Culture in the western European nation of Belgium involves two aspects—that shared by all Belgians, and the differences between the Dutch-speaking Flemish and the French-speaking Walloons. While Belgians view their culture as an integral part of European culture, members of each of the two main linguistic groups generally make their cultural choices from within their own communities. Outside of those communities, the Flemish draw largely from English-speaking culture that dominates sciences, professional life, and most news media, and from the Netherlands on Belgium’s northern border. French-speakers are more likely to focus on cultural life in France, along its southwestern border, and elsewhere in the French-speaking world.

The Belgian labor law distinguishes between two types of employees: white collar workers who perform intellectual wok and blue collar workers who perform mostly manual work. An employment contract will be drawn up considering the differences between these two types of activities.

The employment contract in Belgium can be distinguished not only according to the type of work performed by the individual, but also according to its duration. Belgian law recognizes the following types of contracts:

- Open-term employment contract

- Fixed-term employment contract

- Temporary contract

- Replacement contract

- Employment contract for a specific type of work with determined or undetermined duration

Labor Standard Act or Employment Act

All labor-related acts are enforced by the Federal Public Service Employment, Labor and Social Dialogue.

Minimum Wage

The minimum wage is 1,562.59 EUR per month with wage payments being made monthly.

Working Hours

In Belgium, working time may not exceed eight hours a day. Moreover, daily work must in principle be performed between 6:00 a.m. and 8:00 p.m. because of the ban on night work (see below).

However, daily working time may be increased as follows:

- Nine hours if the worker does not work more than 5½ days a week (work schedule in which the worker, in addition to his or her weekly day of rest, has at least half a day's rest)

- Ten hours if the workers are absent from home for more than 14 hours a day because of the distance between the workplace and their place of residence or stay

Except for derogations (laid down by royal decree or collective agreement), the length of each work session cannot be less than three hours.

In Belgium, working time may not exceed 40 hours a week. In 2003, a law was created under which working time was generally reduced to 38 hours a week. Under this general reduction to 38 hours, the general rule is that the weekly work schedule that can be applied in undertakings is either 38 effective hours a week or 38 hours on average over a specified reference period.

Examples:

- Effective work for 40 hours a week with the allocation of 12 compensatory days of rest (over a one-year reference period);

- Effective work for 39 hours a week with allocation of six compensatory days of rest.

However, collective agreements concluded in joint committees in many sectors have reduced this level to 38 hours.

Overtime Pay

Overtime is generally allowed provided that the normal weekly working time is respected, on average, over a determined reference period (generally three months) if employees carrying out overtime are given compensatory time off.

As a rule, an employee cannot work for more than 11 hours per day and 50 hours per week. In principle, the number of hours performed over and above the average weekly working time cannot at any stage during the reference period (generally three months) exceed 78 hours (or 91 hours if the reference period is set at one year). If the applicable hour limit is exceeded, the employee must be given immediate compensatory time off. These limits can be increased to 130 hours or 143 hours following a specific collective negotiation process.

An employee who has worked overtime is generally entitled to compensatory paid time off to be taken within a certain period. In certain circumstances an employee will be entitled to overtime pay when he/she has worked overtime. Overtime pay is at least 50% more than the employee’s normal salary and is double their normal salary if the overtime was worked on a Sunday, on a public holiday, or on another legally granted day off.

Income Tax Filing

Income tax must be paid by all people who have settled in Belgium. Tax authorities calculate the amount of tax payable based on the annual income tax declaration. Employees can fill out and submit a tax declaration over a secure internet site “tax-on-web.” The amount of time spent living in Belgium will determine the amount of tax an employee must pay:

Income tax must be paid by all people who have settled in Belgium. Tax authorities calculate the amount of tax payable based on the annual income tax declaration. Employees can fill out and submit a tax declaration over a secure internet site “tax-on-web.” The amount of time spent living in Belgium will determine the amount of tax an employee must pay:

- Living in Belgium for at least six months in the tax year? The employee must pay tax on his or her worldwide income.

- Living in Belgium for less than six months in the tax year? The employee is not considered a tax resident and only pays tax on income earned in Belgium.

- Income from other EU countries? The employee must make sure he/she never pay tax twice on the same income.

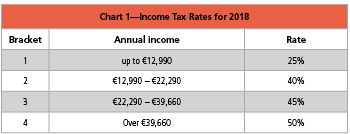

There are five tax brackets for income tax (see Chart 1).

Social Insurance Programs

The Belgian social security system is based on the payment of social contributions on the employee’s income from work. These social contributions serve to finance the social security system.

Each month, the employer pays a considerable amount on top of an employee’s salary into the social security fund. The employee also pays a proportion of his or her gross salary in social security contributions. This fund is then used to pay social security for the following items:

- Allowances in the event of sickness

- Unemployment benefits

- Allowances in the event of incapacity for work through sickness or invalidity

- Allowances in the event of accidents at work

- Allowances in the event of industrial disease

- Family allowances

- Pensions

Rates are charged on both employers and employees and for 2018 stand at 45.57% for employers and up to 13.07% for employees. Payments to social security are paid quarterly but in most cases a monthly advance of those payments is required. The United States and Belgium have a totalization agreement that helps protect employees who may work in both countries.

Time Off

Maternity/Paternity Leave—Parents who are employees in the Belgian system are each entitled to take parental leave of up to four months per child before that child turns 12 years old. If your child was born after 8 March 2012, this leave is paid for up to four months; before 8 March 2012, this leave is only paid for up to three months. Maternity and paternity leave are one and the same.

Annual Leave (Vacation)—The length of paid holiday will depend on the number of months during which an employee was paid in Belgium in the preceding year. An employee who worked a full calendar year on a full-time contract, for example, is entitled to four weeks’ legal holiday the following year.

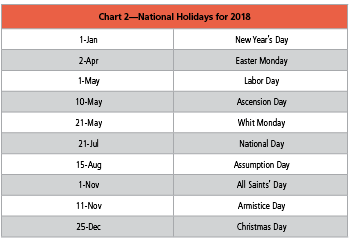

The legal minimum amount of holiday entitlement in Belgium for people working full-time is 20 days, but some companies offer extra holidays. If an employee is entitled to paid holiday leave, he or she will be paid their normal salary plus a complement of 92% of gross salary. Unpaid leave is possible if an employer agrees, but this has an impact on the employee’s social rights. Each year the Belgium government will put out the national holiday schedule (see Chart 2).

The legal minimum amount of holiday entitlement in Belgium for people working full-time is 20 days, but some companies offer extra holidays. If an employee is entitled to paid holiday leave, he or she will be paid their normal salary plus a complement of 92% of gross salary. Unpaid leave is possible if an employer agrees, but this has an impact on the employee’s social rights. Each year the Belgium government will put out the national holiday schedule (see Chart 2).

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Dee Byrd, CPP, PHR, SHRM-CP, is a Project Manager for PayTech, Inc., who has more than 25 years of global payroll management experience and has represented the payroll profession by speaking to the U.S. Congress in matters regarding multistate payroll taxation issues. She is an American Payroll Association (APA) Vice President, a member and past chair of the APA’s Electronic Payments Committee, part of the APA’s Payroll Cards Subcommittee of the Government Relations Task Force (GRTF), a member of the APA’s Global Issues Subcommittee of the Strategic Payroll Leadership Task Force (SPLTF), and a member of the APA’s Board of Contributing Writers. She was also the APA’s 2011 Payroll Woman of the Year.