Many organizations treat payroll compliance as only a local country problem, but they need to gain control over their compliance processes globally, two Celergo Global Payroll experts explained in the GPMI webinar “Global Compliance: It’s Now About the Money, the Data, and the Automation.”

“When most people think about compliance, really what they’re thinking about is risk,” said Michele Honomichl, Celergo’s Founder, Executive Chairman, and Chief Strategy Officer. “The goal is to determine where your risks are in your organization and how you can mitigate those risks to keep yourself compliant globally and keep your penalties and other such business blockers down.”

She and Kira Rubiano, Senior Partner Management Specialist for Celergo, led their audience through an overview of the factors that take global payroll beyond the local country—global data privacy, global money movement compliance, global anti-bribery regulations, and automated compliance.

“It’s not just compliance to a particular country,” Honomichl said. “It is across a region or across the entire globe.”

Starting with data privacy, they stressed that companies managing any kind of European data must comply with the EU Data Directive, which states that personal data should not be processed at all unless certain conditions are met. It is based on seven principles:

Starting with data privacy, they stressed that companies managing any kind of European data must comply with the EU Data Directive, which states that personal data should not be processed at all unless certain conditions are met. It is based on seven principles:

- Notice

- Purpose

- Consent

- Security

- Disclosure

- Access

- Accountability

“How do you ensure compliance?” Honomichl asked. ”Follow the seven principles. If you do that, you’re in good shape. And you have to be able to prove that you followed them, not just in policy but also in process.”

She also emphasized encryption as a way to ensure data is secure from point to point across all levels.

“From a payroll perspective, we really consider any data that the employee has as confidential,” she said.

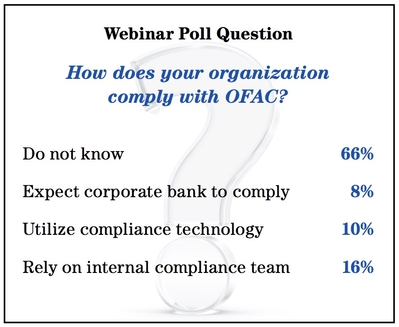

She also touched on the U.S.-EU Privacy Shield, which replaced Safe Harbor with stronger controls, and the Office of Foreign Assets Control (OFAC), a unit of the U.S. Treasury Department. Companies doing business globally must ensure that global personnel and foreign companies they conduct business with are not on OFAC's Specially Designated Nationals and Blocked Persons List.

Rubiano led the discussion on bribery, explaining that in many parts of the world bribery is commonplace and seen as an acceptable, albeit illegal, part of conducting business.

“That being said, local practices should not dictate or override global compliance standards,” she said, pointing to the U.S. Foreign Corrupt Practices Act and the UK Anti-Bribery Act as examples.

She also talked about a global shift into leveraging technology as governments see the need to streamline tax reporting and filing, receive data in real time, and reduce red tape and manual processes.

“We really want you to walk away today thinking about global accountability and global visibility, not just knowing your organization is locally compliant and locally being held accountable,” she said in conclusion. “Global compliance cannot be overlooked, and it often is.”

Nicole Smith, GPMI Director of Instructional Design and Learning Development, hosted the webinar, which is available On Demand.