The Republic of Korea (ROK), commonly known as South Korea, lies in East Asia and forms the southern part of the Korean Peninsula. It shares a border with North Korea along the Korean Demilitarized Zone, while the Yellow Sea marks its western boundary and the Sea of Japan defines its eastern limit. South Korea asserts itself as the legitimate government of the entire peninsula and neighbouring islands. The nation's population is approximately 51.96 million, with around half residing in the Seoul Capital Area, ranking as the world's fourth most populous metropolitan region. Other significant urban centres include Incheon, Busan, and Daegu.

The Republic of Korea (ROK), commonly known as South Korea, lies in East Asia and forms the southern part of the Korean Peninsula. It shares a border with North Korea along the Korean Demilitarized Zone, while the Yellow Sea marks its western boundary and the Sea of Japan defines its eastern limit. South Korea asserts itself as the legitimate government of the entire peninsula and neighbouring islands. The nation's population is approximately 51.96 million, with around half residing in the Seoul Capital Area, ranking as the world's fourth most populous metropolitan region. Other significant urban centres include Incheon, Busan, and Daegu.

Since the 1960s, South Korea has made remarkable strides in economic growth and global integration, transforming into a high-tech industrialised economy. In 2006, it joined the prestigious trillion-dollar club of world economies. According to World Bank data from 2022, South Korea holds the position of the world's tenth-largest economy by GDP. The country's economic fundamentals remain robust, with its trade volume ranking ninth globally as of 2020.

South Korea's success was initially facilitated by a system of close government and business ties, incorporating directed credit and import restrictions. The government prioritised importing raw materials and technology over consumer goods, emphasising savings and investment rather than consumption.

Company Payroll Registration

A new company is required to apply for registrations within 15 days of the first month which allows the company to start paying monthly withholding payroll tax by the tenth day of the next month. A new company is subject to tax registration within 20 days after the start day of business to comply with all Korean tax laws, including withholding payroll tax.

Labor Code

The following information is covered by South Korea’s labor code:

- Employment contracts

- Wage protection

- Rest days

- Holidays with pay

- Paid annual leave

- Sickness allowance

- Maternity protection

- Statutory paternity

- Leave severance payment

- Long service payment

- Employment protection

- Termination of employment contract

- Protection against anti-union discrimination

Minimum Wage

In 2023, the minimum hourly wage is 9,620 KRW ($7.19 USD). *Note: The minimum wage for 2024 will increase by 2.5% to 9,860 KRW ($7.37 USD) per hour.

Working Hours

The workweek is eight hours per day, 40 hours per week. The workweek is from Monday to Friday. The general working hours for commercial offices are from 9:00 a.m. to 6:00 p.m. Some South Korean companies operate on Saturdays and expect employees to work either normal hours or an overtime rate of pay.

Overtime Pay

All hours exceeding the standard 40 hours are paid as overtime and are regulated by employment contracts or collective bargaining agreements. In general, overtime is paid at 150% of the standard salary rate, increasing to 200% for night work after 10:00 p.m.

There is a maximum number of 12 overtime hours per week. A maximum of 52 hours, including overtime, can be worked in a week. *Note: There are current reforms from March 2023 in place to allow for hours up to 69 hours a week that are currently being challenged and may be removed. The new reform has introduced a system that guarantees a rest period of 11 hours between each working day and allows these hours to be used consecutively with annual paid leave entitlements but would require an agreement between the employer and the employee.

Remote Work

In 2020, South Korea’s Ministry of Employment and Labor (MOEL) released a remote working manual for employers.

At the core of the manual is the fact that remote working or work-from-home arrangements are fundamentally based on an agreement between the employer and employee. Employers are within their rights to reject an employee’s request to work remotely.

Various behaviours may violate office or company regulations. For example, working at a cafe or shared workspace instead of at home can only be done with prior permission or a specific agreement with employers. By comparison, employers are prohibited from tracking remote employees without their consent.

Another issue covered by the MOEL’s remote working manual involves workplace accidents, which states that accidents sustained while working at home are considered occupational accidents. It makes sense for employers to establish minimum safety standards for their employees’ proposed work-from-home environments.

13th or 14th Month Wages

There are no provisions within the labour code for 13th or 14th-month payments. However, it is common to give performance-based or incentive bonuses. All bonuses are up to the discretion of the employer or stipulated in the employment agreement. All bonuses are subject to payroll tax.

Severance Pay

Employers must adopt a retirement benefit system. The default is the statutory severance pay system. Upon the termination of employment for any reason, including employee resignation, and the employee has been employed for at least one year, the employee is entitled to severance pay of 30 days’ average wages. For example, all wages generally include any bonus paid within the previous three months for each year of continuous service.

Taxes

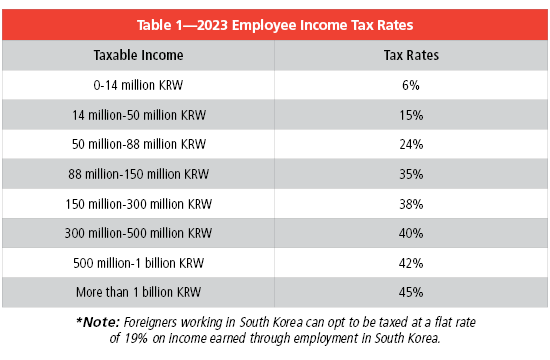

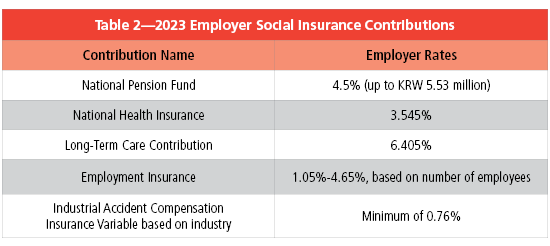

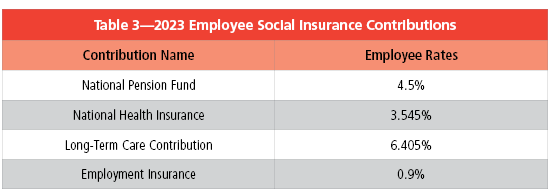

Employers in South Korea have withholding obligations for their employees. Those withholding obligations include income tax (see Table 1) and social security contributions (see Tables 2 and 3) covering pensions, unemployment, and medical care.

Withheld taxes must be reported to the tax authority by the 10th of the following month—and payroll reports must be kept for a minimum of five years. Businesses with less than 20 employees can report taxes twice a year if an arrangement is made with the tax authority.

Time Off

Annual Leave

The Labor Standards Act (1997) provides employees with minimum annual leave. Employees who complete a full year of employment are entitled to 15 days of annual paid leave.

Parental Leave

Parental leave is available to employees that have been employed with the same company for more than one year.

Maternity Leave

Employees are entitled to 90 days of paid maternity leave (or 120 days in the case of twins). It’s compulsory for mothers to take 45 consecutive days of leave after childbirth. Of the 90 days of maternity leave, at least 60 days (or 75 days in the case of twins) is paid by the company, with the remainder paid by the government.

Employees on maternity leave are considered “protected employees.” Employers cannot terminate an employee's contract on maternity leave or within the 30 days following the specified maternity leave.

Paternity Leave

The paternity leave entitlement is 10 days of paid leave. Of these 10 days, five days are paid by the company, with the other five being covered by Employment Insurance.

Sick Leave

Employers are not required to provide paid leave for non-work-related illnesses. Employees generally use their annual paid leave as personal sick days.

Bereavement and Compassionate Leave

Bereavement or compassionate leave is not covered by South Korean law. However, many companies offer congratulatory and condolence leave for weddings and funerals. Although these types of arrangements vary from company to company, these forms of leave are granted in addition to annual paid leave.

Holidays

There are 11 holidays per year (see Table 4).

Benefits

Healthcare

The National Health Insurance Act (1999) and the Occupational Safety and Health Act (1990) are both central to South Korea’s universal healthcare system.

Universal healthcare is funded through the National Health Insurance (NHI) scheme, to which both employers and employees make mandatory contributions.

Pensions

All employers and employees must contribute to the National Pension fund. The National Pension Act (1986) and the Guarantee of Employees’ Retirement Benefits Act (2005) set out minimum standards relating to retirement and pensions.

Employers must provide a retirement benefit to all employees who have worked for at least one year. Larger businesses may enroll their employees in corporate pension schemes; certain minimum retirement benefits may also be in the form of a corporate pension.

Disability

The Act on the Employment Promotion and Vocational Rehabilitation of Persons with Disabilities (2007) sets out certain provisions for individuals with disabilities. The Act's goal is to “facilitate and promote employment opportunities and the vocational rehabilitation of disabled persons so that they may be able to enjoy their lives with human dignity through vocational lives fit for their abilities.”

Unemployment

Unemployment insurance is funded through the contributions of employers and their employees. The contribution totals 1.8% of the monthly salary and is split equally between employer and employee (0.9% each).