Located in southeastern Europe, Greece consists of nine geographic regions: Macedonia, Central Greece, the Peloponnese, Thessaly, Epirus, the Aegean Islands, including Dodecanese and Cyclades, Thrace, Crete, and the Ionian Islands. It is considered the “cradle of Western civilization” since it is “the birthplace of democracy, Western philosophy, the Olympic games, Western literature, historiography, political science, major scientific and mathematical principles, and Western drama.”

According to World Bank statistics from 2013, Greece’s economy is the 43rd largest by GPD at US $242 billion, and is the 15th largest economy in the European Union.

Applicable Laws

Each year, the Greek government, in collaboration with the syndicate unions, announces special wage tables for each working position. These tables, which take into account factors such as the employees’ prior working experience, marital status, and certified knowledge, estimate the minimum legal salary that should be paid by employers. Any amount over the lowest legal one can be agreed on between the employer and the employee.

Due to the economic crisis, many of the collective agreements have been terminated or not renewed. The general non-salary-related rules of those not renewed or terminated continue to apply, but the ones concerning salary compensation do not. The National General Collective Agreement states the minimum salary all employers must pay.

Throughout the year, 12 salaries are calculated, one for each month. In addition, three more benefits are provided:

- During the Christmas period (paid until December 21 and in value almost equal to a monthly salary)

- During the Easter period (payable until Holy Wednesday and in value equal to half a salary)

- When the employee is on his or her annual paid leave (financially equal to half a salary as well)

All salaries and benefits are subject to social insurance and tax deductions.

Social Insurance Foundation

Greece has numerous social insurance foundations. Each one is responsible for a different working specialty. Every employer and employee needs to be registered in the equivalent social insurance foundation according to the employer’s activities and the employee’s working position.

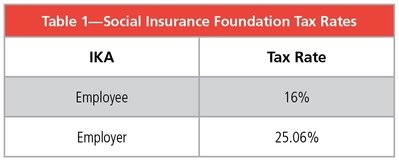

The most common social insurance foundation is IKA (Social Insurance Foundation). Its deductions are calculated on the gross salaries as seen in Table 1.

These percentages apply when both pension and health deductions are covered by IKA.

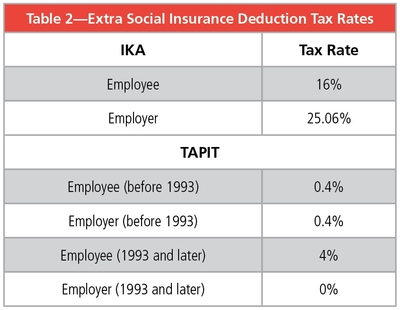

In cases when extra social insurance deductions are required, such as TEAYEK—social insurance foundation regarding employees working in stores—the percentages differ as seen in Table 2.

All percentages are calculated on the gross salary with a pre-set limit of deductions. All percentages are calculated on the gross salary as long as the salary doesn’t exceed the amount of €5,860.80 per month.

In case of a salary of €6,000.00 per month, for example, the social insurance deductions will be calculated on the ceiling amount of €5,860.80.

The employer is obligated to pay all calculated social insurance deductions to the respective foundation at the end of the following month. In case of delinquency, the payable amount is surcharged at 3% for the first month and 1% for every additional month.

In addition, the employer is obligated to submit a statement with the employees’ complete personal, working, and financial data at the end of the following month for the trimester at hand. If the deadline is not met, the employer is fined 10% for the first month of delay and 30% for every additional month of delay. All percentages are calculated on the trimester’s total social insurance deductions.

Tax Deductions

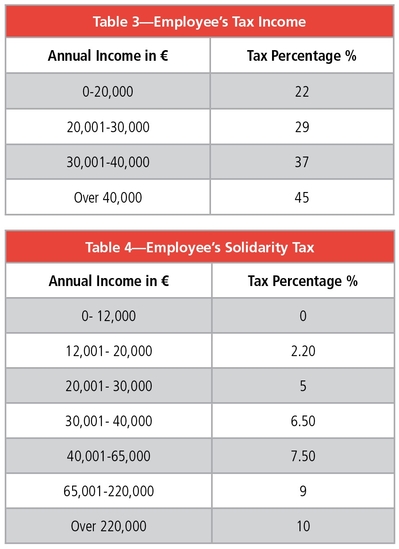

Employees’ salaries are subject to tax deductions. The percentage used to calculate the tax deduction varies according to the employee’s estimated annual income. See Tables 3 and 4.

Every second month, the employer is obligated to pay the amount of taxes withheld from the employees’ salaries until that time by submitting the appropriate statement. Furthermore, the employer has to submit an annual statement with the total financial data for the year.

Employment Procedure

For an employment relationship to be established, the employer has to be legally registered to the appropriate social insurance foundation. Once this is done, a hiring document is completed with the employee’s personal information such as full name, IRS number, education level, etc., and working information (such as working position and employer data). Both employer and employee sign the document, which must be submitted to the authorities on the same day.

For an employment relationship to be established, the employer has to be legally registered to the appropriate social insurance foundation. Once this is done, a hiring document is completed with the employee’s personal information such as full name, IRS number, education level, etc., and working information (such as working position and employer data). Both employer and employee sign the document, which must be submitted to the authorities on the same day.

Besides the hiring documents, an employment agreement document also must be completed and signed by both parties. The agreement’s content can vary. Typically, the agreement states the nature of the employee’s position, the way he or she will be paid, the working hours, as well as the period of employment. The period of employment could be infinite or defined as a time period of one month to a year. In addition, the working hours can be agreed on as long as they don’t exceed eight hours per day and 40 hours per week.

After each hire,

the employer has to submit a personnel chart containing the new employee’s working and personal data on the day of the hiring. This chart is submitted to the relevant authority. The same personnel chart is also submitted once every year with all the employee’s data.

Protection of Employment

Holidays—Each employee is entitled to two days of annual paid leave for every month of service. The pre-mentioned method applies for the first two years of employment (a limit of 20 days for the first year, and a limit of 21 days for the second year) of employment. From the first day of the third year, the employee has the right to 22 days of paid leave. Once the employee completes 10 years of service for the same employer or 12 years’ experience overall, he or she is entitled to 25 days of paid leave. See Table 5 for a list of holidays.

Illness—In case of an absence because of illness, the employee has to visit a doctor approved by the Social Insurance Institute so that a formal document can be issued stating the days the employee requires to recover. The employer covers half the amount of the salary and the insurance of the first three days of recovery. For any additional day, the employee will get a portion of his salary from the Social Insurance Institution and the remainder from his employer.

Maternity—A mother-to-be has the right to 56 days of leave before the estimated date of the birth and 63 days of leave after it. The employer has to cover the salary as well as the insurance of the employee for the first 30 days of leave. The Social Insurance Institution covers the remaining days. The mother also has the right to a six-month leave after the end of the 63 days. During that time, her compensation and insurance are only covered by the state. A new mother cannot be laid off for at least 18 months after she has given birth. Furthermore, when she returns to her working duties, she has the right to a reduced shift. Specifically, she can work an hour less each day for 2 ½ years or—if the employer agrees—two hours less a day for a year and an hour less for half a year.

Payroll Calculation Procedure

Each month, the employees’ working days are counted in order for the payroll to be calculated. Then, all social insurance and tax deductions are calculated. After the payroll procedure is completed, several obligatory reports must be printed: a payroll chart (a list of all the employees and their calculated payrolls, Social Insurance Funds chart) and pay slip.

Termination of Employment

When an indefinite duration agreement is signed between the employer and the employee, the employer has the right to terminate the employment at any time. The employee is notified of the dismissal, and an employment termination document is signed by both parties. The document must be submitted to the competent authority within eight calendar days. In case of an employment termination, the employer is obliged to pay the employee a compensation fee, unless the employment period is less than a year. In case of a defined duration agreement, the employer does not have the right to end the employment. The only way to lay off the employee is by compensating for the full agreed salary up to the end of the agreed time of employment.

When a defined duration agreement comes to an end, the employee is obliged to leave without any additional compensation. If the defined duration agreement comes to an end and the employer wishes to keep the employee, then the agreement is automatically altered to one of indefinite duration of employment