Bosnia and Herzegovina is located on the Balkan Peninsula in Southeastern Europe. Gaining independence from former Yugoslavia in 1992, the country’s population of 3.8 million people is multiethnic, influenced by its borders with Croatia, Serbia, and Montenegro.

Known for its mountainous regions and cultural and religious aspects, the World Tourism Organization estimated Bosnia and Herzegovina to have the third highest tourism growth in the world.

While currently a candidate for membership in the European Union and NATO, the country is a member of the Council of Europe and was a founding member of the Mediterranean Union since its creation in 2008.

Applicable Laws on Payroll Fees

Below are the current Bosnian and Herzegovina applicable laws on payroll fees:

- The Labor Law of the Federation of Bosnia and Herzegovina (FBiH)

- The Labor Law of the Republic of Srpska (RS)

- The Law on Pension and Disability Insurance of FBiH

- The Law on Pension and Disability Insurance of RS

- The Law on Contributions of RS

- The Law on Contributions of FBiH

- General Collective Agreement of RS

- General Collective Agreement of FBiH

Payroll Calculation Procedure

The tax base is the net income. After all deductions such as social insurance contributions, personal income tax, and other taxes are made, the employee is entitled to a net monthly salary which in average amounts to 428,00 EUR.

Social Insurance Foundation

Social Insurance Foundation

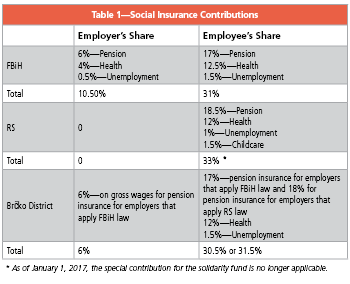

The contributions in the FBiH for social security (pension/disability and health insurance) are paid both by employers and employees on the gross amount of the employee’s salary.

In the Republic of Srpska (RS), the social insurance contributions are also calculated on the gross amount of the salary.

In Brčko District, pension insurance contributions are regulated by the entity regulations.

The social insurance contributions are deducted from the employee’s gross salary based on the percentages seen in Table 1.

Tax Deductions

Personal income tax in the entire territory of FBiH is 10%, and the base for tax calculation is gross deducted for contribution amount tax deduction amount. The tax deduction for RS is 200.00 Bosnia and Herzegovina convertible mark (BAM) monthly. For FBiH, it is 300.00 BAM monthly and based on the tax card issued by the tax administration (every employee has the right to an additional tax deduction for close family dependents or interest paid on a housing loan).

Employment Procedure

Labor laws in FBiH recognize different types of employment contracts such as:

- Permanent

- Temporary

- Part-time

- Seasonal

- Probationary

Employment procedure in FBiH stipulated by the labor law is based on the employment contract (must be in written form) signed with employees for a definite or indefinite period. Among other conditions, the employment contract must contain the following:

- Name and seat of employer

- Qualification and residence of employee

- Employee’s salary and duration of contract

- Annual leave duration

- Working hours

- Place of work

- Time of conclusion of work

- Working conditions

- Description of duties and rights

- Dismissal notice

Upon signing a labor agreement, the employer has an obligation to register employees with the Pension/Disability Fund and the Health Fund. The probation period may not last longer than six months for FBiH, and three months for RS.

Normal working hours are eight hours per day or 40 hours per week. The working week lasts five consecutive days—from Monday to Friday. In cases such as increased work volume and force majeure (earthquake, flood, fire) or other similar cases, employees are obliged at the employer’s request to work overtime, which could be up to 10 hours a week maximum for RS and eight hours a week maximum for FBiH.

The employment contract can also be signed on a part-time basis, providing that employees are entitled to social insurance contributions and all other rights in proportion to the time spent at work. Employers may conclude a contract with a trainee for the specific professions determined as the trainee period by Bosnian authorities.

Protection of Employment

Holidays: In accordance with the labor laws in FBiH and RS, the minimum annual leave is 20 days, however, no longer than 30 working days, during which the employees are entitled to full salary compensation based on the laws, collective agreements, and the rule books.

Employees who are younger than 18 years old (minors) are entitled to a minimum 24 days of annual leave, while employees who are engaged in jobs under special working conditions are entitled to a minimum of 30 paid leave days by the labor law of FBiH. Employers may agree with employees to divide their annual leave into two parts, provided that one part of the annual leave is not less than two weeks without interruption.

Illness: Under the labor laws in FBiH, employees are entitled to an additional paid leave of absence for five working days for RS, and seven working days for FBiH, annually in cases of serious illness and death of family members. Employees may refuse to work if required health and safety measures are not met by the employer at the workplace. Employers must register all employees for health and health/disability Insurance and enable the full protection of employees against any accidents at work.

When an employee is temporarily unable to work, employers cannot terminate the employment contract with an employee who suffered an injury at work or was sick. The employer must allow employees to return to their same job they worked in before the occurrence of these conditions.

Maternity: Women are entitled to maternity leave for a period of one year without interruption during the pregnancy, childbirth, and after the birth for the care of the baby. Under the labor law of RS, in the case of a birth with twins, or the birth of a third child, women are entitled to 18 months of maternity leave. The woman may start the maternity leave at her request within 28 days before the due date and on recommendation of a competent doctor. She may start to work at her request before the expiration of her maternity leave, but not before 60 days after the childbirth under the labor law of RS, and 42 days under the labor law of FBiH. She is entitled to a 60-minute break during working hours for child feeding and other care. During maternity leave, women are entitled to full salary compensation, the net amount of which could be reverted to the employer from social service with prompt and correct application supported by proposed documents.

Termination of Employment

Employment contracts can be terminated by the employer or employee upon agreement, death of employee, by the decision of a competent court, expiration of the period stated on the contract if it is concluded at a definitive time, etc. In FBiH, employers are entitled to terminate the employment contract for various reasons including lack of organizational or technical skills or on economic bases, poor performance, or different types of misconduct. The notice period cannot be shorter than 15 days if the employee terminates the employment contract, or shorter than 30 days if the employer terminates the employment contract. The notice period starts upon submission of the written notice either from the employer or the employee.

Dajana Topic is the Regional Executive for Bosnia, Croatia, and Slovenia at Eurofast. Her responsibilities include implementing the operational practices of offices in Banja Luka, Sarajevo, Zagreb, and Ljubljana as well as strategic objectives in the region. . She has more than 10 years of experience in the area of marketing, business development, and financial services including tax, accounting, and payroll. She has been involved in a number of projects regarding foreign investments, EU funds, business plans, and various marketing activities in Bosnia and Herzegovina, Croatia, and Serbia. Topic studied Economics in Banja Luka, specializing in Business and Entrepreneurship. She has a master’s degree from the Frederick University Nicosia in Cyprus. She is also a speaker at various seminars focusing on tax-related issues and investments in the region. Topic speaks Serbian, English, and Greek.