-benefits/