Data accuracy, global compliance, and employee service are the basic tenets of a global payroll strategy. These are the three key challenges global payroll professionals are addressing. The more countries in which a company operates, the more monumental these challenges become. This is felt the most when companies rely on spreadsheets, manual workflows, and disparate systems (and vendors) for processing payroll.

As you read this, you are probably aware of the major shifts in how companies are approaching payroll on a global level. There are three clear trends that underpin this shift:

1. Companies Are Centralizing Key Payroll Processes—The strategy here is to consolidate vendors and systems, provide a globally consistent employee experience at the local level, and provide more holistic visibility into true workforce costs.

To embark on this journey of centralizing payroll, companies need to overcome two key barriers: data integrity and disparate systems (both processes and technologies). On a global scale, these are significant challenges that inevitably put the thought of transforming to rest before you even get started. Let’s face it, payroll needs to get done—and trying to lead a centralization effort would be akin to changing an engine on a passenger plane midflight.

2. Software as a Service (SaaS) or Cloud Technology Is Being Increasingly Embraced at a Global Level—WWe don’t have to look further than the last two or three annual American Payroll Association (APA) Annual Congresses to notice that virtually every payroll (and ancillary service) provider is promoting cloud solutions. Cloud solutions give companies a flexible delivery model, a reduced reliance on IT resources, and generate higher return on investment (ROI). In fact, research published in 2016 by Boston-based Nucleus Research, which studies various enterprise solution areas found that “cloud application projects deliver 2.1 times the ROI of on-premise solutions.” This is mainly attributed to the cloud’s lower initial and ongoing costs and its ability to deliver future benefits without the cost and disruption traditionally associated with upgrading, expanding, or customizing business applications.

3. Global Payroll Strategy Now Includes Time and Attendance Processes—A 2017 Ceridian study on the maturity of human resources technology found that only 5% of companies have fully integrated systems that require no manual intervention. The same study found that half of these companies reportedly found errors in their data from “sometimes” to “very often,” with organizations in the 5,000- to 10,000-employee size range reporting the highest percentage of “often” finding errors at 9.9%. In the gross-to-net process, the gross piece is one of the biggest challenges for companies, specifically time and attendance data. This is where most payroll professionals spend time and effort–ensuring time and attendance data is complete and accurate.

Today, global organizations are increasingly looking to integrate payroll and time solutions into a single application and one database. In addition to reducing the volume of manual workarounds required to ensure the accuracy and completeness of gross data, single applications allow for a better employee experience in which employees can see their timesheets, hours worked, and pay slips in one place, regardless of the country in which they live and work.

These trends are a result of companies aiming to transform their global payroll function into a strategic business partner. Research by Hackett Group showed that approximately 40% of top performers (defined as the top 10% in terms of maturity in the global payroll study) intend to move to the cloud over the next two to three years.

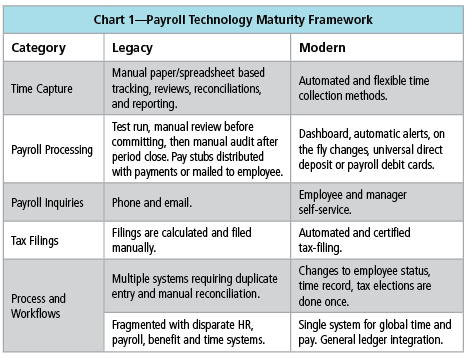

At a workshop conducted during the 2017 APA Annual Congress in Orlando, I shared the Payroll Technology Maturity Framework (see Chart 1). While most companies are somewhere in between the “Legacy” and “Modern” functions, the future state is to reach a utopian situation where global payroll teams are worrying less about how global payroll is done and more about the strategic value it adds to the business—specifically, better employee experience and access to key data.

Things to Look for When Evaluating Cloud Technology

The future of global payroll technology is cloudy. But navigating a noisy and crowded space especially in the dynamic, fast, and innovative SaaS landscape is challenging. What are the key questions to ask during due diligence? While selection processes may differ, at the end organizations require a solution that is suited for payroll (i.e., accurate and compliant), is easy for everyone else to use, and provides the necessary data and capabilities to drive positive business outcomes. If we agree with this statement, there are three things to consider when evaluating cloud solutions for global payroll:

1. Usability—Anyone who has been through a payroll technology implementation (or any enterprise-wide application implementation, for that matter) would attest that change management is one of the most critical elements to ensure a successful implementation and strong payback period. If employees and managers don’t (or can’t) use it, the tactical workload on the payroll team will increase exponentially. Furthermore, a cloud system with regular updates and enhancements allows vendors to constantly maintain a high level of consumer usability as they innovate their products. This usually comes at no cost to the client.

2. True Single Application—Whether systems are described as “integrated,” “unified,” or by some other term, this is where similar vendor messaging can confuse the landscape. Looking at the process from time gathering through to payroll close (as well as audits and reports), payroll is impacted by many pieces: clocks and timesheets, the pay calculation engine, taxation, benefits, disbursements, and reporting. When evaluating cloud payroll vendors, it is critical to partner with a vendor with a global workforce management application and a single view of the payroll process. Otherwise, when an error occurs, it is a challenge and a risk to identify the culprit. If the company has hourly workers across various countries, one workforce management rules engine for defining wage and hour rules, contract terms, overtime, holiday, etc. is necessary for data integrity and compliance. A single application would eliminate a layer of effort and risk of having separate systems for time and payroll. If the vendor uses in-country partners, it is important to ensure that the global aggregator is built within the single application allowing complete visibility into the process, and for the employee, it is vital to ensure a single user experience is maintained.

3. Experience and Expertise—Don’t forget about the tough stuff—i.e., compliance. This should be weighed heavily when evaluating vendors. A payroll system’s first priority is to enable you to improve accuracy and manage compliance. It is critical to work with a vendor that has a strong commitment to enabling compliance and providing peace of mind, offering solutions and services as a true partner.

As global payroll organizations seek to transform from tactical administration into strategic business enablement, they are looking for cloud technology to support their efforts. The goal is to ensure that the solution is built on a single database with a strong focus on the employee experience. Moreover, it is critical to partner with a vendor that “gets it” when it comes to your need to adapt to the ever-changing regulatory landscape.

Larry Dunivan is Chief Revenue Officer at Ceridian.