China is the world’s second-largest economy and is the most populous nation on Earth. China offers enormous opportunities for global companies, both as a manufacturing labor pool and, increasingly, as a consumer market of seemingly endless potential.

In the 40 years since Deng Xiaoping’s “reform and opening-up” policy of 1978, China’s GDP has developed at an unprecedented rate, averaging 10% growth per annum. However, the relentless momentum of investors turning their sights toward China has softened of late.

China’s labor costs have been increasing in the recent decade. In some large cities, the cost of employment has increased dramatically, especially in some special industries where employees’ payroll costs tend to be closer to developed countries.

Social Welfare System

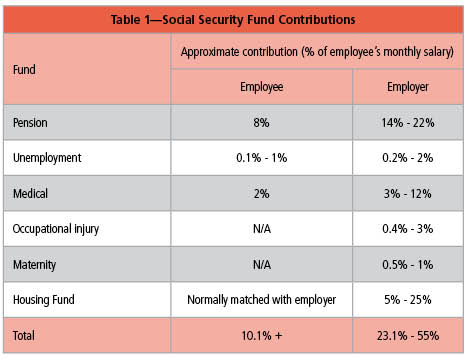

Social insurance payments in China (also called “social welfare” or “mandatory benefits”) are mandatory contributions to government-run funds and are made by both the employer and the employee (whose contribution the employer is responsible for withholding each month). Social insurance obligations from the employee and employer, respectively, can vary considerably depending on the city in which the contributions are being made. For a company with employees based in a number of cities around the country, this means the overall cost to the company for an employee earning a monthly salary of 10,000 renminbi (RMB) in one city may be quite different to someone on the same salary based elsewhere. In total, there are five social security funds:

- Pension

- Unemployment

- Medical

- Occupational injury

- Maternity

Added to these is a mandatory Housing Fund not strictly considered a type of social welfare, but generally included within the scope of social security. Housing Fund contributions are mandatory and come from both the employer and the employee. Money in the housing fund can be used by employees to pay the down payment on a house, or to subsequently pay back a loan to the bank. In some cities, it can also be used for renting apartments for single individuals.

Added to these is a mandatory Housing Fund not strictly considered a type of social welfare, but generally included within the scope of social security. Housing Fund contributions are mandatory and come from both the employer and the employee. Money in the housing fund can be used by employees to pay the down payment on a house, or to subsequently pay back a loan to the bank. In some cities, it can also be used for renting apartments for single individuals.

While employees are also mandated to make their own contributions to several types of social insurance, the portion contributed by the employer is normally the higher of the two sides. In fact, social security payments typically add an additional cost of between 23% and 55% of an employee’s salary each month. The Housing Fund (HF) rate various in different cities. For the city that charges a HF rate at the maximum of 25%, then there are lower social insurance charging rates, thus the overall the maximum employer rate still ends up being 55%

The contribution rates that employers and employees pay for social welfare are as listed in Table 1 (with minor changes in different cities). Normally, the employee’s average monthly salary will be considered as the contribution base. However, it normally is capped by three times the city’s average monthly salary figure.

Individual Income Tax

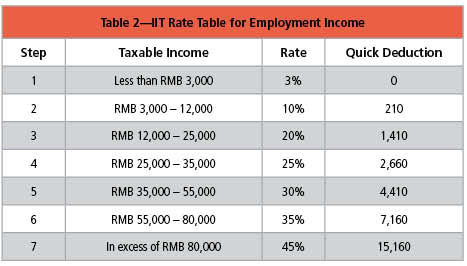

In accordance with the Individual Income Tax Law (IIT) of the People’s Republic of China (PRC), IIT is imposed on all individuals, including Chinese and foreign nationals, residing in or deriving income from China. PRC residents are generally subject to tax on their worldwide income, while nonresidents are taxed on their PRC-sourced income only. IIT is imposed on income from wages and salaries at progressive tax rates ranging from 3% to 45% with seven tax brackets (steps); IIT on wages and salaries is normally withheld by the employer and paid to the tax authorities on a monthly basis.

Before 1 October 2018, foreign individuals working in China (including residents of Hong Kong, Taiwan, and Macau) had a standard monthly deduction RMB 4,800 and Chinese people had a monthly deduction at RMB 3,500. However, to relieve an individual’s personal tax burden, the central government just announced a new tax deduction amount of RMB 5,000 for all individuals. This new implemented law in just started on 1 October. Based on the current plan, in 2019, all individuals will enjoy a few other supplementary tax dutiable benefits (mainly relating to critical illness, children’s education cost, parents support, home loan expenses). The central government is collecting local public opinion and expect to announce the final policy by the end of the year.

Before 1 October 2018, foreign individuals working in China (including residents of Hong Kong, Taiwan, and Macau) had a standard monthly deduction RMB 4,800 and Chinese people had a monthly deduction at RMB 3,500. However, to relieve an individual’s personal tax burden, the central government just announced a new tax deduction amount of RMB 5,000 for all individuals. This new implemented law in just started on 1 October. Based on the current plan, in 2019, all individuals will enjoy a few other supplementary tax dutiable benefits (mainly relating to critical illness, children’s education cost, parents support, home loan expenses). The central government is collecting local public opinion and expect to announce the final policy by the end of the year.

Monthly taxable income is calculated after a standard monthly deducted amount – RMB 5,000. All the money paid into Chinese social insurance and certain allowances can also be added to the pre-tax deduction.

Here’s an example of how an IIT rate might be calculated:

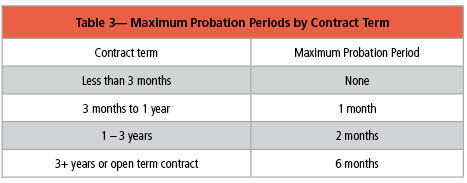

Also, the employer is allowed to pay the employee 80% of the full salary in the employment contract during the probation period.

There are four types of employment:

- Job contract

- Part-time contract

- Fixed-term contract

- Open-term contract

The majority of employees hired in the private sector in China are given fixed-term contracts. In certain cases, a fixed-term contract may turn into an open-term contract. The job and part-time contracts are only of limited relevance.

Annual Leave and Public Holidays

By law, employees in China are allowed to have five to 15 days’ paid annual leave depending on accumulated working years. They also have the day off on public holidays. Employees who have worked at a company for one continuous year are entitled to five days’ annual leave. Employers do not have to give leave to employees who have not yet worked for one year.

By law, employees in China are allowed to have five to 15 days’ paid annual leave depending on accumulated working years. They also have the day off on public holidays. Employees who have worked at a company for one continuous year are entitled to five days’ annual leave. Employers do not have to give leave to employees who have not yet worked for one year.

In practice, most employees are given the weekends off. Foreign-invested companies typically give all of their employees 15 to 25 days of annual leave.

There are eleven national holidays in a calendar year, and at each year-end the central government issues the next year’s public holidays. In China, the government normally will combine the national holidays with closed weekends together an all days are listed on the holiday calendar. If the national holiday falls on a weekend, the government will provide additional days as supplementary leave. The local banks follow the same schedule (see Table 4)*.

An employee, Thomas, works in China and his monthly gross income after deducting local social welfare contribution is RMB 20,000. His IIT will be calculated as:

RMB 20,000 – RMB 5,000 (standard deduction) = RMB 15,000

Thomas’ IIT = RMB 15,000 x 20% (tax rate) – RMB 1,410 (Quick Deduction) = RMB 1,590

Hiring Employees in China

Hiring Employees in China

The employer needs to sign a written contract with the employee within one month, starting from the day the employee starts working at a company. If not, the employee is entitled to double salary for each month he or she has gone without a contract. After a year without a written contract, the employer is deemed to have given the employee an open-term contract.

The employer can choose to set a probation period at the start of the contract. During the probation period, it is easier for the employer to dismiss the employee. The employee may also resign after giving three days’ notice. It is therefore not advisable to give too long of a probation period. The length of the fixed-term contract will determine the maximum length of probation the employer can set (see Table 3).

Overtime

In China, overtime is paid differently depending on the work-hour system adopted by the employer—either standard work hours, comprehensive work hours, or non-fixed work hours. Note that comprehensive and non-fixed work-hour systems require special approval to implement. The standard work-hour system requires that an employee’s normal working day should not exceed eight hours, that the normal workweek not exceed 40 hours, and that each employee should be guaranteed at least one rest day per week. The majority of white-collar jobs in China now operate according to this model.

Rather than a unit of one week, the comprehensive work-hour system adopts a set period (typically one month) as the base to calculate the employee’s working hours. Although the distribution of hours worked during this period can be irregular, the average number of working hours per day and per week should roughly correspond to the levels set out in the standard work-hour system. Lastly, the non-fixed work-hour system is geared toward positions like senior management, salespeople, and employees in the transport, warehousing, and railway sectors who generally do not receive overtime payments, as it is considered impractical to measure their time spent working.

When overtime payments become necessary, there are certain mandatory requirements concerning the minimum amount to be paid. These are:

- 150% of base hourly pay for overtime worked on weekday evenings

- 200% of base hourly pay for overtime worked on weekends

- 300% of base hourly pay for overtime worked on national holidays

Termination of Employment

From a legal perspective, terminating employees in China can be more difficult than expected, especially under the comparatively stringent regulations on terminating employment contracts since 2008. Employers should follow these steps to ensure full compliance:

Step 1—Determine whether the termination is an early termination or not. If the employer chooses to terminate the employee prior to the expiration of the first fixed-term contract, this is considered “early termination” and certain additional requirements apply.

Step 2—In case of early termination, the employer should attempt to negotiate an agreement with the employee, including the termination date, severance payment, and any other necessary details. This is often the safer option even if there are grounds for unilateral termination.

Step 3—If unable to come to a termination agreement, consider whether there are grounds to support immediate termination for cause or a 30-day notice termination without cause, keeping in mind the statutory obstacles to such types of termination.

If none of the above measures can be adopted, then the termination is likely to be considered an unlawful termination and an additional severance payment might be required.

*Author's Note: This is an expected holiday list for 2019. The official list of holidays is not usually issued by the government until mid-December.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Helen Kong is Manager of the International Payroll Service Team at Dezan Shira & Associates. She has been working in the HR field for Dezan Shira since 2008 and leads a specialized team in Dalian for payroll and HR administrative outsourcing services. Helen has expertise in providing tax planning and advisory services for foreign individual income tax matters and has also helped many newly established companies on HR start up related services. Before joining Dezan Shira & Associates in 2008, Helen worked at a U.S. Fortune 500 company. She achieved her bachelor’s degree at Massey University in New Zealand, and she holds a Level One China Human Resources Certificate.