Global organizations are facing critical challenges managing a rapidly expanding mobile workforce while under increasing pressure to maintain accurate withholding and reporting in countries throughout the world.

As organizations continue to expand operations globally, the need for the right skilled worker has never been greater, and companies are finding a limited availability of locally skilled workers to support increasing operations. More and more organizations are deploying employees on international assignment to perform services in countries throughout the world. With this expansion, local regulatory agencies are giving greater scrutiny to ensuring that the required withholding and taxation of employee compensation is reported accurately and timely. In some circumstances, including cases where a country requires reporting for its citizens on a worldwide basis or where an employee is splitting time in multiple locations, there can be a withholding and reporting obligation in both the home and the host country. As the expansion of the mobile workforce continues, employers are looking to implement a solid global framework to support the complex withholding and reporting requirements mandated by the countries where their employees are working.

Shadow Payroll

Shadow Payroll

For most companies, one component of the framework to support the accurate withholding and reporting of their international assignments is a “shadow payroll” procedure. Essentially, shadow payroll enables global organizations with international assignees a mechanism to facilitate income reporting and local tax withholding for an employee who is performing services in one country but also has reporting and/or withholding obligations in another country. One example would be an individual who remains on the home country’s payroll system and is working in a different host country. This approach is executed to keep the company in compliance with local tax laws and is often done to support an employee’s benefit and pension provisions.

In addition to local reporting requirements, many countries in Europe and throughout the world operate a “pay-as-you-earn” (PAYE) or similar system of income tax withholding requirements that require income tax to be withheld and remitted to the tax authorities at the time the compensation is delivered. In a shadow payroll arrangement, an employee will be paid fully in one country and not be physically paid any net pay amounts through the other country’s payroll. In the case of a home country actual payroll and host country shadow payroll, the employee is paid through the home country payroll and also will be reported in the host country payroll system in order to report the income and calculate the total value of statutory taxes for the country in which services are performed. These tax payments are then made to the host country taxing authorities. This arrangement enables the employer to meet both its host and home country statutory reporting obligations and produce the appropriate year-end tax slips or wage statements. This arrangement requires that a company decide whether taxes for the shadow payroll country are paid on behalf of the employee or are withheld from the employee’s actual pay. In addition to the assignee’s regular pay being properly taxed and reported, many employers will also pay an assignee’s additional benefits while that employee is working outside of the home country. Cost-of-living adjustments and host-country housing are some of the most commonly paid benefits. Depending on the tax law in the jurisdiction where the payroll is being reported, the additional benefits may be considered part of the taxable compensation and could need to be reported. Organizations need to understand what types of compensation and benefits are, and are not, subject to taxation in various countries.

Home Payroll

Home Payroll

Individuals on assignment outside their home countries who remain on home-country payroll may be required to continue to pay income or social taxes at home for compensation earned while performing services abroad. Residency, assignment duration, and travel back to the home country can factor into this determination. Home payroll processing generally includes most compensation elements, including the full compensation package regardless of what country it is paid in.

Challenges Faced by Global Payroll Managers

With International Assignees

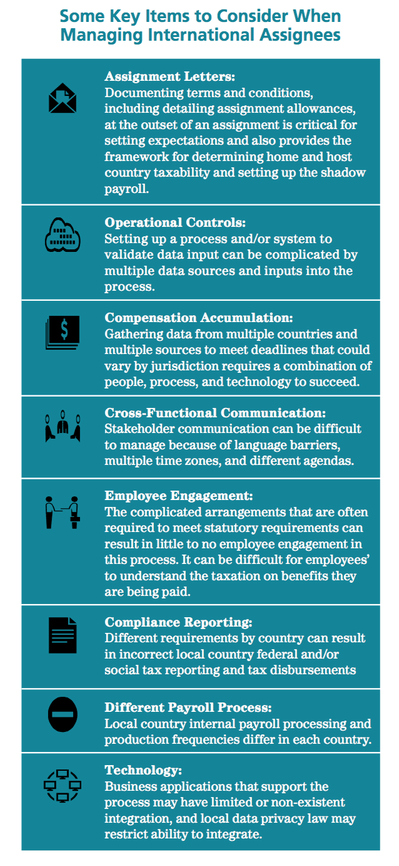

Outside of maintaining compliance in a shadow payroll arrangement, employers must contend with many other challenges to ensure that the shadow payroll process is working correctly. HR and payroll managers must track the employee’s assignment details from beginning to end and often even beyond (for example, when there are trailing host-country tax payments made on behalf of the individual, or when multi-year incentive awards are paid in relation to periods while on assignment). If companies do not have a strong mobility framework in place, managing these challenges becomes extraordinarily more difficult to manage, making the shadow payroll process more complicated as well. (See sidebar of a few key items to consider.)

The Case for the Shadow Payroll Process

Because authorities are aware that companies often do not have the resources to support this area, employers also must be aware that in-country tax and revenue authorities are intensifying their scrutiny on inaccurate withholding and reporting for international assignees. As a result, companies can be exposed to hefty fines and, in some extreme cases, imprisonment for noncompliance with regulations. Some authorities also recognize these violation fees as a lucrative revenue stream for their countries. All of this potentially could lead to unwanted media attention and weaken a company’s brand image.

As the web of complex reporting intensifies, mobility and payroll managers are being asked to put in a consistent and compliant approach to assignee compensation and proper withholding and reporting. As EY’s 2014 Global Compensation Survey indicates, employers are now putting a greater focus on making sure they comply with reporting and withholding requirements in the countries in which they operate (see Figure 1 above).

Building a Comprehensive

Building a Comprehensive

Shadow Payroll Framework

As employers evaluate how to structure the shadow payroll process within their organizations, they should begin by assessing the capabilities of the current payroll processes and identifying which specific elements are presenting significant issues that could put the company most at risk for noncompliance. Identifying what is and is not working in the current environment will help organizations establish their own priorities in building a comprehensive framework to support the process.

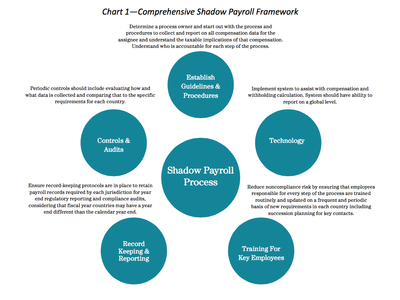

Organizing this approach around the shadow payroll framework will support successful execution and delivery. Organizations should appoint a person with responsibility for the overall process, outline the basic policies, and implement appropriate controls for reporting. They should establish a sustainability model that keeps key stakeholders informed of the process and makes sure that the appropriate technology is in place to support and enable the process (see Chart above).

Once the basic global payroll framework has been established, organizations can build the requirements to support the solution. Payroll managers should look across all aspects of the shadow payroll process to evaluate the multiple inputs and outputs that are required and clearly define where the critical data is coming from and where it needs to go. Clear lines of accountability for the collection of data and proper execution of the process become critical aspects for success.

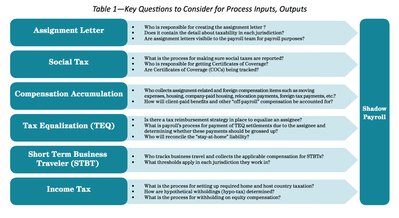

To understand the detailed aspects of what data requirements are needed as inputs into the shadow payroll process, employers should consider the answers to some key questions (see Table 1 above). Establishing the answers to these questions on a global scale can be challenging but is essential in making sure the shadow payroll process will succeed.

Once organizations have established the basic framework and answered the detailed questions about inputs and outputs, they can then begin executing their own shadow payroll process to aid the required withholding and reporting compliance for each country in order to mitigate risk.

Most organizations find this task too overwhelming to maintain within their own operations and find it necessary to use external advisors. Generally, these external advisors provide the data needed to understand what is and is not taxable in each country and, in some cases, the actual execution of the shadow payroll.

In Summary

The global workforce is expanding. Compliance with home and host income tax reporting and withholding obligations is putting increased pressure on HR and payroll managers throughout the world. Not getting it right can be costly to organizations.

It is important for organizations to build the right framework to support reporting and withholding for the international assignees’ compensation and reportable benefits. There are many things to consider when building this type of framework and many options to choose from to support the shadow payroll process and overall global payroll operations.

EY has payroll and tax advisors who have extensive knowledge, expertise, and multiple industry insights to help organizations define what their shadow payroll process should be and what solutions should be in place to enable the process.