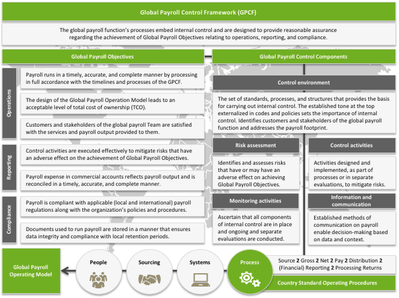

Creating a Global Payroll Control Framework (GPCF) requires the design of four sections. Previous articles (November and December 2015 issues) have addressed the first section, Global Payroll Objectives, and the first three components of the second section, Global Payroll Components. This article addresses the remaining two components (monitoring activities and information and communication) and the third section, the Global Payroll Operating Model.

Monitoring Activities

Ascertaining that all five components of internal control are present and functioning requires ongoing and separate evaluations as part of a framework, according to the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Ongoing evaluations are typically built into business processes, and the process owner periodically conducts separate evaluations at set times. Findings are evaluated against criteria established in the GPCF and communicated to both internal and external stakeholders in order to take the appropriate follow-up actions. The disclosure of information is crucial to internal control and the pursuit of full transparency. Separate evaluations are important for mitigating non-recurring risks or those occurring outside of payroll, as well as for evaluating the effectiveness of the internal control system itself.

Separate evaluations could be in the form of recurring payroll meetings, customer and stakeholder surveys, or Audit of Control Effectiveness (ACE) reviews. In these payroll meetings, the aim is to evaluate the periodic payroll cycle, discuss feedback from customers and stakeholders, and analyze the payroll dashboard. Ideally, payroll providers also join these meetings, especially if outsourcing is centralized, for the sake of transparency and improving the working relationship. In these meetings, participants assess the impact of changes to the control environment (new businesses, changed legislation, personnel changes, etc.) on daily operations and achieving objectives. This enables the global payroll function and the payroll vendor to anticipate an upcoming event (ex ante) instead of reacting to the event once it has occurred (ex post).

Everyone who has worked for one of the Big Four consultancy firms will recognize the weekly meeting where attendees discuss the latest news on payroll taxes. Why not also do this as part of the monitoring activities in payroll meetings? It will increase the global payroll function’s knowledge and, amongst many other benefits, enhance their global and local risk identification capabilities. One of the inherent risks in payroll, according to a Wolters Kluwer 2015 article by Elmer Van Lienen, is a lack of payroll tax knowledge that leads to the inability to identify taxable events that occur outside of payroll or to detect possible payroll tax liabilities.

An ACE review assesses the effectiveness of control activities and, for instance, whether documents used in the processes are kept up to date. Start with self-audits and then let internal audit, the SOX team, and/or an external auditor perform the ACE reviews as part of their routine audits. They would ideally use the self-audits as a base for their audits, reducing their time spent on auditing the payroll function and potentially saving the organization money. Finally, conduct a quarterly customer and internal stakeholder survey to assess the satisfaction with services provided (typically an operations objective). How will you know if those in remote locations are satisfied if you don’t ask them? Global payroll functions benefit from satisfied employees who receive timely responses to questions they find important. Employees who don’t receive responses or who receive inaccurate payments can become less motivated. Simply conducting such a survey establishes a better relationship between customers and/or stakeholders and the payroll function.

An ACE review assesses the effectiveness of control activities and, for instance, whether documents used in the processes are kept up to date. Start with self-audits and then let internal audit, the SOX team, and/or an external auditor perform the ACE reviews as part of their routine audits. They would ideally use the self-audits as a base for their audits, reducing their time spent on auditing the payroll function and potentially saving the organization money. Finally, conduct a quarterly customer and internal stakeholder survey to assess the satisfaction with services provided (typically an operations objective). How will you know if those in remote locations are satisfied if you don’t ask them? Global payroll functions benefit from satisfied employees who receive timely responses to questions they find important. Employees who don’t receive responses or who receive inaccurate payments can become less motivated. Simply conducting such a survey establishes a better relationship between customers and/or stakeholders and the payroll function.

Information and Communication

In order for team members to carry out their internal control responsibilities, they must know their roles and responsibilities. According to COSO, communicating the right information at the right time enables the global payroll function and its stakeholders to make the right business decisions every day. The GPCF should therefore include timelines for what information and documentation is communicated to whom and when. Disclose the framework to everyone who has a role in the GPCF processes or depends on payroll output, such as accounting and financial planning and analysis.

Another important part of this component is to formalize the communication method and tools:

- What is the primary language for all communication?

- Which communication tools are used for reaching out to remote locations?

- How frequent is the contact between regional teams?

- What information is provided about the global payroll function’s performance?

The last question is especially important because managing payroll on a global scale brings unique challenges, and regular insight into performance is a basic requirement. The information included in a payroll dashboard (used in payroll meetings) should ideally touch on meeting timelines, accuracy of payroll runs, and numbers of processed starters, leavers, and changes within identified groups of common changes. Many more metrics and indicators should be included, but their feasibility depends on the ability of the global payroll function or vendor to deliver these metrics. Whatever the dashboard looks like, discussing the contextual factors in payroll meetings is crucial to identify root causes, drive continuous improvement, and have constructive discussions with payroll vendors (see May 2015 Global Payroll article on “Importance of Context in Measuring, Managing the Global Payroll Functions”). The ultimate next step is internal benchmarking across regional teams and external benchmarking of performance metrics with peers.

Global Payroll Operating Model

The first two sections of the GPCF are vital for being in control of payroll. But without a functioning and well-balanced Global Payroll Operating Model, it is virtually impossible to provide reasonable assurance that payroll objectives are being met. A Global Payroll Operating Model should be efficient, effective, and transparent in its design and daily operation. In this respect, efficient means doing things right, and effective means doing the right thing. According to Van Lienen, transparent means having proper controls in place and fostering a culture that stimulates disclosing information and raising flags when events occur that adversely affect the achievement of objectives. After the first two sections in which the global payroll function operates are made clear, the next logical step would be a closer look at the operating model. However, most organizations approach this the other way around. This can, of course, work for some organizations, but it seldom does in the long run. Work from objectives (section 1) to components (section 2) to the operating model (section 3) and then drive continuous improvement.

Every operating model can be divided into how people, systems, and sourcing interact in a process. Decisions must incorporate best practices and address both global and regional accountabilities. Aim to get the best balance of cross-cultural competencies, standardized and automated payroll processes, and, to a manageable extent, centralized payroll vendors (per May 2015 Global Payroll article on “Importance of Context in Measuring, Managing the Global Payroll Functions). In designing processes, consider the regulatory and internal timelines that apply to payroll. Then incorporate control activities as regular process steps to ensure meeting them. In these process steps, people, systems, and sourcing all affect the way activities are executed and thus have an effect on the design and efficiency, effectiveness, and transparency of the operating model.

The way global payroll function members put the GPCF into practice, and the intrinsic motivation they must have to be in control of the processes, lead to the payroll output they deliver. Being aware of the required balance among the four elements in all processes and the effect on internal control is crucial. If there is a gap in knowledge, identify and learn or insource it. If there is a lack of automation, incorporate additional manual controls or improve the IT infrastructure.

In Summary

This article addresses the remaining two components of internal control and the four elements of a global payroll operating model. This and the setting of global payroll objectives lead to a GPCF. You can use the summary to start your GPCF (see chart above).

This best-practice method applies to all organizations regardless of their industry, how they have organized their payroll function, or what their payroll footprint is or will be. In this lies the great strength of approaching internal control for payroll this way. After the first version of a GPCF is released, it must be maintained, reflect daily operations, and be adjusted when the control environment changes. It would be a shame to let it be just another well-written document that is not put into practice. When, for instance, your organization is considering changing its operating model, expanding into new markets, or switching payroll vendors, the GPCF is great to have and to use as a starting point for each discussion. A GPCF cannot guarantee perfect outcomes and provide absolute assurance, but that should not stop an organization from trying.