The Indian government has become progressively stricter about what is considered income under tax  law and who must file an income tax return. In particular, companies required to withhold taxes, and individuals or companies in receipt of income, have found themselves subject to increasingly stringent withholding rules. The topic of withholding taxes can be problematic both for the payer (whether resident or nonresident) and for the recipient of the income (whether resident or nonresident).

law and who must file an income tax return. In particular, companies required to withhold taxes, and individuals or companies in receipt of income, have found themselves subject to increasingly stringent withholding rules. The topic of withholding taxes can be problematic both for the payer (whether resident or nonresident) and for the recipient of the income (whether resident or nonresident).

Payer

Indian companies and nonresident companies with India-sourced income (“payers”) must withhold taxes on any payment to another party that is subject to withholding tax in India. If the payer believes that only a portion of the amount is subject to tax, the payer can apply to the assessing officer of the Tax Authority to determine the appropriate portion that is subject to tax.

However, if the payer fails to comply with the withholding tax requirements, the payer can be assessed  interest and penalties. Some of the circumstances in which companies are required to withhold tax from payments to nonresidents are:

interest and penalties. Some of the circumstances in which companies are required to withhold tax from payments to nonresidents are:

- Nonresidents with a permanent establishment in India

- Nonresidents wishing to claim a refund of tax withheld in India

- Nonresident investors (i.e., foreign institutional investors) earning India-source income such as interest and capital gains

- Nonresidents receiving India-source royalties or fees for technical services

- Nonresidents deriving capital gains from the sale or transfer of Indian assets

- Nonresidents engaged in offshore transactions involving a transfer of shares in an Indian company

- Nonresidents earning any kind of India-source income

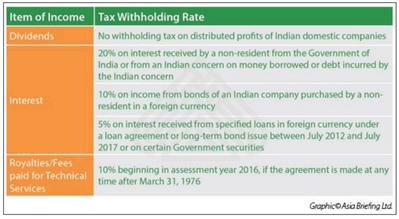

In each of these circumstances, companies making payments to nonresidents must withhold income tax from the payment either at the time when the income is credited to the account of the payee or at the time of payment in cash, check, or bank draft, whichever is earlier. The Income Tax Act provides the rates of withholding. In general, the current withholding rates are listed in the table below.

Payee

Nonresident individuals and companies are subject to withholding tax on income that arises or accrues or is deemed to arise or accrue in India, or income that is received or deemed to be received in India. Individuals and companies who receive India-sourced income are considered to be payees. All of the circumstances outlined above which require payers to withhold tax also require the nonresident payee to file an Indian tax return.

It is important to note that the payee must file an Indian tax return regardless of whether the payee is entitled to the benefits of a tax treaty and/or has zero tax liability. In the past, the Tax Authority did not require return filing if the concerned income was not taxable in India. However, the burden is now on the payee to demonstrate to the Tax Authority that it is eligible for treaty benefits, and in most cases, this will require filing a return. Some payees have the misguided impression that they only have to file a return if they have a permanent establishment in India; but, even if the India-sourced income is exempt from tax under a tax treaty, or if the Indian payer has already withheld the tax, the payee must still file an Indian income tax return.

Nonresidents can choose to be governed by Indian tax law or by the provisions of an applicable tax treaty. In order to be governed by an applicable tax treaty, nonresidents must file a Form 13, “Application by a person for a certificate for no deduction/collection of tax or deduction/collection of tax at a lower rate” if seeking approval for withholding at lower rates. Form 15C or 15D, “Application by Person for Receipt of Sums Other Than Interest and Dividends without Deducting Tax,” is required if seeking authorization for receipt of other sums without tax withholding. Before filing an application for reduced or zero tax withholding, the payee must apply for and receive a permanent account number (PAN) from the Indian government.

Observations

As the Indian Government applies more stringent enforcement of withholding rules, foreign companies who are subject to withholding should obtain a PAN in order to reduce the withholding tax burden on payments they receive from their Indian customers. If the payee does not provide a PAN to the payer, the payer must withhold 20% rather than the 10%-15% rate that applies under most treaties. Additionally, payees should know that the Indian Finance Ministry actively seeks to identify PAN holders who have not filed income tax returns in order to ensure that they are complying with Indian tax law.

Since its establishment in 1992, Dezan Shira & Associates has been guiding American investors through Asia’s complex regulatory environment and assisting them with all aspects of legal, accounting, tax, internal control, HR, payroll and audit matters. As a full-service consultancy with operational offices across China, Hong Kong, India and emerging ASEAN, including liaison offices in Boston and Waltham specifically established to support our American clients, we are your reliable partner for business expansion in Asia and beyond. For inquiries, please email us at [email protected]. Further information about our firm and how we can support American investors in Asia, please visit our North American Desk.