Malaysia is a Southeast Asian country separated into two regions by the South China Sea— Peninsular Malaysia and East Malaysia. With a population of more than 32 million, it is the 44th most populous country in the world and consists of multi-ethnic and multi-cultural people, including Malay, Malaysian Chinese, Malaysian Indians, and indigenous peoples.

Kuala Lumpur, the capital of Malaysia, has long been one of Southeast Asia’s main hubs for business and for investors looking to take advantage of the region’s rapid growth. In recent times, Malaysian authorities have made a pronounced effort to encourage companies to employ local staff.

Within the local market, a number of specialists are available—both expats and nationals. However, some businesses that operate in the region have found it difficult to implement recruitment strategies to attract the right talent. In turn, they have also struggled to employ people compliantly and to secure the relevant work permits.

If your business is considering operating or starting a project in Malaysia, here are some helpful tips to get you started with the tax process in Malaysia.

Work Permits

Before you launch a business in Malaysia, it is important to know about the different employee work permits legally required to operate. For all foreign workers, you will need to sponsor them through your local entity or get a company with a local entity to sponsor your workers.

Once your workers have been sponsored, they will be able to apply for a work permit, also known as an employment pass. Work permits generally last between six months and five years, depending on the duration of the work contract and the type of visa. Application forms are mostly in Bahasa Malaysia language.

The Malaysian government issues three different types of work permits:

- Professional Visit Pass—The Professional Visit Pass is issued to foreigners employed by an overseas company but working with a company in Malaysia. This pass is normally appropriate for technical experts and trainees. The Professional Visit Pass is normally valid for short periods of around six months to a year.

- Temporary Employment Pass—A Temporary Employment Pass is for unskilled or semi-skilled workers in the manufacturing, agriculture, construction, and services fields. The length of this pass is dependent on the length of the contract and can vary from three months to two years. Before the work permit can be issued, quota approval needs to be granted from the Local Centre of Approval, Ministry of Foreign Affairs.

- Employment Pass—An Employment Pass applies to those who want to work in Malaysia with specific skills, generally in technical or managerial positions. It is issued for a minimum period of two years. Before the Employment Pass can be issued, the employment of the foreign worker must be approved by the Expatriate Committee or the relevant regulatory agency.

To complicate this further, a myriad of different types of work permit are needed for the different regions of Malaysia (West Malaysia, Kemamman, Sarawak, Sabah, and Labuan). These additional regional permits may still be required even for Malaysian nationals.

Generally, the following documents are required when applying for a work permit for Malaysia:

- Employment contract/Letter of Appointment

- Original receipts of payment of application

- Copy of employee’s passport (all pages, including cover)

- Passport photos on blue background

- Employee’s CV (résumé)

- Copy of education certificates and qualifications

- Medical report from the employee’s country of origin approved by the Malaysian Ministry of Health (dependent on industry)

If supporting documents are not in English or Malay, they may need to be attested. Taking into account the collecting of relevant documents, the application process and liaising with the relevant government agencies in Malaysia, the process of application to approval can take between one and two months.

Furthermore, if your business requires workers to travel within Malaysia, you may need to apply for more than one work permit. Malaysia has four main work permit regions:

- Peninsular/West Malaysia (i.e., Kuala Lumpur)

- Labuan

- Sabah

- Sarawak

The four different regions have different processing times, and different documentation may be required.

Tax for Expats

The tax year in Malaysia runs from 1 January to 31 December. The tax rate for non-residents is currently a flat 30%, whereas the tax rate for residents is on a sliding scale from 0% to 30%, depending on which income grouping they fall into. Typically, for an average paid worker residence tax is at 14%.

Some businesses will pay the tax on behalf of their staff, whereas others ask their workers to submit the payment themselves. There is also a fixed monthly SOCSO (Social Security Organization) fee for non-residents of 49.4 Malaysian Ringgit (RM) per month, which is similar to a national insurance fee.

When beginning work in Malaysia, you will need to register your employees with a tax number. To do this, you will need the following information from your employees:

- A copy of the latest salary statement (EA/EC form) or latest salary slip

- A copy of identification documents

- A copy of marriage certification (if applicable)

Tax for Residents

If you have workers rotating in and out of Malaysia, they may still qualify for a residency tax rate providing they fit into one of the following criteria:

- If they have been in Malaysia for 182 days per calendar year

- If they have been in Malaysia for fewer than 182 days in a calendar year but have still been in the country for 182 consecutive days, linked to days from the year immediately preceding that calendar year

- If they have been in Malaysia for at least 90 days in a calendar year for three of the four

preceding years

Once they are classified as a resident, if they are employed in Malaysia for fewer than 60 days per year, they are not liable to pay income tax. People who would be exempt from income tax include retired people over the age of 55, those receiving a pension from their employment in Malaysia, and those who are living off bank interest.

A common myth many contractors believe is that they can benefit from this by qualifying as a resident from day one. However, they will automatically be classified as a non-resident for their first six months in Malaysia and be liable to pay tax at 30% from their first day of work.

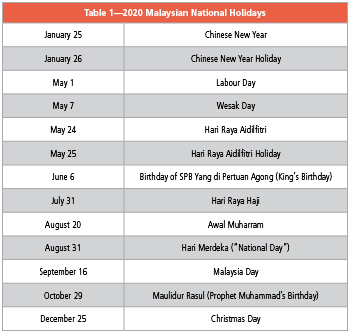

A listing of all national holidays for workers can be found in Table 1.

Tax Return Form

All workers in Malaysia are also required to file an income tax return each year reporting the income they have received. Tax returns must be filed before 30 April of the following year. The government agency that is responsible for tax in Malaysia is the Inland Revenue Board of Malaysia (IRBM). If this form is not completed by the employer or worker, the Malaysian government may issue a fine.

This tax return form can be completed online, or you can appoint a payroll partner to complete it on your worker’s behalf. The following information is needed:

- The worker’s income tax number

- A copy of the worker’s latest salary statement (EA/EC Form) or latest salary slip

- Personal identification number (PIN) for online system (if this is your first time paying taxes in Malaysia, you will need to register with the IRB and obtain your PIN)

All staff employees have to complete tax clearance and tax filing at year-end. The financial year is from 1 January-31 December. Tax filing must be completed by April.

International Payroll Partner

The Malaysian tax and payroll process can often be complex for foreign businesses, so it is common for businesses to partner with a payroll service company to manage the process on their behalf.

More information can be found in our “Malaysia Payroll and Tax Guide.”

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Ben Harden joined Leap29 in 2005. As a Global Operations Manager, he manages Leap29’s Workforce Management division, including payroll, mobility support, and workforce solutions.

Account Manager Rob Day joined Leap29 in 2008 and looks after the workforce management for one of Leap29’s major clients, including the onboarding and payroll of candidates across North America, Europe, the Middle East, and Southeast Asia.