Céad Míle Faílte! (A hundred thousand welcomes!)

Located in the North Atlantic and known as the “Land of a Thousand Welcomes,” the Republic of Ireland is a beautiful land full of myth, faith, and abiding humour. The Irish are renowned for their friendliness and hospitality, and foreign visitors and businesses are very welcome in the country. Be ready for copious cups of tea, lengthy conversations, and some good craic (fun) before you go.

While the Irish never take themselves too seriously, they hold very strong views and appreciate people and conversations that are well-informed and opinionated. In general, the people are highly educated, creative, and good at assessing situations for problem-solving and opportunities. Proud to be Irish, the community is quick to defend and protect their heritage and culture.

In recent years, Ireland has emerged as a major European business hub, particularly for technology and finance companies, which benefit from a very competitive corporate tax rate. This nation of approximately 4.8 million people had a GDP of $294 billion in 2016 with a projected 4% growth in 2017, putting it securely in the top 10 of countries with the highest GDP per capita. But any Irish person will tell you that this nation’s value lies not in its business capacity, but in the green of its fields and the hearts of its people.

In recent years, Ireland has emerged as a major European business hub, particularly for technology and finance companies, which benefit from a very competitive corporate tax rate. This nation of approximately 4.8 million people had a GDP of $294 billion in 2016 with a projected 4% growth in 2017, putting it securely in the top 10 of countries with the highest GDP per capita. But any Irish person will tell you that this nation’s value lies not in its business capacity, but in the green of its fields and the hearts of its people.

Employment Law

Employment law in Ireland is quite detailed and outlines specific responsibilities for employers, which all companies should understand and be sure to fulfil. It is the employer’s responsibility to ensure employees receive certain basic employment rights. There are several resources available for employers to help them know and meet their requirements, including the Workplace Relations Commission, the Irish Business and Employers Confederation (IBEC), the Irish Small and Medium Enterprises Association (ISME), and the Small Firms Association. Additionally, the Department of Employment Affairs and Social Protection maintains several Intreo offices, which offer employment and income support, and provide a range of useful services for employers.

A key distinction in Irish employment law is whether a worker is engaged through a contract of service or a contract for services. Individuals on a contract of service are employees and entitled to the full extent of protections under employment law. Workers on a contract for services are independent contractors, and while there are legal protections for those working relationships, they are not guaranteed the same rights as employees.

Employee Contracts

While it is not necessary to include every detail of an employment agreement in a written contract, employers are required by law to provide specific terms and conditions of employment in writing within two months of the start of employment. The Workplace Relations Commission provides guidance on the exact information required, which includes full names of the employer and employee, job title, compensation, hours of work, and notice requirements.

Because employment law in Ireland is precise and comprehensive, most employers use thorough employment contracts that specify all terms governed by the law. These terms are generally agreed to ahead of time, with the contract serving to formalize the employment. Probationary periods are common and generally six months with an option to extend to a maximum of one year from the employment start date.

Minimum Wage

In January 2018, the national minimum wage for experienced adult workers rose to €9.55 per hour. It is important to note the handful of exceptions to the national minimum wage, which include workers under the age of 18 and those who have less than two years of employment of any kind, as well as individuals employed by a close family member and those in statutory apprenticeships.

Working Hours

The average work week in Ireland is 39 hours, with typical office hours from 9:00 a.m. to 5:30 p.m. with an hour taken for lunch, generally between noon and 2:00 p.m. Some offices, including government departments, banks, and post offices, will close for an hour at that time to accommodate employee lunch breaks. The maximum average working week may not exceed 48 hours, calculated as a four-month average.

While the Irish are extremely dedicated and talented workers, they value their personal and family lives a great deal and are unlikely to work late nights or weekends if a task can wait until the next business day. Rest periods are stipulated by EU directives, which allow for at least 11 hours of continuous rest in every 24-hour period and at least 24 hours of continuous rest every week.

Overtime Pay

Overtime is considered any work done outside of normal working hours. While there is no statutory obligation for employers to compensate employees for overtime work, workers may negotiate additional compensation ahead of time with their employer. Any expectations around overtime work and compensation should be agreed to beforehand and documented in the employment contract.

In general, work performed on a Sunday receives a premium; however, there is no specific guideline for type or amount of compensation. Under the Organisation of Working Time Act, in the absence of pre-agreed terms, employers must give employees one or more of the following to compensate for Sunday work: a reasonable allowance, a reasonable pay increase, or reasonable paid time off from work.

National Holidays

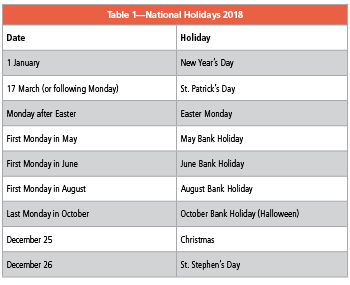

Employees in Ireland benefit from nine national or public holidays, on which most companies and services are closed for business (see Table 1). Additionally, many businesses recognize Good Friday with either a paid day off or reduced working hours. If a fixed-date holiday such as Christmas or St. Stephen’s Day falls on a weekend, the holiday is typically celebrated the following Monday. However, this is not law, and an employer may elect instead to give employees a different paid day off in the same month, an extra day of annual leave, or an extra day’s pay.

Employees in Ireland benefit from nine national or public holidays, on which most companies and services are closed for business (see Table 1). Additionally, many businesses recognize Good Friday with either a paid day off or reduced working hours. If a fixed-date holiday such as Christmas or St. Stephen’s Day falls on a weekend, the holiday is typically celebrated the following Monday. However, this is not law, and an employer may elect instead to give employees a different paid day off in the same month, an extra day of annual leave, or an extra day’s pay.

When traveling to or doing business in Ireland, it’s good to keep in mind that Sunday is widely considered a day of rest. Particularly outside of Dublin and major cities, it’s not unusual for local shops and even petrol stations to be closed on Sundays. However, you’ll find the pubs open.

Income Tax

Employers deduct tax on income earned from employment directly from employees’ salaries through the Pay As You Earn (PAYE) system, which employees can access online through the Revenue website. The amount of tax owed depends on the employee’s salary amount and personal circumstances, with a range of income tax reliefs available to offset the tax liability.

Employers deduct tax on income earned from employment directly from employees’ salaries through the Pay As You Earn (PAYE) system, which employees can access online through the Revenue website. The amount of tax owed depends on the employee’s salary amount and personal circumstances, with a range of income tax reliefs available to offset the tax liability.

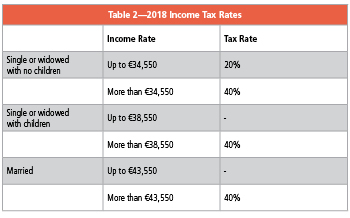

Tax bands are set from year to year, and the income amounts liable for the standard tax rate of 20% were raised in 2018 to what is listed in Table 2. There are several tax credits and reliefs that may offset employees’ tax liabilities, which they may apply for through Revenue.

Social Insurance

The Universal Social Charge (USC) replaced the income levy and health contribution in 2011, and is owed by all employees making more than €13,000 annually. The USC is payable on gross income and is deducted from salaries on a weekly or monthly basis through the PAYE system. Most employees also make automatic contributions to the Social Insurance Fund, known as PRSI. The amounts owed vary by class of insurance and are deducted automatically through PAYE. These contributions generally determine the eligibility of employees and their family members for many insurance benefits, including unemployment assistance.

Health Care

Ireland has an extensive system of health services that are generally available to all residents, including general practitioners (GPs), hospital services, accident and emergency services (A&E), maternity care, and others. Most residents can access required care for a small fee, and certain people may access free health services by qualifying for a medical card from the Health Service Executive (HSE). Additionally, Ireland provides free health care for all registered children under the age of 6 with a special under-6 medical card.

There are also several providers of voluntary private health insurance in Ireland, as regulated by the Health Insurance Authority. Individuals may purchase private insurance on their own, or employers may offer an optional subsidized insurance scheme to their employees. Private insurance can be used to pay for private care in hospitals and certain health professionals, which can be an attractive option depending on individual circumstances.

Pension Scheme

Irish residents receive State Pension payments once they reach the age of 66, provided they contributed sufficiently to social insurance. A number of changes were made to the State pension scheme for 2018, including the introduction of the Total Contributions Approach (TCA) to calculating pensions as well as a new Homecaring Credit, which provides credited contributions for up to 20 years for workers who spent time out of the workforce while raising children or in caring roles.

Time Off

Entitlements around paid leave are clearly stipulated in Irish law, although employers are allowed to alter some provisions with the employees’ expressed agreement. However, the allowances provided under law supersede any agreements made to provide the employee with less leave, regardless of whether the employee agreed to the terms. For example, even if a male employee agreed to and signed a contract that specified no paternity leave, he is still entitled to the paternity leave provided under employment law.

Full-time employees are entitled to four weeks of paid annual leave every year, although a greater allowance may be negotiated and detailed in the employment contract. The employer may decide when annual leave is to be taken, but must take into account the needs and opportunities of the employee. It is up to the employer whether employees can carry over annual leave to the following year, although doing so would be uncommon in Ireland.

Maternity Leave

All female employees, regardless of the duration of employment or hours worked per week, are entitled to the basic period of maternity leave, which provides for 26 weeks of leave along with an additional 16 weeks of unpaid leave. As with paternity leave, employees are not guaranteed compensation during their leave, but they may qualify for the Maternity Benefit for the 26 weeks. The additional 16 weeks are not eligible for the Maternity Benefit. Employers may elect to provide some level of pay during maternity leave, which should be explained in the employment contract.

Similarly, adoptive mothers are entitled to 24 weeks of Adoptive Leave, with an additional 16 weeks of unpaid leave. They may qualify for the Adoptive Benefit from the Department of Social Protection during the 24 weeks. If a male worker is the sole adoptive parent, he is entitled to take Adoptive Leave and apply for the Adoptive Benefit.

Paternity Leave

New parents other than the mother of a child are entitled to two weeks of paternity leave anytime within the first six months after the birth or adoption of a child. Employees are not guaranteed pay during their paternity leave, although they may qualify for the Paternity Benefit from the Department of Social Protection, and many employers provide for some level of compensation during that time.

Other Allowances

Additional leave entitlements for employees include Carer’s Leave for 13-104 weeks, for which an employee may qualify for the Carer’s Benefit or the Carer’s Allowance, and Parental Leave of up to 18 weeks to care for qualifying children. Additionally, employers may make accommodations for sick leave and pay, but it is up to the employer and terms should be clearly addressed in the employment contract.

Paul Bartlett is the CEO of CloudPay, a managed global payroll and payments solution for multinational organizations. A global business expert, Bartlett has deep experience helping companies improve the efficiency and scalability of their operations using technology and services. As CloudPay’s CEO, Bartlett spearheads corporate innovation and product development initiatives focused on automating client workflows and minimizing manual practices. Throughout his career, Bartlett has helped organizations address strategic and operational challenges as they navigated different growth phases and scaled their operations. In addition to CloudPay, Bartlett has served as a partner of Rho Ventures since 2007, focusing on investments in SaaS, software-related services, and new media.