France, officially the French Republic, is a Western European country bordered by Andorra, Belgium, Germany, Italy, Luxembourg, Monaco, Spain, and Switzerland. By land area, France is the largest country in the European Union. It is divided into 27 administrative regions, has a population of more than 64 million, and about 81 million tourists visit it each year. The countryside is dotted with ancient castles and chateaus, set in stunning natural beauty.

France is home to a number of ethnicities and regional diversity. Social class remains important, as are the regional aspects of cuisine, dialect and language, and tradition. However, the French as a whole are proud of their national identity, and their cuisine is among the finest in the world.

Labor Code

There is a good reason why France is known for having more labor and tax legislation and work-time rules than any other country. One reason for the problem is that many sources affect the relationship between employer and employee. French employees are entitled to a variety of legal protections under the French Labor and Social Security Code, hundreds of country-wide collective agreements governing specific industries, an almost unending variety of collective bargaining agreements (CBAs), and the legal system.

Minimum Wage

French law establishes a minimum wage for all employees, which is raised annually. The current minimum wage is €9.76 per hour or €1,480.27 a month. Employers may establish higher salaries and pay year-end bonuses, and CBAs often provide more generous compensation than the statutory minimum.

Workweek, Work Conditions, Hours of Work

Under French law, the standard workweek for nonmanagement positions is 35 hours, although CBAs may set a different standard. Employees must be granted 11 consecutive hours of rest away from work per day. Non-managerial employees cannot work more than six days per week.

Overtime is allowed provided employees do not work more than 44 hours a week on average over a 12-week period. Under no circumstances are employees, except for senior management, allowed to work more than 48 hours a week or 10 hours a day.

Overtime Work Compensation

The law or applicable CBA sets an annual quota of overtime per employee, usually 220 hours. Workers may not work in excess of this amount. Compensation for overtime is calculated at 125% of the normal hourly wage for the first eight hours worked above the standard workweek and 150% for every additional hour. Higher rates may be stipulated in collective agreements, and employees may opt for compensatory time off in lieu of monetary payment.

Wage Payment

Overlapping laws and regulations make it tough for employees to calculate how much employees must be paid and leads to one of the most complicated pay slips in Europe, dominated by an overwhelming jumble of numbers. Amounts that must show up on the pay slip include not only gross and net wages but also:

- Employer and employee contributions to unemployment and retirement insurance

- Family benefits

- Housing help

- Transportation tax

- The pension plan

Wages must be paid no less than monthly unless the employee’s occupation is classified as seasonal, temporary, intermittent, or work-from-home. Such employees must be paid semimonthly, with no more than 16 days between payments. There is no mandate on when bonuses or other allowances should be paid. However, it is customary for employees to receive a 13th-month bonus at the end of December.

National Holidays

Workers in France are guaranteed 11 paid holidays annually and five weeks of paid vacation. The government guarantees only Labor Day (May 1) as a paid holiday for French employees not covered by CBAs. An employee who is required to work on May 1 is entitled to 200% premium pay. Employees covered by CBAs are entitled to paid holidays each year (see Table 1).

Taxes

France is one of a very few countries not currently operating a tax withholding system on employment income. French income tax generally is not withheld at the source and is paid in arrears. However, that is scheduled to change as of January 1, 2018. The withholding tax will be processed at source through payroll. This will require French companies to put in place processes for tracking and determining the tax treatment of wages and fringe benefits as they currently do for social security purposes. As a result of this responsibility being placed on employers, it is likely that the employer will be deemed to have some liability in cases where underwithholding may have occurred. The transition to the new system raises questions for employees. In 2017, taxpayers will pay the income tax due on their 2016 income. This is the same approach as taken in previous years. In 2015, for instance, French taxpayers paid tax on their 2014 income. However, in 2018, taxpayers will pay the income tax due on their 2018 income via payroll withholding. The provisional payments that would normally be required to be paid in 2018 on income earned in 2017 will not be levied, providing the earnings are in line with the income declared in the previous three years. Income tax will only apply to exceptional income, investments, and capital gains. Income taxes are levied progressively, with tax rates adjusted according to both income and family size. The tax year is the calendar year, Jan. 1 to Dec. 31. Two separate governmental organizations are responsible for taxation policy in France: the Minister of Economy, Finances and Industry, and the Minister for the Budget, Public Accounts, the Civil Service, and State Reform. French residents, as well as foreign nationals residing in France, are liable for domestic income taxes on all worldwide income.

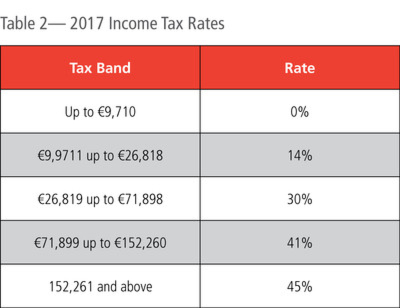

Personal Income Tax Rates

France levies a progressive income tax on employees. Only employees whose annual income exceeds €9,710 are liable for income taxation, beginning at a rate of 14% and rising to 45% for employees making in excess of €152,260 (see Table 2). Individuals with annual incomes between €250,000 and €500,000 must pay an additional 3% income tax, while individuals with incomes in excess of €500,000 must pay an additional 4% tax for a top marginal tax rate of 49%.

Generally, all salaries, wages, and gross proceeds, including benefits in kind, are liable for income taxes. Tax liability on income is determined based on the complete earnings of a household, including the primary earner, his/her spouse (whether in a civil or marital arrangement) and any children or dependents residing in the household. Resident employees are taxed on all wages, salaries, compensation, and other payments received in consideration of employment. Taxable income is calculated by taking the total wages of an employee and deducting social security payments and expenses related to business activities (i.e., payments in kind), as well as applicable tax credits (e.g., child care for young children). The total deductible amount for taxpayers on personal income taxes is capped at 10% of taxable employment income but not to exceed €1,183.

Incentive Plans

The French Labor Code has various incentive plans, including profit-sharing, stock options, and free allotment of shares. Companies with more than 50 employees are required to offer a profit-sharing plan negotiated as part of a CBA with employee representatives. Unless a minimum seniority condition applies, all employees are plan participants. Rights are allocated based on salary, although ceilings may be set to ensure a larger share to lower-paid employees. Employees may choose to invest their funds in company stock or bonds or in accredited investment funds. Depending on plan design, employee access to funds is blocked for three to five years. Amounts credited to the plan are deductible by employers for tax purposes and generally not subject to social security contributions, while for employees profitsharing sums are exempt from income tax.

Stock Plans

Employees who take part in stock option plans and receive gains from these plans are subject to paying income tax and contributions to social taxes. The discount, the first type of gain that can be acquired from a stock option plan, is equal to the difference between the value of a share at the time of offer and the price of a share when it becomes available to the employee. Only discounts considered excessive are taxable in the year in which the option is exercised. The exercise of stock option plans and bonus shares also are taxed on the progressive income tax scale in addition to being subject to a withholding tax of 19% less social security contributions.

Social Insurance Programs

France has a multifaceted social insurance system that is financed by both employee and employer contributions based on total wages. Generally, social insurance contributions are levied on all employees and are collected at source by their employer. All employers, including foreign employers that hire employees eligible for social insurance, must withhold contributions and pay into the social insurance system. Employers may also be responsible for some social welfare payments based on employee salaries. The social benefits are financed by taxes imposed on employee wages, severance pay, termination pay and other employer provided benefits. However, employer direct contributions to the social security system are not counted toward employees’ taxable income.

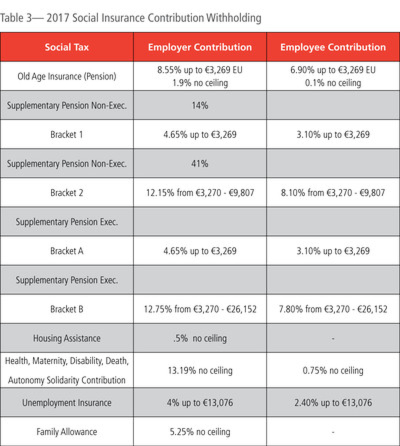

Rates and Thresholds

Employers are responsible for with holding from employee wages social insurance contributions as shown in Table 3.

Payment of taxes, both social and income, are made annually, quarterly, or monthly. Payroll tax obligations between €850 and €999 per employee are reported and paid annually by January 15 after the preceding tax year. Obligations between €1,000 and €4,000 per employee are reported quarterly January 15, April 15, July 15, and October 15. Payroll tax obligations exceeding €4,000 per employee are reported monthly within 15 days of the preceding month.

Employer-Employee Relationship

In France, there are two types of employment contracts. An employee can be employed based on an open-term contract or a fixed-term contract. Employment contracts should be in writing although not required unless the contract is for a fixed term or if a CBA requires that it be in writing. An open-term contract, as the title suggests, is for an indefinite period of time. Any written employment contract should be in French and contain specific information as to identity of the employee and employer, the employee’s duties and responsibilities, duration of the contract, the place of work, the amount of compensation, probationary and notice period if applicable, regular working hours, and paid leave.

Collective Bargaining Agreements

CBAs are sometimes applicable nationally while others are at a localized level and typically relate to a particular sector of the industry or commerce.

Paid Vacation

Employees are entitled to five weeks of annual leave and can accrue leave at a rate of 2.08 days per month for a five-day workweek, up to 2.5 days per month for the 12-month period. At least 12 consecutive days of leave must be taken between May 1 and October 31. The entire country goes on holiday in July and August and many stores and restaurants, except those crammed with tourists, are closed. Sunday work remains an exception and must be authorized either by law, for specific sectors or geographical areas, or by the Labor Administration. An employee is entitled to vacation pay equivalent to 10% of gross compensation earned during the reference period June 1 to May 31. In no case may the employee be paid less than what would have been earned during that vacation period.

Sick Leave

Employees on sick leave receive a daily statutory benefit, and the employer is required to pay the difference between that benefit and the employee’s normal compensation. Employees with at least one year of service are eligible for the statutory sickness allowance after a waiting period of seven days of sick leave. An employee’s absence due to illness suspends the work contract and the employer’s obligation to fully compensate the employee. Social security and employer together provides 90% of salary for at least 30 days computed according to the employee’s net service date. If sick leave lasts longer than 30 days, the employee must undergo a medical examination before returning to work.

Family Leave

Employees are entitled to certain statutory rights linked to private events such as marriage, bereavement, births and adoption, and years of service. An employee may take unpaid family leave of three to five days per year for a sick child, six weeks for adoption of a child abroad, three months to take care of a relative with a terminal illness or severe handicap, one to three years of parental leave to raise a child under three years old, one year to set up a business, up to 11 months of sabbatical leave with the employer’s agreement, and six months to take part in a humanitarian association abroad. Any employee may take paid family leave of three days following the birth or adoption of a child, four days for her/his own wedding, one day for his/her child’s wedding, and one day for the death of a close relative (father, mother, parents-in-law, and siblings). CBAs may provide more generous benefits.

Maternity Leave

Employees are required to take, and employers are required to compensate for, maternity leave. The amount of time designated for such leave is determined based on the following metric: One child, with one child preexisting, grants the mother six weeks of prenatal leave, plus 10 weeks of postnatal leave. One child, with two or more children preexisting, grants the mother eight weeks of prenatal leave, plus 18 weeks of postnatal leave. Twins yield 12 prenatal weeks and 22 postnatal weeks. Triplets yield 24 prenatal weeks and 22 postnatal weeks. Medical complications will yield two additional prenatal weeks and four additional postnatal weeks.

Paternity Leave

Male employees are entitled to paternity leave of 11 days within the four months following a child’s birth, in one block, irrespective of the couple’s marital status. Working fathers can take a mandatory 11 days or 18 days for multiple births, plus three extra days of paid holiday for the birth. Paternity leave, like maternity leave, is paid for by the Social Security Office.

Adoption Leave

On the day of the child’s arrival, a parent is eligible for 10 weeks of leave if one or fewer children reside in the home. If a home has two preexisting children, a parent is eligible for 18 weeks of leave. If two or more children are adopted simultaneously, a parent is eligible for 22 weeks of leave. Additional time between 11 and 18 additional days may be granted for parents who split their leave eligibility between them.

Other Leave

Parental child-rearing unpaid leave may also be taken by either parent for a maximum of three years to raise a child under three years old.

Workers’ Compensation

Benefits are calculated from average daily earnings received during the 15 working days prior to cessation of work. Medical costs are covered as well. If the disability is determined to be permanent, the employee receives either a lump sum or a pension, the type and amount depending on the degree of disability and the worker’s age and earnings.

Termination and Severance Pay

Employees are entitled to one of two types of redundancy payments at termination depending on which is most favorable—statutory redundancy or contractual redundancy. Employees who have worked for an employer for at least one year are entitled to severance pay. This payment is calculated based on the employee’s gross salary in the year preceding termination. Although termination pay is generally subject to income taxes, in specific cases, termination pay can be exempt from income tax as stated in the Labor Code. Employees who are terminated outside of their own fault are entitled to at least two-tenths of a month’s salary per year of service. Employees released from employment for reasons other than gross misconduct after at least one year of service are entitled to compensatory redundancy. This payment is calculated based on a reference wage and depends on the employee’s seniority in the company. The reference wage is one-twelfth of the gross wage, including bonuses, for the preceding 12 months of employment or one-third of the gross compensation for the preceding three months—whichever is more favorable. The compensation cannot be less than one-fifth of the month of salary per year of service, plus two-fifteenths months per year beyond 10 years of service. If the dismissal is triggered by economic reasons, these rates are doubled. Employees are not entitled to this benefit if they are terminated due to their own poor performance or negligence. Employees released from employment for reasons other than gross misconduct after at least one year of service are entitled to compensatory redundancy. This payment is calculated based on a reference wage and depends on the employee’s seniority in the company. An employee can only be dismissed in very specific circumstances and after the completion of a regulated process. French workers also receive compensatory coverage for involuntary termination.

Web Resources

For more information, see the following web resources:

Official French Administration

Ministry of Finance, Economy, and Industry

France Business Etiquette, Culture, and Manners