Costa Rica (meaning “rich coast”), officially the Republic of Costa Rica, is in Central America. It is bordered by Nicaragua to the north, Panama to the southeast, the Pacific Ocean to the west, the Caribbean Sea to the east, and Ecuador to the south. It has a population of about 5 million, of which nearly a quarter live in the capital and largest city of San Jose.

Costa Rica has pristine rainforests that are protected, as is evident from the abundance of plants and animals found there.

The tropical climate is year round and the seasons are defined by how much rain falls during a particular period. The “dry” season (December to April) is known to the residents as summer, and the “rainy” season (May to November) is known as winter.

Costa Rica is called the “Silicon Valley of Latin America” and has attracted commercial giants such as Microsoft, GE, Abbot Labouratories, Continental Airways, and Intel Corporation. Costa Rica's economy has transformed over the past decade, moving away from its longtime dependence on agriculture to one based on technology and tourism.

Labour Laws

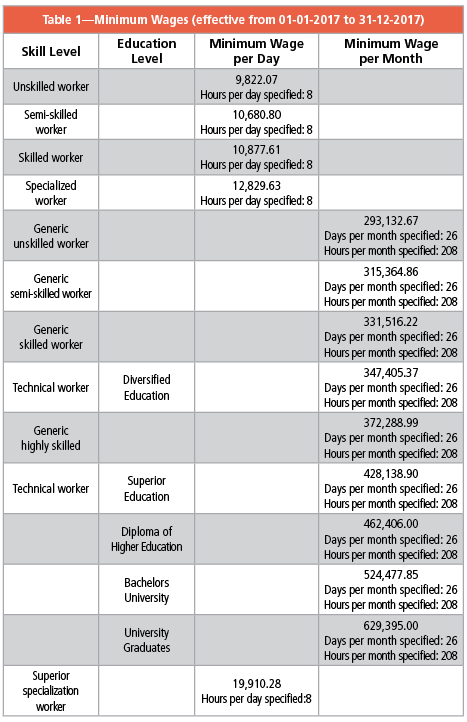

The Ministerio de Trabajo Y Seguridad Social (MTSS) or the Costa Rican Ministry of Labour and Social Security determines minimum daily salaries for almost every profession (see Table 1).

These become part of the Labour Standard Act or Employment Act. Law No. 832 gives the National Wages Council the power to determine specific minimum wages across the country for occupational lines. The fixed component of minimum wage is established twice a year, in January and at mid-year (July or August).

Working Hours: According to Article 136 of the Costa Rica Labour Code (CRLC), effective working hours shall not exceed eight hours in a day and 48 hours a week. However, if the work is not unhealthy or dangerous, a company may stipulate an ordinary workday of 10 hours, provided that the workweek does not exceed 48 hours.

The CRLC stipulates three shifts:

- Day shift—work performed between 05:00 and 19:00

- Night shift—work performed between 19:00 and 05:00

- Mixed shift—work that includes periods of time comprising both day shift and night shift

Overtime Pay: Overtime cannot exceed four hours per day for a total of 12 working hours per day.

Time worked over the CRLC limits is considered “extraordinary” and is paid at an additional 50% of the regular salary.

Additionally, six hours of night shift work should be paid an equivalent to eight hours of a day shift.

Managerial positions or work that by its nature cannot be done during regular hours (e.g., agents and employees who work on commission) are excluded from the maximum hour limitations, but still cannot be required to work more than 12 hours a day.

Employment Contracts: The CRLC, Articles 18-42, defines the employment contract. The contract is legally binding on both the employer and employee. There are specific provisions for the contract relating to certain professions (e.g., farm work, the employer is obligated to pay the market rate, etc.). Three copies of the contract are required to be submitted within 15 days. One copy is for the employer, one copy is for the employee, and one copy is provided to the Employment Bureau of the Ministry of Labour and Social Security.

The written contract must contain:

- Name, nationality, age, sex, and marital status of the employee

- Address of both parties

- Number and details of identity cards

- Precise descriptions in case the employee has a temporary residence

- Duration and nature of the employment contract with remuneration decided and payment details

- Working hours and overtime agreements

- Workplace

- Any other provisions including remuneration for services, notice periods, date and place the contract is signed with a legal witness to the signing

The CRLC does recognize verbal employment contracts in certain instances (e.g., work relating to crops, domestic services, temporary work lasting for not more than 90 days). In the instance of temporary work, the employer must issue a written document stating the work to be done and must pay the worker every 30 days.

Severance pay: If an employee is fired without cause and has worked at least three months, the employer has to pay a severance payment. The amount is based on time worked and could be up to 22 days per year worked with a cap of eight years. The CRLC has a specific calculation table to determine the total amount due the employee.

Income Tax Filing

Income Taxes: The employer acts as a withholding agent for its employees. The withholding rate ranges from 0% to 15% of gross wages, and tax is paid to the tax authorities (Ministry of Finances’ Unified Tax Registry) on a monthly basis.

Payment Due Dates: Monthly

Social Insurance Programs: The employer must contribute 26.33% of the gross wages paid to its employees, and the employees contribute 9.34%. Employer-paid Workers’ Compensation Insurance is 1.5% - 4% of gross salaries.

Health Insurance: All employers are mandated to register every employee with the Social Security Administration (CCSS), which manages the health system along with the Ministry of Health. Employer contributions usually amount to 34.5% of salary, and the employee contribution is 9.7% of salary.

Time Off

Christmas Bonus: Every worker in Costa Rica has the legal right to receive an additional month of wages paid by the employer as a year-end Christmas bonus unconditionally. The bonus must be paid by the employer between December 1-20. The bonus is prorated if the employee works less than a year.

Holiday: See Table 2 for a list of Costa Rica’s national holidays. An employee who is required to work on a legal holiday must be paid double wages.

Annual Leave (Vacation): Workers are entitled to a minimum of two weeks’ paid vacation for each 50 weeks of continuous employment with the same employer. The wages to be paid to the employee during vacation must be based on the average weekly wage earned during the previous 50 weeks of employment.

The CRLC does not allow accumulated vacation time, and only under special circumstances will the law allow breaking the vacation into a maximum of two separate vacations.

The employer can decide the best time for an employee to take the mandatory vacation time.

Sick Leave: An employee who is on sick leave receives at least 50% of his/her salary for the first three days. From the fourth day on, the CCSS pays 60% of the salary if the employee has a medical certificate issued by a CCSS doctor. The employer is not required to pay salary after the third day except for maternity leave.

Maternity Leave: The employer must allow for one month of maternity leave prior to birth and three months after birth, paying 50% of salary for three months. The CCSS pays the other 50%.

Kristine Willson, CPP, is a Consultant with kww Consulting. She received the American Payroll Association’s Meritorious Service Award in 2007 and its Special Recognition Award in 2010.

Kristine Willson, CPP, is a Consultant with kww Consulting. She received the American Payroll Association’s Meritorious Service Award in 2007 and its Special Recognition Award in 2010.

Web Resources

Ministry of Labor and Social Security

http://www.mtss.go.cr/

Deloitte International Tax Costa Rican Highlights

https://www2.deloitte.com

Wage Indicator

http://www.wageindicator.org/main