The robots are coming to your payroll department, but don’t be afraid—they could make your life far easier. This emerging technology, called robotic process automation (RPA), can drive new efficiencies into payroll by revolutionizing the way you deal with everyday tasks.

Don’t be fooled by the name. RPA doesn’t involve any hardware robots. Think of it as a software-based artificial intelligence co-worker, shadowing payroll operatives, so it can learn how they perform mundane tasks and handle them automatically.

According to EY, over 90% of payroll tasks are highly repetitive. It believes that RPA can automate at least two-thirds of them, cutting costs and saving time.

These tasks are the tedious manual operations that payroll workers grapple with each day as they collect information from many other business units in a myriad of formats. They must manually validate that information to ensure that it is accurate and complete and enter it into other applications. This involves reading, processing and sending emails, pulling data from Word documents and Excel spreadsheets, and filling out electronic forms.

These manual tasks are highly error-prone. It’s all too easy to copy and paste data between the wrong fields or mistype a piece of information. The more tasks there are, the more likely errors are to creep in.

RPA automates these tasks, dealing with all the systems that one would normally deal with, extracting, processing, and entering data on their behalf. It can do this because the information payroll workers handle is highly structured.

Data may arrive in many different formats, but it is often tabulated into cells and fields, and payroll workers handle it in accordance with predefined rules. This means RPA is very good at handling that data because it knows what to expect.

Microsoft Office macros and scripted programs have enabled companies to automate tasks for years, but those required programming skills. The automation also tended to work for just one program at a time. RPA works across all the systems payroll touches without you having to change any underlying code. It can make payroll more efficient while offsetting expensive software development.

The Benefits of RPA

Those efficiencies translate into impressive figures. EY believes it can cut the time taken for a task from two hours to three minutes once completed forms are received. It also estimates a 50% to 70% cost reduction over manual processes.

Other benefits from payroll systems include consistency. While it’s human nature to make mistakes, machines tirelessly apply the same rules every time, which minimizes the opportunity for errors.

Software operations also create an audit trail that shows administrators exactly what it did to information at every step along the way, which is useful for compliance.

Another aspect of RPA that helps with compliance is data protection. Payroll workers deal with some of the most sensitive data in a company. Manually downloading, copying, and pasting it risks valuable regulated information ending up in the wrong places, littered across desktop machines where administrators can’t track it. RPA can be configured to handle this data centrally, avoiding that problem.

Examples of RPA in Payroll

RPA can help payroll functions in multiple ways, especially when it comes to the core task of payroll batch processing. It can make life easier for operators by creating and importing batches into payroll systems overnight, ready for when they start the day.

RPA can also simplify post-processing tasks. For example, a department might normally generate PDF copies of pay slips and manually upload them to the HR system after a payroll run. Instead, an RPA agent could automatically fill out those slips in the HR system as they are processed, saving human operators time and effort.

Four Applications for RPA in a Payroll Environment

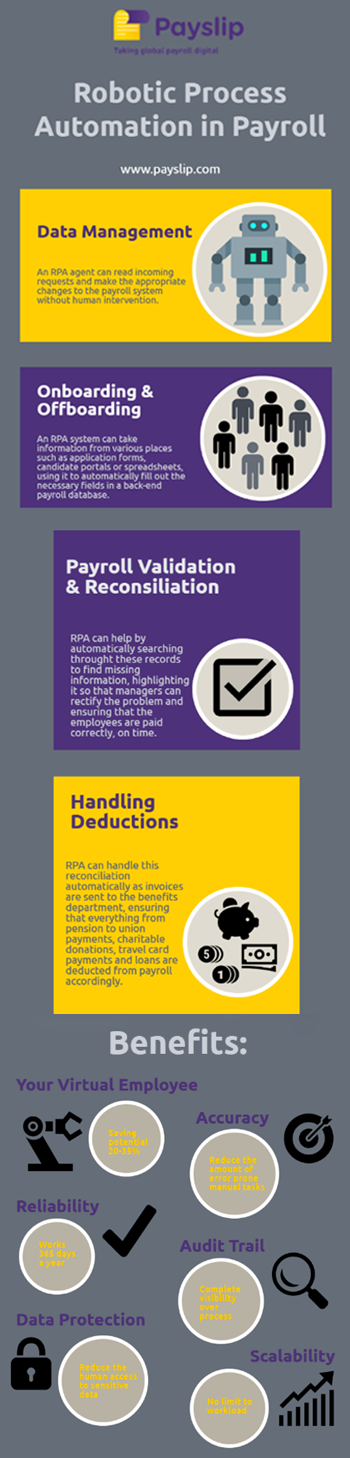

- Data management

Keeping data current is an important part of the payroll process. Long-term data such as names, addresses, bank account details, and job titles can all change, as can salary and benefits details. Other alterations or additions to employee data are more temporary, such as bonuses, expenses, and overtime arrangements. Sometimes, it is necessary to add information that is missing from an employee’s record altogether and communicate that to the payroll system.

These changes have typically been manual, frequently involving emailed requests. An RPA agent can read incoming requests and make the appropriate changes to the payroll system without human intervention.

- Onboarding and offboarding

For many companies, the employee onboarding process is the last thing to be automated. Payroll workers must often enter basic details such as names and addresses that already exist elsewhere in digital forms. RPA can help to streamline this process.

An RPA system can take information from various places such as application forms, candidate portals, or spreadsheets, using it to automatically fill out the necessary fields in a back-end payroll database.

The same goes for handling job leavers. RPA can minimize the work involved by automatically updating the leaver’s status across different software systems.

- Payroll validation and reconciliation

Discrepancies in payroll records can lead to legitimate mistakes in which companies undercompensate employees for their time. Even worse is the opportunity for fraud as deliberately falsified entries lead to overpayments. Combing through records, including hourly time entries and employee expense claims, looking for these differences is a time-consuming and error-prone process.

RPA can help by automatically searching through these records to find missing information, highlighting it so that managers can rectify the problem and ensuring employees are paid correctly, on time. It can also check for disparities in hours worked vs. hours budgeted, and can find anomalous expense claims by scanning for values that fall outside predefined thresholds.

When these automated reconciliation and verification processes raise red flags, the RPA system can automatically notify the managers responsible so they can resolve the issue.

Beyond these everyday verifications, RPA can also regularly take care of tasks that might otherwise be left until the end of the quarter such as tax reconciliation. This keeps the payroll function ahead of the curve and avoids work accumulating over time.

- Handling deductions

Handling deductions for each employee can tie up payroll staff for hours as they attempt to reconcile vendor invoices against lists of employees and their entitlements. RPA can handle this reconciliation automatically as invoices are sent to the benefits department, ensuring everything from pension to union payments, charitable donations, travel card payments, and loans are deducted from payroll accordingly.

Managing the Risks

RPA can be a valuable tool for payroll departments, but it comes with challenges. One potential stumbling block is that some payroll departments may use complex processes they have not properly documented. Companies trying to automate these could bog themselves down in confusion.

RPA can be a valuable tool for payroll departments, but it comes with challenges. One potential stumbling block is that some payroll departments may use complex processes they have not properly documented. Companies trying to automate these could bog themselves down in confusion.

Ensure that all payroll workflows are well understood with clear, documented rules. At the very least, try to find one discrete manual process that meets this requirement and can be automated without relying on the other processes.

When you can show a return on investment from automating this one process, you can expand it to others. After automating enough of them, you can look at end-to-end process transformation in which multiple automated payroll tasks rely upon each other.

The Cost of RPA

Another risk is underestimating the cost of RPA. Be aware of the costs involved and do your return on investment projections before you begin. You’ll face licensing fees for the software, along with the initial costs of developing the bots to perform your automated tasks. RPA may be simpler and cheaper than redeveloping all of your software, but it still takes some setup work.

With some thoughtful preparation and planning, RPA can breathe new life into your payroll process, creating fast and consistent workflows. It needn’t replace your existing payroll software, and neither should it replace your payroll employees. Instead, it frees them up to deal with non-standard requests that take time to address. It also enables them to think more strategically, analyzing payroll data for valuable insights that could help to refine operations still further.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Aoife Flynn is Chief Marketing Officer, Payslip. Flynn has more than 15 years of experience in marketing and international business. Previously, Flynn worked for Taxback.com across both B2B and B2C markets in the United States, U.K., and Ireland. While working for Taxback.com, Flynn was responsible for developing and growing its first SaaS product, a U.S. nonresident tax preparation software for international students studying in the United States. Flynn joined Payslip in early 2017 and leads all marketing-related activities including digital and traditional marketing, public relations, and events. Flynn attained a bachelor’s degree in marketing management at the Institute of Technology and undertook further studies in digital marketing at the Dublin Institute of Technology in 2016.