Croatia declared its independence from Yugoslavia in 1991 and is a member of NATO and the European Union (EU). The Republic of Croatia is located in Southeastern Europe, bordering the Adriatic Sea between Bosnia and Herzegovina and Slovenia. The country of 4.3 million people is rebounding from an economic slowdown in 2008 and still faces challenges of high unemployment and a difficult investment climate. National leaders simplified the tax code in 2016 to stimulate domestic growth and foreign investment.

Croatia declared its independence from Yugoslavia in 1991 and is a member of NATO and the European Union (EU). The Republic of Croatia is located in Southeastern Europe, bordering the Adriatic Sea between Bosnia and Herzegovina and Slovenia. The country of 4.3 million people is rebounding from an economic slowdown in 2008 and still faces challenges of high unemployment and a difficult investment climate. National leaders simplified the tax code in 2016 to stimulate domestic growth and foreign investment.

Applicable Laws

The main laws that regulate employment in the Republic of Croatia include labour acts, wage directives, social security acts, and employment protection acts. Employers, employees, and trade unions can stipulate working conditions more favourable to employees than the ones prescribed by the Croatian labour acts as well as less favourable if authorised to do so.

Labour wages in Croatia are regulated by laws, collective contracts, individual contracts, and internal company bylaws. The minimum wage is determined annually by government regulation for each year and it increases in parallel with the real GDP growth from the previous year. For the period of 1 January-31 December 2019, minimum gross wage is set at about 3,750 HRK (EUR 505).

Social Insurance Foundation

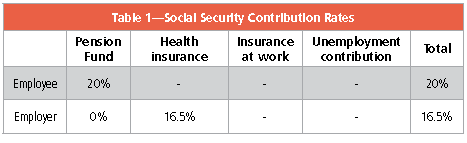

Social security contributions payable by the employee are subject to a ceiling defined by law.

- Employer: 16.5% calculated and paid on top of the gross salary

- Employee: 20% calculated and deducted from the gross salary

Pension fund contributions are paid in two pillars. The first pillar is 15% and is based on generation solidartity, meaning current retirements are paid out from these funds. The second is 5% and is personal for each employee.

The first pillar contribution calculation has a maximum annual base, and for 2019, this is HRK 608,256.

If an employee exceeds this base during the year, only 5% for the second pillar is calculated.

Personal Income Tax

Taxable income is gross salary deducted for 20% pension contributions. Taxable base is the difference between taxable income and tax relief of each employee (personal allowance).

Minimum personal allowance (nontaxable part of income) amounts to HRK 3,800.

This can vary from employee to employee, since it increases based on dependent family members.

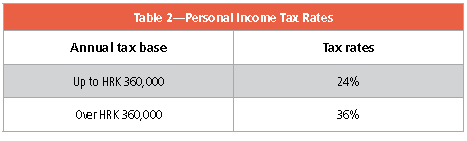

The tax scale by which the individual income is taxed as indicated in Table 2.

Calculated income tax is the base for the additional city surtax, which varies depending on the employee's city of residence from 0 to 18%.

Illness: Each employee has the right to sick leave for the whole period of sickness until a medical doctor confirms that they are able to return to working duties, or until the Pension Committee declares a permanent lack of ability for work.

During sick leave, the employer is liable to compensate the employee with salary for the first 42 days of illness. From the 43rd day onward, the employee is compensated by the Croatian Health Insurance Fund for at least 70% of their average salary for the past six months. Special cases apply where the Health Fund can cover 100% of the employee’s salary.

Maternity: The employer cannot refuse to hire a pregnant woman or terminate her employment contract due to her pregnancy. Furthermore, information regarding the employee’s pregnancy is strictly confidential and the employer is not allowed to inquire.

The employee is entitled to maternity leave from 28 to 45 days prior to birth, depending on the circumstances, until six months after the birth of a child and an additional six months of parental leave. Parental leave can be extended to 30 months depending on the number of children. The parental leave can be given to either of the two parents. During maternity and parental leave, the employees are compensated by the Croatian Fund for Health Insurance according to the employee’s average salary during the past six months for the maternity leave and according to a limit set by the state for the parental leave (approximately €350).

Termination of Employment

An employment contract ends in the following cases:

• Upon death of the employee

• Upon death, or upon liquidation or bankruptcy of the employer

• Expiration of a fixed-duration contract

• When the employee has reached age 65 or completed 15 years of social insurance contributions

• Upon mutual agreement

• Upon a legally effective decision due to inability to work

• By cancellation

• By court decision when authorised

When terminating an employment contract, the employer must prepare a notice of dismissal in writing, give reasons for the dismissal also in writing, and serve the employee with the notice.

In cases of regular notice, the notice period lasts between two weeks and three months depending on the time the employee has worked continuously for the same employer. The notice period starts running on the day the notice is served and cannot run during pregnancy, maternity, parental and adoption leave, or work with shortened hours. On termination, the employee is entitled to all statutory compensation regarding salaries, unused paid leave days, etc.

Payroll Calculation Procedure

Monthly payroll calculation depends on the number of days or hours the employee has worked during the relevant month. The gross salary is calculated, and then all statutory contributions regarding wage tax and social security are calculated and deducted. The net salary is paid to the employee, while the deductions are forwarded to the relevant authorities.

Employment Procedure

When employing personnel, the employer must keep records of its employees and, upon request from a Labour Inspector, must present the records. At the commencement of the employment, an employment contract must be completed in writing. Employment contracts can be either of definite or indefinite duration. An employment contract must include these essential elements:

- Contracting parties and their permanent residence

- The place and nature of work

- Date of commencement and termination in case of a definite duration contract

- Duration of paid annual leave

- Basic salary

- Working hours

- Notices

An employment contract can be completed for a full-time or part-time working arrangement. The statutory full-time working hours cannot exceed 40 hours per week. A time schedule can be arranged differently, whereby an employee can work more than 40 hours per week some weeks and less than 40 in others. Such a schedule is not considered as overtime work provided that certain legal requirements are met. Overtime work is possible in specific cases. Overtime work cannot exceed 180 hours per year or 50 hours per week, while a collective agreement can allow 250 hours of overtime yearly. Minors are prohibited from working overtime.

Protection of Employment

Annual Leave: Each employee who has worked for at least six months with the same employer has the right to a paid annual leave of at least four weeks for each calendar year. Leave days over the aforementioned limit must be stipulated in the employment contract or by a collective agreement. Employees with less than six months of service with the employer are entitled to a proportion of the annual leave equal to 1/12 of the annual leave for each full month of work. Holidays, non-working days, and days of sick leave cannot be calculated as annual paid leave. An employee has the right to take annual leave in two parts unless otherwise agreed upon by the employer or stated in the employment contract. In such cases, the first part of the annual leave must last at least two weeks.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Afrodita Taci ([email protected]) leads the Eurofast Global tax and accounting department in Croatia. With more than eight years of experience in managing and advising multinational companies, Taci successfully leads the team of accountants and tax advisors. Taci has engaged with and managed complex set-ups for many multinational companies in Croatia, including detailed tax planning.