Montenegro, meaning “black mountain,” is a country of about 650,000 people located in Southeastern Europe. It is bordered by Albania, Bosnia and Herzegovina, Croatia, Serbia, and the Adriatic Sea, with Italy on the other side. A former republic of Yugoslavia, Montenegro later joined in federation with Serbia until 2006, when it became an independent nation.

Montenegro is transitioning to a market economy, and most of its state-owned companies have been privatized, including 100% of its banking, telecommunications, and oil distribution systems. The country joined the World Bank and International Monetary Fund in 2007 and the World Trade Organization (WTO) in 2011. In 2017, Montenegro becomes a member of NATO. It is in negotiations to join the European Union.

The country has a Mediterranean climate, with hot, dry summers and cold winters that bring heavy inland snowfall.

Applicable Laws

Applicable Laws

The main laws that regulate employment include:

- Labor Law

- Law on Pension and Health Insurance

- The Law on Salaries of Civil Servants and State Employees

- Law on Contributions of Mandatory Social Insurance

- Law on Personal Income Tax

- Collective agreements between labor unions and the government

Social Insurance Foundation

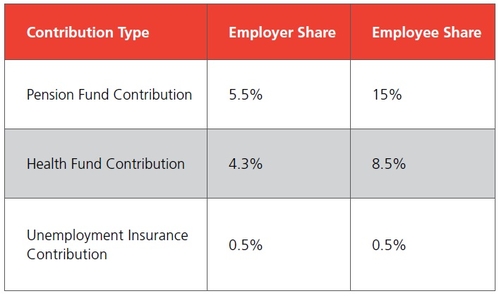

Social insurance contribution rates are shown in Table 1.

The basic personal income tax rate is 9%, and there is a surtax of up to 15% on the individual income tax, which is withheld from employees’ salaries.

These rates apply to the gross monthly salary. For the period 2013-2015, the government implemented the personal income tax surtax related only to salaries. According to it, gross income above EUR 720.00 per month is taxed at a rate of 13%. In 2016,the additional personal income tax rate is 11%.

Other employer obligations:

- January 31 of the current year is the deadline for submitting the Report on Paid Gross Salaries, Taxes and Contributions for Employee (OPD2). Reports must be submitted for each employee and include information on total amount paid for gross salaries as well as mandatory pension and health insurance during the previous year.

- January 31 of the current year is the deadline for submitting the Report on Paid Gross Salaries, Taxes and Contributions for Employer (OPD3). Reports must be submitted for the employer and include information on the total amount paid for gross salaries, mandatory pension, and health insurance during the previous year for all employees.

Personal Income Tax

Montenegro’s personal income tax rate is 9%. It is imposed on the full net salary amount.

Employment Procedure

The employment contract is signed in the local language prior to the employee assuming work responsibilities. If the employer fails to sign an employment contract with the employee in written form prior to assuming work responsibilities, it is considered that the employee has established an employment relationship for an unlimited duration of time as of the date of assuming work responsibilities, should the employee accept that employment. In this case, the employer must sign an employment contract for an unlimited period of time within three days from the first day the employee assumes work responsibilities.

Montenegrin Labor Law recognizes three types of employment:

1. Undefined duration of employment

2. Employment for defined period of time

3. Short-term employment for occasional engagements such as consultancy

Normal working hours are eight hours a day or 40 hours per week. An employee can conclude employment contracts with more than one employer and thus make a full-time work engagement. An employment contract can be concluded for work engagements with less than full time, but not less than one-fourth (10 hours) of the full-time hours.

Protection of Employment

Protection of Employment

Holidays: In each calendar year, the employee has the right to an annual leave as set by the collective agreement or the employment contract, but the number of total leave days should not be less than 20 working days. An employee has the right to be fully paid during official holidays set by law (see Table 2).

Illness: Medical doctors must recommend sick leave. The employer has an obligation to pay 70% of the employee’s gross salary for up to 60 days of sick leave. For sick leave that lasts longer than 60 days, the Health Fund covers 70% of the gross salary.

Maternity: Women have the right to be absent for 365 days on maternity leave. Maternity leave starts four weeks before the delivery date. The employer is obligated to pay the total amount of the employee’s last salary during the maternity leave. In the first 10 days after the payment of the monthly salary, the employer has to submit the request form for reimbursement. Reimbursement for an employee on maternity leave is limited to two average national salaries.

Payroll Calculation Procedure

Employee monthly net (or gross) salary is determined inthe employment contract that has to be signed by the employee and the employer. If the employee worked overtime, the employer is obligated to recalculate the salary on a monthly level. Each month’s obligatory reports include:

- Payroll slip

- Report to Tax Office on monthly amount of tax and contributions

- Report to Municipal Office with dataon paid taxes and surtax

Web Resources

For more information, visit the following web resources:

CIA The World Factbook—Montenegro

https://www.cia.gov/library/publications/the-world-factbook/geos/mj.html

Department of Public Revenues

www.poreskauprava.gov.me/en/administration

Government of Montenegro

www.gov.me/en/homepage

The Law Library of Congress—Montenegro

www.loc.gov/law/help/guide/nations/montenegro.php