Mexico, a nation located in the southern region of North America, is officially known as the United Mexican States. It shares its northern border with the United States, while the Pacific Ocean lies to its south and west. The southeast of Mexico is bordered by Guatemala, Belize, and the Caribbean Sea, and its eastern boundary is formed by the Gulf of Mexico.

The United Mexican States operate as a federation with a representative, democratic, and republican form of government, as outlined in the 1917 Constitution. This constitution delineates three tiers of governance: The federal Union, state governments, and municipal governments.

Labor Code

In Mexico, the Secretariat of Labor and Social Welfare is the primary authority overseeing employment law. While many of the employment regulations in Mexico align with standard practices across Latin America, there are distinct nuances unique to the Mexican context that businesses and employees must be aware of to ensure compliance and foster a fair working environment.

Mexican labour law encompasses a wide range of areas to ensure fair and equitable treatment of employees in the workplace. These areas include the following:

- Minimum Wage Regulations: Establishing the legal minimum wage standards for different regions and types of work

- Work Hours and Overtime: Defining standard working hours, overtime policies, and compensation for additional work

- Health and Safety Standards: Implementing regulations to ensure a safe working environment and prevent workplace accidents or illnesses

- Social Security and Benefits: Mandating employer contributions to social security and outlining employee entitlements such as healthcare, retirement benefits, and disability support

- Vacation and Leave Policies: Specifying the amount of annual leave, maternity/paternity leave, and other types of leave employees are entitled to

- Employment Contracts: Regulating the formation, terms, and termination of employment contracts, including fixed-term and indefinite contracts

- Non-Discrimination and Equality: Prohibiting discrimination based on race, gender, age, and other factors and promoting equality in the workplace

- Union Rights and Collective Bargaining: Protecting the right to form unions and engage in collective bargaining for better working conditions

- Dispute Resolution: Establishing mechanisms for resolving labour disputes, including mediation and arbitration processes

- Training and Development: Encouraging or requiring ongoing employee training and professional development opportunities

- Termination of Employment: Setting out the legal procedures and requirements for terminating employment, including notice periods and severance pay

Minimum Wage

The minimum salary in Mexico is 207.44 pesos ($11.54) per day for employees working there. In the Free Zone of the Northern Border—referred to as Zona Libra by the local population—the minimum wage is 312.41 pesos ($17.38) per day.

Working Hours

According to employment law, the typical workweek in Mexico consists of 48 hours, distributed over six eight-hour days, followed by a day of rest.

Employees who exceed 48 hours of work in a week are eligible for extra pay proportionate to the additional hours worked. Furthermore, Mexican labour regulations stipulate that employees earn a 25% bonus on their regular pay for working on Sundays.

The working day is when an employee is available to the employer for work-related duties. As per the Federal Labour Law in Mexico, working hours are categorised into three types:

- Daytime Shifts: From 6:00 a.m. to 8:00 p.m.

- Night Shifts: From 8:00 p.m. to 6:00 a.m.

- Mixed Shifts: Combines daytime and night hours, with the night portion not exceeding three and a half hours

The law sets maximum working hours: Eight hours for daytime shifts, seven hours for night shifts, and seven and a half hours for mixed shifts.

Overtime Pay

Overtime pay is double the rate of regular working hours. If an employee works more than nine hours of overtime a week, the employer must compensate them at a rate of triple the normal hourly wage.

13th Month or Christmas Bonus Wages

Employees are entitled to a 13th month pay (Aguinaldo), which is calculated based on 15 working days of their regular salary. This additional salary is paid out on December 20 each year, representing an extra (bonus) payment that employers are required to make. It's important to note that this 13th month salary is considered taxable income in Mexico.

Vacation Bonus

Employees are entitled to a vacation bonus, which is an additional benefit to their regular vacation entitlement. This bonus is legally mandated and is calculated as 25% of the regular salary that the employee would earn during their vacation period. It means that employees receive their usual salary while on vacation, plus an extra 25% of that amount. This bonus is designed to ensure that workers have extra financial support to enjoy their time off. The vacation bonus is a standard part of employment benefits in Mexico, reflecting the country's commitment to ensuring workers have time and resources to rest and rejuvenate.

Severance Pay

If an employer in Mexico terminates an employee without cause, the employee is entitled to a comprehensive compensation package. This package includes payment for all hours the employee has worked up to the date of dismissal. Additionally, the employee is entitled to three months of salary and 20 days of pay for every year they have worked with the company. A seniority subsidy is also provided where applicable. Additionally, the employee is compensated for any outstanding vacation time they have not taken. Finally, the employee receives a proportion of their annual bonus, calculated based on the portion of the year they have worked prior to their dismissal. This ensures that employees are fairly compensated in cases of unjust termination.

Taxes

The fiscal year in Mexico spans from 1 January to 31 December. The country's tax system is managed by several agencies, including the following:

Residents employed in Mexico are required to acquire a tax ID number (RFC) and a CURP (Uniform Population Control). Employers in Mexico must register all their employees with these tax authorities.

In Mexico, there are 10 recognised categories of taxable income. These include salaries and remunerations, professional fees and business activity income, incorporation regime, rental income, income from the sale and acquisition of assets, interest, prizes, dividends, and other forms of income.

Furthermore, Mexican employers must register their employees with the Mexican Social Security Institute. Upon registration, employees receive a confirmation. Contributions to the Mexican Social Security Institute are deducted from employee salaries, and employers also make additional contributions. The rates and limits of these contributions vary and are based on multiples of the minimum wage.

Tax Rates

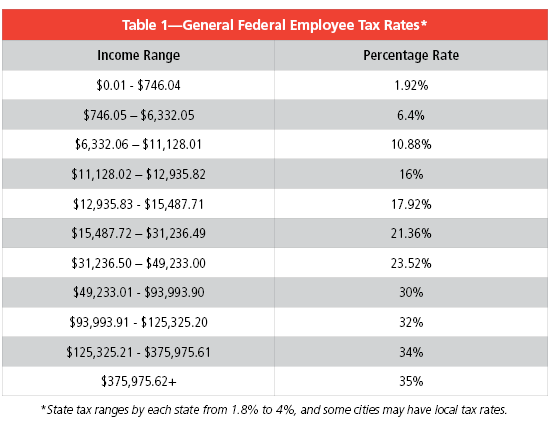

Table 1 shows the general federal employee tax rates.

Social Security Contributions

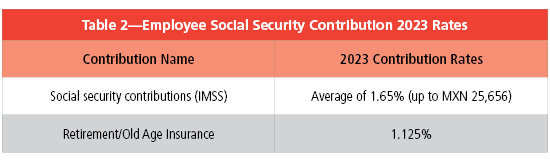

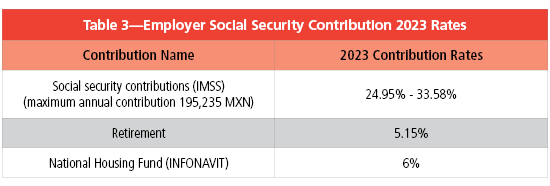

Table 2 shows the social security contributions for the employee, and Table 3 shows contributions by the employer.

Time Off

Annual Leave

Under employment law, as outlined in Article 76 of the Federal Labour Law, employees are granted an annual vacation period that increases with their tenure at a company. Once an employee completes their first year of work, they are entitled to 12 days of vacation. This entitlement increases to 16 days after their third work anniversary and then to 20 days after six years of service. From the sixth year onwards, the vacation period is extended by two days for every additional five years of service. This structure ensures that the longer employees remain with a company, the more vacation time they accrue, rewarding their commitment and service.

Maternity Leave

The labour law provides new mothers with 12 weeks of maternity leave. This leave starts six weeks before the expected delivery date, as confirmed by a medical professional. In cases of adoption, new mothers are entitled to six weeks of maternity leave starting from the day of the adoption.

Paternity Leave

New fathers, including in adoption scenarios, are entitled to five days of paternity leave. This provision ensures parental support during the crucial early stages of childbirth or adoption.

Sick Leave

According to labour laws, an employee who suffers from a non-occupational illness or injury is eligible for full medical care from the beginning of their condition. Additionally, if their illness or injury hinders their ability to work, they are entitled to financial compensation. The social security fund provides this compensation, which amounts to 60% of the employee's salary. It commences on the fourth day of the employee's absence and can continue for up to 52 weeks, ensuring financial support during their recovery period.

Bereavement Leave

Under employment law in Mexico, there is no statutory right to leave in the case of bereavement, and any such allowance must be agreed to with the employer if it is not in the employment contract terms. In cases of all leaves, be sure to check any collective bargaining agreements (CBAs).

Holidays

Per Article 74 of the Mexican Federal Labor Law, employees are entitled to time off on nationally recognised holidays (see Table 4). Should an employee work on one of these federal holidays in Mexico, they are legally entitled to receive their standard pay in addition to double time compensation. This equates to receiving triple their regular pay for the day worked. There are nine public/national holidays, and others vary between regions. Employers may offer Holy Thursday, Good Friday, Day of the Dead, Mother’s Day, and Day of the Virgin of Guadalupe as holidays.

Additional Common Benefits

It is always essential to check CBAs for additional common benefits that might be obligatory to provide to employees. Below are a few examples of other common benefits:

- Supplemental health, dental, and vision insurance

- Internet allowance

- Cell phone allowance

- Food/meal allowance/vouchers

- Wellness/fitness allowance

Locale

Spanning an area of approximately 1,972,550 square kilometres (761,610 square miles), Mexico ranks as the 13th largest country in the world by land area. Mexico has a population of nearly 130 million citizens and is the world's 10th most populous nation with the highest number of Spanish-speaking residents. The country's political structure is a federal republic with 31 states and Mexico City as the capital.

Mexico boasts the 15th largest economy globally based on nominal GDP and ranks 11th when measured by Purchasing Power Parity (PPP). Mexico holds the 86th position and is rated high on the Human Development Index. Its considerable economic size, population, influential culture, and progressive democratisation classify it as a regional and middle power. Additionally, several experts recognise Mexico as an emerging power. In terms of UNESCO World Heritage Sites, Mexico leads the Americas and stands seventh worldwide. It is also recognised as one of the world's 17 megadiverse countries, coming in fifth for natural biodiversity. The richness of Mexico's cultural and biological assets and its diverse climate and geography make it a prime destination for tourists. Mexico was the sixth most visited country in 2018, attracting 39 million international visitors.