Argentina, officially the Argentine Republic, is a federation of 23 provinces and one autonomous city, Buenos Aires. The country is located in the southern portion of South America and is bordered to the south and west by Chile, to the north by Bolivia and Paraguay, and to the northeast by Brazil and Uruguay. Argentina has a population of more than 42 million and is home to a vibrant social life. Argentines tend to be laid-back but love to tango at every given opportunity. The Argentine people are connected to their culture and history since winning their independence from Spain in 1816.

Argentina, officially the Argentine Republic, is a federation of 23 provinces and one autonomous city, Buenos Aires. The country is located in the southern portion of South America and is bordered to the south and west by Chile, to the north by Bolivia and Paraguay, and to the northeast by Brazil and Uruguay. Argentina has a population of more than 42 million and is home to a vibrant social life. Argentines tend to be laid-back but love to tango at every given opportunity. The Argentine people are connected to their culture and history since winning their independence from Spain in 1816.

Approximately 97% of Argentina’s population is of European descent, and the country has one of the highest literacy rates in the world. Argentina is rich in natural resources and has large agricultural and industrial sectors.

Labor Code

The Argentine government in June raised the monthly minimum wage to 6,810 Argentine pesos (country code ASR) for employees who work an eight-hour workday. Additional increases to 7,560 pesos in September 2016 and to 8,060 pesos in January 2017 are scheduled. Employees can be paid by time worked (hours, days, months, etc.) or by the amount of work completed. Remuneration can be a sum of money, or up to 20% of all remuneration can be paid by covering the cost of housing or utilities. For cash payments, employers are required to make the deposit in the employee’s name to a bank that has an ATM no more than two kilometers away from the place of work in an urban area or no more than 10 kilometers away from the place of work in a rural area. Services for depositing and receiving funds from employment must be of no cost to the employee. Argentina has no variable minimum wage.

Workweek, Work Conditions

Argentine law prohibits workers from exceeding eight hours in a day or 48 hours in a week. An average workweek is 45 hours, including five hours on Saturday. Night work is defined as work between 9 p.m. and 6 a.m., and employees working at night cannot work more than seven hours in a 24-hour period. Employees working in unhealthy jobs—defined as subject to toxic fumes or dust—cannot work more than six hours in a 24-hour period or 36 hours in a week.

Overtime, Work Compensation

Overtime work is considered any work performed in excess of 48 hours in a week. Overtime work is remunerated at 1.5 times the normal rate of pay. However, overtime work on holidays, Sundays, and after 1 p.m. on Saturdays is paid at double time. Overtime work cannot exceed 30 hours per month or 200 hours per year.

Pay Period

Employees are paid at different times depending on the nature of their work. For an employee who is paid monthly, paychecks are to be delivered at the end of the month. For employees who are paid daily or hourly, paychecks are to be delivered at the end of each week or biweekly. For employees who are paid based on work completed, paychecks must be delivered at the end of the week or biweekly for all work completed in that time frame. Employers are required to deliver payment within four days of the pay period ending for employees paid monthly or biweekly and within three days for workers paid weekly.

Fringe Benefits

The Aguinaldo (Christmas box) is a bonus payment common in Latin America. Argentina Law stipulates that this bonus payment should be paid in two installments, June 30 and December 31.

National Holidays

National Holidays

Argentina observes several holidays. When holidays fall on a Tuesday, the previous Monday is considered a paid public holiday. If holidays fall on a Thursday, the following Friday is considered a paid public holiday. Several holidays, such as Carnival and Easter, are not set to a specific day, so dates vary year to year. Argentina also recognizes various other holidays that can be taken by people of different faiths, including Rosh Hashana, Passover, Yom Kippur, Feast of Sacrifice, Islamic New Year, and Completion of the Fast. These days can be taken as paid holidays only by the practitioners of the respective faiths. Paid public holidays are according to Table 1.

Taxes

The tax year in Argentina is the calendar year—January 1 to December 31. Argentina has a main taxation system for employees and a separate system for the self-employed. Employers must withhold income tax and contribute to social taxes for all employees. Income tax law stipulates that Argentine citizens are taxed on their global income. Non-Argentine residents pay tax only on Argentina-sourced income. All income is subject to taxation. This includes all compensation for services rendered by the employee. The central government sets limits on regional and municipal taxation. Employers and employees must submit annual income tax returns indicating withholding amounts, tax-free income, and any other taxes. Tax payments for June and December are higher, as the Aguinaldo is taken into account in these months.

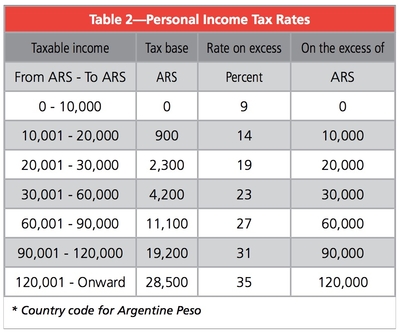

Personal Income Tax Rates

Income tax is collected solely by the government of Argentina and is regulated by the Administración Federal de Ingresos Públicos (AFIP). Tax deductions are made progressively across seven income bands, each of which has a corresponding tax rate and tax base (see Table 2).

Income tax rates for individuals range from 9% to 35% and include fixed charges assigned to each tax bracket except the 9% bracket. Withholding amounts can be determined per employee based on salary and family allowances.

Taxes and social security payments must be remitted by the 16th of the next month after they are withheld. If the 16th falls on a weekend or public holiday, payments may be made on the next working day. Employer contribution rates are equal to 23%, 24%, or 27% depending on the type of employer. Most employers are subject to the 23% rate.

Expatriates working in Argentina on a regular basis for less than six months are taxed at a rate of 35% of their imputed Argentina-sourced income. This tax is calculated on 70% of the gross amount received, making an effective tax rate of 24.5%.

Stock Plans

Employee stock options are taxable based on their discount price upon exercise. Employers must withhold income taxes on the difference between the price employees paid for the shares and the price they received upon selling them. Employers must apply the same tax rates, returns, and remittance methods as those applied to normal salary payments in withholding income taxes from the share option plans.

Social Insurance Programs

Employers are obligated to enroll employees for social benefits. Both employers and employees make contributions into the social security system to cover a range of benefits, including pensions, disability, and survivors’ benefits; benefits for sick leave, maternity, paternity, and parental leave; workers’ compensation; and unemployment and disability benefits. Seventeen percent of an employee’s wages is withheld from a paycheck for social taxes—11% for retirement, 3% for health care, and 3% for social services.

Employer-Employee Relations

Labor contract law mandates that employers offer compensation and benefits to their employees, including temporary and contracted workers. These include minimum wage, overtime work, normal hours of work, holidays, leave, wage payment, termination pay, and workers’ compensation.

Paid Vacation

The paid annual leave entitlement depends on the employee’s length of service with the current employer. If a worker has not been with an employer long enough to accrue vacation days, one day off for every 20 days of work is offered.

Sick Leave

An employee has the right to sick leave with full pay for a period of up to six months annually if the length of service is more than five years, or three months if the net credited service is less than five years. If the employee has family charges, these entitlements are extended to six and 12 months, respectively. The employee also is entitled to sick leave without pay for another 12 months, during which the employer is obliged to maintain the employment relationship.

Maternity Leave

Women are allowed to take a paid leave from work 45 days before and 45 days immediately after the birth of a child. This leave is paid through social security funds. Women can request to reduce this time off to a minimum of 30 days before and after a birth. In the case of pre-term births, women can take off more than 45 days after the birth in order to fulfill the full 90 days off. Women are guaranteed employment stability during a pregnancy and are entitled to continue working after giving birth with the same conditions as prior to the pregnancy. In addition, women are allowed six months of unpaid leave after the birth of a child. A woman is also entitled to two daily breaks of 30 minutes each to breastfeed her child. This entitlement lasts for one year after childbirth but may be extended upon submission of a medical certificate.

Other Leave

Employees who are expectant fathers are entitled to two days of paid time off for the birth of a child. Employees are granted 10 days of paid time off when they are first married. Employees are also entitled to paid leave to attend an examination in secondary or university education for a total of 10 days annually.

Bereavement Leave

Employees are granted three days of paid leave for the death of a spouse, partner, child, or parent in addition to one day of paid leave for the death of a sibling.

Workers’ Compensation

Workers’ compensation exists for employees injured or involved in a work-related accident. This compensation includes benefits for disability and death. Companies are responsible for the cost of medical treatment and prescriptions of the injured employee. If the disability is determined to be permanent, the employee receives a lump sum or a pension, the type and amount depending on the degree of disability and the worker’s age and earnings. The monthly benefit is equal to the employee’s earnings when the disability began, plus any additional pay increases received by workers in an equivalent position.

Termination, Severance Payments

Notice periods for involuntary termination are mandatory and are determined by the employee’s length of service. Employees are required to give 15 days’ notice in the case of voluntary separation. Employers or employees who violate the notification agreement are liable for payment in lieu of the notice. However, employers are not required to provide any payment to employees who are terminated during the probationary period.

Pension

Retirement age for the basic pension is65 for men and 60 for women. Women may choose to retire at age 65 for a higher pension. Generally, an employee must have a minimum of 45 yearsof contributions and service to be qualified for a service pension. The retirement age and contribution requirements are reduced up to 10years for hazardous or unhealthy occupations.

Business Etiquette

Argentina is a relationship-driven culture from both a personal and business perspective. It is important to build both family and friend networks and to use them for favors and assistance. Argentines like to do business with people they know and trust and prefer face-to-face meetings rather than by telephone or in writing. Appointments are necessary and should be made one to two weeks in advance, preferably by email or telephone. Avoid January and February, which are their vacation times; the middle weeks of July, when many go skiing; and during the two weeks before and after Christmas.

You should arrive on time for meetings, although the person you are meeting may not be punctual. Appearances are important, and you are normally judged by the way you present yourself. Some small talk is welcomed prior to the commencement of a business meeting. Business decisions are not made at meetings but through a very slow and bureaucratic process that requires several layers of approval.

Business attire is formal and conservative, yet stylish. Men should wear dark-colored, conservative business suits, and women should wear elegant business suits or dresses. Quality accessories are important for both sexes. Business cards should be in both English and Spanish and are presented without formal ritual.

Values

The family is the center of Argentine life, and the extended family plays a dominant role. Argentines maintain close physical distance when speaking and will often touch each other during a conversation. Respect and recognition is expected and routinely affects personal life at home, in the community, and in business.

Language

Although Argentina’s official language is Spanish, Argentine Spanish is different from the Spanish spoken in Spain. In some ways it sounds more like Italian than Spanish. Many other languages are spoken in Argentina, including Italian, German, English, and French.

Religion

The Argentine constitution guarantees all residents the right “to profess their faith freely” and states that foreigners enjoy all the civil rights of citizens, including the right “to exercise their faith freely.” Greater than 70% of the population is Roman Catholic. Other world religions, notably Islam, have gained a foothold within the country during the last 10 to 15 years.

Culture

The initial greetings are formal and follow set protocols by greeting the eldest or most important person first. A standard handshake with direct eye contact to indicate interest and a welcoming smile will suffice.

In general, Argentines prefer third-party introductions. Upon arrival at a gathering, wait for the host or hostess to introduce you, and when leaving, say goodbye to each person individually. If you are invited to an Argentine home for dinner, it is customary to take a small gift for the hostess and arrive 30 or 45 minutes later than the stated time since on-time arrival is not the norm. Wait to be seated by the host, and practice your table manners. You will not go wrong if you take your cue from your hostess.