The State of Israel, an independent nation in Southwest Asia, is located between the eastern shores of the Mediterranean Sea and the head of the Gulf of Aqaba. Israel was established on 14 May 1948, as a Jewish state. Israel is considered the Holy Land for Christians, Jews, and Muslims. The official language of Israel is Hebrew, although English is used as a second language, and recently Russian has become commonplace.

Employee Data Input

The maintenance of processing the employees' data changes involves the following issues:

- Fixed data–incorporation hiring registration, incorporation termination registration, changes in employments, etc.

- Variable data–overtime, incentives, unpaid work, deductions, etc.

Changes in Fixed Details

Changes in employees' personal details, scope of work, employment details, etc., should be reported as soon as possible, usually before the monthly payroll is executed.

The following data should be transferred while hiring a new employee:

- Contract conditions between the employer and the employee, including salary, insurance, and funds, etc.

- Employee declaration regarding personal details (Form 101), to be filled out and signed by the employee prior to the first day of employment. The form will be updated and signed at the beginning of each calendar year and/or if any changes occur.

- Employer will verify that the employee fulfilled his/her bank details.

The employer must manage an accurate time and attendance system specifying each month as follows:

- The number of days each employee worked

- The number of vacation days each employee used

- The number of sick days each employee used

- The number of reserve duty days each employee served

- The number of hours each employee worked

- The number of days/hours of unpaid absence each employee took.

This data must be provided to the payroll provider in order to avoid disinformation on the pay slip.

The following data should be transferred when an employee retires from work:

- Which party chose to terminate the employment, since a period of advanced notification is required by the law from both parties. An employer can choose whether the employee will work during the "advanced notice" period or whether to compensate him/her financially for that period.

- The terms of the severance—according to the agreement made between the parties as part of the severance negotiation.

The payroll producer then executes the following procedures:

- Calculation of all balances (convalescence, vacation, etc.)

- Calculation of the compensation component

- Updating the insurance company

- Producing the "final settlement" pay slip

- Producing Form 161: employer's notification of employee's employment termination. The employee uses this form in order to receive the tax authority's approval for receiving the severance compensation funds from the insurance company. The employer must sign this form.

Changes in Variable Details

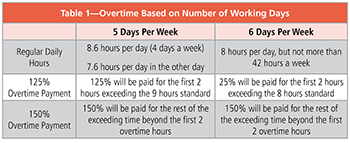

According to the law, for a monthly-based salary, overtime calculation is made by checking the daily hours and then the weekly hours. Overtime hours must first be approved by the employer.

According to the law, for a monthly-based salary, overtime calculation is made by checking the daily hours and then the weekly hours. Overtime hours must first be approved by the employer.

Overtime also depends on the number of working days a week the employee works, as specified by Table 1.

Bonus/MBO–These components are part of the agreement between an employer and an employee and can include the following:

- Permanent component—includes factors such as monthly commission, where the average yearly commission is calculated as part of the severance compensation payment.

- Shift hours:

- Daytime shifts–Payment is based on the regular hourly rate.

- Weekend shifts–Payment is based on the weekend hourly rate (calculated as 150% of the regular hourly rate).

- Night shifts (as of 23:00)–Payment is based on the hourly night rate (calculated as 150% of the regular hourly rate).

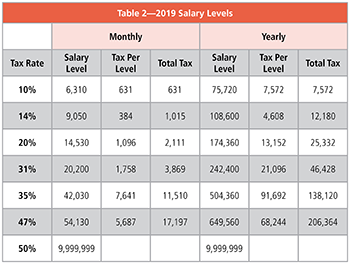

Salary Levels in Israel

There are different salary levels in Israel that are taxed differently (see Table 2).

The Israeli government wants to encourage growth in several locations in Israel. Due to the following, Israeli residents who live in those locations are entitled to an additional tax credit.

Imputed Value of an Automobile

Many employers provide vehicles to their employees. Since employees are using the vehicles 24/7, the tax authority determines "imputed value." This means that the conceptual salary of the employee is higher than his or her gross salary.

The tax authority publishes a separate tax table which defines the taxable benefit of each car in Israel.

Two (or More) Employers

Employees may work in more than one job at the same time. In order to tax them in advance, the tax authority determines that the employee will declare his or her "major job" (primary job).

The major job will be taxed according to the salary levels in Israel (see above). The secondary job will be taxed at a rate of 50% unless the employee receives withhold approval from the tax authority.

Types of Leave

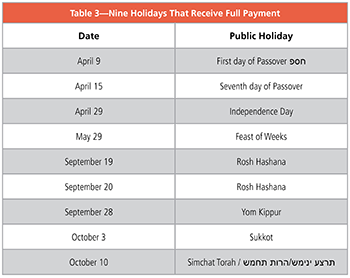

Holidays in Israel are defined by law, stating which dates are partial working days and which are non-working days. The following is a breakdown of holiday pay:

- Monthly Based Salary – employer will pay holidays as full work day

- Daily/Hourly Based Salary – employer will pay a full payment for nine specific holidays under two conditions (see Table 3):

- The employee has been employed for at least three months prior to the holiday.

- The employee has worked a day before and a day after the holiday (absences require the employer's consent).

The only non-working day in Israel that is not a holiday is Election Day. Employees who worked 14 consecutive days before the Election Day are entitled to full payment for this day.

Bereavement Leave

A grieving period of seven calendar days is fully paid when the following conditions are met:

- The employee has been employed for at least three months prior to the grieving period.

- The deceased relation to the employee is a parent, child, spouse, or sibling.

The Social Security Institute

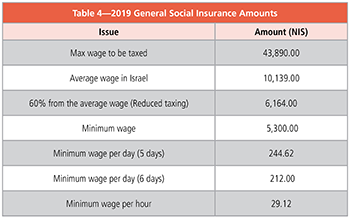

Israel’s social insurance include several general amounts (see Table 4).

Israel’s social insurance include several general amounts (see Table 4).

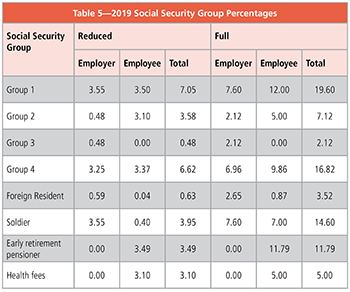

Israel has various social security groups that can be broken down as follows:

- Group 1—Israeli residents above 18 years old who haven't reached retirement

age yet

- Group 2—Men or women above "Eligibility Age" who do not receive a pension from the Social Security Institute

- Group 3—Israeli residents younger than 18 years of age

- Group 4—Men and women between "Retirement Age" and "Eligibility Age"

Table 5 shows the latest social security group percentages.

Employee Benefits

Israel’s Pension Law obligates employers to allocate the following:

- An amount of 6.00% (out of the basic salary) for compensation

- An amount of 6.50% (out of the basic salary) for pension

- In addition, the employee participates with his/her employer in the amount of 6.00% (out of the basic salary)

Many employers in Israel allocate amounts to "Manager's Insurance" (Bituach Menahalim) because it has better conditions than the Pension Law and substitutes for it. The employer allocates the following:

- An amount of 8.33% (out of the basic salary) for compensation

- An amount of 6.50% (out of the basic salary) for pension

- Usually, the employer will allocate an additional 2.5% (out of the basic salary) for a work disability case, but not more that 7.5% for both a pension and disability case

- In addition, the employee participates with his/her employer in the amount of 6.00% (out of the basic salary)

- In most Israeli IT companies, employers deposit to Manager's Insurance

- The employee can choose which insurance company he/she wants to work with

Many employers in Israel allocate amounts to “Study Funds” (Keren Hishtalmut). The employer allocates the following:

- An amount of 7.50% (out of the basic salary) to study funds

- In addition, the employee participates with his/her employer in the amount of 2.50% (out of the basic salary)

- The employee can draw study fund deposits only once every six years

- The earnings that is acquired in the funds is tax exempt

- In most Israeli IT companies, employers deposit to study funds

- The employee can choose which insurance company he/she wants to work with

- In a case of relevance to the teaching segment, a rate of 8.40% will occur; in addition, the employee participates with his/her employer in the amount of 4.20% (out of the basic salary)

- In a case of Controlling Shareholders, a rate of 4.50% will occur; in addition, the employee participates with his/her employer in the amount of 1.50% (out of the basic salary)

Employers' Duties

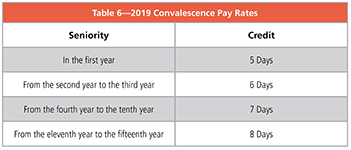

According to Israeli law, every employer must pay once a year (in July or in the August payroll) an amount for Convalescence Pay (Dmey Avraha) that reflects convalescence conditions according to Table 6.

According to Israeli law, every employer must pay once a year (in July or in the August payroll) an amount for Convalescence Pay (Dmey Avraha) that reflects convalescence conditions according to Table 6.

Between July 2018 and July 2019, an employer should pay NIS 378 for each day. The employer can choose either to give the employee more than the days mentioned or a higher amount than 378 NIS (the amount changes once a year according to the government decision). The employee will be able to get convalescence conditions only after seniority of one year (at least). The employer can choose how to pay convalescence. It can be paid every month (with the payroll) or once a year as mentioned.

Sickness Days

According to Israeli law, every employee can use 18 sick days per year, which will be paid, partially, by the employer. An employee can accumulate a maximum of 5 years of sickness days (90 days). The employer will pay for each sickness day according to the three month average salary of the employee (basic salary).

Every month, an employee can follow the accumulated sickness allocation in his/her payroll slip. The employer can choose to give the employee more than 18 sick days per year.

Payment is made as specified below:

- First day—no payment is due

- Second and third day—50% of the daily rate of the employee's salary is paid

- From the fourth day forward—100% of the daily rate of the employee's salary is paid

Special absences which are considered by law as sick days are: child sickness, parent sickness, spouse sickness, abortion, fertility treatment, pregnancy and delivery by a spouse.

The employee may use up to 8 sick days a year due to a child's sickness and up to 6 days a year due to a parent's sickness (providing that his/her spouse didn't use sick days as well). These sick days are part of the 18 days mentioned above and are not additional days.

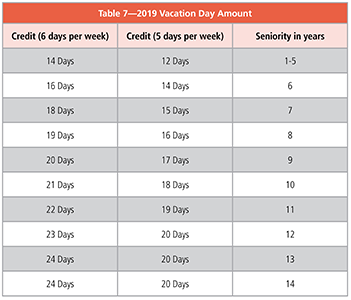

Vacation Days

According to Israeli law, every employee must use several vacation days per year as Table 7 shows.

The employer will pay a vacation day according to the last salary of the employee (basic salary). Every month, the employee can follow the accumulated vacation allocation in his/her payroll slip. The employer can choose to give the employee more than the days mentioned above.

Consider that tax is still withdrawn (from employees) and social security must be paid every month until the 15th of the following month.

Reserve Army

The Social Security Institute will refund employers that have employees serving in the IDF reserves. Accordingly, an employer will pay the monthly payroll to the employee and then will be credited by the Social Security Institute.

Maternity Leave

During maternity leave, payments to the employee are made by the national insurance.

The employer's obligations are as follows:

- Provision of authorization stating the period and payroll details of the employee for the period stated by the law – for claiming child birth allowance from national insurance.

- Continuation of all the social benefits the employee is entitled to (vacation, sick days, seniority, pension, etc.).

- Receiving the employee back to work when the maternity leave ends and maintaining her as an employee for at least 60 days as of the day of her return.

Termination of employment within this period is allowed only by the minister of labor's authorization.

The maternity leave period is 15 weeks, with an additional two more weeks per each additional child delivered at the same birth.

Additionally, a pregnant woman is entitled to take up to 6 weeks, of the total maternity leave she is entitled to, before the estimated date of birth.

Paternity Leave

An employee whose spouse gave birth may claim part of the maternity leave according to the following conditions:

- He may only use the second half (the first seven weeks after the delivery must be used by the women; the following weeks or part of them may be used by the man).

- The wife has given her consent in writing.

- His wife has worked during this period.

End of Year

Employers will submit Form 126 at the end of the year. The following form summarizes the payments during the year, taxes withheld, etc. This form must be filed to the tax authorities after comparisons are made to the monthly 102 reports. The form will be submitted by electronic file to the tax authorities around March-May of the following tax year.

Annual statements to employees (Form 106) are usually provided around March-April of the following tax year.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Matan Lazar, C.P.A. Co-CEO, M.A in business management (M.B.A) with specialization in finance, and B.A in business management, specialized in accountancy from the college of management. Matan is a licensed accountant at Lazar & Co and a member of the Institution of Certified Public Accountants in Israel (ICPAS).

Matan has worked for several years in the audit department for the Somekh-Chaikin international accountants firm (KPMG). Within his work in the firm, Matan has gathered the audit records of large public companies required to international financial reporting standards (IFRS) and the American generally excepted accounting principles (US GAAP). Matan was previously a controller at one of the large leasing companies in Israel. Currently, Matan keeps collaborating with the company, as an external advisor.