The Federal Democratic Republic of Ethiopia is in the northeast region of the African continent, which is commonly referred to as the “Horn of Africa.” The landlocked country is bordered by the nations of Sudan and South Sudan to the west, Uganda and Kenya to the south, Somalia to the east, and Eritrea and Djibouti to the north.

The Federal Democratic Republic of Ethiopia is in the northeast region of the African continent, which is commonly referred to as the “Horn of Africa.” The landlocked country is bordered by the nations of Sudan and South Sudan to the west, Uganda and Kenya to the south, Somalia to the east, and Eritrea and Djibouti to the north.

The name “Ethiopia” comes from the Greek words “aitho” and “ops,” which together mean “burnt face” and was the way the ancient Greeks referred to the dark-skinned people of eastern Africa. It is one of the oldest nations in the world, having been founded in 980 B.C., and takes the honour of being the oldest independent country in Africa. One of the unique heritage facts about the country is that it is home to one of the oldest Christian churches.

Ethiopia is the only country in the world to have 13 months in a year with Ethiopians celebrating New Year in September. It is also one of only two nations in the world never to have been occupied, although it has had to defend itself on occasions to maintain that status.

Coffee, which is estimated to be consumed daily by 80% of Americans, was reportedly first discovered by an Ethiopian goat herder named Kaldi in the Kaffa region in about 850 A.D. It is from the word Kaffa that the word “coffee” may derive. According to the legend, Kaldi noticed his goats “dancing” after eating the berries off the coffee plant. Coffee is a top agricultural export, and it is the world’s second most valuable commodity after petroleum.

Another fact which is unfortunately commonly associated with Ethiopia is famine, and the country has suffered periodic droughts and famines over the past, which has led to a long civic conflict. Ethiopia is second in population in Africa (after Nigeria).

The government has announced a 10-Year Development Plan, which will run from 2020-2030. According to The World Bank, “The plan aims to sustain the remarkable growth achieved under the Growth and Transformation Plans of the previous decade, while facilitating the shift towards a more private-sector-driven economy. It also aims to foster efficiency and introduce competition in key growth-enabling sectors (energy, logistics, and telecom), improve the business climate, and address macroeconomic imbalances.”

Any international organisation wishing to operate within the country needs to be aware of the employment legislation in the country and how employment income is treated from a tax perspective.

Ethiopia was also a founding member of the United Nations and serves as the base for many international organisations. As a result, it is important for global payroll professionals to have insight into how payroll operates in Ethiopia.

Regular Working Hours, Overtime Regulations

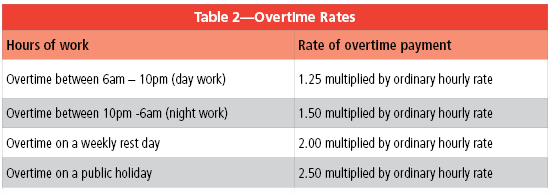

Legislation concerning employment in Ethiopia is largely contained in Labour Proclamation No. 42/1993. Normal hours of work may not exceed eight hours a day or 48 hours a week. Overtime is covered in Section 68 of the proclamation. In terms of this section, an employee who works overtime will be entitled to receive payments as set out in the legislation (see Table 1).

Payment of overtime is normally made at the same time as normal salaries are paid.

There is a maximum of two hours of overtime in any one day, 20 hours in any one month, and 100 hours in any one year.

Types of Leave

Annual Leave

Unless provided in the Labour Proclamation, employers may not pay employees wages in lieu of annual leave. An employee is entitled to a maximum of 16 working days of leave for the first year of service. The entitlement is increased by one working day for each additional two years of service.

Sick Leave

Once an employee has completed probation, they will be entitled to sick leave. Sick leave days cannot be more than six consecutive months in any 12-month period commencing from the first day of sickness. An employee shall be entitled to a payment of 100% of their wages in the first month of sickness. This reduces to 50% in the next two months of sickness. During the last three months, there is no sick pay entitlement.

Maternity, Paternity Leaves

Women are entitled to 120 consecutive days of paid maternity leave. No less than 30 days are required to be taken prior to child birth/due date and 90 days should be taken following child birth. Before any maternity leave is taken, a woman must provide a maternity confirmation certificate. The actual proclamation specifies 120 working days, however, elsewhere in the legislation reference is made to consecutive days. Despite the ambiguity, most companies follow the practice of consecutive days.

Fathers are entitled to unpaid paternity leave of up to three days.

Special Leaves

One of the special leave types covered in the legislation is leave for family events. An employee can receive pay for up to three workings days when the employee gets married or when their spouse, descendants, or close relative dies.

Leave for education or training is determined in accordance with collective agreements or work rules.

There are various other special leave types covered in the legislation.

National Holidays

The Federal Democratic Republic of Ethiopia currently celebrates 13 national holidays each year (see Table 2).

Income Tax on Employment Income

An employee is defined for tax purposes as an individual engaged to perform services under the direction and control of another person. The engagement can be on a permanent or temporary basis. The definition does not include independent contractors. However, it does include directors or other holders of office in the management of a body, government appointees, and persons holding public offices.

Income tax is imposed on any employment income received, whether payments or gains are in cash or in-kind services, by virtue of the employment relationship. Income from former employment or from prospective employment is also included.

Regulations are issued by the Council of Ministers which outlines the type of taxable fringe benefits and how those will be assessed.

Employers are obligated to withhold income tax from each payment made to an employee. The taxes withheld are required to be paid by employers to the Ethiopian Revenues and Customs Authority (ERCA) within 30 days from the end of each calendar month in which the tax was withheld. The payments must be accompanied by a statement for each employee who derives taxable income for the month.

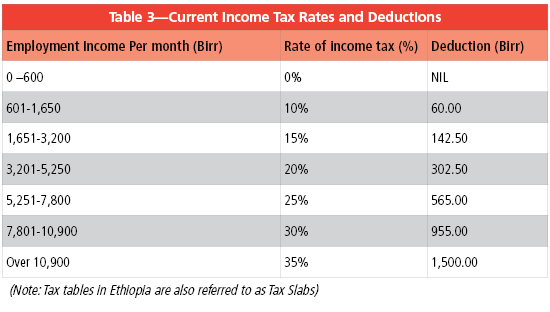

The tax rates are set out in Schedule A, Article 11. The rate of employment income tax is progressive (see Table 3). The maximum rate is 35% for employment income of greater than 10,900 Birr ($205.93 USD). The employment income tax payable by an employee is a final tax on the employment income of the employee.

The tax rates are set out in Schedule A, Article 11. The rate of employment income tax is progressive (see Table 3). The maximum rate is 35% for employment income of greater than 10,900 Birr ($205.93 USD). The employment income tax payable by an employee is a final tax on the employment income of the employee.

Exemptions

There are certain categories of income which are exempt from the payment of employment income tax. The most common components of an employee’s package, which are fully or partially exempt, are listed as follows:

- Any amount paid by an employer to cover the actual cost of medical treatment of an employee would be exempt from taxes.

- An allowance paid to an employee in lieu of a means of transportation which meets certain conditions would qualify for the exemption. The allowance must be granted under a contract of employment. The maximum tax-exempt allowance is currently set at 2,200 Birr ($41.56 USD) per month and the allowance cannot exceed 25% of the employee’s salary. It is also important to note that the allowance does not cover instances where an employer arranges or gives a vehicle to an employee and the vehicle is used between the employee’s residence and their place of work.

- Where an employee is granted a hardship allowance or weather allowance because of working in a remote and/or desert place within Ethiopia, for example in Asosa or Gambela, a portion of the allowance would be tax exempt. The tax-exempt percentage depends on the specific place in which the employee is working. More details can be found in the Directive No. 21/2001 and Directive No. 102/2007 issued by ERCA.

- If an employee receives a per diem allowance for traveling more than 25km from his/her place of work, then the greater of 500 Birr ($9.45 USD) per day or 4% of the employee’s monthly salary will be exempt from income tax. The per diem allowance must be included in the employment contract and the wording needs to indicate that the allowance is only paid for per diem purposes. This per diem allowance will not cover expenses incurred by an employee in their daily commute from their place of residence to the office. It will also not cover expenses paid to an employee who has a company vehicle or makes use of a transportation service provided by the employer.

- Amounts paid to an employee in respect of work-related travel costs will be exempt so long as there is documented evidence of the costs and the costs are in line with prevailing land and air transport fares. Transport expenses which are paid to an expatriate employer when they leave the country having terminated the employment contract, are exempt subject to certain conditions. The costs should be covered within the employment contract, which should have a clause outlining the repatriation costs. The costs should also not exceed prevailing land or air transport fares and there is a limit on the amount of luggage which can be transported (currently, the limit is 300kgs). This exemption also covers inbound expatriate travel expenses but again the employment contract must contain wording to cover this expense.

- Employees working in the mining, manufacturing, or agricultural sectors who receive free food and beverages from their employer will also have a portion of this cost exempt from employment income tax. The percentage allowed depends on the industry.

- Where an employer contributes towards a pension, provident, or other retirement fund for the benefit of an employee, and if the total monthly contribution does not exceed 15% of the employee’s monthly income, the contributions will be exempt from employment income taxes in the hands of the employee.

Termination Process

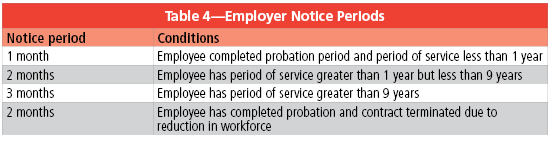

A fixed term contract can be terminated for reasons such as business, personal, or employee misconduct. The notification must be delivered by hand to the employee and needs to be in writing as well as specifying the reason for the termination.

Employers are required to provide notice to an employee as per statutory rules. The notice periods that are required to be given are provided in Table 4.

Employers are required to provide notice to an employee as per statutory rules. The notice periods that are required to be given are provided in Table 4.

The Ethiopian Labour Proclamation requires severance pay to be paid to any employee who has completed a probation period. The probation period should not be longer than 45 consecutive days.

The severance pay amount will be dependent on the employee’s length of service. The severance pay rates are as follows:

- 30 days at the regular salary rate for one year of service. (Where the service is less than a year, the amount will be pro-rated.)

- 10 days at the regular salary rate for every additional year of service after the first year. (Total severance pay must not exceed 12 months of wages.)

- 60 days at the regular salary rate in addition to the above payments for employees who are terminated on the grounds of redundancy.

Conclusion

Having a basic overview of the employment and tax legislation in Ethiopia will enable global payroll managers to provide valuable input into any discussions within large organisations looking to expand into the region. Local knowledge is key to ensuring compliance and ensuring that employment contracts are correctly drafted before engaging staff in a new region is critical. As always, payroll departments have a strategic role to play in this area.