Global payroll professionals can be part of the solution to youth unemployment and underemployment.

Global payroll professionals can be part of the solution to youth unemployment and underemployment.

According to the World Employment and Social Outlook: Trends 2018 report, global unemployment appears to be stabilizing after a rise in 2016.

“Even though global unemployment has stabilized, the global economy is still not creating enough jobs,” said Guy Ryder, International Labour Organisation Director.

According to a 2019 briefing by the United Nations’ Department of Economic and Social Affairs called “World Economic Situation and Prospects,” the decline in labour force participation among young people aged 15 to 24 was noted as being partly attributed to extended education and an associated postponement to entering the labour market. However, during 2018, 21.2% of young people were “Not in Education, Employment, or Training” (NEET).

The briefing further reported that “youth unemployment rates in North Africa are higher than 25% in countries such as Egypt, Tunisia, and Algeria. Meanwhile, sub-Saharan Africa displays the highest youth working poverty rates in the world, at about 70%.”

So, what are some of the ways in which world leaders and governments can tackle this global issue, and how does payroll play a role in addressing it?

One of the ways in which countries can fund skills training is by imposing taxes on employers via payroll. By regulating the collection of levies through payroll, governments hope that employers will be encouraged to upgrade the skills of their workforce. It is a resourceful means of mobilizing funds from the public sector.

Payroll Taxes to Fund Skills

A number of countries have implemented a form of payroll tax to facilitate the collection and administration of funds for the purpose of skills development. For payroll professionals, this form of funding affects them directly.

In the United Kingdom, an employer with an annual salary bill in excess of £3 million is liable for the payment of an Apprenticeship Levy, which came into effect on 6 April 2017. The levy is charged at a rate of 0.5% of the employer’s salary bill and is payable through PAYE. Each employer receives one annual allowance of £15,000 to offset against its levy payment. Employers that operate multiple payrolls will only be able to claim one allowance. In the U.K., the Institute for Apprenticeships is the body that ensures high-quality apprenticeship standards and advises government on funding for each standard.

Singapore has a Skills Development Levy (SDL), which is imposed by the Skills Development Levy Act. Employers are required to contribute 0.25% of the monthly remuneration of each employee, with a minimum payment of $2 (for an employee earning less than $800 a month), and a maximum of $11.25 (for an employee earning more than $4,500 a month). The funds are used by the Skills Development Fund (SDF) to support upgrading programmes operating within the workplace and to provide training grants to employers that send their employees on training under the national continuing education and training system.

As we have touched on already, Africa has by far the largest problem with youth unemployment. So, what is Africa doing to address this?

Spotlight on Initiatives in Africa

In Tanzania, the Tanzania Revenue Authority (TRA) collects an SDL imposed under the Vocation Education Training Act and the Income Tax Act. The levy is payable by any employer that employs four or more employees and is based on the gross emolument paid/due to an employee in respect of employment or services rendered. SDL is currently levied at 4.5%. The employer has an obligation to calculate the levy and make the payment to the tax region in which the employer is registered. The payment needs to be made on or before the seventh day of the month following the month of the payroll. There is a further requirement to remit a half-year certificate reconciling with the monthly returns submitted during the period.

Elsewhere, the introduction of a skills levy has been a recent event. In December 2016, the Zambian parliament delivered a budget that introduced an SDL payable by employers effective on 1 January 2017. The levy is collected by the Zambia Revenue Authority (ZRA) and paid into the Technical Education Vocational and Entrepreneurship Training Authority (TEVETA) Fund. The SDL Act requires each employer (with a few exceptions) to contribute a levy of 0.5% on the gross remuneration, as defined in the Zambian Income Tax Act of 1966 (ITA), payable or deemed to be payable to its employees. Casual employees and international assignees/expatriates are included in the definition of employees. The one exception is that payments made toward pension benefits are not included in gross remuneration. The payments and filings need to be completed monthly by the 10th of the month following the month in which SDL becomes due. There are penalties and interest for late return filing and payments.

South Africa

“In South Africa, high youth unemployment has been a persistent problem for decades—remaining stubbornly high at about 40% in 2018. While economic conditions in Africa are expected to gradually improve in the near term, this is clearly insufficient to absorb a fast-growing labour force. Against this backdrop, the creation of decent jobs for youth is the most crucial challenge in order to raise living standards in the continent” (“World Economic Situation and Prospects,” April 2019 Briefing, No. 125).

For some time, South Africa has taken a triple approach to the problem of skills shortages and youth unemployment. An SDL has been legislated under the SDL Act since the late 1990s. The levy is calculated on remuneration less certain SDL exclusions and allowable deductions. Currently, 1% of the leviable amount is payable by the employer to the South African Revenue Services (SARS), which administers the collection of the levies. Penalties are imposed if the calculation is not correct or if the payment is late. Only employers expecting to have an annual payroll bill of less than 500,000 Rand in the following 12 months as well as certain public benefit organisations are exempt from SDL.

The second approach to the high unemployment problems facing South Africa came with the introduction of the Employment Tax Incentive (ETI) Act in 2014. ETI is in essence a cost-sharing scheme with the government to create jobs for youth employment. An amount is calculated in accordance with a formula to determine a PAYE credit per “qualifying employee” per month. The qualifying employee must be a South African citizen (have a valid South African Identity document, Asylum Seeker permit, or an identity document issued in terms of the Refugee Act), be between the ages of 18 and 29, earn between R2,000 and R6,000 per month, and have been employed on or after 1 October 2013. SARS undertakes the administration of ETI.

The third approach does not operate via payroll, but is something that payroll professionals should be ensuring that their employers are aware of. Section 12H of the Income Tax Act grants an additional tax allowance in respect of recognised learnership agreements entered into by employers. This specific tax allowance was introduced as a further attempt to encourage skills development and job creation by assisting businesses to reduce training costs for employees and new entrants to the job market. The current allowances are in place until March 2022.

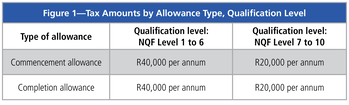

Figure 1 sets out the amounts available for the tax deduction.

Figure 1—Tax Amounts by Allowance Type, Qualification Level

Unemployment Issues in Other African Countries

Other countries in Africa are also tackling unemployment issues, and some of the ways are briefly outlined below:

- Gabon—A tax referred to as the “Professional Training Tax” (PTT) is payable on the gross monthly remuneration of each employee—subject to certain limits—at a rate of 0.5%. The PTT is levied monthly by the employer and paid to the authorities by the 15th day of the month following the salary payment.

- Malawi—The “Technical, Entrepreneurial and Vocational Education and Training” (TEVET) Act legislates a tax-deductible levy of 1% of the value of the basic payroll of non-governmental employers.

- Morocco—A payroll tax called the “professional training tax” is imposed on the gross monthly remuneration of employees, subject to social security contributions, at a rate of 1.6%.

- Tunisia—An employer is required to pay a professional training tax at a rate of 1% of gross salary in the manufacturing sector, and 2% for other activities.

- Nigeria—All employers with five or more employees or employers with fewer than five employees but with a minimum annual turnover of Naira (NGN) 50 million are required to contribute 1% of the annual payroll costs to the Industrial Training Fund (ITF). The amount is payable annually no later than 1 April of the year following the tax year. Employers can obtain a refund of up to 50% of training costs provided the training programme meets the requirements of the ITF’s reimbursement schemes.

- Algeria—Algeria has a “vocational training tax,” which requires companies employing more than 20 employees to contribute 1% of annual payroll for vocational training, and an additional tax of 1% of annual payroll for learning (apprenticeship).

Global Payroll Is the Mechanism for Change

It is evident from the information above and in recent amendments to legislation across the globe that governments are taking steps to address the high youth unemployment and skills shortages, specifically in Africa. Countries are starting to realize that payroll is often the mechanism to collect funds for these initiatives. Payroll professionals have an important role in ensuring that the correct application of the relevant legislation is being applied in payroll and that any changes in legislation are implemented into the payroll software in a timely matter to ensure ongoing compliance.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Sharon C. Tayfield is a Director in the Global Outsourcing division of BDO LLP (UK). BDO is a global accountancy and business advisory firm. Tayfield graduated with a Bachelor of Commerce majoring in Accounting, Taxation, and Managerial Accounts and Finance. She followed this with a post-graduate degree in Education. Tayfield went on to earn a degree in Advanced Property Practice in 1993. In 2001, she successfully earned a post-graduate degree in Financial Markets and Instruments. In 2014, she completed the CIPP (Certified Institute of Payroll Professionals) Payroll Technician Certificate. She is a registered member of CIPP in the U.K. and APA.