Only recently, “talent management” was the watchword in the human resources (HR) community for finding skilled, experienced, and talented employees to fill vacancies throughout the world. However, with the COVID-19 pandemic, many have put this concept out of their minds. Others have had to adapt and have done so with varying degrees of success.

All large companies face similar challenges: staff becoming overwhelmed with the administration of salaries, benefits, and other HR-related issues. To make matters worse, many HR staff are not familiar with the procedures and regulations involved with payroll and benefits. Therefore, they cannot carry out this type of work effectively, which poses a particular problem for new employees.

Maintaining compliance is a second issue companies face, from the lack of knowledge necessary to adhere to continuously changing compliance regulations and other HR demands. Maintaining the standards set by compliance regulations is one of the most work-intensive areas. Failure to comply with tax and legal requirements can lead to financial penalties or worse.

A professional employer organization (PEO) can help. PEOs can work in partnership with your company, providing a comprehensive array of HR services, including benefits management, payroll processing, annual/quarterly/monthly reporting, recruitment, compliance, and work permits, etc. In essence, a PEO is the outsourcing of your company’s HR department.

A PEO can provide you with expert service at a competitive price, at a time when your company needs help with its HR administration. However, you will still have control of HR’s softer side, such as a selection of staff.

One of a PEO’s main benefits comes in situations where foreign companies do not have a legal entity registered for a country where they wish to operate. This situation makes it difficult for such companies to recruit local workers and maintain compliance with the correct tax and labor laws and regulations.

The restriction on employee mobility has been one of the critical measures worldwide to stem the spread of the COVID-19 virus. A PEO allows companies to avoid mobilizing employees from their home country and forego the associated expense. This service is particularly advantageous for companies that do not have a legal identity in the country they wish to operate.

PEO companies tend to be part of a wider PEO network, forging professional connections, and working with one another to provide services across various countries and legal boundaries. These collaborative business relationships enable PEOs to take on more of the burden of responsibility from employers, even more so than a conventional outsourced HR department can.

These relationships also give PEOs access to an enormous resource pool of employees from many companies. Regardless of your company size, PEOs can leverage their bargaining power to ensure that you get the same rates as larger companies for services such as insurance, employee healthcare, and benefits provisions.

As an employer’s strategic partner, PEOs can take on some of the risks. For instance, a PEO can take on the responsibility for laying off staff and ensure that the process adheres to the correct country laws and regulations. PEOs can also help in dispute resolutions and help protect a business during an industrial or staff lawsuit.

There are options to outsource certain aspects of your HR functions, such as outsourcing to payroll companies. However, these companies do not become a strategic partner. They may do a great job of filing your annual returns and processing payroll, but they do not share in any of the risks in the way that a PEO does. Instead, they provide a specialized service on behalf of you, the customer.

Your Company’s Role When Working With a PEO

When your company operates with a PEO, you will continue to have control over your employees’ roles and activities. The PEO assumes the responsibilities for administration of their wages, taxes, and benefits. The exact extent of the PEO’s responsibilities is agreed with the employer and laid out in the service agreement. The only interaction that an employee would routinely have with the PEO is the PEO’s name appearing on their pay slip or other HR-related paperwork.

Services PEOs Provide

The exact level and range of services provided by PEOs will differ. The following are a range of typical services offered by PEOs:

- Improved service levels. Due to their collaborative nature and scale of operations, PEOs tend to access higher quality benefits and services than small or medium-sized companies.

- Wage compliance and order management. When processing wages, most countries have a legal requirement to adhere to management and wage compliance regulations.

- Employee compensation management. Handling injury claims, staying on top of workplace safety issues, and taking care of policy claims, paperwork, and audits can be time consuming.

- Compliance assistance. PEOs are compliance experts, keeping up to date with ever-changing regulations across different countries and economic regions.

- HR management. Managing and supporting HR activities and personnel with a company. This management includes vacation management, termination assistance, liability management, risk reduction, etc.

- Training. PEOs can assist with employee training and development.

- Recruitment. Although PEOs will deal with your recruitment process, you will still maintain control over selecting employees.

- Strategic HR planning. Developing plans and strategies for attracting and retaining the best talent to your company and controlling HR expenses.

These services are generic, and your company only needs to select the level and range of services you wish the PEO to take on. The content of services is specified in the service agreement.

Disadvantages of Partnering With a PEO

This article has detailed many of the advantages of partnering with a PEO. Of course, there will always be the other side to consider, so here are a few disadvantages for your consideration:

- Potentially restricted options. Your employees may be content with their current benefits and HR support. Partnering with a PEO is likely to mean that there will be changes to your existing benefits. These are options that the PEO will have control over, as they are the provider.

- Unexpected changes. The PEO, as an individual business entity, can decide if the level of risk and responsibility has increased. PEOs can change the risk category of their partner and increase the service price accordingly.

- Issues with cash flow. A PEO might insist on having up front or down payments for their services. This situation could lead to cash-flow issues for the employer company.

- Potential financial risks. Despite partnering with a PEO, an employer company may still retain a certain amount of legal liability. Such situations could arise, for instance, in the event of false unemployment claims. If audited and found guilty of illegal activity, a company can still face a fine even though it is working with a PEO.

Employer of Record (EOR)—An Alternative to PEOs

If you are not interested in partnering with a PEO, there is an alternative outsourcing solution available. Working with an employer of record (EOR) is a suitable arrangement for those companies that are not interested in fully outsourcing their HR requirements or do not want to be in a collaboration agreement.

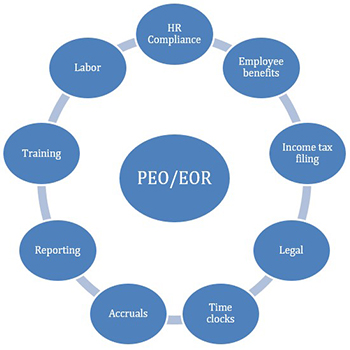

An EOR provides similar services to a PEO, but an EOR becomes the staff’s full legal employer and pays for the staff. EORs handle salaries, salary compliance, tax, benefits, unemployment claims, and other related issues (see Figure). This distinction is significant and relevant, certainly for companies that intend to expand into other countries. Such expansion can lead to more complex arrangements in terms of regulations, local employment rules, and work permits, etc.

Using an EOR, a company can legally employ workers for the country where the EOR is located because the EOR will be the company’s legal employer. Finding and retaining staff in such a situation is much more straightforward if a company enters a partnership with an EOR.

Reduce Complexity--Don’t Establish a Legal Entity in a Country

Using a PEO or an EOR both make it simpler for companies of any size to operate should they not wish to establish a legal entity in a particular country. It is also a satisfactory solution for companies that want to reduce the HR administration and management burden.

Indeed, during the COVID-19 pandemic, either one of these arrangements makes it easier for existing employed experts to move or to hire new experts without the often crippling burden of red tape, bureaucracy, and financial cost. PEOs/EORs present a creative way to get around the restrictions that COVID-19 measures have placed on businesses’ nature, regardless of size or location.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Matan Lazar, CPA, is Co-CEO and Principal Accountant with Lazar and Company, Certified Public Accountants. He is a licensed accountant and a member of the Institution of Certified Public Accountants in Israel (ICPAS). Lazar has extensive experience performing financial and accountancy projects and has been dealing with PEO service for many years operating worldwide. Visit https://www.lazarco.com/ for more information.