When organizations have their operations based out of a single country or a handful of countries, the complexities that they face while managing HR or payroll might not be as significant as compared to managing the same processes in multiple countries across geographic regions.

When organizations have their operations based out of a single country or a handful of countries, the complexities that they face while managing HR or payroll might not be as significant as compared to managing the same processes in multiple countries across geographic regions.

As businesses expand to new geographies, payroll teams often opt to deal with multiple payroll service providers or various payroll technologies. The need to address local taxes, legal compliance, pay cycles, expats, and shadow payroll creeps in. Diverse delivery models also enter the landscape along with the requirement for help desk support in multiple languages.

Eventually, an organization as a whole begins to experience incorrect payroll, delayed disbursements, increased payroll costs, and data privacy risks resulting in an overall poor payroll experience. Suddenly, the desire to be the best employer in the business regions in which they operate starts to look like a colossal mission, while the need to centralize control increases.

Continual improvement is a hallmark of a successful business. Progressive companies identify ways to improve the overall quality of their work. This includes maintaining happy and satisfied employees. One of the most effective ways to maintain a good relationship is through the delivery of their wages. This includes on-time and accurate pay, responsive query resolution, easy tax-filing, an easy-to-use self-service system, etc. Organizations can live up to their employees’ expectations through a better system. Happy and satisfied employees are better engaged. Compared to their larger counterparts, smaller organizations generally experience fewer complications. However, that does not mean some common variables can be overlooked among organizations of all sizes in the way payroll is managed. The following includes a few key variables that impact the overall payroll experience and their significance among small and large organizations.

Technology

Processing payroll in three or four countries may not seem too complex for organizations. Their upstream processes to initiate a payroll cycle and enter required payroll information are relatively less dependent on diverse systems. They could choose to utilize the power of spreadsheets, combined with a robust regional payroll system, and obtain desired outputs. However, for larger global organizations there could be several different systems in which to input payroll information. They might include data sets from a human resources information system (HRIS), global mobility system, and/or time and attendance systems. Some of these might vary from country to country. Companies often seek a provider that can help integrate payroll with these systems and automate the input process.

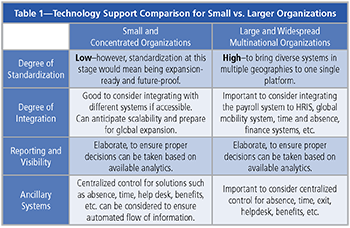

While processing huge data sets, it helps to eliminate errors during input processing and to streamline the entire process. Therefore, the requirement for support from technology during the granular steps of actual payroll processing is far more demanding for a larger organization (see Table 1).

Table 1—Technology Support Comparison for Small vs. Larger Organizations

Looking at downstream processes, larger organizations tend to look for a technologically superior solution. They seek a system capable of supporting them in areas such as help desk, reporting and analytics, and tax filing evenly throughout the countries in which they are issuing a payroll. Without a doubt, smaller organizations must also take care of these post-payroll processes. But because this is for fewer countries, they do not necessarily depend heavily on technology. They have every option of completing them either locally with an expert or, in some cases, within the organizations themselves. However, by ensuring that payroll is supported seamlessly by a single system, from upstream to processing to downstream, organizations can achieve accurate payroll and exceptional user experience.

Process and Data Flow

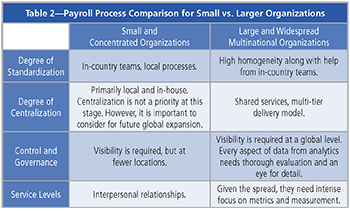

Irrespective of their size, organizations should consider having a single, well-defined payroll process. The solution should guarantee accurate, on-time payroll for the entire workforce. A larger organization also needs to find a solution that can streamline its process across all regions and locations (see Table 2). This must be in unison with keeping the organization compliant to local laws and statutory requirements.

Organizations must thoroughly define:

- Input sources, support for multiple input methods

- Data completeness and accuracy

- Multi-level input and processed data validators

- Controls pre- and post-payroll processing

- Draft run improvisation to accuracy

- Treasury management and general ledger posting

- Pay slips and statutory filing

- Payroll helpdesk support

- Payroll compliance management

Table 2—Payroll Process Comparison for Small vs. Larger Organizations

The intensity of repercussions, if not handled well in larger organizations, is multifold owing to its geographical presence and thereby making a suitable business case for them to outsource these tasks to a provider that can support them globally while being as local as possible.

Any organization, irrespective of its size or its payroll platform, could face repercussions if the payroll processes and flow of data among solutions are not adequately defined. A detailed study encompassing the following should be done prior to starting any payroll engagement:

- Identify upcoming or on-the-fly HR projects that might affect the payroll project

- Define all systems from where the payroll system will receive data as inputs such as:

- HRIS

- Absence and time system

- Global mobility system

- Finance system

- Benefits/compensation

- Define and understand country-specific pay elements, paystubs, pay registers

- Identify collective bargaining agreements that could be applicable in some countries

- Understand payroll policies and country-/geo-specific compliance requirements with a framework to ensure alerts and notifications of changes in compliance rules.

Reporting and Analytics

A global payroll service provider should be able to allow complete control to an organization’s managers, its finance and payroll teams, and provide all users a uniform payroll experience. Besides, reporting and analytics are important instruments for an organization’s stakeholders to be able to take appropriate decisions at an appropriate time. Providing an overall view of the matrices is as important as having the ability to deep-dive into calendar reports viewed for every country. This may not be too complicated in organizations with a lesser geographic presence. But for larger organizations, most users in different countries often have a dissimilar opinion of how they look at the organization's HR and payroll.

Similarly, service level agreements (SLAs) are an important measure of performance. However, larger organizations tend to place greater emphasis on them in order to facilitate single-window monitoring of multi-country payroll reports and dashboards.

Support and Post-Payroll

Support throughout and post-payroll is an important variable. Without adequate support to users (employees or payroll processing teams) and a defined post-payroll process, a payroll in itself is incomplete.

Although a huge task, an organization concentrated in specific geography may have the liberty to ensure these processes are addressed with the help of an in-house team. It is, however, more important for large and widespread multinational organizations. The enormity of support queries arising from payroll may be overwhelming, given the number of users in the organization and the number of countries in which the organization operates. Due to the presence of different languages, different time zones, etc. it is, therefore, easier when the provider can help the organization in such a way that they can support the users in their local languages and are reliably available when users have questions.

A payroll provider should be able to provide real-time, on-the-ground support for all compliance-related activities and should be able to report them accurately. Countries such as France, Brazil, Italy, China, or Japan have multiple levels of taxation. A single payroll team operating from one country would find it impossible to track the ever-changing legislation. Falling out of compliance is a potential risk to an organization’s security and finances. At the same time, the provider should be equally able to effectively support the organization in tax audits and reviews.

In Conclusion

Some of the most important aspects of payroll differ significantly from small to large businesses. While small businesses could opt to cross-utilize resources to manage payroll, they are more flexible and generally quicker to adopt a unified solution to perform multiple tasks. Large organizations, on the other hand, operate under a working model with defined responsibilities among payroll associates with regard to their role in the payroll process. They require better support from the chosen provider that can deliver a global service while staying as local as required.

A common solution for organizations of all sizes is to standardize to a common platform. Small, concentrated organizations benefit from this not just by having one platform but also to be ready to scale up in the future with centralized control. Large, globally spread out multinational companies additionally benefit by bringing a seamless payroll and compliance experience for their employees globally, having a holistic global/regional view of payroll and compliance.

The goal is to increase payroll fluidity to minimize pressure. Fluidity here would be synonymous to adopting a single platform payroll solution, irrespective of the geographical presence. A system that can connect to any existing HR system for inputs can support multiple languages and fluid downstream capabilities. When choosing a payroll provider, organizations small or large should aim to find a solution that helps them do payroll more efficiently, effectively, conveniently, and affordably.

A capable system would be able to utilize all available resources to their fullest potential by collectively introducing processes to address recurrent tasks with consistency. Maintaining a fluid payroll system will ensure less pressure on the organization and provide a unique singular experience to its users.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Diganta Gogoi is a Client Partner at Neeyamo who has extensive experience in global payroll service and delivery. His expertise has helped global organizations strategically find a solution that meets their HR requirements. He is primarily responsible for devising Neeyamo’s growth strategies for the Europe region. A native of northeastern India, Gogoi started his career in HR and payroll with globally established organizations. Since then, he has supported various subject matter experts and global organizations in offering HR solutions that transcend borders.