By Kristine K. Willson, CPP

The Czech Republic, also known as Czechia, is a landlocked country that consists of 13 regions and is located in the center of Europe. Prague is the capital of what was formerly known as Czechoslovakia prior to the formation of the Czech Republic and Slovakia in 1993. The country is bordered by Germany and Austria to the east, and Poland and Slovakia to the west.

The Czech Republic, also known as Czechia, is a landlocked country that consists of 13 regions and is located in the center of Europe. Prague is the capital of what was formerly known as Czechoslovakia prior to the formation of the Czech Republic and Slovakia in 1993. The country is bordered by Germany and Austria to the east, and Poland and Slovakia to the west.

Culture

This country is family oriented with most families only having two children and multiple generations living in the same household. Traditionally, the father worked while the mother ran the household. In the last few years, more families have become two income earners with the mothers entering the workforce. They still hold on to their family values though and cherish their time away from work. This country seems to have mastered work-life balance.

Labor Code

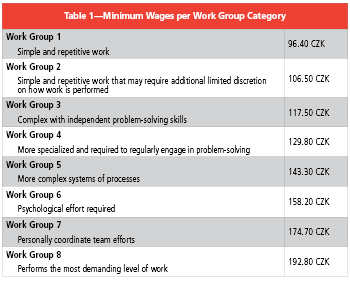

The standard working hours in the Czech Republic are 40 hours per week with the maximum workday being 12 hours. While the standard minimum wage is 96.40 Czech Koruna (CZK) per hour, there are different “work groups” that have higher minimum wage rates. The work group category shown in Table 1 is based on the jobs scope of complexity and level of “professional sophistication.”

Since 1 January 2022, the minimum wage has been increased by 1,000 CZK to 16,200 CZK; the minimum hourly wage has been increased to 96.40 CZK. The bottom levels of guaranteed wages for individual work groups have also been increased to 16,200 CZK up to 32,400 CZK (eight groups depending on complexity, responsibility, and strenuousness of the work performed).

The increase in the minimum wage has an effect, for example, on the limit establishing entitlement to a tax bonus (the annual income amounts to at least six times the minimum wage/at least half of the minimum wage per month, i.e. 8,100 CZK); the maximum amount of earnings of a job seeker registered by the Labour Office (half of the minimum wage); the amount of state social support allowances except for allowances reflecting the applicant´s income; increase in the maximum tax relief for the placement of a child in a pre-school facility (in the amount of minimum wage); and increase in the limit to exempt pensions from income tax (up to a 36 multiple of the minimum wage— 583,200 CZK for 2022).

Overtime is compensated at a premium of 25% for hours worked over 40 in a week. Employers cannot require more than an average of eight hours of overtime in a 26-week period and 150 hours in a calendar year. Employees under the age of 18 cannot work overtime.

Hours worked at night or weekends are paid at 10% above the normal wage.

Any time worked on a paid public holiday are compensated with time off within three months of the holiday.

Hours worked between 10:00 p.m. and 6:00 a.m. is considered night shift and may not exceed eight hours within a 24-hour period.

Workers are paid monthly and must receive a written wage statement including pay rate, pay grade, pay day, and employee’s hire date or whenever their pay rate changes. They must also provide monthly itemized pay slips which detail wage and deductions. Wage is paid in legal tender and are rounded up.

The termination process begins when either party provide one calendar month of notice. The only time employers are not required to give notice is for gross breach of contract or if the employee is convicted of criminal charges.

The termination process begins when either party provide one calendar month of notice. The only time employers are not required to give notice is for gross breach of contract or if the employee is convicted of criminal charges.

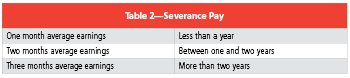

With termination there is severance pay based on length of employment (see Table 2).

Income Tax

Foreign employees’ income tax filing (items to consider, not all will be represented in every country and there may be additional).

Taxes are imposed on workers who reside in the Czech Republic full time or at least 183 days in a tax year, which is a calendar year.

The current income tax rate is 15% on income of up to 48 times the average wage in Czech Republic which is currently based on 35,441 CZK ($1,494.14 USD) and an income tax rate of 23% on income more than the threshold that increased in 2022 to 1,867,728 CZK ($78,947.03 USD).

Social Security

Social security withholding for the employer is 24.8%. The rate consists of pension Insurance of 21.5%, sickness insurance of 2.1%, and unemployment insurance of 1.2%. The wage base of social security is the same as noted for income tax. Employees pay pension insurance at 6.5%.

Health Insurance

Employers are mandated to enroll workers in private health care insurance and withhold contributions from employees’ pay. Coverage begins on the first day of employment and ends upon termination.

Time Off and Leave

Various time off is required to be available to the employee.

Full-time employees are given four weeks of annual leave each year and is paid at their average rate of pay when taking the leave. If leave is not taken in the year is paid to the employee using their average wage.

One week of supplemental leave is provided to employees who perform “hard work,” which is defined by the Labor Code as certain medical fields of work, work involving exposure to radiation, work involving contract with infectious materials, work in tropical areas, work involving regular contact with prisoners, and work involving scuba diving. If leave is not taken in the year provided, it is not paid out.

Employees are provided 14 days of sick leave and are paid at 60% of wages paid the prior year. If employees need more sick time, they may be eligible to receive an additional time from social security.

Civic Duty Leave is unpaid approved leave to fulfill civic duties, where service leave is paid leave in the case of military service but paid by the military authority.

Paid parental leave is available through Czech Republic’s Social Security Administration and entitles female workers 29 weeks of maternity leave (37 weeks in the case of multiple births). Leave can be taken starting six weeks prior to the due date. Women who adopt a child are entitled to 22 weeks of maternity leave.

Men are entitled to seven days of paternity leave within the first six weeks of birth or adoption.

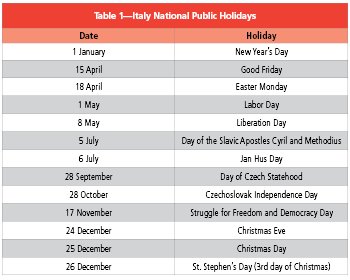

There are 13 mandatory paid holidays in the Czech Republic (see Table 3).

Other

Workers’ compensation and retirement plans are covered under Social Taxes.