In Part I, “Staffing Challenges in a Global Payroll COE,” we discussed the current global payroll landscape. This included the long-term development of organizational expansion over the globe and the challenges this rapid expansion has had on payroll teams as they were struggling to balance accuracy with efficiency.

In Part I, “Staffing Challenges in a Global Payroll COE,” we discussed the current global payroll landscape. This included the long-term development of organizational expansion over the globe and the challenges this rapid expansion has had on payroll teams as they were struggling to balance accuracy with efficiency.

In this article, we outline current capabilities required to succeed in the global payroll arena. We illustrate how current perceptions of the payroll function miss the mark. We then outline opportunities available to stakeholder communities when the payroll organization is fully developed as a center of excellence (COE).

Payroll’s Cycle, Operations

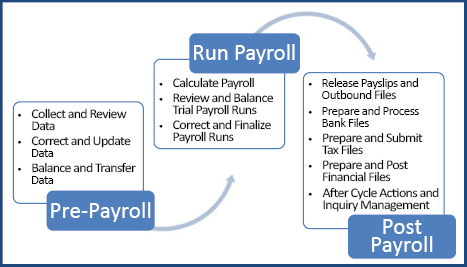

While the main payroll cycle activities required in all organizations generally contain the same elements as illustrated in Figure 1, payroll processing does not happen at the push of a button. Specific knowledge and skills are central to execute pre‐payroll events before starting a payroll cycle and continue well beyond the payment date. At the very core, ensuring payroll compliance is essential in making sure employees are paid accurately, on time, and in full compliance with multiple regulatory authorities. This can include labor and employment, employee/employer payroll tax, social insurance, data protection and privacy, relocation and mobility, and fringe benefits.

Figure 1—Main Elements in a Payroll Cycle

Critical to effective payroll operations are solid governance, sophisticated and fit-for-purpose technology, data intelligence, strong partnerships, and thorough knowledge of payroll operations. Payroll operations include the following:

- Processing multiple pay cycles

- Updating systems with tax, benefits, and compensation schemes

- Designing and testing new systems or system features

- Consulting with stakeholders on enterprise initiatives

- Any other activity impacting employee pay

To do this well, world‐class payroll professionals must be data-driven, detail-oriented, and strive toward continuous improvement while leveraging an analytical mindset.

Illustrating Global Payroll Capabilities

The “outside view” of a payroll department typically sees data entry and collection, gathering time, and calculating payroll as the only capabilities of the payroll department. As long as employee pay is deposited into bank accounts, no one thinks further in terms of payroll responsibilities and capabilities. In reality, however, an effective global payroll organization is driven by a clear strategy that is tied to organizational goals and complete with an organizational design that is sustainable over time.

A global payroll organization is guided by a governance model that leverages modern technology, solid stakeholder partnerships, effective project management, and clean source data. The model in Figure 2 is a visualization of capabilities that enable this end-to-end view of accurate and timely delivery of pay, versus the “outside view” of a payroll department.

The “old days” of focusing solely on payroll processing are gone. Back then, the payroll function was purely transactional in nature, moving transactions from one system to another, validating data and calculations, distributing files and reports, and answering employee questions.

While most data elements are now automated, the valuation of the data and compliance interpretation still needs to occur. This can happen through stakeholder engagement during program and policy development, system configuration and testing, process governance, and other internal controls.

Start With Job Knowledge

With the global payroll evolution just described, it may be difficult to determine where to begin. As a global payroll professional, you may have already been thinking about this, so let’s start by reviewing the critical areas that every global payroll professional will likely be involved in during the course of business and then layer it with required skills and competencies.

First and foremost, basic to sound knowledge of country-specific compliance is key to driving effective operations. Without this knowledge, payroll processing, internal/external audits, and technology management would be very difficult. Each payroll professional must have a sufficient understanding of gross-to-net, wage taxation, social security and employment laws, and accounting practices. Most of all, the payroll professional must demonstrate a collaborative and effective approach in working across functions.

When we talk about compliance, however, it is not that a global payroll professional must know every regulation in every country. Instead, the expectation is to be resourceful when it comes to research, in managing ambiguity and leveraging that knowledge in the decision-making process. The ability to interpret the rules and find their practical application in the specific situation, as an example. As we know all too well, laws change, and each situation requires a unique, relevant, and compliant solution.

When there is a thorough understanding of payroll compliance and operations, it becomes easier to take on projects and partner with various stakeholders. While projects require knowledge of technology, data intelligence, and project management methodology, effective stakeholder partnerships require a solid understanding of the payroll governance model employed in the organization. Having knowledge of all aspects of global payroll means managing complexity in areas that can be totally different from each other.

For instance, the skills required to be effective in global payroll operations are different from the skills needed to be effective in projects and partnerships. Strategy and organizational alignment vary widely, so the skills required to develop strategy in alignment with the organization are also very different in terms of managing governance and technology. The global payroll specialist role inherently must possess cultural sensitivity, varied communication styles, change management, and flexibility in both thought and action. The global payroll specialist encompasses a completely different skill set today compared to the payroll specialist of yesterday.

With emerging technology, global payroll professionals need to be tech-savvy and continuously develop technical abilities. With the constant introduction of new technologies, innovation and creativity are also essential in providing the best and most modern customer experience. Some risk-taking is essential in moving toward a best-in-class global payroll organization that flexes to the current environment. Creating ways to complete payroll tasks on a mobile device or offering a new way of getting paid—such as earned wage access (also called on-demand pay)—are just a few examples.

Being detail- oriented is more important than ever. For example, during the payroll processing cycle, details need to be closely monitored. Anything out of the ordinary must be identified and vetted with stakeholders to ensure accuracy. The payroll professional must possess an empathetic view of the customer experience, practice active listening, and demonstrate flexibility in finding sound and compliant solutions to problems while meeting deadlines for accurate, on-time payroll delivery.

This is where strategy and organization are of utmost importance. Global payroll leaders not only need to ensure that there is an effective operating model and department structure to meet the organization’s needs but also a model that ensures continuous talent development and education, business continuity, and skills that enable the team to provide best‐in‐class customer service. After all, our purpose is to ensure timely and accurate payments to employees even in times of crisis and disruption.

Multi-Tasking Ninjas

Global payroll professionals, for lack of a better term, are “multitasking ninjas.” In addition to fundamental skills required to calculate accurate pay, an empathetic, culturally sensitive approach is required when communicating with stakeholders from different cultures speaking different languages. Working in the global arena requires having a global perspective, valuing differences, and managing complexity and ambiguity to comfortably make sound decisions, thus possessing the unique ability to balance global standards with local nuances.

As illustrated, the global payroll function has evolved from traditional data entry and the issuing of paychecks to a COE where the demands have become greater for the global payroll professional. Leadership must take a step back and analyze exactly what is required to run an effective global payroll function in the current environment, perform a job analysis, and build a roadmap to develop talent and leverage the strengths of existing employees. Change doesn’t happen overnight. Leaders must ensure that every team member is part of this journey.

In the final section of this three‐part article, we will provide examples of an effective global payroll structure and describe how to get there, where to get educated, and wrap up with a call to action.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Judy Hamilton is Director of Global Payroll at UKG (Ultimate Kronos Group). Her passion for payroll runs deep as she loves to learn about effective leadership and organizational development to stay aligned with company strategy and ways to develop talent to build a best-in-class global payroll organization at UKG. Hamilton is a member of the American Payroll Association’s (APA) Strategic Payroll Leadership Task Force (SPLTF) Global Issues Subcommittee.

Judy Hamilton is Director of Global Payroll at UKG (Ultimate Kronos Group). Her passion for payroll runs deep as she loves to learn about effective leadership and organizational development to stay aligned with company strategy and ways to develop talent to build a best-in-class global payroll organization at UKG. Hamilton is a member of the American Payroll Association’s (APA) Strategic Payroll Leadership Task Force (SPLTF) Global Issues Subcommittee.

.png?sfvrsn=dc7861e7_0) Deborah Fallon Piacitelli, MBA, CPP, is Global Payroll Compliance Leader at W. L. Gore & Associates. She has been leading the payroll function for more than 20 years for both privately held and publicly held organizations. Piacitelli has substantial experience in compensation, benefits, equity, and accounting. Her current professional initiatives include building harmonized payroll processes across the globe, developing audit-ready payrolls, standardizing and automating repetitive tasks, and developing a high-performance global team.

Deborah Fallon Piacitelli, MBA, CPP, is Global Payroll Compliance Leader at W. L. Gore & Associates. She has been leading the payroll function for more than 20 years for both privately held and publicly held organizations. Piacitelli has substantial experience in compensation, benefits, equity, and accounting. Her current professional initiatives include building harmonized payroll processes across the globe, developing audit-ready payrolls, standardizing and automating repetitive tasks, and developing a high-performance global team.