Known as the cradle of Western civilization, Greece is the birthplace of Western philosophy, democracy, and major scientific and mathematical principles. Situated within Southern and Southeast Europe, the country is made up of a diverse geography including nine geographic regions, numerous islands, and mountainous areas with Mount Olympus being the highest peak at more than 9,000 feet.

Known as the cradle of Western civilization, Greece is the birthplace of Western philosophy, democracy, and major scientific and mathematical principles. Situated within Southern and Southeast Europe, the country is made up of a diverse geography including nine geographic regions, numerous islands, and mountainous areas with Mount Olympus being the highest peak at more than 9,000 feet.

Due to its rich culture and history, Greece’s tourism industry is particularly important and contributes 25% of the nation’s GDP alone. With more than 33 million visitors in 2018, Greece is one of the most visited countries in the world.

Greece was the 10th country to join the European Union (EU) and adopted the Euro as currency in 2001. It is also a member of numerous organizations including NATO, the World Trade Organization (WTO), and the Council of Europe.

Law on Payroll Fees

Each year, the Greek government (in collaboration with the syndicate unions) announces special wage tables for each working position. These tables—which take into account factors such as the employees’ prior working experience, marital status, and certified knowledge—estimate the minimum legal salary that should be paid by employers. Any amount over the lowest legal one can be agreed upon between the employer and the employee. Due to the financial crisis, a significant number of collective agreements have been frozen or not renewed. The general non-salary-related rules of those not renewed or terminated continue to apply, but the ones concerning salary compensation do not. The National General Collective Agreement is the one that states the minimum salary that all employers must abide by.

Throughout the year, 12 salaries are calculated, one for each month. In addition, three more benefits are provided:

- During the Christmas period (paid until December 21 and in value almost equal to a monthly salary)

- During the Easter period (payable until Holy Wednesday and in value equal to half a monthly salary)

- Additional benefit is given when the employee is on his/her annual paid leave (financially equal to half a monthly salary as well)

All salaries and benefits are subject to social insurance and tax deductions.

Social Insurance Foundation

All salaries are subject to social insurance deductions.

There are numerous social insurance foundations, each one responsible for a different working specialty. Every employer and employee needs to be registered in the equivalent social insurance foundation according to the employer’s activities and the employee’s working position.

There are numerous social insurance foundations, each one responsible for a different working specialty. Every employer and employee needs to be registered in the equivalent social insurance foundation according to the employer’s activities and the employee’s working position.

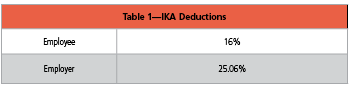

The most common social insurance foundation is IKA (Social Insurance Foundation). Its deductions are calculated on the gross salaries as follows in Table 1.

The above percentages apply when both pension and health deductions are covered by IKA.

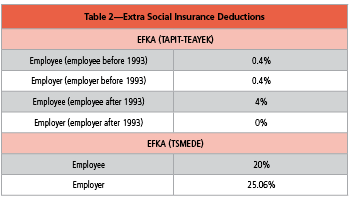

In cases when extra social insurance deductions are required (e.g., such as TEAYEK—the social insurance foundation regarding employees working in stores), the above percentages differ as follows in Table 2.

In cases when extra social insurance deductions are required (e.g., such as TEAYEK—the social insurance foundation regarding employees working in stores), the above percentages differ as follows in Table 2.

All percentages are calculated on the gross salary with a pre-set limit of deductions. All percentages are calculated on the gross salary as long as the salary doesn’t exceed the amount of €6,500.00 per month.

In case of a salary of €7,000.00 per month, for example, the social insurance deductions will be calculated on the ceiling amount of €6,500.00.

The employer is obligated to pay all calculated social insurance deductions to the respective foundation at the end of the following month for the one at hand. In case of delinquency, the payable amount is surcharged with a percentage of 3% for the first month and a percentage of 1% for every additional month.

In addition, the employer is also obliged to submit a statement with the employees’ complete personal, working, and financial data at the end of the following month for the trimester at hand. In case of not meeting the deadline, the employer is fined with a percentage of 10% for the first month of delay and a percentage of 30% for every additional month of delay. All percentages are calculated on the trimester’s total social insurance deductions.

Tax Deductions

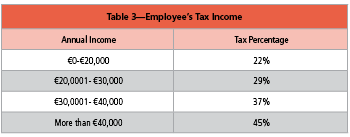

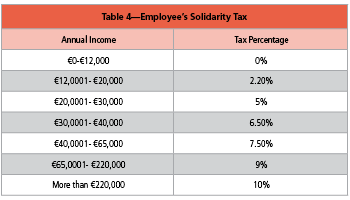

Employees’ salaries are subject to tax deductions. The percentage used to calculate the tax deduction varies according to the employee’s estimated annual income (see Table 3 and Table 4).

Every second month, the employer is obligated to pay the amount of taxes withheld from the employees’ salaries until that time, by submitting the appropriate statement. Furthermore, the employer has to submit an annual statement with the total financial data of the year.

Employment Procedure

For an employment relationship to be established, the employer has to be legally registered in the appropriate social insurance foundation. Once this is done, a hiring document is completed with the employee’s personal information including full name, IRS number, education level, etc., and job information (such as working position and employer data). Both employer and employee sign the document, which must be submitted to the authorities on or before the first day of employment, but never later.

Besides the hiring documents, an employment agreement document must also be concluded and signed by both parties. The agreement’s content can vary. Typically, the agreement states the nature of the employee’s position, the way he/she will be paid, the agreed working hours as well as the period of employment. The period of employment could be infinite or defined as a period of one month to one year. In addition, the working hours can be agreed on as long as they don’t exceed eight hours per day and 40 hours per week.

After each hire, the employer has to submit a personnel chart containing the new employee’s working and personal data on the day of hire. This chart is submitted to the relevant authority. The same personnel chart is also submitted once every year with all the employee’s data.

Overtime

A new circular 40090/Δ1 14024 has been adopted by the authorities of the Labor Insurance Organization regarding overwork and overtime hours.

From 1 September 2018, the announcement of overwork and overtime hours before the commencement is a requirement. Until the amendment, it was mandatory to submit to the Labor office only the overtime hours of the month until the 15th of the following month. The overworking hours (5 hours in total per week) were not subject to announcement to the authorities.

The related Form E8 should be submitted to the authorities (ERGANI-SEPEnet) before the employees start overwork or overtime hours. A submitted Form E8 with a protocol number can be modified if there is a last-minute change of the working schedule before the commencement of it.

The submission date of the E8 form will be considered the date and the time of the successful electronic registration to the Labor office with an automatic delivery to the sender of a unique protocol number.

If the deadline for the submission of the E8 form has elapsed, an electronic submission will not be possible and submission can only be done in hard copy. However, in this case a penalty fee could be calculated.

Payroll Calculation Procedure

Each month, the employees’ working days are counted in order for the payroll to be calculated. Then, all social insurance and tax deductions are calculated. After the payroll procedure is completed, there are several obligatory reports that must be printed. They are as follows:

• Payroll Chart—A list of all the employees and their calculated payrolls

• Social Insurance Funds Chart

• Payslips

Termination of Employment

When an indefinite duration agreement is signed between the employer and the employee, the employer has the right to terminate the employment at any time. The employee is notified of the dismissal and an Employment Termination document is signed by both parties. The document must be submitted to the competent authority within four calendar days. For an employment termination, the employer is obliged to pay the employee a compensation fee, unless the employment period is less than a year. In case of a defined duration agreement, the employer does not have the right to end the employment. The only way to lay off the employee is by compensating him or her for the full agreed salary up to the end of the agreed time of employment.

Notice Periods for Indefinite Contracts

For the first 12 months, an (open-ended) employment contract can be terminated without notice or severance pay. Thereafter, the minimum notice periods are:

- One to two years of employment: one month

- Two to five years of employment: two months

- Five to 10 years of employment: three months

- More than 10 years of employment: four months

When an employee is terminated without a notice, he/she is entitled to full indemnity compensation.

Special Cases

The following categories are protected by law against termination:

- Employees on leave

- Pregnant women—during pregnancy and for one year after birth

- Drug addicts participating in a treatment program

When a defined duration agreement comes to an end, the employee is obliged to leave without any additional compensation. If the defined duration agreement comes to an end and the employer wishes to keep the employee, then the agreement is automatically altered to one of infinite duration of employment.

Fixed-Term Contract

A fixed-term contract cannot exceed three years in total or three renewals. After these specific conditions end, the contract automatically converts into one of indefinite duration.

Leave

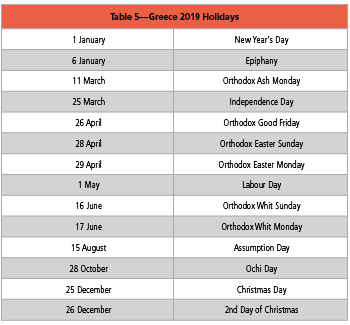

Holidays—During the first calendar year of employment, the employee is entitled to proportionate holiday time. In a five-day employment schedule, the holiday time is calculated as 20 days of holiday for the year of employment, rounding up the result for shorter periods (see Table 5).

Holidays—During the first calendar year of employment, the employee is entitled to proportionate holiday time. In a five-day employment schedule, the holiday time is calculated as 20 days of holiday for the year of employment, rounding up the result for shorter periods (see Table 5).

During the second calendar year (i.e., once 12 months of employment are completed), holiday time increases by one day. Therefore, by the end of the second calendar year, the employee is entitled to 21 days of holiday, assuming a five-day employment schedule.

During the third calendar year, the employee is entitled to receive the full holiday time at any time of the year, even on 1 January. Once 24 months of employment are completed, the employee is entitled to receive 22 days of holiday, assuming a five-day employment schedule.

For employees who have been working for more than 12 years (or for more than 10 years for the same employer), holiday time is calculated on a basis of 25 days. Once 25 years of service are completed, an extra day of holiday is added, and the employee is entitled to receive 26 days.

Sick leave—Sickness should be evidenced by a certificate from a doctor. If the employee has been working for up to four years, he/she can be absent due to sickness for up to one month; for a working time of up to 10 years, the absence can last up to three months; for working time of up to 15 years, the absence can last up to four months; and for a working time of more than 15 years, the absence can last up to six months. Violation of the above time limits may be considered as a tacit rescission of the contract. The employee can claim half of his or her pay for the first three days and full pay for 15 days for the first year in employment or 30 days for any year thereafter, less the amount which the employee received from his or her social security provider.

Maternity leave—Female employees are entitled to 17 weeks of maternity leave, which is broken down into eight weeks (56 days) before the expected date of childbirth and nine weeks (63 days) thereafter. A working mother is entitled (for a period of 30 months as of the end of maternity leave) to either come to work one hour later or depart one hour earlier each day. Alternatively, she can agree with the employer to work for two hours less per day for the first 12 months and one hour less for the next six months.

Alternatively, and subject to the consent of the employer, she can receive approximately three months (105 days) of continuous paid leave. New mothers that are insured with the Social Security Fund may also obtain a special leave for the protection of the child which is paid by the Fund. The mother also has the right to a leave of six months after the end of the 63 days. During that time, her compensation and insurance are only covered by the state. A new mother cannot be terminated for at least 18 months after she has given birth.

Parental leave—New fathers are entitled to two days of special paid leave for each child. They can also make use of the reduced working schedule of the mothers if the latter do not make use of it.

Voting leave—The voting leave for national employees depends on the distance needed to travel to reach the town where the voter is registered. The voting leave is paid.

Parental leave or leave for visiting the child's school—Employees may receive up to four days per calendar year. The specific leave is paid and the parent should provide to the employer a signed document from the school. Parental leave is granted for children from 4 to 18 years old.

Unpaid leave—This type of leave can be provided only with an agreement between the employee and the employer.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Antonis Gavrielides is the Country Manager of Eurofast Greece. He is also acting manager of Eurofast Athens in charge of Eurofast’s activities in the country. Furthermore, he is responsible for the company’s local payroll and employment service line working together with its multinational and local clients ensuring their business needs are met and the clients are fully compliant with all the laws, rules, and regulations in Greece. Gavrielides has prior audit experience working for a Big Four company in Cyprus. Before his appointment to manager in Greece, he held the position of group internal auditor at Eurofast for a number of years. He has completed his studies in the Democritus University of Thrace in Greece and acquired the BSc in Agriculture Development and a Master in Agriculture Economics and Business Management in 2007. In 2013, he completed his studies in University of Cyprus and acquired the MBA qualification.