In the absence of a global income tax standard, multi-country payroll practitioners must be prepared to master the operational features of many different withholding schemes. What follows are some themes behind its administration.

In the absence of a global income tax standard, multi-country payroll practitioners must be prepared to master the operational features of many different withholding schemes. What follows are some themes behind its administration.

United Kingdom Income Tax Withholding

Using cumulative year-to-date figures for pay and tax, to calculate the latest income tax deduction, is often adopted where the tax authority wishes to minimise the use of an annual tax return.

The basic principle is that payroll calculates income tax based on the individual’s taxable pay for the year to date. Thresholds for the starting points for varying rates of tax are spread throughout the tax year, as is the operation of any form of tax allowance. If the employee has peaks or troughs in income, the tax deduction adjusts accordingly, including, if necessary, the payment of tax refunds in a year via payroll.

By using cumulative pay for the year to date, the total annual tax bill is correct at any point in the tax year. For those with one job and straightforward tax affairs, the cumulative tax calculation will deliver the exact liability within pennies by the end of the tax year. This method is used in the U.K. and the Republic of Ireland, and as a result only 30% of U.K. taxpayers are required by His Majesty’s Revenue & Customs (HMRC) to complete a tax return.

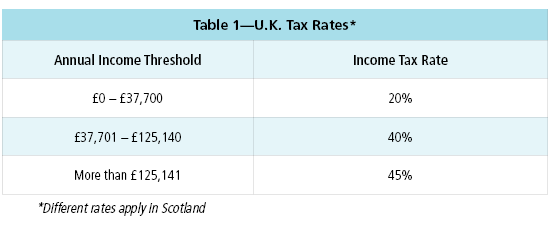

The 20% and 40% thresholds are cumulated throughout the year. Tax is calculated using the taxable pay for the year to date. So, the 20% threshold in the first month is set at £3,142 (£37,700/12), for the second month, it is set at £6,283 (£37,700/12 x 2), and so on.

Here is a calculation example:

- Bob earns net taxable pay of £3,000 per month, so in the first month, he pays tax at 20% = £600

- In his second month, he is paid an additional bonus of £10,000, so his net taxable pay for year to date is now £16,000

- The threshold for 40% tax for the second month is £6,283

- The first £6,283 x 20% = £1,256.60

- The remaining £9,717 x 40% = £3,886.80

- Total tax due for year to date = £5,143.40

- Bob has already paid £600 in the first month, so the second month tax deduction is £5,143.40 - £600 = £4,543.40

- In the third month, Bob takes a period of unpaid leave and earns net taxable pay of just £1,000

- His year to date net taxable pay is £17,000, which is taxed as follows:

- The first £9,425 x 20% = £1,885

- The remaining £7,575 x 40% = £3,030

- Total tax due for the YTD is now £4,915

- Bob has already paid in the first and second months, a combined £5,143.40

- £4,915 - £5,143.40 equals a credit of £228.40, which Bob receives as a tax refund via payroll

Most jurisdictions worldwide require an annual tax return to be completed, and therefore use per pay period calculations. For this reason, payroll withholding schemes don’t need to be as accurate as the U.K./Irish model. While they are based on the annual thresholds for the different rates of tax in-country, they are likely to not be penny perfect. Many can be based on “steps” of income with one deduction covering a range of taxable pay spanning $10-$20. They may also include a standard personal tax allowance not tailored to the individual’s personal circumstances.

Australia Income Tax Withholding

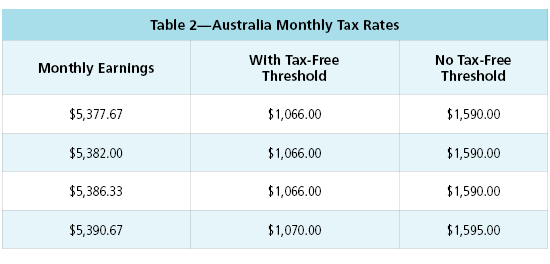

Consider the position in Australia where per pay period tax tables are in operation. Table 2 is an extract from the country’s current monthly tax table.

Based on Table 2, here is a calculation example: David starts at a company and provides a Tax File Number (TFN) Declaration. He provides his TFN number and indicates he wishes to claim the tax-free threshold. His first month’s salary is $5,385, and his tax is calculated by checking the monthly tax tables.

The nearest table entry down is $5,382. As he has checked the box claiming the tax-free threshold, his deduction is taken from column 2, which is $1,066.

If he hadn’t done this or provided his TFN number, the tax due would be taken from column 3 at $1,590. If his pay had been $5,378 or $5,389, the answer would still be the same.

Clearly, David’s deduction is not penny perfect, and any small differences will be accounted for on his tax return at the end of the year.

Per pay period systems do not cope well with one-off spikes of income, such as annual bonuses, or drops in income, such as periods of unpaid leave or sick leave. This could lead to significant adjustments for tax via the personal tax return—either more to pay or refunds due.

How Tax Rules Work in Other Countries

To address this, jurisdictions often have special rules to cope with peaks in income. The German approach is to ensure that special one-off items of pay, such as annual bonuses, are taxed using different methodology than the standard monthly salary.

In effect, the payroll software looks at the income for the year to date, estimates what other income is likely to be paid for the rest of the year, and then adds on top the one-off pay item. The resulting total is compared to an annual tax table to determine the likely marginal rate of tax, and this is then applied to the one-off item of pay.

Japan follows a similar process by comparing total income for the year to date in December at tax year-end to an annual tax table. The resulting liability is compared to the sum of monthly deductions already taken throughout the year, and an appropriate plus or minus adjustment is then applied to the last salary payment of the year.

Some countries have seemingly simple flat rate percentage deduction systems that are relatively easy for the employer to operate, but which mask the complexity of the final tax calculation. The French Prelevement a la Source scheme is a good example of this.

France currently has four rates of income tax that are applied progressively as income rises. But the employer is simply sent one set flat rate percentage to apply to the employee’s taxable income.

The complexity in the French system lies in the computation of family taxation rates, which fortunately for employers, has been taken care of by the Tresor Public when they send the simple flat rate percentage to enact. The trick is in calculating taxable pay, which the employer calculates as gross pay and benefits minus social insurances plus the “Contribution Sociale Généralisée” (CSG) and “Contribution pour le Remboursement de la Dette sociale” (CRDS) contributions.

You might encounter the phenomenon of an employee asking their employer to deduct more tax from salary than required through use of standard tax tables. This would be unheard of in countries like the U.K. and Ireland, but is an accepted feature in other jurisdictions, primarily to ensure that those who have income, which is untaxed at source, can avoid building up large arrears which would await the taxpayer at tax return time.

Sweden provides a good example of this. The employer must make the higher requested deduction on the first payday that falls a fortnight (two weeks) after the initial request is made. The tax deducted is included in standard reporting and on the annual income statement. The deduction is shown on the payslip as a separate line labelled “Frivillig Skatt” (voluntary tax).

Some jurisdictions will roll up the deduction of income tax and employee social insurance contributions into one deduction. The tax tables published by these jurisdictions include a combined deduction for both deductions with just one amount shown on the payslip.

Some examples of this include the following:

- Sweden—a 7% employee pension deduction charged on income up to SEK 599,601

- Norway—an 8% national insurance charge on all income

- Netherlands—27.65% national insurance charge covering three funds charged on monthly income up to € 5,580 per month

Where expatriate staff are sent to work in such jurisdictions, it is vital that any relevant certificate of coverage issued under a bilateral social security agreement is passed to the local payroll department promptly who may be performing shadow tax calculations on the expat employee.

This will ensure that they can set any indicator required on the software so that only the income tax element of the tax table is applied. This can be difficult to spot where the rolled-up approach is applied as it wouldn’t be obvious from the employee’s payslip that local social insurance had been erroneously applied.

Supplemental Income Tax

What often happens when a government has promised not to increase income tax but needs to raise more revenue? One approach is to simply introduce a supplementary income tax, thus ensuring that the literal promise of the politicians was not broken!

This was the case in Ireland when the Universal Social Charge was introduced in 2011. Using a name that alluded to social insurance was also a good way to try and deflect accusations of broken promises.

But the Universal Social Charge is calculated using the same cumulative principle applied to income tax, and crucially awards no direct entitlement to social security benefits because of being paid. Ireland told the Organisation of Economic Cooperation and Development that it was to be viewed as an income tax and was available to be claimed as a tax credit as part of the operation of its double taxation agreements. It is an income tax.

Often supplementary income taxes are raised for a defined purpose in government expenditure. Take the Solidarity Surcharge levied in Germany. Its original avowed purpose was to provide funds to help with the very significant costs incurred in helping to integrate the old DDR back into the rest of Germany after the fall of the Berlin Wall. Thirty years later that task is largely completed, although the German government has found it now cannot do without the extra income. The solution has been to raise the income threshold at which the tax starts so high that now only 10% of German taxpayers have a liability for it. So German payrollers will have to master the separate legislation covering it for a while yet.

India uses the Cess system (short for assess) for a similar purpose. It refers to an additional charge which is levied with an end objective in mind, and unlike income tax, a “Cess” can only be used for its specified purpose.

The educational and health Cess is levied to provide and develop health and educational services in rural and semi-urban areas. It is charged at the rate of 4% of the income tax liability rather than of the income and is displayed as a separate sum on the payslip.

Finally, there may be income tax collection required for bodies other than national or local government. The Church Tax system in Northern Europe is a good example. Having grown out of the tithe system by which church members were expected to donate a portion of their agricultural produce, taxation systems eventually replaced gifts of agricultural produce. In Scandinavia, these are “invisible” to the payroll practitioner because they have been rolled into the general tax deduction.

In Germany, Church Tax (or Kirchensteuer) will be charged separately on payslips to active members of the Christian and Jewish faiths. This again works as a supplementary income tax and is charged at 8% or 9% of the income tax levied on members rather than on their income.

This is not small change either. In 2022, the Catholic Church raised €6.8 billion in Church Tax, with the Protestant denominations raising €4 billion.

As you can see, in the absence of a global income tax standard, global payroll professionals must be knowledgeable of the many different income taxes used around the world.